Payments KYC/AML Compliance Solution

Secure, compliant payments—anywhere you operate

Global compliance made easy: prevent fraud, onboard faster, and meet international regulations—AMLD6, FinCEN, and more—at scale.

30 secs

average verification time

40%

cost reduction with automated KYC/AML

85%

reduction in successful ATO attacks

Compliance at the speed of growth

Stop fraud before onboarding starts

Prevent bad actors from slipping through with advanced pre-screening. Sumsub uses risk-based digital profiles, device intelligence, and sanctions screening to detect threats like identity fraud and sanctioned individuals before onboarding even begins. All fully compliant with the AMLD6 and other global AML frameworks.

See the average pass rate in your target country

Aruba

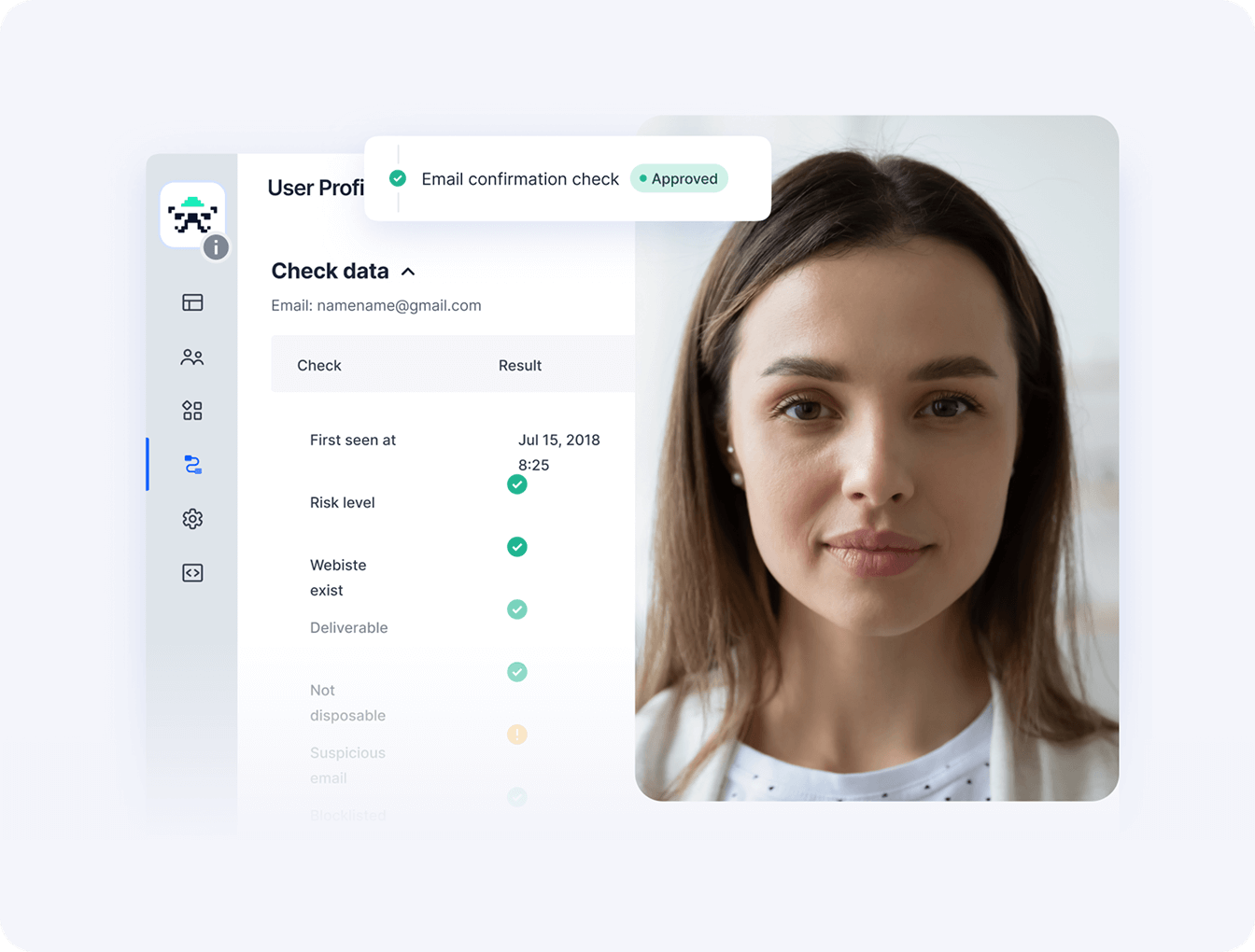

Welcome users in seconds, not days

Onboard legitimate customers in under 30 seconds with automated KYC that cuts costs by up to 40%. Reduce drop-offs, minimize manual errors, and stay compliant anywhere in the world.

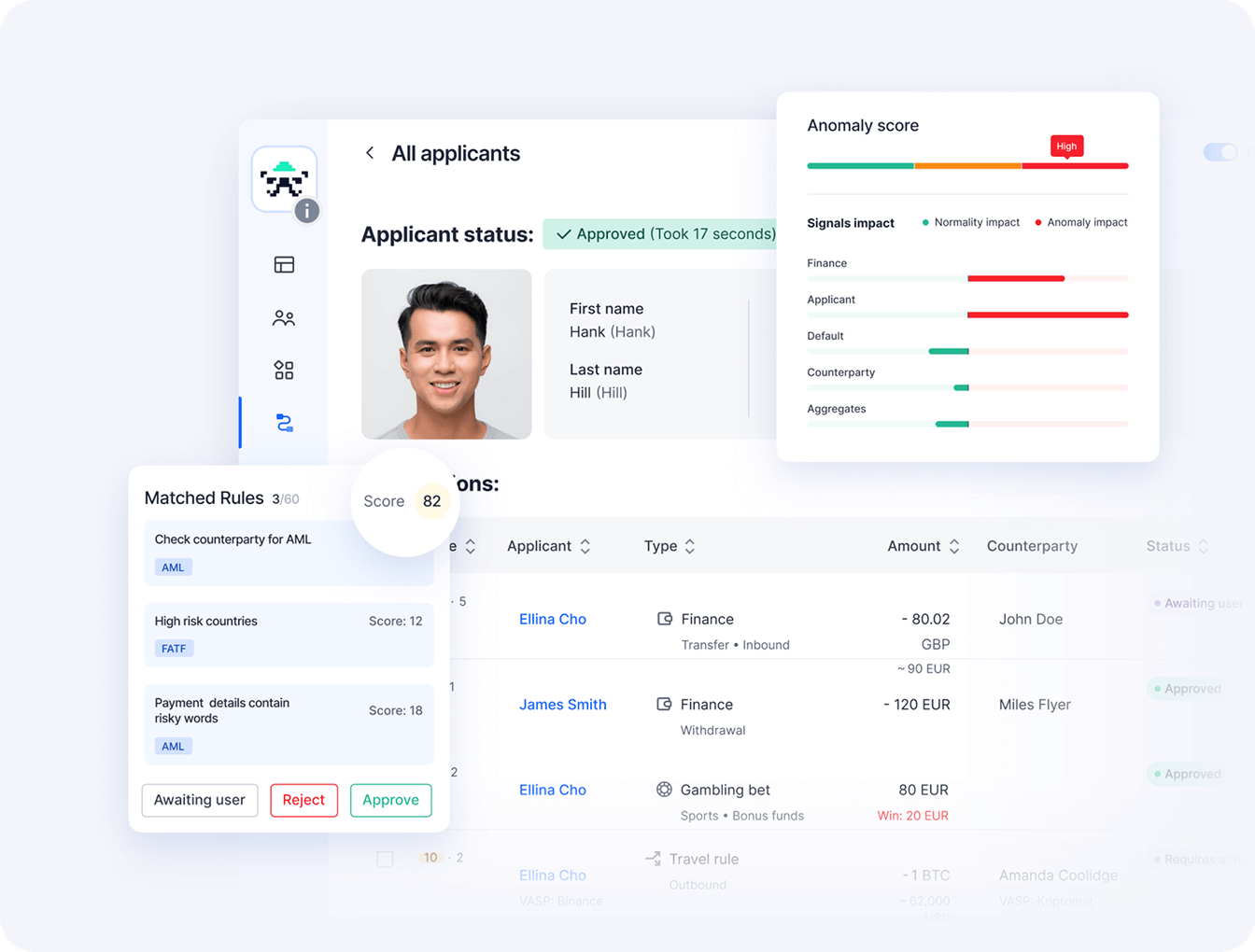

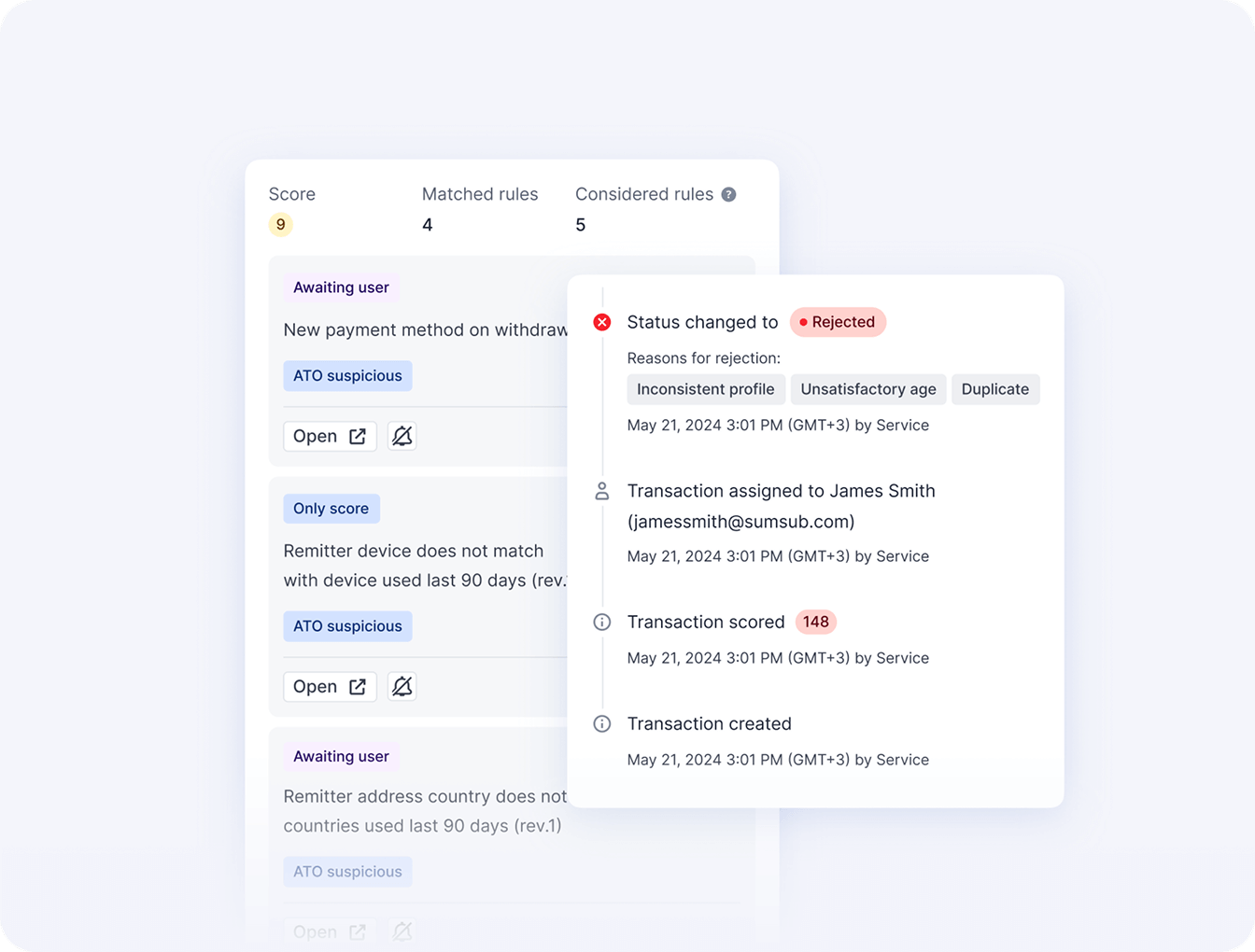

Detect payment threats in real time

Protect your business from card fraud, chargebacks, ATOs, and money laundering with AML Transaction Monitoring. Sumsub analyzes thousands of data points instantly, flagging suspicious behavior on users or devices before harm is done. Block stolen cards and illicit transactions in real time to safeguard your revenue and reputation.

Always-on risk detection, built to adapt

Stay ahead of threats with continuous risk assessment. Sumsub monitors user behavior in real time to detect emerging risks and anomalies before they escalate. As fraud tactics and regulations evolve, our system adapts to keep you protected and compliant at all times.

Stay audit-ready everywhere you operate

Ensure full compliance across regions with Sumsub’s Workflow Builder and real-time regulatory updates. From AMLD6 in the EU to FinCEN in the U.S., built-in checks and automated documentation help you stay ahead of evolving rules. Every verification and transaction is logged in a central dashboard for fast, transparent audits. AI-powered Case Management lets you flag and resolve risks quickly, helping you avoid fines, protect your license, and prove compliance anytime.

Let the numbers do

the talking: get 240% ROI

Independent research by Forrester Consulting revealed that companies using Sumsub’s all-in-one verification platform achieved a 240% ROI. It’s not just about cutting costs—Sumsub actively drives revenue growth and improves operational efficiency. See the measurable impact it can make on your bottom line.

240%

ROI

3.21M

NPV

4.55M

Benefits PV

< 6

months payback

No-Code Workflow Builder:

Compliance on Your Terms

Workflow Builder

Flexible Rules

Sumsub’s no-code Workflow Builder lets you design and adapt your entire verification flow without writing a single line of code. Tailor the experience by country or user risk profile, adding document-based checks, AML Screening, Address Verification, and more based on your exact requirements.

Don’t take our word for it.

Here’s what our clients have to say

Choosing Your Ideal Solution?

Let the numbers do the talking: See how we exceed our competitors in key areas, as validated by user reviews on G2.