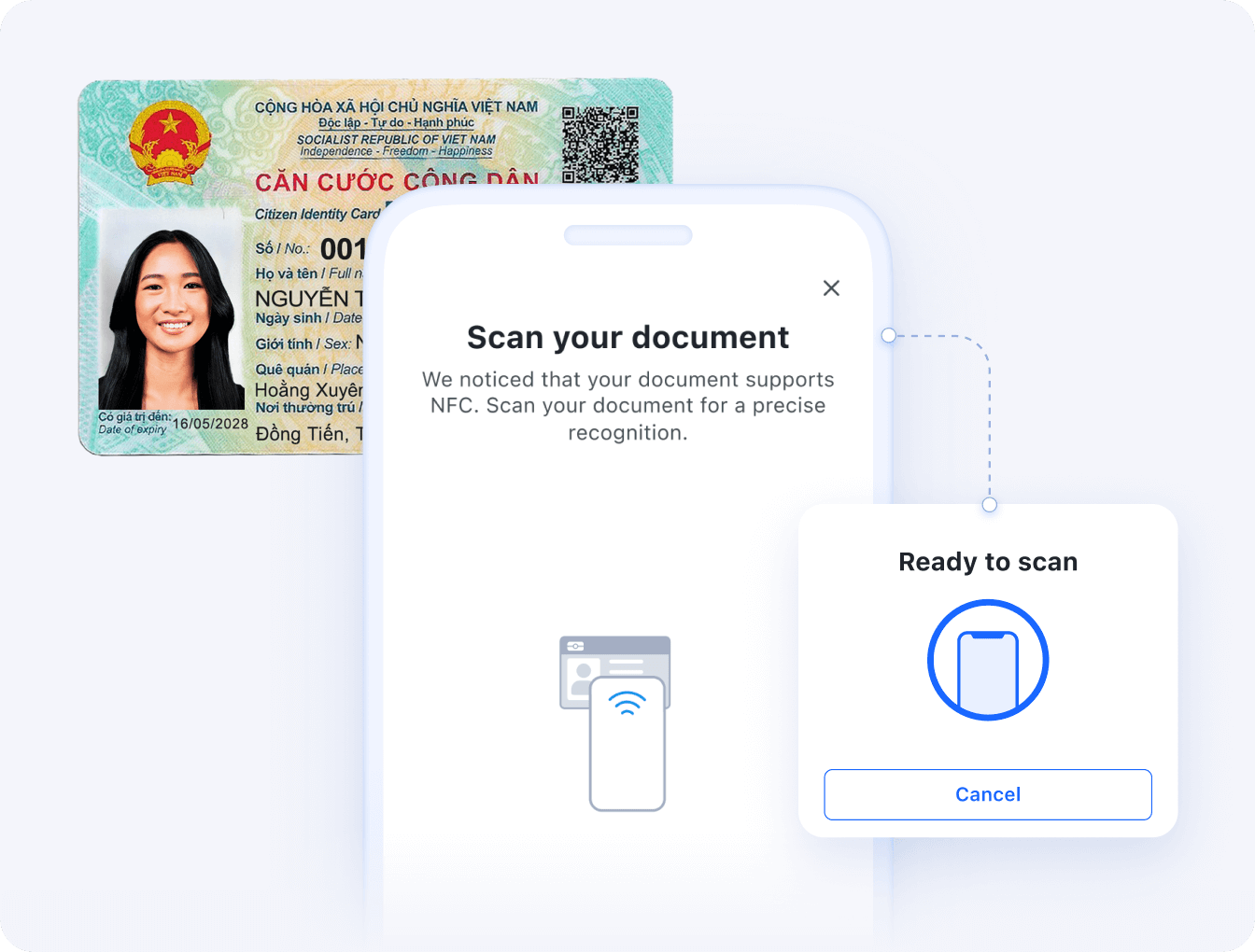

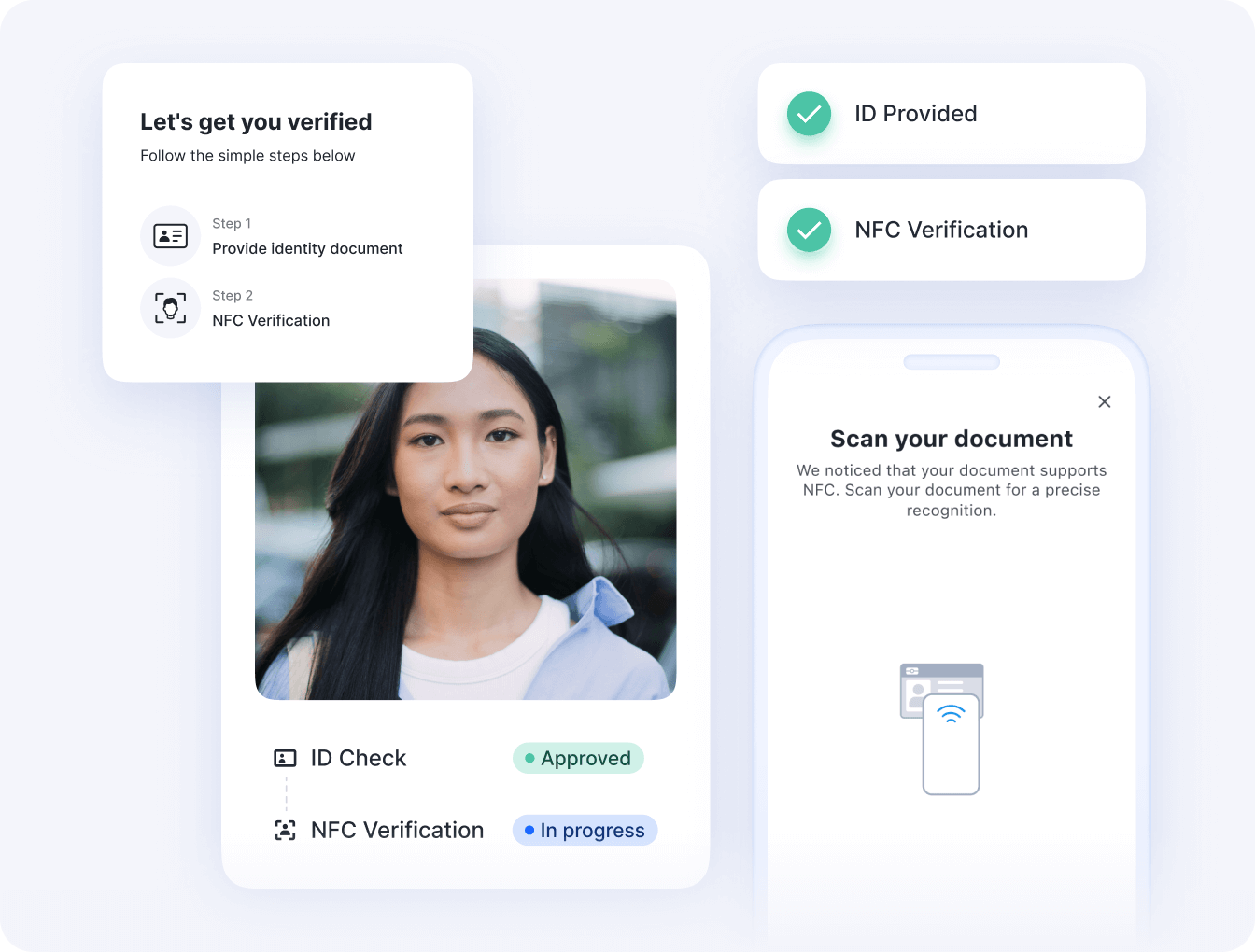

NFC Verification

Fraud-proof ID checks with a single tap

The impact of NFC Verification

Verify securely and accurately

Meet regional KYC/AML

requirements

Frictionless, tap-and-go experience

Add another layer of fraud protection

to your KYC flow

Let the numbers do

the talking: get

240% ROI

Сompanies that work with Sumsub identity verification software save costs and increase revenue, according to the “Total Economic Impact™ Of Sumsub’s Verification Platform study by Forrester Consulting. Let’s see what results you can get.

How NFC Verification works for you

Integrations

Maximize pass rates with the right integration

Unilink

Skip the integration process entirely and add an identity verification link or QR code to your website. Your customers can pass verification immediately by simply clicking the link.

What our customers

say about us

Before using Sumsub, false positives were a constant issue, and our pass rate was down to 40%. With Sumsub’s features, we jumped up to 92% pass rates.

Product Owner at Yolo Group

Choosing your ideal solution?

Sumsub is G2’s Top Pick

Surpass competitors with a partner who knows how to excel, as validated by user reviews.

FAQ

What is an NFC on a passport/ID card?

An NFC chip securely stores the holder’s identity data, including personal details, photos, and digital signatures. Smartphones with NFC capabilities can read this data contactlessly.

What is NFC authentication?

NFC authentication is the process of verifying identity by reading secure data directly from a biometric ID or passport chip—ensuring the document’s authenticity and validity.

What is NFC ID verification?

NFC ID verification uses smartphone technology to securely read and validate data from embedded ID chips, preventing document forgery and improving verification speed.

What is NFC identity verification?

NFC identity verification is a secure verification method that extracts data from a document’s NFC chip and cross-validates it against cryptographic and visual checks, strengthening fraud prevention.