Banks and neobanks

Handle compliant onboarding at scale with real-time AML and fraud monitoring. Keep audit-ready logs across products and regions. Resolve identity across accounts and channels.

Learn more

Orchestrate identity verification checks, code-free. Place checks at any stage of the customer journey for top anti-fraud protection and pass rates worldwide.

Handle compliant onboarding at scale with real-time AML and fraud monitoring. Keep audit-ready logs across products and regions. Resolve identity across accounts and channels.

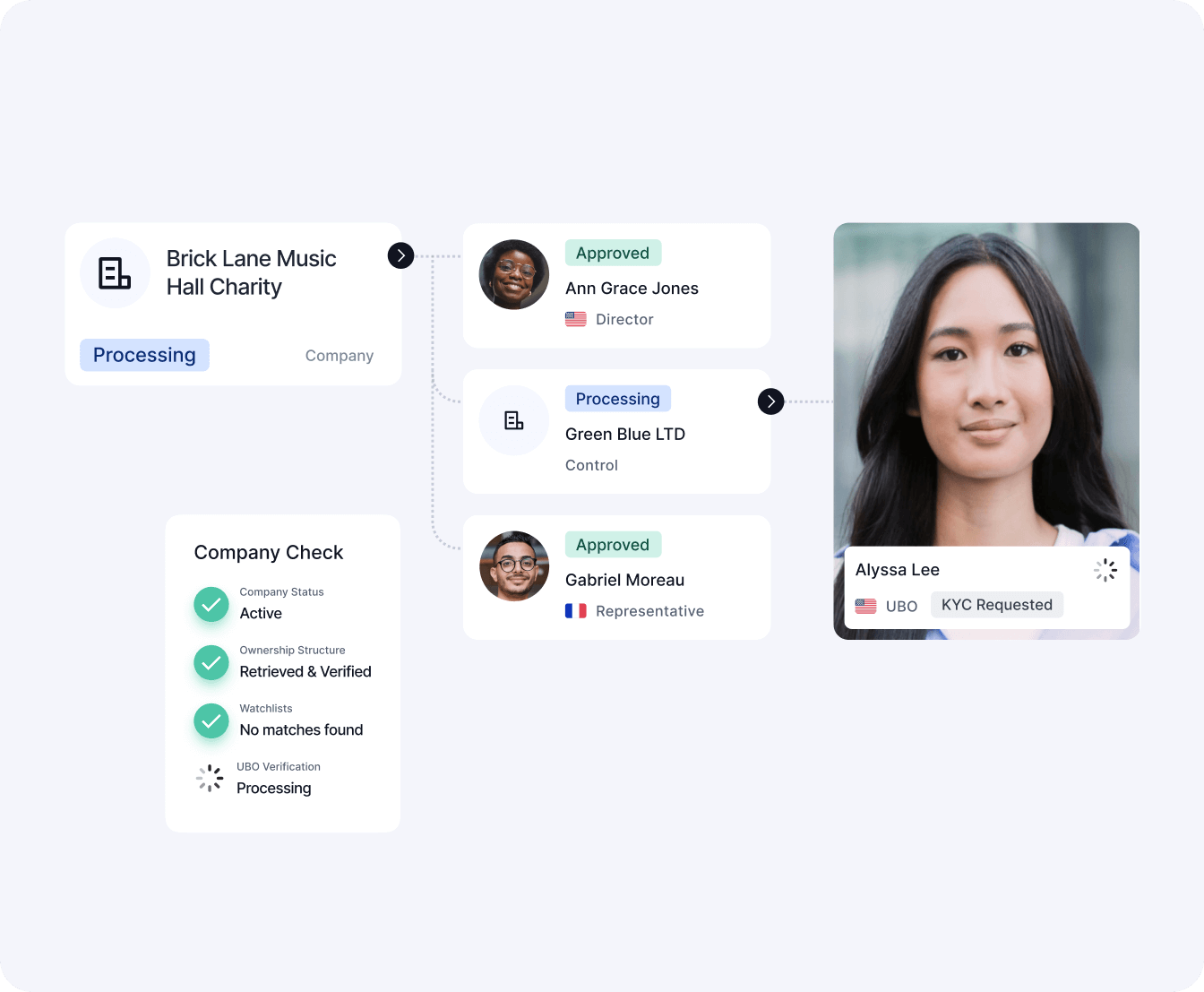

Learn moreVerify merchants and agents automatically with KYB checks. Monitor transactions across terminals and channels. Reduce chargeback and payment fraud.

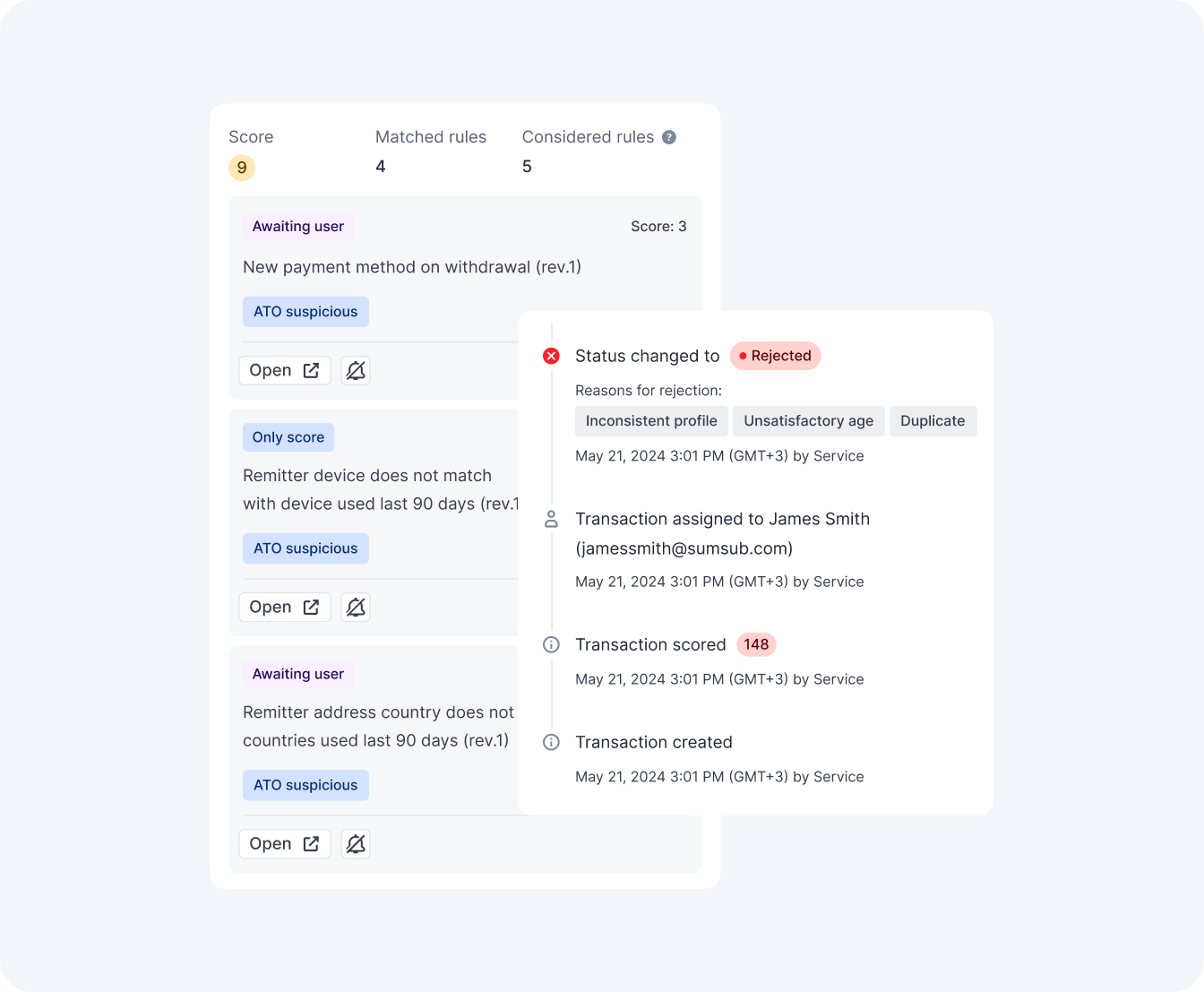

Learn moreScore P2P and cross border risk in real time. Detect mules and account takeover with device and network signals. Stay compliant with Travel Rule and sanctions checks while onboarding genuine users fast.

Verify thin-file customers with alternative signals. Catch synthetic IDs and loan stacking. Score repeat borrowers based on behavior. Run fraud and AML controls that work with credit workflows.

Need the Ideal Solution?

Optimize your fraud detection and response strategy, where cost reduction is achieved effortlessly. Avoid internal development expenses with easy configuration and pre-designed anti-fraud rules.

73

Net Promoter Score

92%

Ease of use

90%

Ease of setup

* According to G2 2025 Identity Verification Spring Report