Index reveals that Europe leads in fraud protection, while the U.S. and many Asian countries see major declines.

Today Sumsub released the second edition of its Global Fraud Index, produced in collaboration with Statista, CryptoUK, Digital Assets Association, Vixio Regulatory Intelligence and MENA Fintech Association.

“This year's Global Fraud Index shows that fraud protection isn't about geography, it's about governance. At the same time, fraudsters are getting their hands on increasingly powerful AI tools. What was once a niche threat has become commonplace”, said Timothy Owens, Tech and AI Industry Expert, and Senior Research Lead Technology and TeleCommunications at Statista. “For technology leaders, the message is clear: treat fraud exposure like system uptime. It requires constant monitoring. Verification systems, information sharing between organisations, and robust incident response aren't optional anymore; they're fundamental components of operating in today's digital environment.”

Key highlights of the 2025 Global Fraud Index study include:

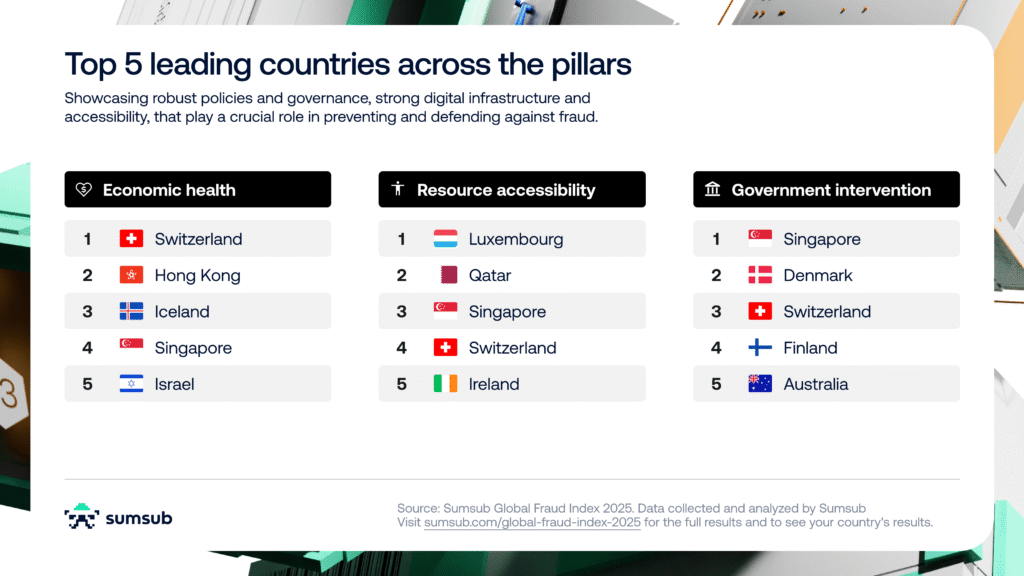

- The 15 countries most protected against digital fraud are: Luxembourg, Denmark, Finland, Norway, the Netherlands, Switzerland, New Zealand, Sweden, Austria, Singapore, Slovenia, Israel, Malta, Lithuania and Australia.

- The 15 countries least protected against digital fraud are: Pakistan, Indonesia, Nigeria, India, Tanzania, Uganda, Bangladesh, Rwanda, Azerbaijan, Sri Lanka, Ethiopia, Brazil, Armenia, Kenya and Colombia.

- Singapore dropped from #1 in 2024 to #10 in 2025.

- The U.S. fell by 36 positions (from #55 to #91) and Malaysia declined 52 (from #34 to #86).

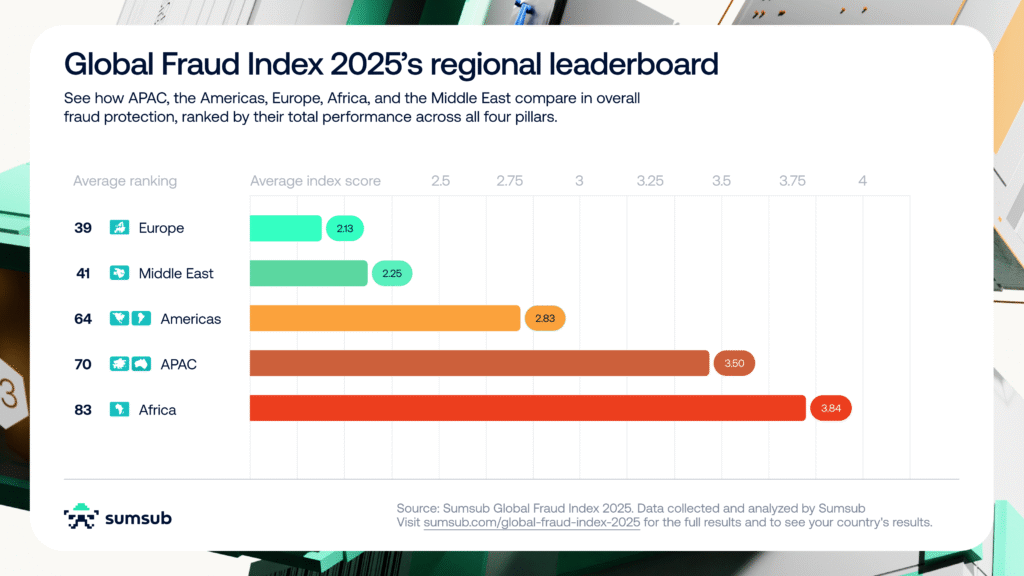

- Europe has the largest concentration of countries in the list of 15 most protected ones.

- Pakistan holds the last position in the Index for the second consecutive year.

- The U.S. has the highest government AI readiness index across the globe.

The report examines fraud risk across 112 countries to assist regulatory bodies, governments and businesses in understanding and preventing fraud.

After being well-received last year, the 2025 Index expands on its 2024 study, adding nine new countries including the Philippines, Vietnam, Kenya, Uganda and Nigeria. The research combines Sumsub’s internal verification data with external sources such as the World Bank, Transparency International, and Oxford Insights to offer a comprehensive view of fraud exposure.

You can find additional data-driven insights, explore interactive maps and infographics as well as build country-specific comparisons here: https://sumsub.com/global-fraud-index-2025.

In addition, Sumsub’s inaugural What The Fraud Summit that will facilitate the public-private sector partnerships and knowledge sharing critical to strengthening fraud prevention, will be taking place in Singapore from November 19 to 20, 2025. Learn more about the WTF Summit and ticket details: https://sumsub.com/wtf-summit/.

“Fraud rates alone don’t tell the full story—it’s essential to have a 360° view of the fraud landscape, globally and locally. As economies digitize, fraudsters exploit weak spots, making comprehensive, country-specific insights critical to anticipate trends and protect people and businesses, says Vitaliy Gribanov, Senior Brand and Creative Director at Sumsub. “We see elevated interest in this as a trusted source of data amid growing debates around AI threats. That’s why we launched our 2024 research, and with the latest edition we’re proud to strengthen Sumsub’s role in providing actionable insights that help businesses and governments stay ahead of fraud.”

Methodology of 2025 Global Fraud Index study

The Global Fraud Index uses both internal and external data. Sumsub’s internal data is based on volumes of over 1 million checks conducted daily on the platform. The majority of data is from 2024-2025, with one indicator from 2023. External sources include The World Bank, The Heritage Foundation, Oxford Insights, Transparency International, Numbeo and other databases.

The Index consists of 4 main pillars of analysis for each country. Those include not only the country’s fraud rate itself, but also incorporate ‘The Fraud Triangle’ hypothesis. This widely-used model reflects how certain factors – namely, pressure, opportunity, and rationalization – contribute to higher fraud rates and corruption. In digital fraud, this triangle manifests through lower digital resources accessibility, less efficient government intervention, and higher economic instability scores.Please find more details on Methodology here: https://sumsub.com/global-fraud-index/methodology-2025/