- May 19, 2025

- 9 min read

AML Compliance Program: The Essential Guide for 2025

This guide helps businesses develop an AML compliance program to keep customer onboarding effective.

An AML (Anti-Money Laundering) compliance program consists of policies and procedures that financial institutions enact to prevent money laundering and terrorist financing. An effective Anti-Money Laundering (AML) program is one of the keys to protecting businesses from illicit money and fines for non-compliance.

Let’s start from the basics. Financial businesses need to keep an eye on multiple AML guidelines, rules, and regulations. And there are many different rules to follow. Some are international, such as the Financial Action Task Force’s (FATF) Recommendations or the European Union’s AML Directives. While others are national, such as the Bank Secrecy and Patriot Acts in the US. Then you have country-specific regulators that regularly amend AML guidelines in their respective jurisdictions. Despite these variations, there are general international standards that all countries are expected to follow to maintain a unified global approach to combating money laundering.

AML best practices continue to advance in order to keep such businesses stress- and fraud-free. However, incorporating new measures doesn’t always come smoothly. Business owners have to invest time and resources in renovating their AML policies and building reliable AML programs.

This article will guide you through the process of building an AML compliance program for your business, with insights from the experts at Sumsub.

What is an AML compliance program?

An Anti-Money Laundering (AML) compliance program entails everything a company does to prevent money laundering and terrorist financing

- Employee training

- Customer due diligence

- Ongoing monitoring

- Record keeping

- Detection of suspicious operations

- Reporting.

The aim of an AML compliance program is to detect, respond, and eliminate inherent and residual money laundering, terrorist financing, and fraud-related risks.

An effective AML compliance program won’t let suspicious customers and transactions enter the financial system. However, criminals constantly invent sophisticated methods of money laundering and fraud to fly under the radar. In 2025, no industry is immune to money laundering, as criminals exploit every possible channel—from sports to NFTs—to move illicit funds. That’s why it’s essential to develop a robust AML program capable of detecting and responding to both traditional money laundering and increasingly complex fraud schemes.

Otherwise, businesses expose themselves to financial and reputational losses.

Suggested read: The Three Stages of Money Laundering and How Money Laundering Impacts Business

What impacts AML compliance. Before creating a compliance program, an organization has to summarize and define its potential risks and legal obligations.

- The money laundering risks it’s exposed to

- Respective local and foreign laws and punishment for non-compliance

- Potentially suspicious activities within the company.

Suggested read: Machine Learning and its Role in Fraud Detection and Anti-Money Laundering Compliance

Key components of an effective AML program

This guide contains the steps to developing an effective compliance program:

1. Appointing a compliance officer

AML legislation in most countries requires obliged entities to appoint an AML compliance officer (or an MLRO). This person handles everything related to the compliance program: internal audits management, compliance analysis, development of appropriate guidelines, employee training programs, etc.

Candidates for this position must possess expert knowledge of regulatory data sources, compliance analysis tools, and demonstrate expertise in relevant regulations.

In addition, a compliance officer needs extensive experience in the financial sector, preferably in AML compliance, legal, or internal risk audits. Another must is appropriate certification (CAMS, CAFP, CRCM, etc.).

2. Implementing internal policies and procedures

Developing and maintaining robust internal policies and procedures is essential for the effective operation of an AML program. These should be tailored to the organization's size, complexity, and risk profile, and should include procedures such as:

- Customer Due Diligence (CDD)

- Transaction monitoring

- Record-keeping

- Reporting of suspicious activities

Regular reviews and updates of these policies help them remain effective and aligned with current regulatory expectations.

3. Conducting risk assessments

A customer risk assessment analyzes the information collected from the customer during onboarding to assign a particular risk level to them. FATF recommendations require that financial institutions take steps to identify and assess their money laundering and terrorist financing risks, including factors relating to customers, countries or geographic areas, as well as products, services, transactions, or delivery channels.

One of the most important points is the Business-wide risk assessments, which should help understand the risks in a particular AML jurisdiction.

ML/TF risks associated with business relationships should be covered by corresponding Customer Due Diligence (CDD) policies and procedures (which we will discuss in detail in the following section). This means deciding on the appropriate level and type of Due Diligence (including simplified due diligence, or enhanced due diligence) for a given customer base.

Next, the entity is required to develop policies and procedures to detect, monitor and report, where applicable, customers and transactions which pose high risk due to common risk factors, such as high-risk countries, PEPs, due diligence results, etc.

4. Customer Due Diligence (CDD)

Regulatory bodies put Customer Due Diligence (CDD) into action, which aims to improve transparency in financial transactions. It does this by requiring financial institutions to:

- Identify and verify customers. Confirm the identity of customers opening accounts.

- Identify and verify beneficial owners. Determine the persons who own or control legal entity customers.

- Understand the nature and purpose. Comprehend the intended purpose of customer relationships to develop risk profiles.

- Conduct ongoing monitoring. Monitor transactions to identify and report suspicious activities and update customer information as necessary.

5. Ongoing monitoring

Continuous monitoring of transactions and customer activities is crucial to detect and prevent illicit activities. Organizations should employ systems capable of identifying unusual patterns or behaviors that may indicate money laundering.

6. Independent testing and auditing

Independent testing of the AML program should be conducted periodically to assess its effectiveness. This can be performed by internal audit departments, external consultants, or qualified personnel not involved in the AML function. For example, Section 59(2) of the New Zealand AML/CFT Act obliges companies to carry out an independent audit every two years or upon a supervisor’s request.

An independent auditor must have sufficient AML expertise not only to examine existing policies and procedures, but to make proper recommendations for their improvement, if necessary. Some of their responsibilities include:

- Evaluating compliance controls. Auditors assess whether AML policies and procedures are being followed and if they are aligned with current legal and regulatory expectations.

- Testing transaction monitoring systems. This includes reviewing the logic and effectiveness of automated systems and alert thresholds.

- Reviewing recordkeeping and reporting processes. Auditors check if FIU reports (Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs)), where applicable, are filed accurately and in a timely manner.

- Identifying program weaknesses. Independent testing helps uncover procedural gaps or ineffective controls that could expose the organization to risk.

- Assessing employee compliance. Auditors may evaluate staff awareness and adherence to training, escalation procedures, and proper documentation.

According to the FFIEC BSA/AML Examination Manual, the scope and frequency of independent testing should be commensurate with the organization's risk profile and may be conducted annually or more frequently for high-risk institutions.

7. Beneficial ownership reporting (where applicable)

For example, under the Corporate Transparency Act, FinCEN requires certain entities to report beneficial ownership information to improve transparency and fight illicit activities. Reporting companies must disclose:

- Beneficial owners. Individuals who, directly or indirectly, own or control a significant percentage of the company.

- Company applicants. Individuals who file the formation documents for the company.

This information helps law enforcement and regulatory agencies prevent the misuse of legal entities for money laundering and other illicit purposes.

Check out this guide to learn the specifics of beneficial ownership reporting across the US, EU, and APAC: The Full Guide to Beneficial Ownership Reporting: What Businesses Need to Know in 2025

8. Employee training and awareness

It is necessary to design an employee training program to meet the AML requirements of the company. The program should be scheduled in accordance with recent changes in legislation or after serious incidents, such as employees involved in money laundering. If such incidents occur, it means that existing policy is ineffective and must be amended.

To have proper protection from money laundering, entities should have internal controls across all departments and branches.

Who to train: compliance and audit teams, senior management, and high-risk departments that come into direct contact with clients.

Training topics:

- General information: the consequences of failing to comply with AML/CFT laws, as well as the importance of spotting and stopping these crimes.

- Legal framework: detailed review of anti-money laundering regulations.

- AML penalties: an overview of penalties for non-compliance with AML laws.

How to train: There are some conventional training methods that are commonly used onsite, online, through third parties, or with the help of experienced employees:

- Educational presentations and webinars prepared by the company’s compliance officer

- Interactive e-learning modules and evaluation tests to measure AML proficiency

- Regular staff meetings concerning the latest AML issues on the market

- Updating Anti-Money Laundering controls and guidelines according to legislation and sharing the changes with staff.

Of course, every company has to consider its AML steps depending on the industry and business specifics.

Compliance with regulatory requirements

An effective Anti-Money Laundering (AML) program must align with various regulatory requirements and guidelines established by authorities. These regulations are designed to detect, prevent, and report money laundering and related financial crimes. AML compliance programs are mandatory for a broad range of financial institutions, including:

- Banks and credit unions

- Broker-dealers and investment advisers

- Money services businesses (MSBs)

- Insurance companies

- Casinos and gaming establishments

- Mutual funds and other investment companies

Bank Secrecy Act (BSA)

The Bank Secrecy Act (BSA), which was passed in 1970, forms the foundation of the anti-money laundering (AML) rules in the United States. It mandates financial institutions to implement comprehensive AML programs, maintain detailed records, and report certain transactions to the Department of the Treasury. Key requirements under the BSA include:

- Establishing a BSA/AML compliance program. Financial institutions must develop and maintain procedures reasonably designed to assure and monitor compliance with BSA requirements.

- Reporting obligations. Institutions are required to file FIU reports (SARs or CTRs) for transactions that meet specific criteria.

- Customer Identification Program (CIP) and Customer Due Diligence.

Proper Identification and verification of the customers in accordance with CIP

EU’s AML package

The European Union introduced a comprehensive AML package in 2024, aimed at harmonizing regulations across member states. Key components include:

- Regulation (EU) 2024/1624. Focuses on preventing the use of the financial system for money laundering or terrorist financing.

- Directive (EU) 2024/1640. Establishes mechanisms for member states to prevent the use of the financial system for illicit purposes.

- Regulation (EU) 2024/1620. Establishes the Authority for Anti-Money Laundering and Countering the Financing of Terrorism (AMLA), granting it supervisory powers over high-risk financial entities.

Asia-Pacific (APAC) regulations

In the APAC region, countries are updating their AML regulations to align with international standards. The regulations include, but are not limited to:

- Australia. The Anti-Money Laundering and Counter-Terrorism Financing Amendment Bill 2024 expands AML obligations to include sectors like real estate, legal, and accounting services. This move aims to modernize Australia's AML framework and prevent potential "grey-listing" by the Financial Action Task Force (FATF).

- Hong Kong. The Hong Kong Monetary Authority (HKMA) has launched the "Fintech 2025" strategy, promoting the adoption of regulatory technology to enhance AML compliance and combat financial crime.

- Singapore. The Monetary Authority of Singapore (MAS) continues to enforce stringent AML regulations, emphasizing the importance of technology in detecting and preventing money laundering activities.

Best practices for AML compliance

Maintaining AML compliance is not a one-time task—it’s an ongoing process that requires strategic planning, cross-functional coordination, and proactive adaptation to regulatory and criminal landscape shifts. Organizations that implement AML best practices are not only more likely to pass audits and examinations but also better protected against reputational, financial, and legal risks.

An effective AML program should be:

- Risk-based: Tailored to the specific threats posed by high-risk customers, geographies, and delivery channels.

- Proactive, not reactive: Adjusted regularly based on new risks, guidance, or enforcement trends.

- Deeply embedded: Integrated into business operations, not siloed as a compliance-only responsibility.

- Audit-ready: Documented clearly, with evidence available to support your compliance efforts at any time.

To help ensure you're on the right track, you can download our concise AML Audit Readiness Checklist highlighting the core elements regulators expect to see.

AML compliance audit readiness checklistTo go further:

- Set internal reminders for regular reviews and risk reassessments

- Use dashboards or compliance tools to track ongoing AML efforts

- Establish escalation processes for issues discovered during internal reviews or audits

- Stay engaged with regulators and industry bodies to anticipate future expectations.

Feel free to save this checklist to your device.

Common challenges in AML compliance and how to overcome them

Despite significant investments in AML compliance, many organizations continue to face persistent challenges that can lead to regulatory scrutiny, financial penalties, and reputational damage. Understanding these challenges and implementing strategies to address them is crucial for maintaining a robust AML program.

Evolving regulatory landscape

AML regulations are continually evolving, with new laws and amendments introduced to address emerging risks.

To avoid this, businesses should establish a dedicated regulatory watch function within the compliance team to monitor changes in AML laws and regulations. Engage with industry associations and regulatory bodies to stay informed about upcoming changes. Regularly update internal policies and procedures to reflect new regulatory requirements.

Inadequate transaction monitoring systems

Outdated or poorly calibrated transaction monitoring systems can fail to detect suspicious activities effectively. Additionally, it’s done manually in a lot of cases, using internal solutions like spreadsheets, which is highly impractical. As a result, businesses can face not just one penalty, but multiple ones from different regulators. A notable example is TD Bank, which faced two penalties in 2024: $1.3 billion from FinCEN and $1.8 billion from the US Department of Justice.

You should conduct regular assessments and updates of transaction monitoring systems to make sure they can detect current money laundering typologies. Implement advanced analytics, advanced transaction monitoring solutions, and AI tools to enhance detection capabilities. Ensure that systems are tested and validated periodically to maintain their effectiveness.

Complexity in Beneficial Ownership Identification

Identifying and verifying beneficial owners, especially in complex corporate structures, remains a significant challenge. Notably, criminals often use shell companies and layered ownership to obscure their identities.

Implement robust KYB procedures that include thorough verification of beneficial ownership information. Utilize reliable data sources and registries to cross-verify ownership details. Adopt a risk-based approach to CDD, applying enhanced due diligence measures for higher-risk entities.

Suggested read: UBO: Understanding the Ultimate Beneficial Owner

Data management and integration issues

Invest in data integration platforms that merge information from multiple sources into a unified system. Implement data governance frameworks to improve data quality, consistency, and integrity. Regularly audit data management practices to identify and address gaps.

Strengthening your AML compliance framework

An effective AML compliance program isn’t just a collection of documents gathering dust—it's a dynamic framework that needs to adapt as your business evolves, as regulations change, and as the landscape of financial crime shifts. To truly strengthen this framework, businesses should go beyond just following a basic checklist. Instead, embrace a strategic, technology-driven approach that keeps pace with these changes.

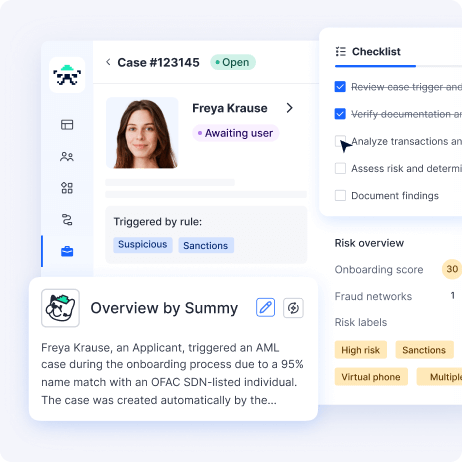

At Sumsub, we provide a full-scale AML/KYC Compliance software designed to help businesses automate and streamline their entire compliance workflow—from customer onboarding to ongoing monitoring and reporting.

Sumsub’s AML solution includes:

- Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) of both natural and legal persons

- Business verification

- Automated screening against global sanctions, watchlists, and PEP databases

- Dynamic risk scoring

- Ongoing transaction monitoring with customizable risk scenarios

- SAR/STR case management tools

- Workflow automation to adapt instantly to changing risk levels

- Comprehensive audit trails for full transparency and accountability

Whether you're a crypto platform, fintech, bank, or payment provider, Sumsub helps you build a robust, audit-ready AML framework that scales with your business and keeps you ahead of financial crime and regulatory scrutiny.

-

What are the essential pillars of an AML compliance program?

The important pillars of each AML compliance program are appointing a compliance officer, developing internal policies and procedures, conducting ongoing training, independent testing of the program, implementing Customer Due Diligence, conducting proper record-keeping, and filing suspicious activity reports (SARs/STRs).

-

Who is required to implement an AML compliance program?

Financial institutions, crypto businesses, money service businesses, and other regulated entities under laws like the BSA are required to have an AML program in motion.

-

How often should AML programs be independently tested?

The frequency of testing the AML program depends on the organization’s risk profile, jurisdictional requirements, and risk appetite. However, in most cases, independent testing should be conducted at least annually to ensure the program remains effective and compliant.

-

What are the consequences of non-compliance with AML regulations?

Penalties for non-compliance with AML regulations can include heavy fines, license loss, reputational damage, and even criminal liability for serious breaches.

-

How does customer due diligence fit into an AML program?

Customer due diligence is a core component of an AML program, used to verify customer identities, assess risk levels, and monitor for suspicious activity throughout the customer relationship.

-

What is an AML compliance software?

AML compliance software automates tasks like identity verification, sanctions screening, transaction monitoring, and reporting to help meet regulatory requirements efficiently.

Relevant articles

- Article

- 1 week ago

- 6 min read

What counts as proof of address in the UK? See accepted documents and how to open a bank account if you’ve just moved to the country.

- Article

- 6 days ago

- 11 min read

Check out how AI deepfakes are evolving and discover proven strategies for detecting and preventing deepfake threats to protect your business.

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.