Behind every major financial crime headline lies the same enabler: money laundering. It fuels corruption, terrorism, and fraud, costing the world trillions each year and putting businesses under strong scrutiny. According to the United Nations Office on Drugs and Crime (UNODC), 2-5% of the world’s GDP—roughly $2 trillion—is laundered each year. Meanwhile, Europol estimates that less than 1% of these illicit funds are successfully detected and recovered.

The message is clear: the global fight against money laundering is intensifying, and regulators are placing growing pressure on businesses across sectors, from fintechs and banks to gaming and crypto platforms, to demonstrate compliance.

To stay up to date, companies need more than manual checks or fixed compliance processes. They need smart, automated, AI-powered AML systems that adjust to changing regulations, track risks, and identify suspicious activities before problems arise.

This is where Sumsub’s AML Compliance solution comes in.

Why companies need an AML compliance solution

AML compliance is now essential for businesses, not just a box to check. For digital platforms that work in multiple countries, the main challenge is to stay compliant while also keeping things efficient. This means making sure that user onboarding, payments, and customer growth continue smoothly.

Today’s financial crime presents several key challenges:

- Evolving regulations: Laws such as the EU’s AMLA and AMLD6, the UK’s Money Laundering Regulations, and the US Bank Secrecy Act demand continuous compliance and transparent reporting. Businesses must stay compliant across multiple jurisdictions.

- Explosion of data: Compliance teams nowadays deal with large amounts of transaction and identity data. Without automation, manual reviews can quickly become unmanageable.

- Increased regulatory scrutiny: Authorities like FINTRAC, FinCEN, and the FCA are imposing record-breaking fines for AML failures, even on non-bank entities.

- Emerging financial ecosystems: Crypto platforms, payment providers, and online gaming companies are increasingly targeted by money launderers who exploit anonymity and high transaction volumes.

These factors make it impossible to rely only on manual compliance processes. Businesses need real-time screening, dynamic risk scoring, automated reporting, and other useful tools, all integrated into a single, end-to-end system.

How to choose the right AML compliance solution

When selecting an AML compliance platform, organizations should focus on flexibility, coverage, and scalability. The right system must meet current regulations and be able to adapt to future ones, with no cost to operational efficiency.

Here are the core capabilities that matter in AML compliance:

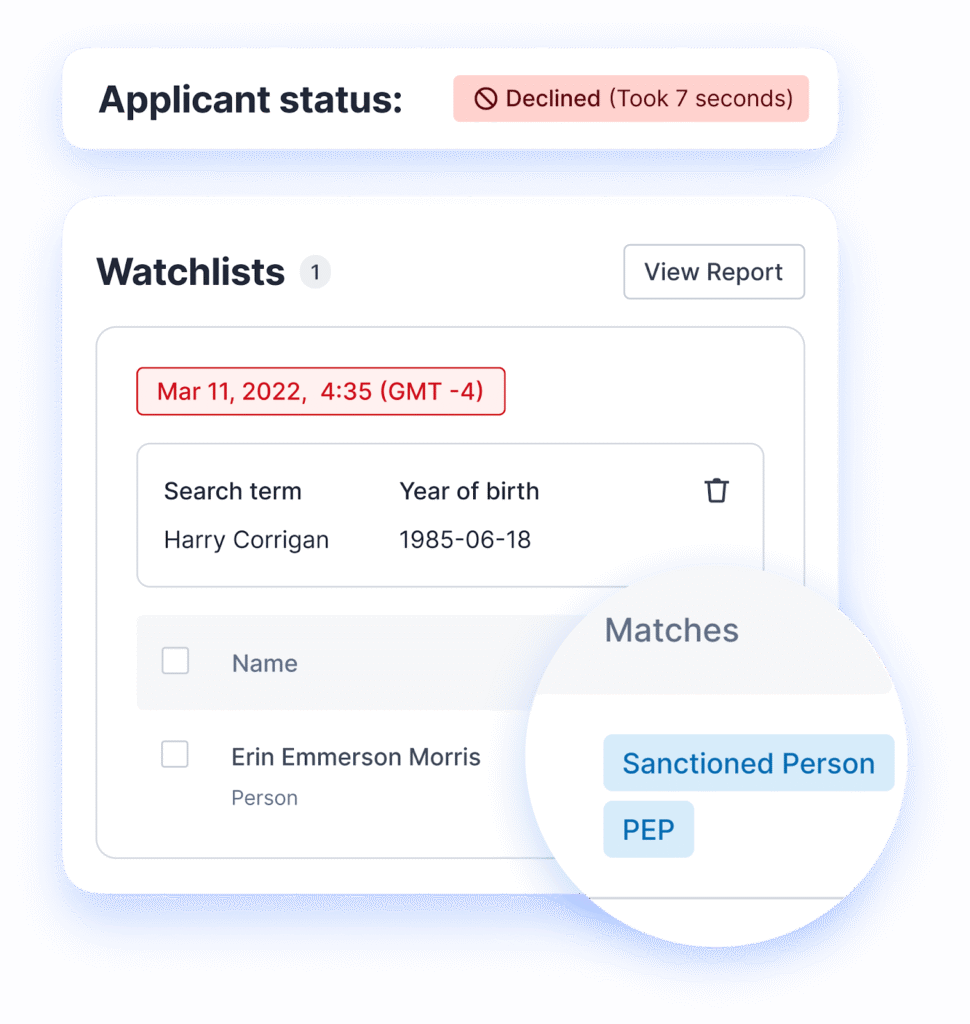

- Comprehensive AML screening: Continuous checks against global sanctions lists, PEPs, and adverse media sources to prevent onboarding of high-risk individuals.

- Ongoing monitoring: Automated rescreening and transaction monitoring to detect suspicious activity post-onboarding.

- Dynamic risk assessment: AI–powered scoring models that are updated as user behavior and regulatory contexts change.

- Customizable rules engine: The ability to tailor risk rules and workflows with no coding required is a good way for a company to keep up with specific policies or jurisdictions.

- Regulatory reporting: A quality solution should have tools for generating suspicious activity reports (SARs) and ensuring audit readiness.

- Unified compliance system: Integration with KYC, KYB, and transaction monitoring for full lifecycle compliance makes things easier and more efficient.

- Scalability and automation: As user volumes grow, the system should handle thousands of checks per day without slowing performance.

- Case management: Automated case management to create cases for investigating using chosen criteria and assign them to dedicated compliance officers for further processing.

The most effective AML compliance solutions go beyond screening. They combine intelligence, automation, and unified data visibility across all stages of the customer lifecycle.

What sets Sumsub’s AML Compliance apart

Sumsub’s AML Compliance solution delivers end-to-end automation and intelligence to help organizations stay ahead of evolving AML obligations while maintaining compliant user journeys. It does so through different handy features. It’s AI-powered, driving smarter compliance decisions, and enhancing automated screening, intelligent risk detection, and streamlined case management.

1. End-to-end AML automation

From onboarding to continuous monitoring, Sumsub automates AML checks across the whole customer lifecycle. Companies can screen users and entities against vast global sanctions and watchlists, PEP lists, and real-time adverse media sources.

2. Unified compliance hub

Sumsub’s AML engine integrates seamlessly with its KYC, KYB, and Transaction Monitoring tools. This lets compliance teams manage identity verification, screening, and risk monitoring under one roof, which helps eliminate isolated data collections.

3. Dynamic risk scoring

Every user and business entity is continuously evaluated based on behavior, geography, and transaction data. Risk scores update in real time and give a clear picture of evolving threats.

4. Automated rescreening

Regulatory lists and sanctions are updated regularly and often. Sumsub’s automated rescreening ensures that existing customers are rechecked automatically, with alerts triggered when risk statuses change.

5. Configurable rules and workflows

No two businesses have identical AML policies. With Sumsub’s no-code Workflow Builder, teams can adjust verification paths, set escalation rules, or automate reviews based on dynamic conditions, without developer input.

6. Global regulatory coverage

Sumsub covers over 220 countries and territories, supporting compliance with FATF standards and various local AML regulations.

7. Audit-ready compliance

All actions are recorded in a clear and unchangeable audit trail. This helps businesses prepare for reviews and inspections by regulators with full transparency and ease. The solution can also generate and export FIU reports directly from the case management interface for compliance purposes.

In short, Sumsub empowers compliance teams with a centralized, adaptive system that evolves with both regulations and risks.

How clients benefit from Sumsub’s AML Compliance

Sumsub’s AML solution is already helping companies across industries, including finance, crypto, telecom, and iGaming, achieve compliance while keeping growth on track.

Betmaster: Scaling compliance in a global iGaming market

As a global iGaming operator, Betmaster faced the challenge of keeping up with AML compliance across multiple regions, each with distinct regulatory requirements. Manual checks slow down onboarding and create inconsistencies in risk management.

By integrating Sumsub’s AML Compliance solution via SDK, Betmaster automated its user screening and verification processes and improved transparency with detailed reporting. The result was a streamlined player verification process with continuous monitoring for suspicious activity.

- Automated AML screening and rescreening of users across jurisdictions

- Got user-friendly verification with minimal manual input

- Strengthened global compliance through unified workflows

Anna Feltfebel

Compliance Manager at Betmaster

At Betmaster, we chose Sumsub for our verification because of their robust and scalable identity verification solutions, which ensure compliance with global regulatory standards. Their AI-powered system delivers fast, accurate verification, enhancing user experience while preventing fraud. This combination of efficiency, security, and reliable support makes them an ideal partner for our compliance needs.

TELUS Digital: Strengthening compliance and maintaining trust

TELUS Digital, part of one of Canada’s largest telecom providers, needed to improve compliance and maintain its standards of verifying the expertise of its contributors. The company was searching for a robust, adaptable fraud prevention framework to safeguard operations and meet diverse customer needs.

Sumsub’s unified platform allowed TELUS Digital to automate user screening, monitor risk in real time, and create transparent audit trails across its ecosystem. The system’s flexibility helped TELUS Digital stay compliant while offering a seamless digital onboarding experience to millions of users.

- Enabled non-technical teams to scale operations efficiently without extensive development resources

- Allowed TELUS Digital to tailor verification processes based on regional risks

- Facilitated seamless integration with TELUS Digital’s IPASS tool

Steve Jablonski

Vice President of Information Security at TELUS Digital

The platform’s workflow functionality provided a flexible framework that addressed our current needs while instilling confidence that it could adapt to future requirements. Sumsub’s customizable checks with bespoke rules and ongoing monitoring allowed us to manage costs effectively, tailoring checks to the specific risks while meeting legal requirements across different jurisdictions.

NiceHash: Building crypto security from the ground up

As a global crypto mining and exchange platform, NiceHash needed a partner capable of handling complex AML requirements while preserving speed and accessibility for users worldwide. It also needed a solution that could help prevent security incidents and fraud cases.

Integrating Sumsub’s AML Compliance solution allowed NiceHash to automate global sanctions screening, monitor transactions, and build transparent reporting pipelines, essential for meeting regulatory expectations in crypto markets. NiceHash was also able to lower its number of security incidents and fraud attempts by 80% using such advanced solutions for KYC as liveness detection, internal blocklist, and watchlist screening.

- Full automation of sanctions and PEP screening for global users

- Continuous risk monitoring across all user transactions

- Faster compliance checks without slowing platform activity

Nikolina Travner

CCO at NiceHash

Sumsub helped us a lot with their highly sophisticated KYC/AML solutions. At the beginning of our collaboration we mainly used it to manage our and our users’ security risks and then as we grew and added more services within our platform, we also added solutions to effectively manage our AML risks and verify our users.

Results that speak for themselves

Companies across various industries have improved their compliance efficiency and accuracy by using Sumsub’s AML Compliance solution. Here are some of the main results that these businesses state they achieved since partnering with Sumsub:

- Up to 80% reduction in manual reviews, freeing teams for more important tasks

- Fewer false positives thanks to AI-driven risk scoring and dynamic rules

- Faster onboarding and transaction approvals while maintaining full AML coverage

- Audit-ready data and reporting that make regulator interactions simpler

- Global scalability, allowing compliance across 200+ jurisdictions from a single dashboard

Sumsub’s AML solution helps companies move from reactive to proactive compliance and risk-based management. AML is not just an obligation, but a business advantage.

AML strategies for a more compliant future

AML compliance must keep up with financial crime. Static checklists and manual reviews can’t keep up with AI-generated identities and deepfakes, international money laundering schemes, or ever-changing sanctions regimes.

Compliance leaders should focus on these points if they want to keep pace:

- Automated continuous monitoring. AML is no longer a one-time process. Ongoing screening and rescreening are crucial for detecting emerging risks.

- Data-driven risk scoring. Machine learning tools that update risk levels consistently can help compliance teams mitigate and remove threats quickly.

- Unified compliance ecosystems. Combining KYC, KYB, and AML tools in a single platform provides clearer insights and fewer data silos.

- Global coverage with local expertise. Rules can vary greatly between different markets. Solutions need to change easily while still being consistent worldwide.

The future of AML compliance is in automation, intelligence, and adaptability. With Sumsub, companies can create compliance programs that are ready for regulations and support growth at the same time.

In an era where financial crime is evolving daily, compliance can’t afford to stand still.Sumsub’s AML Compliance solution empowers businesses to act fast, stay compliant, and operate with confidence—anywhere in the world.