- May 25, 2023

- 4 min read

The Largest AML Fines in the World—2023 Update

Learn about the biggest AML fines issued in 2022.

By the end of 2022, the total amount of Anti-Money Laundering (AML) fines reached nearly five billion dollars. Most penalties revolve around the improper implementation of identity verification and Know Your Customer (KYC) solutions or insufficient internal policies and risk management systems. However, there were also some cases of more deliberate crime, such as facilitating tax evasion.

In short, many businesses have had to pay millions of dollars to regulators, not only leading to debt but also damaging reputations due to investigations. Obviously, it’s much cheaper to invest in efficient compliance procedures and proper checks, rather than dishing out millions in regulatory fines.

Sumsub has compiled the largest AML fines of 2022, diving into reasons behind the penalties and what ended up happening to the companies affected. We also talk about recent developments in the global regulatory framework and offer advice on how to stay compliant with AML regulations in 2023.

Fines by country and industry

According to a Financial Times report, there was a 50 percent increase in AML fines in 2022 compared to the previous year.

Split by industry, trading and brokerage firms were ordered to pay more than six billion dollars. Meanwhile, the banking industry was fined over two billion dollars.

The largest fines of 2022

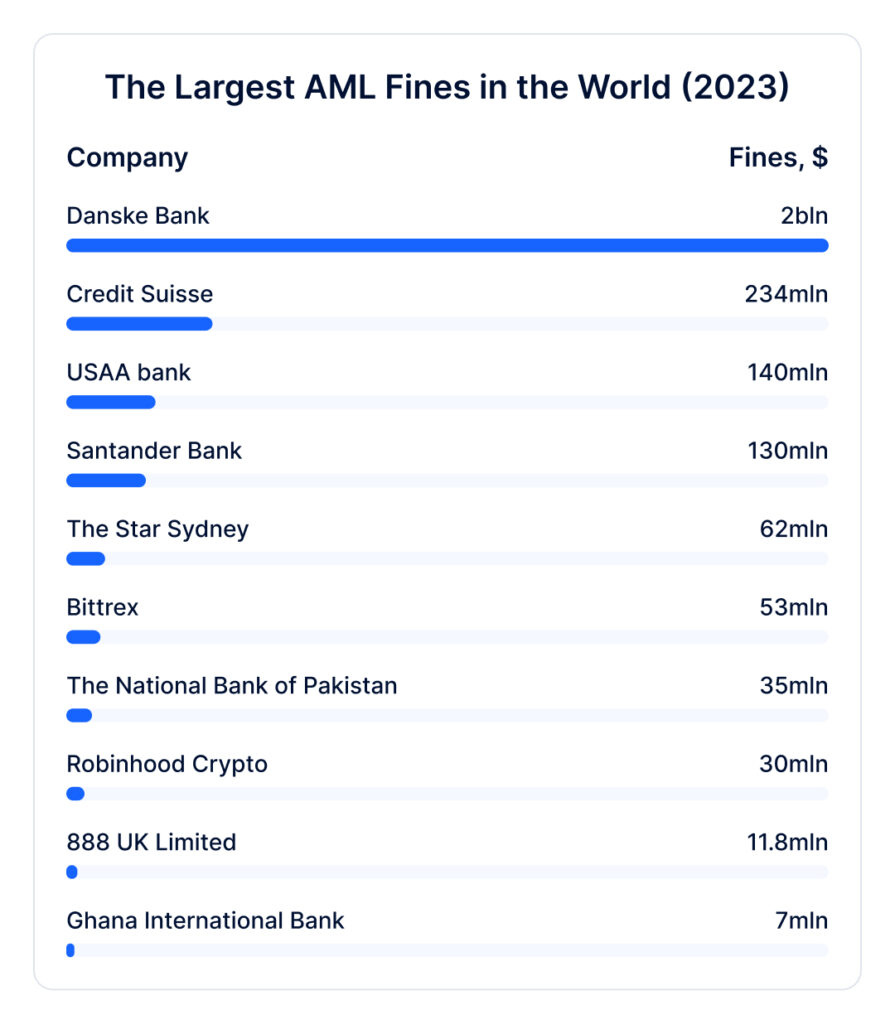

Some of the biggest global companies were penalized over three billion dollars in 2022. In the chart below, you can see which got fined the most.

Now, let’s take a deeper look at the five businesses that had to pay the most.

Danske Bank—Denmark

The Danish bank was fined for failing to comply with a variety of regulations. The bank was accused of lying about the effectiveness of its AML solutions and the adequacy of its transaction monitoring process. As it turned out during the investigation, the bank had a high-risk, offshore customer base.

In 2018, Danske Bank confirmed that a large proportion of its cash flow coming from Estonia had suspicious origins. Yet, it’s not clear how much of it was actually money laundering. As a result, the bank agreed to pay two billion dollars to the US regulators and over $400 million to Estonian authorities.

Credit Suisse—Switzerland

An investigation by French authorities found that Credit Suisse assisted clients in avoiding tax payments. The bank opened a series of shell companies around the world so that clients didn’t have to pay taxes to France. As a result, Credit Suisse had to pay $234 million to settle the case.

This is not the first time the bank was fined by regulators. In 2014, it paid $2.6 billion to the US government for another case of tax evasion. The latest findings of the US Senate Committee of Finance also uncovered that Credit Suisse concealed over $700 million from the IRS in violation of the 2014 plea agreement.

USAA Bank—USA

The USAA Federal Savings Bank is known for working with people who serve or served in the US military. The bank is over 120 years old and has had a good reputation until the last several years. In March 2022, the Financial Crimes Enforcement Network (FinCEN) penalized the financial institution for violating the Bank Secrecy Act (BSA), with instances dating back to 2016. In addition to these compliance problems, the bank admitted that it purposefully failed to properly report thousands of suspicious transactions. As a result USAA Bank was fined $140 million.

Santander Bank—UK

In the last several years, Santander UK Plc (part of Santander Group) implemented inadequate Know Your Customer (KYC) solutions, failing to verify the nature of their client’s business, as well as the purpose of the relationship. This made it easier for criminals to launder money through the bank. Additionally, the UK’S Financial Conduct Authority (FCA) reported that the bank had problems identifying the exact amount of transactions being made through the firm. As a result, the FCA fined the bank over 3,300. The original fine was supposed to be £153,990,400, but since the bank didn’t dispute the decision, it got a 30 percent discount.

The National Bank of Pakistan—Pakistan

National Bank of Pakistan (NBP) was found guilty of failing to comply with regulations. This includes inadequate Bank Secrecy Act and AML compliance programs, serious issues with its transaction monitoring system, and significant shortcomings in managerial oversight. This led to a penalty of $35 million from US authorities, after a series of warnings regarding possible AML breaches and consecutive failures to take any actions.

Main regulations in 2023

Regulators all over the world keep introducing more robust measures to minimize the spread that led to activity in the financial sector. Here are the main regulations of 2023:

- Implementation of the Financial Action Task Force’s (FATF’s) Recommendation 16, known as the Travel Rule, in a growing number of countries

- Introduction of the Markets in Crypto Assets (MiCA) rule by the European Union

- The future establishment of an Anti-Money Laundering (AML) authority in the European Union

- New rules on the Beneficial Ownership Information Report in the US

- Launch of the Collaborative Sharing of Money Laundering/Terrorist Financing Information and Cases (COSMIC) platform in Singapore

- Changes to reporting material discrepancies for companies in the UK

- Expansion of the number of businesses that have to comply with AML laws in Canada

In light of these and other regulatory changes, it’s necessary for companies to quickly adapt to this constantly changing regulatory environment to avoid enormous fines and other penalties (e.g., license revocation).

How to avoid fines in 2023

The obvious answer is to stay compliant with the regulations. But how exactly can companies do this?

- Appointing a Money Laundering Reporting Officer (MLRO)

- Providing relevant training to the employees

- Assessing company risks

- Introducing identity verification procedures for clients

- Conducting Customer Due Diligence checks

- Using transaction monitoring solutions

- Keeping customer records

- Reporting suspicious activities in a timely manner

It should be noted that verification procedures can be long and complicated. That’s why it’s more beneficial to work with verification solution providers that can create custom flows that keep conversion high and compliance bulletproof.

Suggested read: 6 Key Steps to a Successful Anti-Money Laundering (AML) Program in 2023

Relevant articles

- Article

- 2 weeks ago

- < 1 min read

The world’s most anxious compliance officer shares his personal take on how he thinks effective transaction monitoring should be done.

- Article

- 1 week ago

- 9 min read