KYC Identity Verification Service for Hong Kong

Full-cycle verification platform for Hong KongStay compliant and always ahead of fraud. Detect risks early, simplify onboarding, and keep both your revenue and customers safe—all without the complexity. One single solution for KYC/AML, Business Verification, Transaction Monitoring, Fraud Prevention, and Travel Rule compliance.

Secure every step of the customer journey

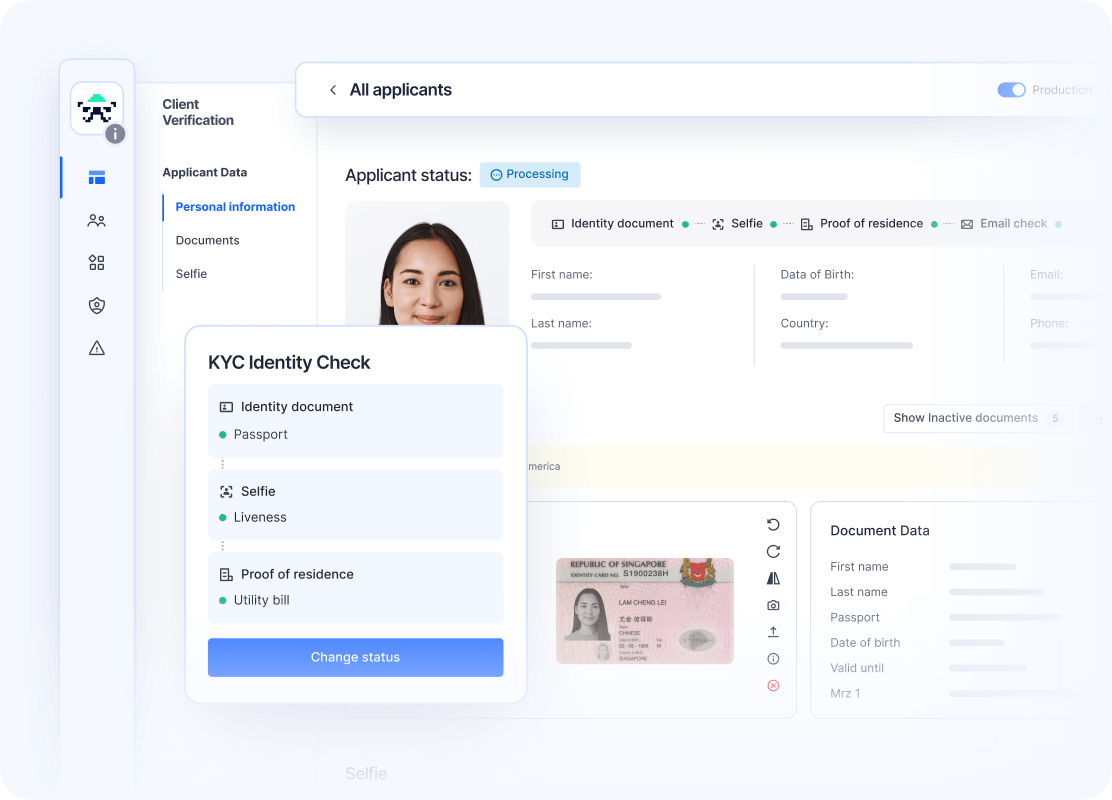

Orchestrate verification checks, code-free. Place checks at any stage of the customer journey for top anti-fraud protection and pass rates worldwide

User Verification

Business Verification

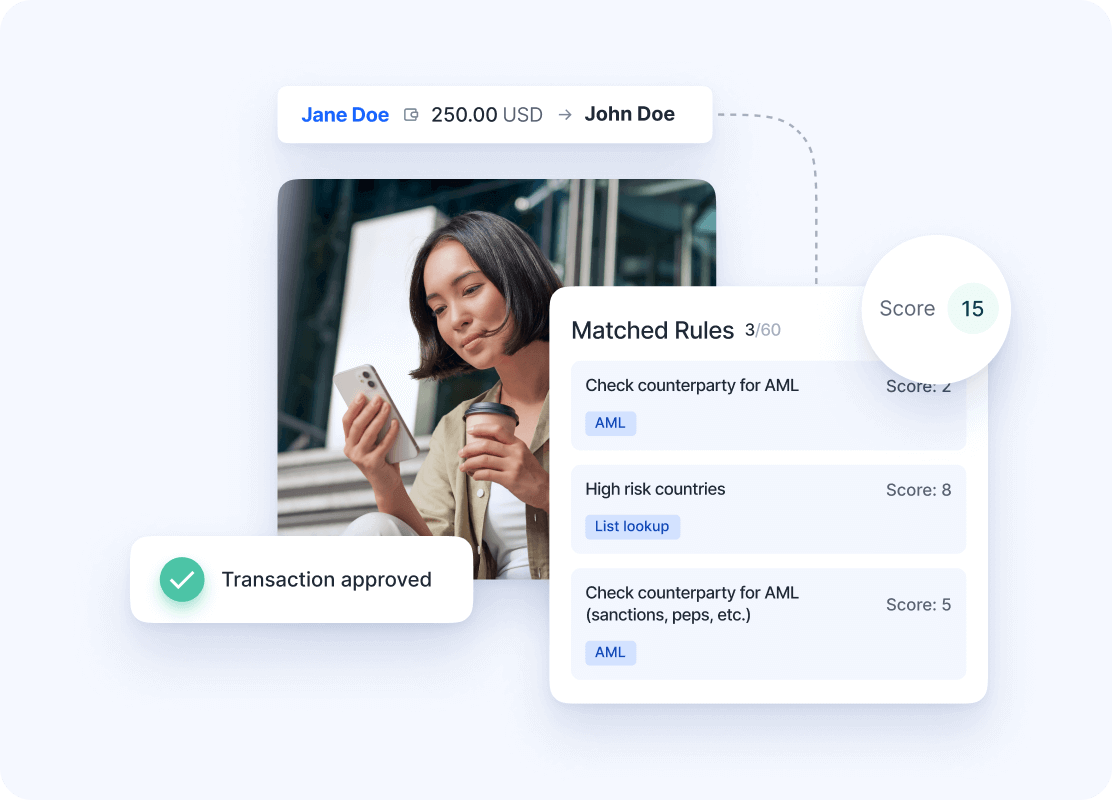

Transaction Monitoring

Fraud Prevention

Local Data Processing

Let the numbers do

the talking: get 240% ROI

Сompanies that work with Sumsub identity verification software save costs and increase revenue, according to the “Total Economic Impact™ Of Sumsub’s Verification Platform study by Forrester Consulting. Let’s see what results you can get

Easily integrate your tech stack with Sumsub

Use Sumsub to integrate the services you need via Web SDK, Mobile SDK, or our RESTful API. Alternatively, you can use Unilink to onboard users via a QR code or a link to the verification form without integrating Sumsub at all. Don’t worry about interruptions with 99.996% uptime.

Don’t take our word for it.

Here’s what our clients have to say

Choosing Your Ideal Solution?

Let the numbers do the talking: See how we exceed our competitors in key areas, as validated by user reviews on G2.

FAQ

What is a KYC check for Hong Kong?

Hong Kong’s financial institutions are required to conduct KYC checks when onboarding customers. The guidelines setting out the KYC procedure are issued by the Securities and Futures Commission (SFC) and Hong Kong Monetary Authority (HKMA). For individual customers onboarded remotely, businesses typically must verify their full name, date of birth, nationality, and unique ID number.

Can KYC be automated?

KYC (Know Your Customer) processes can be automated. Companies automate checks using advanced technologies such as AI (Artificial Intelligence) and machine learning. Automation streamlines customer verification procedures, enhances efficiency and speed, reduces manual errors, and ensures compliance with regulatory requirements.

What is a KYC service?

A KYC service is a third-party solution that offers identity verification and due diligence processes to businesses. It allows companies to use technical solutions for their KYC procedures, helping to streamline customer onboarding, reduce fraud, and ensure compliance with regulatory standards.

What is an identity verification system?

An identity verification system is a software that enables businesses to verify the identity of their customers. Such platforms typically identify and verify personal information, such as data from government-issued IDs, addresses, and other personal data. Identity verification platforms are used by a variety of regulated and non-regulated businesses, from fintech such as PSPs and crypto providers to e-commerce sites, to ensure that their customers are who they claim to be and to prevent fraud and financial crime.

What is eKYC?

eKYC stands for electronic Know Your Customer. It is a technology-driven process that allows organizations to verify the identity of their customers electronically, typically through the use of the photos of documents (or their digital versions) and biometric data. This is often faster and more convenient than traditional face-to-face methods, and helps in reducing paperwork and manual processes.

What is the best AML/KYC provider in Hong Kong?

The “best” solution to pick depends greatly on the requirements of your business. A proper KYC/AML service offers a range of automated verification and authentication checks, integration options, and high pass rates globally. When choosing, evaluate the onboarding experience, verification accuracy, and compliance standards.

What is a Money Service Operator (MSO) license?

Money Service Operator (MSO) license is regulatory approval to provide financial services (money changing services or remittance services) in Hong Kong. Normally, the validity period of a license is 2 years. The Customs and Excise Department (C&ED) has been overseeing the regulation of MSOs since April 1, 2012, under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance, Chapter 615 (AMLO).

What is a Virtual Asset Trading Platform (VATP) license in Hong Kong?

A Virtual Asset Trading Platform (VATP) license in Hong Kong is required for centralized platforms doing business in Hong Kong or actively marketing their services to local investors. These platforms must be licensed and regulated by Securities and Futures Commission (SFC), pursuant to the Securities and Futures Ordinance (Cap. 571) (SFO) and the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615) (AMLO).