Beyond KYC: the Future of Verification Has Already Come

Learn why today protection beyond the KYC stage is more important than ever and how Sumsub has turned into one future-proof platform that provides a verification solution for the whole user journey

Since 2015, Sumsub has offered a reliable KYC (Know Your Customer) solution, perfecting it along the way by adding more checks. This has helped businesses stay fraud-free during the onboarding stage, scale-up, and stay AML compliant, while offering seamless user experience.

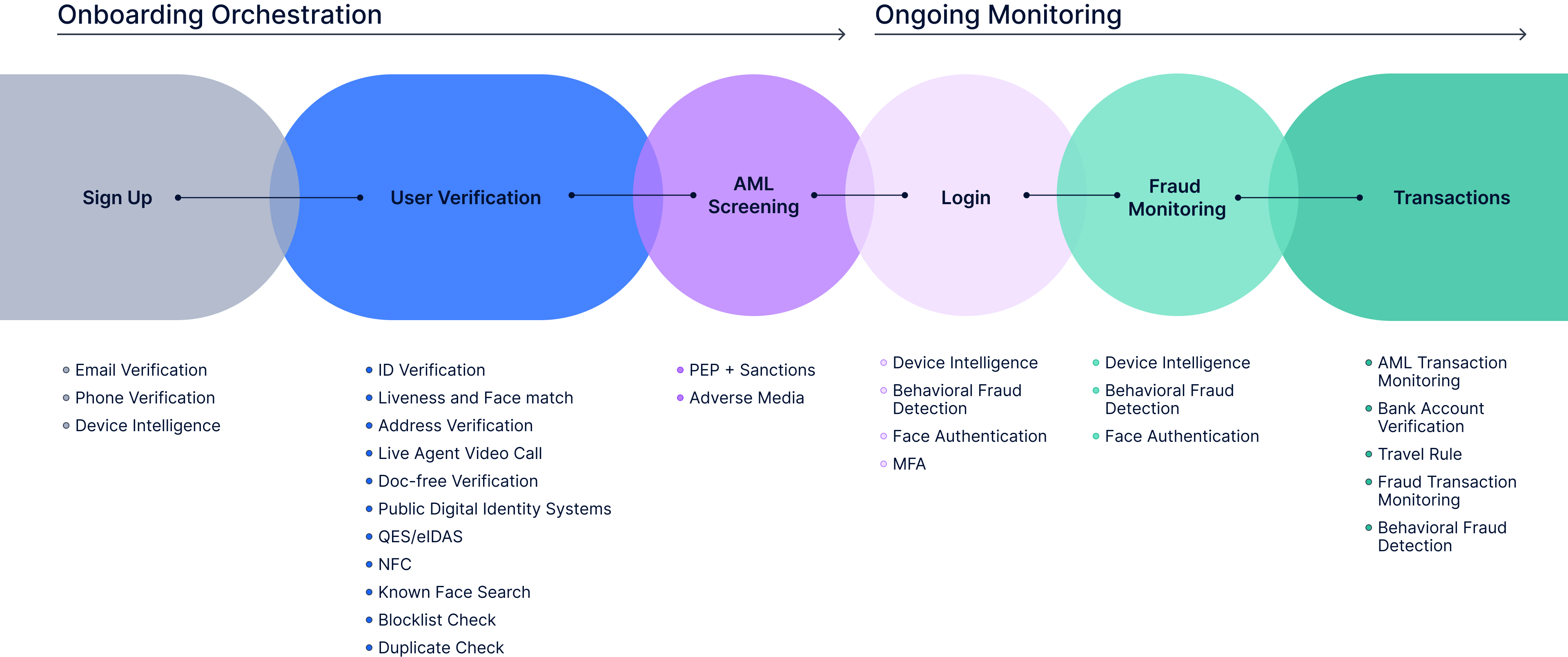

However, our internal data shows that most fraud happens beyond the onboarding stage. In response, Sumsub has developed into the one verification platform that secures the whole user journey. This new positioning is the next step in Sumsub’s mission to create a safe and inclusive digital future for users and businesses alike.

Read on to learn which fraud trends are targeting the digital world in 2023, and how Sumsub combats them.

Prerequisites

Today, dozens of industries—from fintech to crypto—couldn’t properly function without KYC.

Businesses need a reliable KYC tool efficiently for the onboarding stage to detect and prevent financial crime, such as money laundering, terrorism financing, and fraud. By verifying client identities, businesses can immediately detect any suspicious activities and report them to relevant authorities.

Since 2015, Sumsub has offered reliable KYC, helping businesses meet AML compliance requirements while detecting fraud at the earliest stages. This solution has been perfected over the years with Liveness Detection (advanced biometric verification), Video Identification (required in a number of jurisdictions), Proof of Address, 1click (a document-free check across government databases) and a number of other key services. As a result, thousands of businesses worldwide have been able to cover every onboarding pain point, scale up, and stay compliant while enjoying a flawless user experience from Sumsub.

Anticipating new fraud trends, Sumsub has introduced new products which work both separately and as a single whole. This includes Know Your Business (or KYB), which verifies the authenticity and credibility of potential business partners.

But today it’s clear that protecting the onboarding stage only is not enough.

Why KYC isn’t enough today

Several trends influence the fraud prevention landscape in 2023:

- Global increase in fraud. According to Sumsub’s fraud report, identity fraud in the cryptocurrency and banking sectors increased almost two-fold in 2022, while payment fraud grew by 40%. In most cases fraud leads to money laundering

- Democratization of AI technology and, as a result, a rise in deepfakes and synthetic fraud

- Toughening regulations across various industries thanks to increased fraud. One of the most recent examples is the dramatic tightening of forex regulations in St.Vincent and the Grenadines—a former haven for FX brokers.

Sumsub’s internal data shows that most cases of fraud happen after the onboarding stage. This could be already verified accounts getting hacked, stolen and sold. Or it could be “clean” accounts being misused for all sorts of criminal activity.

Today, KYC alone does not solve all the problems that compliance and risk teams face, because they need to monitor the entire user journey. This means verifying user transactions, detecting unusual patterns in a timely manner, and more. To do this, businesses need reliable tools for transaction monitoring, fraud prevention, and Travel Rule compliance.

However, businesses often develop these and other fraud prevention solutions in-house. Or, they opt to integrate several providers and try to connect them to each other, which is a time-consuming headache.

But there is no need to jump through these hoops anymore, as Sumsub has become the one platform to secure the whole user journey.

The new Sumsub

Sumsub has become a full-cycle verification platform that secures the whole user lifecycle, providing:

- User Verification

- Business Verification

- Transaction Monitoring—ongoing screening of customer transactions for signs of fraud and money laundering

- Fraud Prevention—a set of measures which enables identifying malicious user activity throughout the whole user journey

- Case Management—collecting, monitoring and assessing information to detect suspicious user behavior and prevent financial crime. Sumsub’s Case Management processes millions of signals, visualizes them in one dashboard, and helps make well-informed decisions.

Sumsub’s advantages:

- User-centric approach. Sumsub protects users from risks throughout the whole user journey, not just during the onboarding stage

- One provider, one integration, one contract. Sumsub helps save on business resources, with no need to integrate and manage dozens of different instruments any more

- Consolidated user risk profile. Sumsub pays special attention to red flags for fraud and money laundering to increase protection

- Flexibility and customization. Sumsub allows you to create your own industry-specific rules or use a preset library, code-free. You can dry-run new rules on existing data sets to check how they work in a safe environment. Customization is especially advantageous for transaction monitoring and fraud prevention

- Orchestration of all checks. Sumsub offers flexibility when it comes to building user flows, so businesses can balance conversion, AML compliance and anti-fraud, while automating the decision-making process

- Highest conversion rates in the industry. 91.64% in the US, 95.86% in the UK, and 90.98% in Brazil. Sumsub is the only verification service in the industry that reveals its conversion rates

- High conversion rates even for Proof of Address verification—one of the most complex checks for AML compliance

- Quick and robust KYB verification. Sumsub is the only industry player that provides full KYB verification in around 3 hours. KYB verification is performed by a team of certified compliance specialists

- CRM for risk & compliance teams and convenient case management (all in one dashboard)

With Sumsub’s customizable KYC, KYB, Transaction Monitoring and Fraud Prevention solutions, it’s possible to orchestrate the whole verification process, protect businesses from fraud and ML, welcome more customers worldwide, meet compliance requirements, and reduce costs.

Sumsub’s new positioning is the next step in the company’s journey towards creating a safe, accessible, and inclusive digital future for users and businesses alike. By eliminating fraud and verification challenges, Sumsub contributes to a world where anyone—regardless of age, location, or computing skills—can securely access any online service. Going forward, Sumsub aims to continue perfecting its platform to eliminate fraud, overcome verification hurdles, and build a people-friendly digital future.