How to Detect Money Laundering in Vehicle Sales

It's no secret that expensive cars, yachts, and planes can be used to disguise illegal funds. In this article, we dig into how you can detect money laundering and achieve full AML compliance in high-end vehicle sales.

In July 2021, the UK imposed anti-corruption sanctions on Teodoro Nguema Obiang Mangue, vice president of Equatorial Guinea. He was accused of stealing government funds and laundering them through luxury goods and vehicles.

It wasn’t the first time that the vice president faced sanctions. In 2016 and 2017, European prosecutors confiscated his assets, including 26 supercars—Ferraris, Bentleys, and Lamborghinis—worth $27m.

But why did Mr. Obiang Mangue choose cars to conceal his funds? We try to answer this question in this article, diving deep into money laundering in vehicle sales.

Why should I read this?

Under AML regulations, anyone involved in vehicle sales can face significant fines and even criminal prosecution if they fail to detect money laundering. This includes law firms, banks as well as vehicle dealers—who can be any individual or business that trades vehicles or acts as an intermediary in their purchase or sale.

Dealers can fall under various categories in terms of AML compliance. They can be classified as financial institutions, non-financial businesses, and high-value dealers, depending on their size and location.

High-value dealers. A high-value dealer is any business or sole trader that accepts or makes cash payments above a certain threshold. Among countries that adopt this categorization of vehicle dealers are the UK and Australia.

Non-bank financial institutions (US). Any business engaged in the sale of cars, planes, or boats is classified as non-bank financial institutions. This means they must follow AML compliance requirements on par with banks.

Non-financial businesses (Europe). Individuals trading in goods belong to “non-financial businesses” and must comply with European Anti-Money Laundering Directives when they receive payments in cash over €10,000.

All these categories must follow AML requirements, including customer due diligence, suspicious activity reporting, and record-keeping. However, the extent of their AML compliance may differ. To find the exact requirements, dealers can refer to the AML guidance on the website of their regulator.

Why luxury transport attracts criminals

Several years ago, Malaysian businessman Jho Low spent $250 million on a superyacht. However, it turned out that this money was stolen from the Malaysian Welfare Fund. Low went into hiding, and now that same yacht is on sale for 100 million dollars less than he paid for it.

But why choose yachts to launder money? We break down the factors that make vehicle purchases attractive for criminals:

Ability to launder large sums. As prices for luxury vehicles are high, criminals can legitimize significant amounts in a single transaction.

Weak regulatory oversight. Dealerships are less regulated than banks and investment firms. For instance, Canada’s AML requirements don’t even mention vehicle dealers.

Low awareness of AML requirements among dealers. According to Transparency International, high-value dealers have a poor record when it comes to following AML requirements. For instance, they rarely contact law enforcement even if they suspect money laundering.

How money is laundered

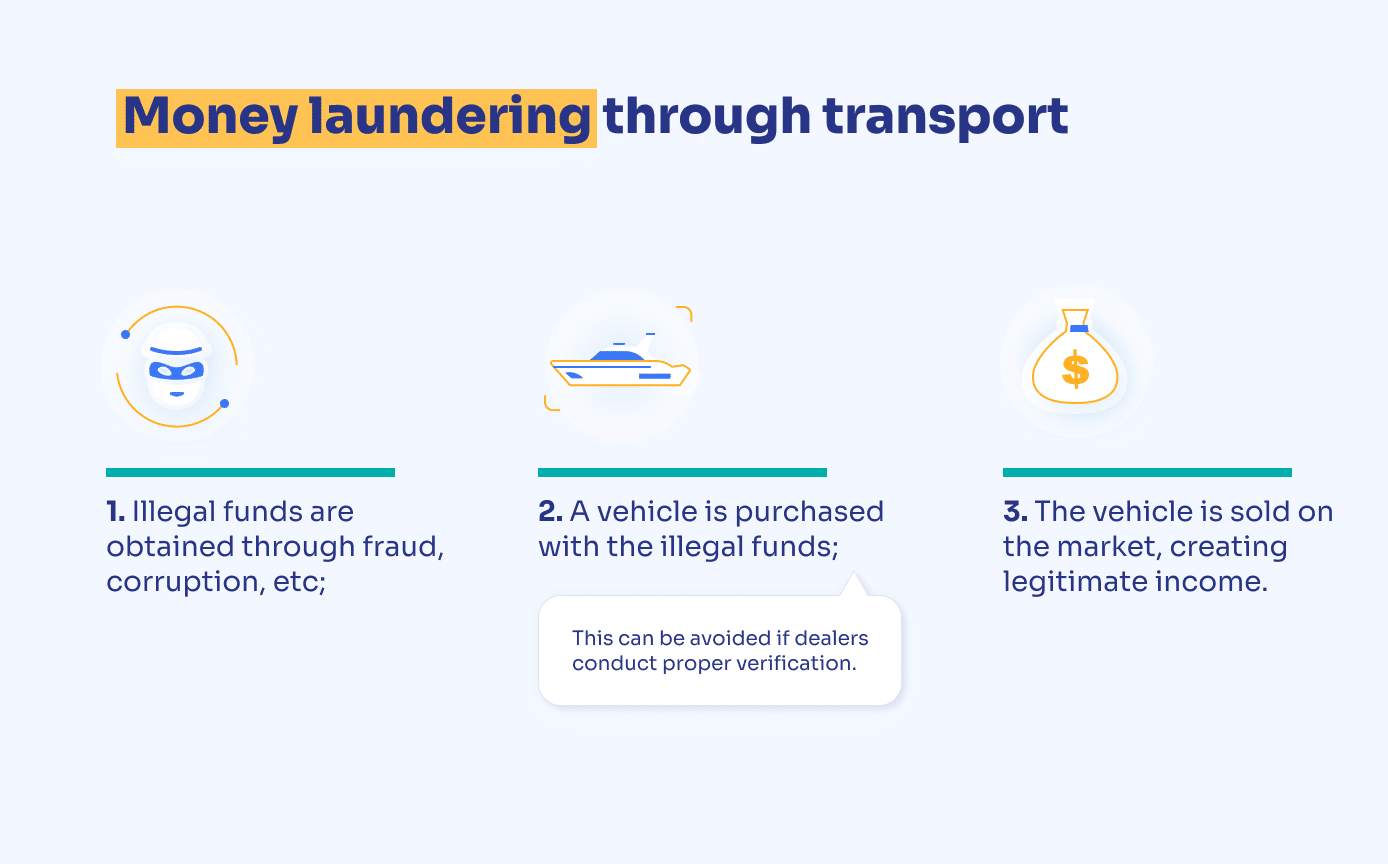

The process of laundering money through vehicle sales can sometimes be quite straightforward: criminals simply buy a yacht with illegal funds in a jurisdiction with weak AML controls and sell it as a legitimate asset in another country.

In the picture is the simplest money-laundering scheme using vehicles

The scheme above is simple, but criminal organizations employ a number of methods to add complexity and stay under the radar of law enforcement. For instance, they can use front companies to conceal the real buyer of a vehicle or try to avoid well-regulated banking systems by paying through cash, mobile apps, and prepaid cards.

Criminals can also trade vehicles to launder money. Here’s how it works: imagine two dealerships, A and B. Dealership A pretends to purchase vehicles from dealership B. In reality, both dealerships collude to fake sales documents and may not even deliver cars. Meanwhile, illegal funds, disguised as payment for the cars, are made to appear legitimate.

Another money laundering method is when criminals pretend to buy a vehicle and put down a deposit on it. Then, they pull out of the deal and ask to have their deposit back. This way they turn illegal money into a legitimate refund, which is explained in the case below.

A drug dealer comes to a Ferrari dealer to buy a Portofino for $215,000. He puts $9,900 down in cash and promises to come back with a check to complete the sale. Later, he says that he’s changed his mind. Meanwhile, the dealership has already deposited the cash into its bank account, and must give the buyer a company check instead. The drug dealer plays the same trick with other sellers and turns illegal proceeds into legitimate company checks.

How to avoid participation in a laundering scheme

A dealer can face fines and imprisonment if they don’t follow proper AML procedures. Here’s how to build an AML system that will detect and deal with money laundering.

Building an AML compliance program. To mitigate money laundering risks, businesses must institute an AML compliance program, which is a combination of internal compliance policies supplemented by the following safeguards:

- Customer identification and verification;

- Customer Due Diligence;

- Ongoing monitoring;

- A compliance team;

- AML training;

- Audits.

The costs of developing an AML compliance program are nothing compared to the financial and reputational losses of failing to prevent money laundering.

In 2015, US law enforcement arrested Bryan Barbarawi, the owner of several car dealerships in Ohio, for money laundering—a crime punishable by up to 20 years in prison and $250,000 in fines.

Barbarawi got caught when he sold a car to an undercover agent who made clear that his money came from “drug trafficking.” To make matters worse, Barbarawi made his employee fabricate a Form 8300—a Report of Cash Payments Over $10,000—to conceal the undercover buyer’s source of funds.

Verifying a customer’s identity. Dealers must verify the identities of the individuals and companies they transact with.

When dealing with customers, businesses must follow a risk-based approach. This means defining the money laundering risk that a customer poses. When doing so, vehicle dealers should consider a range of factors, including the customer’s identity, activity profile, as well as the complexity and volume of the transaction.

If a customer poses a high money laundering risk, dealers must employ a more serious verification procedure known as Enhanced Due Diligence. This includes requesting that the customers submit their proof of source of funds or source of wealth to ensure that the funds come from a legal source.

To check if a customer is sanctioned or involved in illegal activity, dealers should screen buyers against lists of known terrorists, sanctioned persons, and wanted criminals. These include OFAC, UN, and EU Sanctions lists as well as Interpol lists. Also, businesses must perform adverse media checks to see if a customer is mentioned in any negative news.

If the buyer is a company, dealers should determine its Ultimate Beneficial Ownership (UBO), as many criminals use shell firms to keep their names secret. To identify beneficiaries, agents can request that the company submits its UBO information to check it against beneficial ownership registers.

A Chinese businessman wants to buy a yacht from a Dutch shipyard. He sends scanned ID documents and proofs of sources of funds to the seller. The documents are in Chinese. They seem legitimate, but the Dutch seller can’t say for sure. Can the seller proceed with the deal?

In reality, this businessman could have sent fake documents. To avoid selling the yacht to a fraudster, the shipyard needs to check the submitted documents for signs of tampering. This can’t be done just by looking at the documents—advanced forgery is invisible to the human eye.

The solution is to reach out to a remote verification provider, who screens the documents using AI-based technology. These providers use systems that recognize documents by country and type, defining the security features (holograms, stamps, fonts). They then verify the document against the determined security features to detect fakes.

Building an AML team. Dealers must hire specialists responsible for executing the company’s AML policies and procedures. This includes appointing a Money Laundering Reporting Officer (MLRO) to oversee the dealer’s AML procedures and report suspicious activity.

Conducting AML training. All employees should receive training on AML regulation and the company’s AML policies.

Performing an audit. Dealers should schedule annual internal and external reviews to ensure that AML policies are being followed.

Reporting cash. Dealers must report large payments in cash. For instance, in the US, the reporting threshold is $10,000. The term ‘cash’ means notes, coins, or travellers’ cheques, in any currency.

Suspicious Activity Reporting. Dealers must report instances of buyers acting suspiciously (see the red flags below). The buyer shouldn’t be made aware that a report was filed as this may hinder the investigation.

Record-keeping. Dealers must gather, record, and maintain information obtained during customer verification.

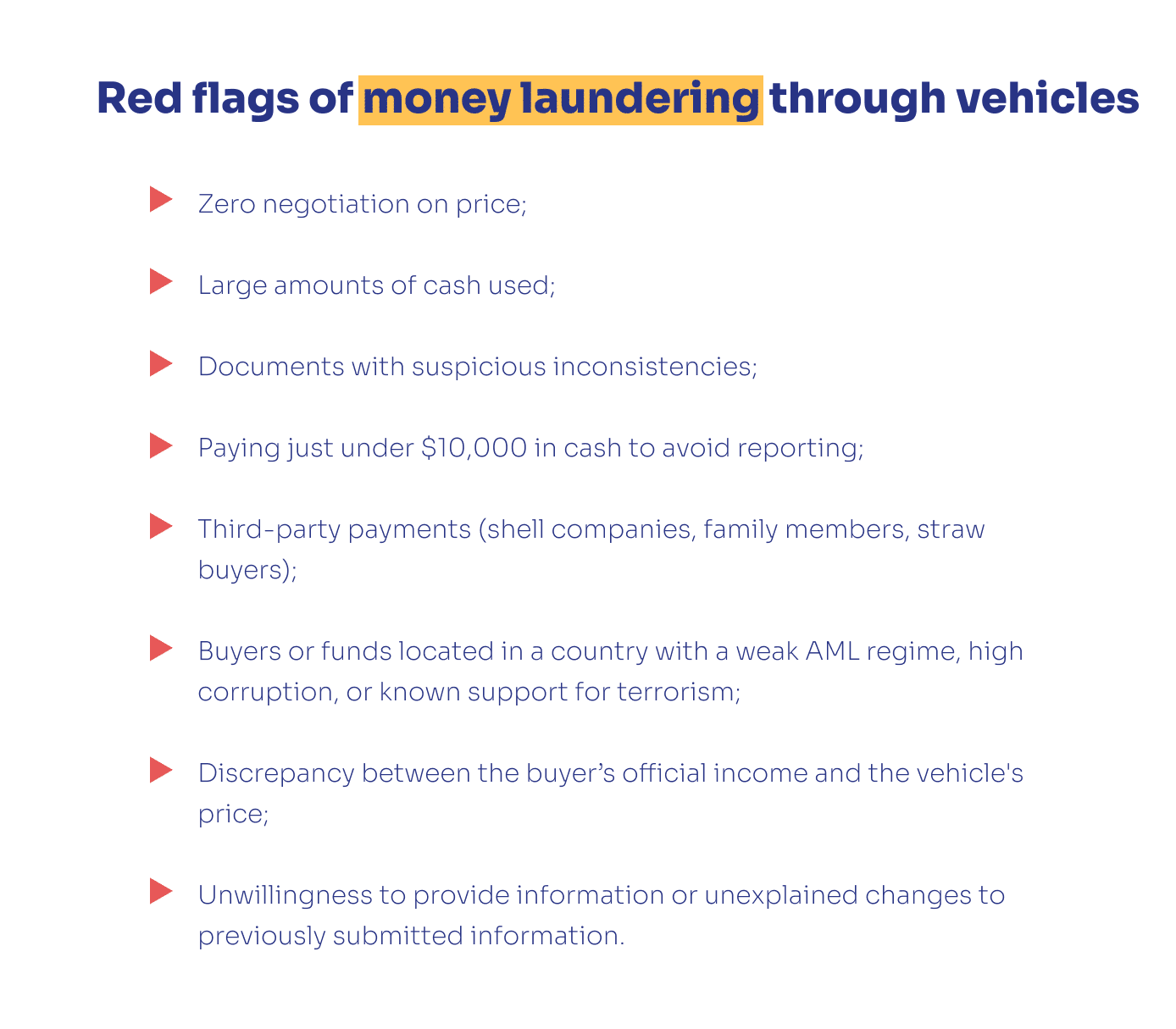

Money laundering red flags to look out for

Dealership employees should be able to detect the signs of money laundering. Here are the main red flags:

- Third-party payments (shell companies, family members, straw buyers);

- Large amounts of cash;

- Documents with inconsistencies;

- Unwillingness to provide information or unexplained changes to previously submitted information;

- Zero negotiation on price;

- Paying just under $10,000 in cash to avoid reporting;

- Discrepancy between the buyer’s official income and the vehicle price;

- Buyers or funds located in a country with a weak AML regime, high corruption, or known support for terrorism.

This is a checklist with the red flags; feel free to save it to your device

The presence of a single red flag may not be a sufficient basis for suspecting criminal activity. In cases like this, dealers should continue to keep an eye on the buyer to put this red flag into context. If a combination of red flags is detected, the company must freeze the deal and file a Suspicious Activity Report with a regulator.

Wrapping it up: detecting money laundering in vehicle sales

Criminals use a number of methods to launder money through vehicles. These include buying a vehicle with cash or running a dealership to conceal the true sources of funds.

To detect money launderers, vehicle dealers should verify the identities and sources of income of the individuals and companies they enter transactions with. Also, dealers must detect and report suspicious activity, build an AML team and follow other AML procedures to avoid regulatory fines and imprisonment.

To become an expert in detecting criminals, read more from our series on money laundering:

Close the Sale: How to Run a Real Estate Business in a Compliant Way

Subscribe to Sumsub’s newsletter so you don’t miss future articles. The form is down below.

Are AML requirements for vehicle dealers making you feel lost? Check out Sumsub’s AML/KYC solution.