KYC Identity Verification Service for Hong Kong

Full-cycle verification platform for Hong KongStay compliant and always ahead of fraud. Detect risks early, simplify onboarding, and keep both your revenue and customers safe—all without the complexity. One single solution for KYC/AML, Business Verification, Transaction Monitoring, Fraud Prevention, and Travel Rule compliance.

Secure every step of the customer journey

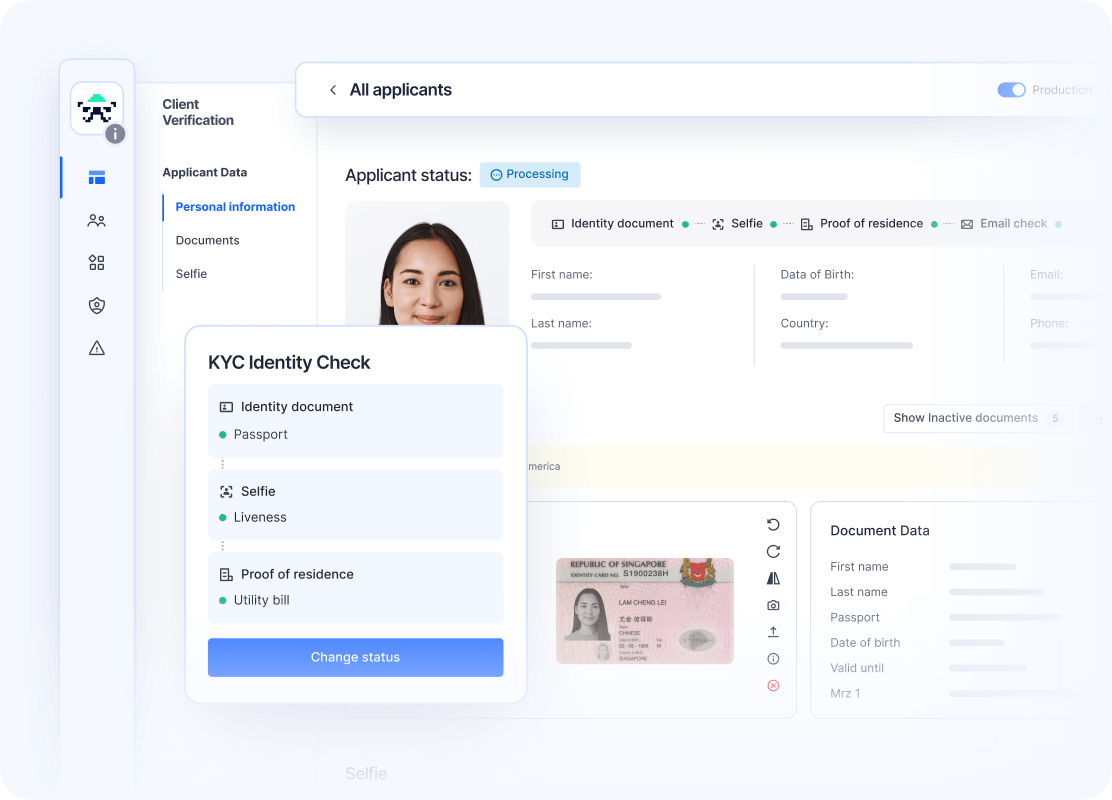

Orchestrate verification checks, code-free. Place checks at any stage of the customer journey for top anti-fraud protection and pass rates worldwide

User Verification

Business Verification

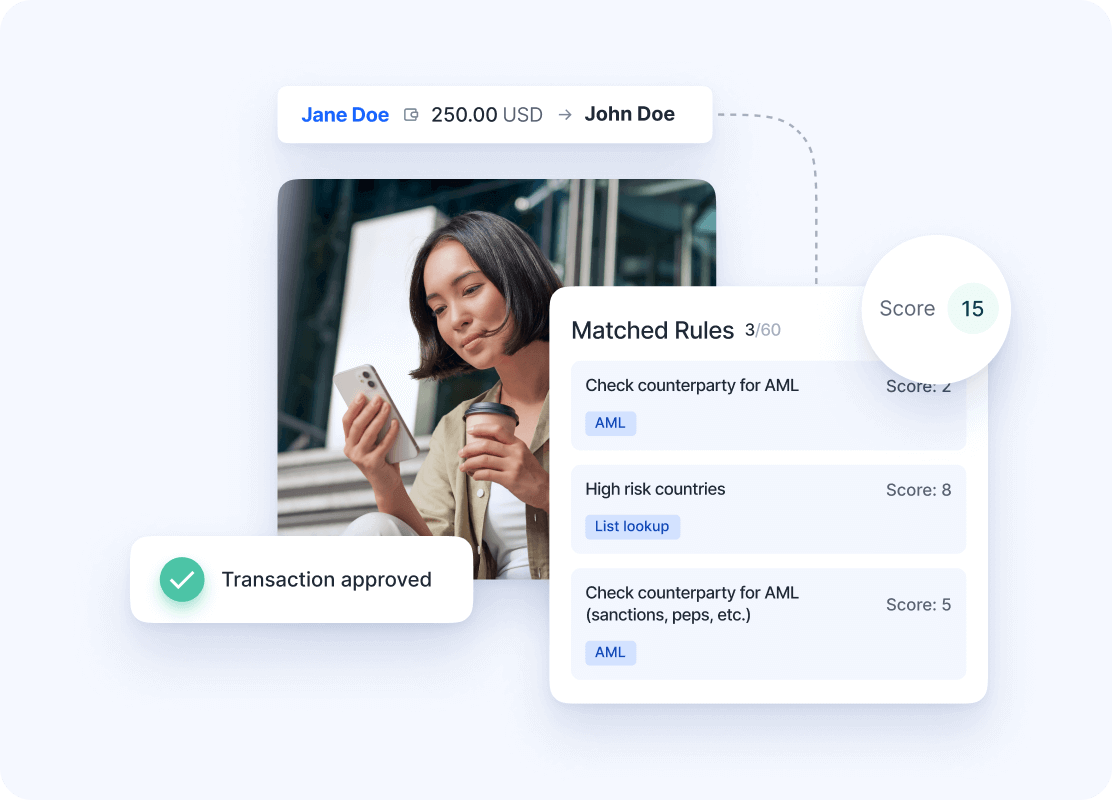

Transaction Monitoring

Fraud Prevention

Local Data Processing

Let the numbers do

the talking: get 240% ROI

Сompanies that work with Sumsub identity verification software save costs and increase revenue, according to the “Total Economic Impact™ Of Sumsub’s Verification Platform study by Forrester Consulting. Let’s see what results you can get

Easily integrate your tech stack with Sumsub

Use Sumsub to integrate the services you need via Web SDK, Mobile SDK, or our RESTful API. Alternatively, you can use Unilink to onboard users via a QR code or a link to the verification form without integrating Sumsub at all. Don’t worry about interruptions with 99.996% uptime.

Don’t take our word for it.

Here’s what our clients have to say

Choosing Your Ideal Solution?

Let the numbers do the talking: See how we exceed our competitors in key areas, as validated by user reviews on G2.