- Oct 13, 2023

- 4 min read

AML Investigation and Case Management: Learn How to Effectively Spot and Report Money Laundering

Learn why an AML case management tool is essential for your business.

Money laundering is a huge global problem. Between $800 billion and $2 trillion is laundered each year, according to the United Nations Office on Drugs and Crime, which amounts to 2-5% of global GDP.

Money laundering has a harmful socio-economic impact, fueling corruption, increasing crime, widening the gap between the rich and the poor, and slowing economic growth. This is why Anti-Money Laundering (AML) regulations—such as KYC compliance—are strict and punishment for non-compliance is severe.

In the past, financial institutions were the primary instrument for laundering illicit funds. Today virtually all businesses—from art to sport—can fall victim to money laundering. Therefore, more industries are now attracting scrutiny from regulators.

Some businesses may not even be aware that they’re being used by criminals for money laundering. However, they may still bear responsibility for it. When the crime is detected, the consequences can be extremely painful. For instance, Danske Bank agreed to pay $2 billion to US authorities for failing to comply with AML regulations—a record fine.

According to the Financial Times, global fines for failing to prevent money laundering and other financial crimes spiked more than 50% in 2022, and the regulations are predicted to keep tightening.

Therefore, all businesses should think about developing a robust AML program with reliable AML investigation and case management capabilities. Let’s discuss this in more detail.

What is an AML investigation?

An Anti-Money Laundering (AML) investigation is a multiphase process employed by financial institutions to detect, prevent, and combat activities associated with money laundering, terrorist financing, and other criminal activity. This includes scrutinizing financial transactions, customer behavior, and other relevant data to identify suspicious patterns, inconsistencies, and potential sources of illicit funds.

Anti-money laundering investigations ultimately aim to stop criminal networks involved in money laundering, ensure compliance with AML regulations, and protect the integrity of the financial system.

What triggers AML investigations?

AML investigations are triggered by various red flags and suspicious activities, which should be outlined in a company’s AML Compliance Program.

The most common red flags and triggers are:

- Large or frequent cash transactions

- Rapid and unexplained transfers

- Complex and/or layered transactions

- Deposits succeeded by withdrawals soon after with no clear rationale

- Refusal to provide documentation and/or information requested for compliance and AML checks

- Transactions inconsistent with a customer’s profile and background

- Inconsistent or unusual customer behavior

- Transactions involving high-risk countries, high-risk industries or individuals, or companies connected to adverse media, criminal activity, and/or sanctions

- Suspicious patterns detected through transaction monitoring systems

- Alerts generated by AML case management software

- Suspicious activity reports from employees, customers, or external sources

- Internal audits indicating AML deficiencies

- Regulatory requirements, including mandatory customer due diligence and reporting of suspicious activities

What is AML case management?

AML (Anti-Money Laundering) case management refers to how investigations into potential money laundering or other financial crime is handled by a financial institution. Case management ensures that each case is thoroughly investigated, documented, and reported in accordance with regulatory requirements. Additionally, it helps to improve AML programs by providing valuable insights and data analysis.

How to create an AML case investigation workflow

Creating an AML (Anti-Money Laundering) case investigation workflow involves defining a structured process for handling and investigating suspicious activities related to money laundering.

An AML case management workflow usually includes:

- Customer verification

- Ongoing transaction monitoring

- Ongoing monitoring of suspicious activities of all clients, paying special attention to medium and high-risk ones

- Reporting suspicious activities to regulators

To manage the entire process in one place, compliance officers use specialized third-party solutions and compliance platforms.

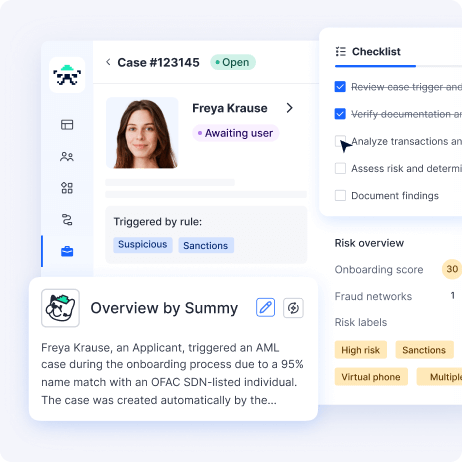

With Sumsub’s AML Case Management software, you can set up your own verification logic with a flexible Workflow Builder, combining triggers and actions to automate decision-making.

The AML case management process

The AML investigation process usually includes the following steps:

- Initial alert. The process begins when an alert is triggered, either by automated monitoring systems, suspicious customer behavior, or internal audits.

- Case review. Investigators review the initial alert to determine its validity and decide if further investigation is required. Some alerts may be dismissed as false positives.

- Customer Due Diligence (CDD). If the alert needs further attention, investigators perform additional CDD to gather further information about the customer or entity involved. In some cases, Enhanced Due Diligence may be necessary, especially for high-risk customers such as Politically Exposed Persons.

- Transaction analysis. Investigators check the specific transactions associated with the relevant alert, looking for patterns, anomalies, transactions inconsistent with the customer’s background and unusual behavior that may indicate money laundering or other illicit activities.

- Source of funds check. Investigators do this to trace the origin of the funds and assess whether they have a legitimate source.

- Suspicious Activity Reporting. If the investigation reveals evidence of suspicious activity or potential money laundering, investigators file a Suspicious Activity Report (SAR) with appropriate regulatory authorities. If money laundering or suspicious activity is confirmed, the institution may need to freeze accounts, cooperate with law enforcement, and take additional compliance measures as required by regulations.

- Record keeping. Thorough documentation of the investigation process, findings, and actions taken is crucial for compliance and regulatory reporting.

- Ongoing monitoring. After the AML investigation is complete, ongoing monitoring of customers and transactions should be continued to prevent crime.

Best practices

Follow these AML case management best practices to prevent money laundering more effectively:

- Learn the regulations of the jurisdictions where operate

- Meet AML compliance requirements

- Use a risk-based approach

- Provide ongoing training and education to MLROs and other employees

- Invest in AML software and systems that facilitate data integration and analysis

- Use AI to identify fraud patterns

- Use machine-learning techniques to clusterize users and identify fraudulent schemes

- Manage all cases in one place to get your data clearly visualized and make well-informed decisions

- Update policies and procedures

- Run independent audits

- Maintain detailed and well-organized documentation of each AML investigation

FAQ

-

What is the anti-money laundering investigation process?

The anti-money laundering investigation process involves detecting, analyzing, and reporting potentially illegal financial activities to prevent money laundering and other crimes, typically following a series of steps including alert generation, customer due diligence, transaction analysis, and reporting.

-

How do you investigate money laundering cases?

Money laundering cases are investigated by scrutinizing financial transactions, conducting customer due diligence, checking the source and movement of funds, analyzing suspicious patterns, and cooperating with law enforcement agencies, when necessary.

-

How long does an AML investigation take?

The duration of an AML investigation can vary significantly depending on the complexity of the case and regulatory requirements, ranging from several weeks to years.

-

What is case management in AML?

Case management in AML is a structured process of handling and tracking individual cases related to potential money laundering or other financial crimes, ensuring compliance with regulations.

-

What is the AML case management process?

The AML case management process involves a systematic sequence of steps, including alert generation, case validation, customer due diligence, transaction analysis, source of funds checks, documentation, reporting, and ongoing monitoring. This is to respond to potential money laundering activities while ensuring regulatory compliance.

-

What is an AML case management solution?

An AML case management solution is a specialized software which helps AML-obliged entities manage, track, document and report the investigation of potential money laundering cases, facilitating compliance with AML regulations.