KYC for Brokers & Forex Trading

Join leading trading platforms building global trust with Sumsub

The ultimate solution for trading and investing

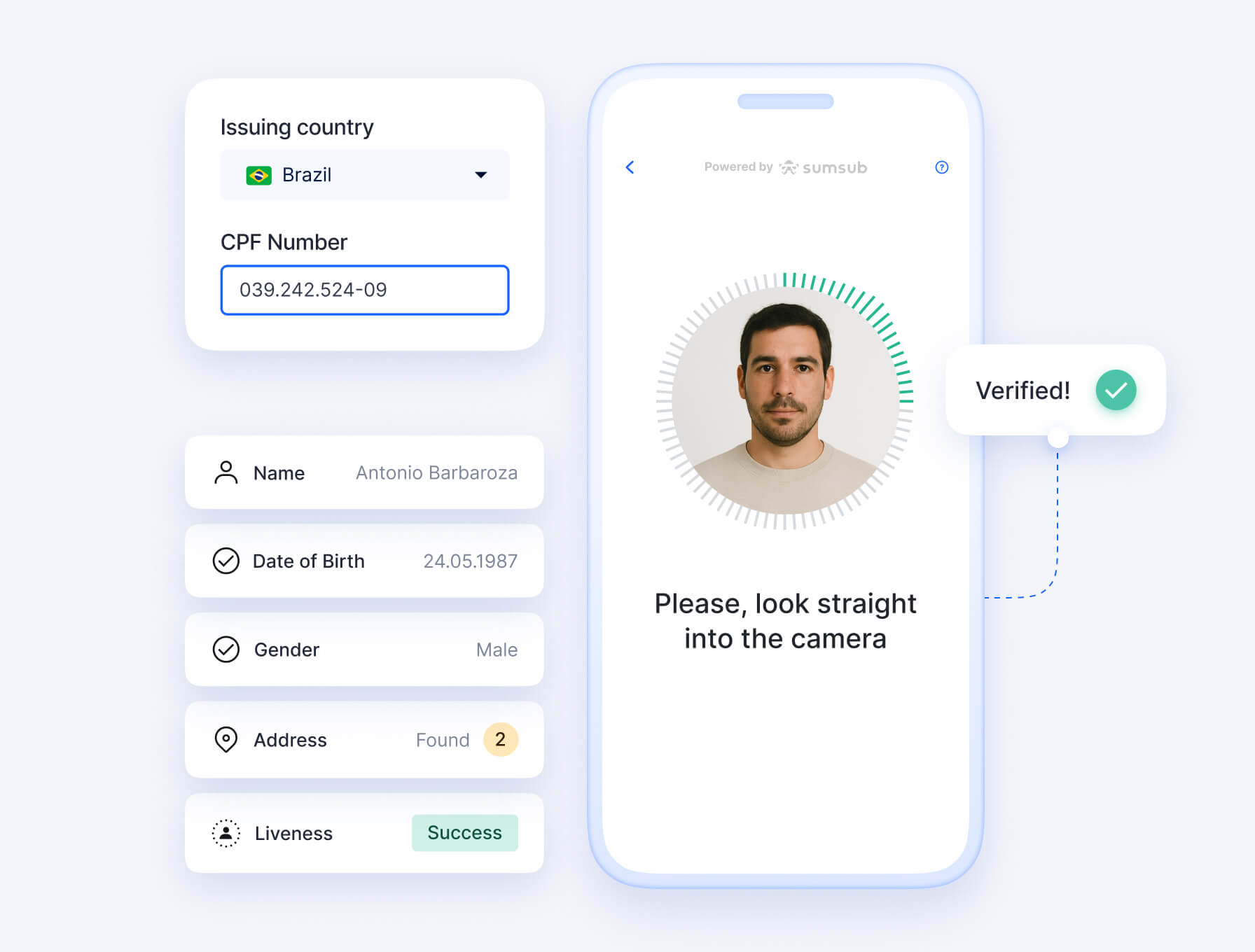

Verify traders, with or without documents

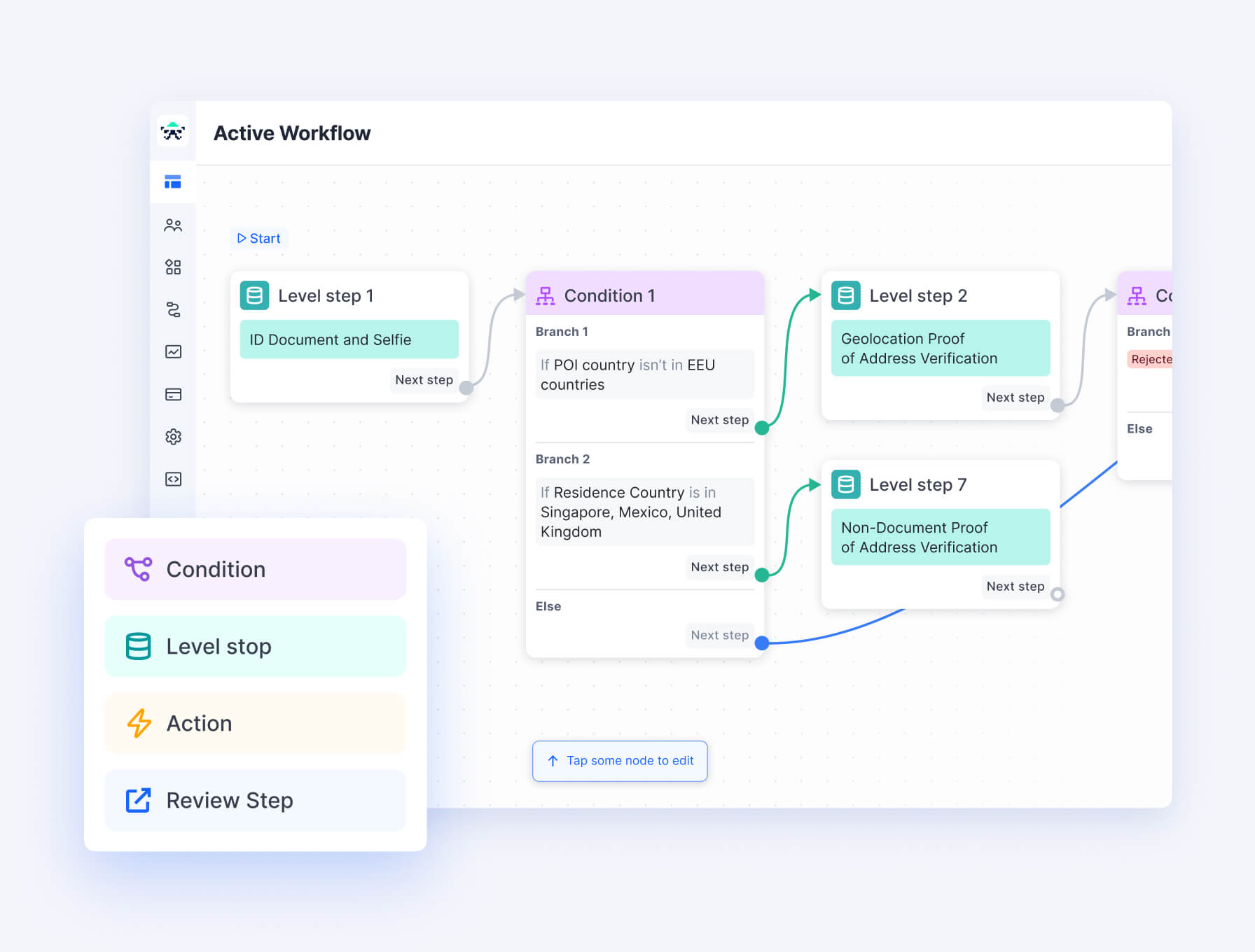

Tailored automated onboarding built for brokerages

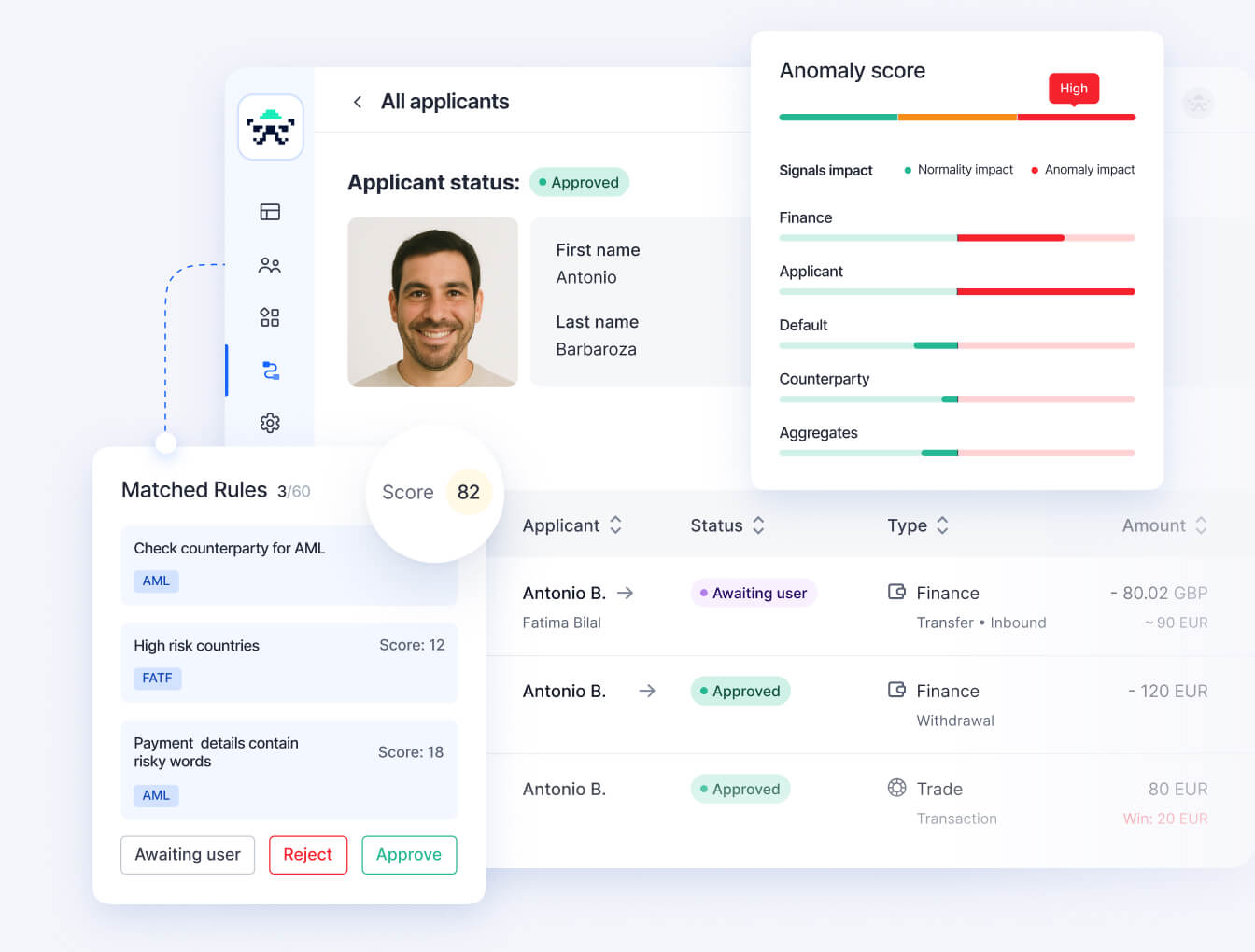

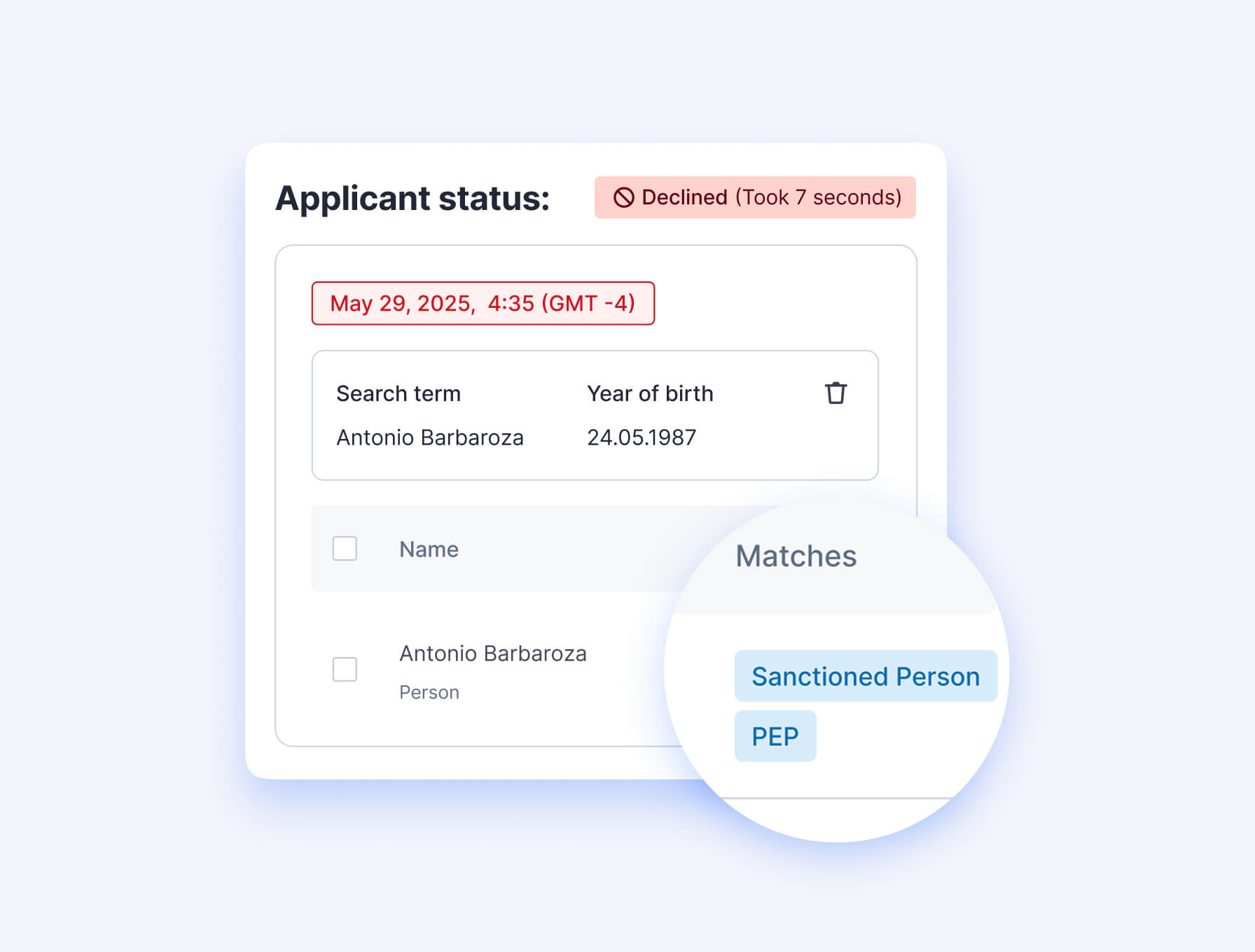

Robust security to protect investor integrity

AI-powered solutions for trading platform protection

Don’t take our word for it. Here’s what

our clients have to say.

Let the numbers do

the talking: get 240% ROI

Сompanies that work with Sumsub identity verification software save costs and increase revenue, according to the “Total Economic Impact™ Of Sumsub’s Verification Platform study by Forrester Consulting. Let’s see what results you can get.

Choosing your ideal solution?

Sumsub is G2’s Top Pick

Surpass competitors with a partner who knows how to excel, as validated by user reviews.

FAQ

What is KYC in trading?

KYC, or Know Your Customer, is an essential process in the trading industry for accurately verifying a customer’s identity, their trading behavior, and assessing their risk profile. Conducting KYC helps brokers protect against fraud and prevent illicit activities, such as money laundering and terrorist financing. The KYC process is revisited periodically throughout the customer relationship to detect any changes to their profile or risk that may impact the trading business.

Is KYC mandatory for trading?

Yes, KYC is mandatory for most trading and investment firms, and failure to implement it can lead to significant fines and penalties from regulatory bodies, as well as reputational damage to the broker. Some trading brokers do not require KYC depending on the region(s) in which the business is operating and typically offer a payment channel that doesn’t involve traditional banks. However, in regions like the US and the UK, the FinCEN and FCA require KYC compliance so non-KYC brokers are illegal. Non-compliance with KYC regulations not only exposes brokers to potential fraud but also illegal transactions that could harm the business.

What is AML in trading?

AML, or Anti-Money Laundering, refers to the set of legal obligations that brokers in the trading industry must follow to detect and report suspicious activities, including money laundering, terrorist financing, and market manipulation. Core AML requirements for brokers include conducting KYC, performing customer due diligence, screening for sanctions, politically exposed persons (PEPs), and adverse media. Brokers must also have procedures in place to file Suspicious Transaction Reports (STRs) and Suspicious Activity Reports (SARs) to relevant authorities within mandated timelines.

Is forex regulated in the USA?

Yes, forex trading is regulated in the USA by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These regulatory bodies aim to protect investors, promote market transparency, and prevent fraud, market manipulation, and unlawful trading in futures and commodities. To be compliant, forex brokers operating in the US must be registered with the CFTC and maintain membership with the NFA to avoid fines and penalties.