Phone Number & Email Identity Verification Tool

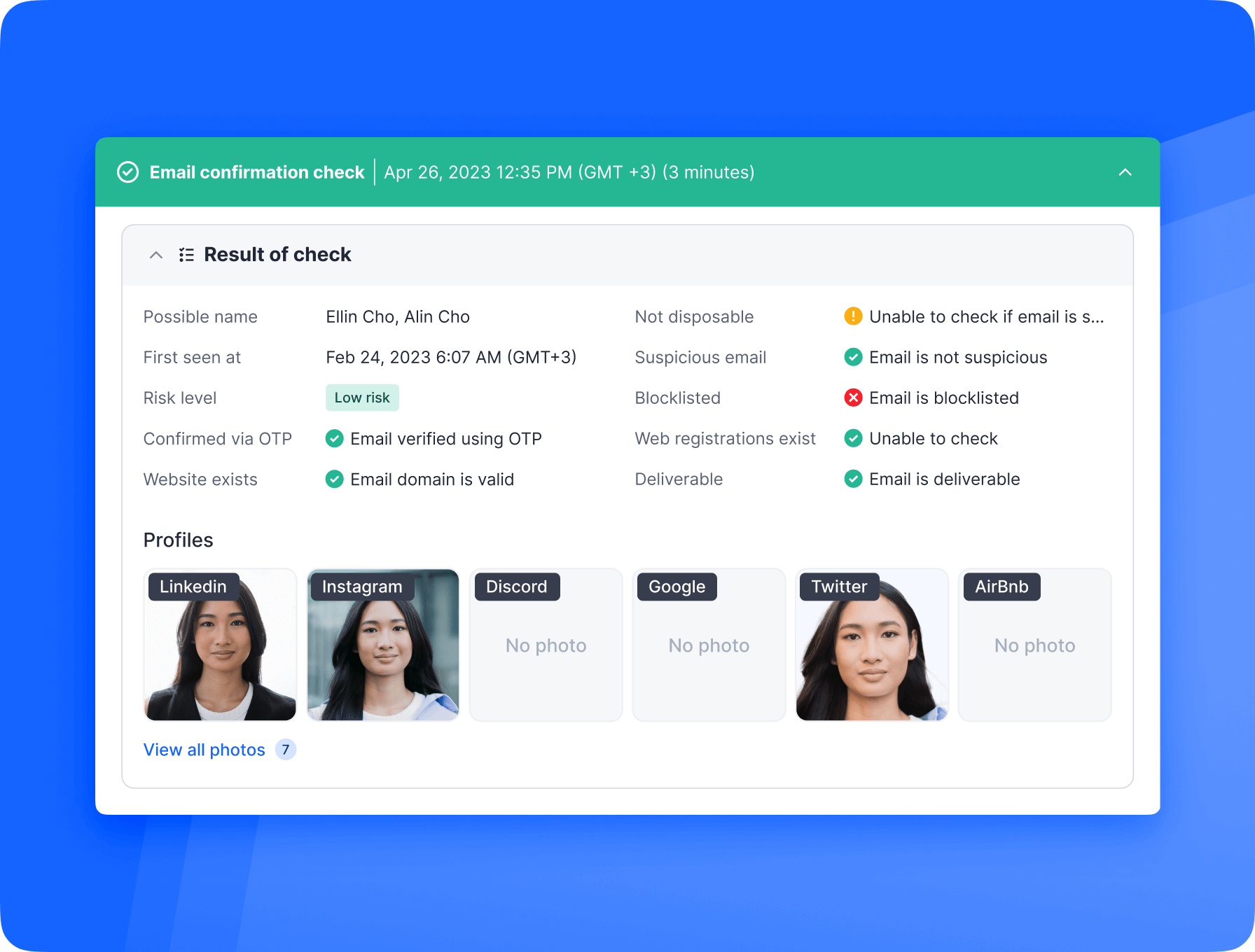

Detect fraud early with proactive email and phone screening

Stop being friendly to fraudsters

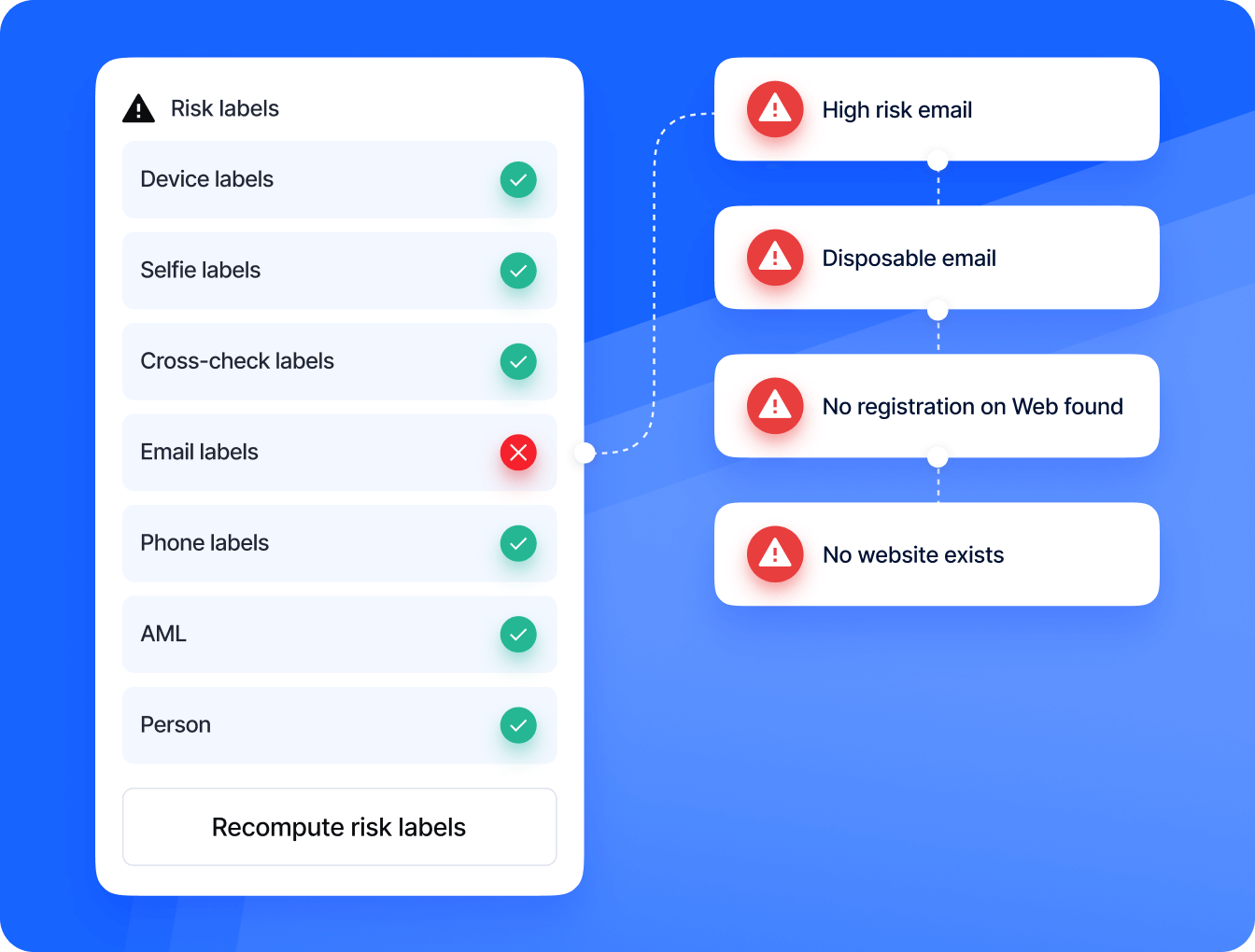

Block disposable contacts, detect masked IPs, and flag suspicious behavior

so that only legitimate users are onboarded.

Only pay for genuine users

Customize risk assessments for your risk appetite

Enrich in-house models with additional data

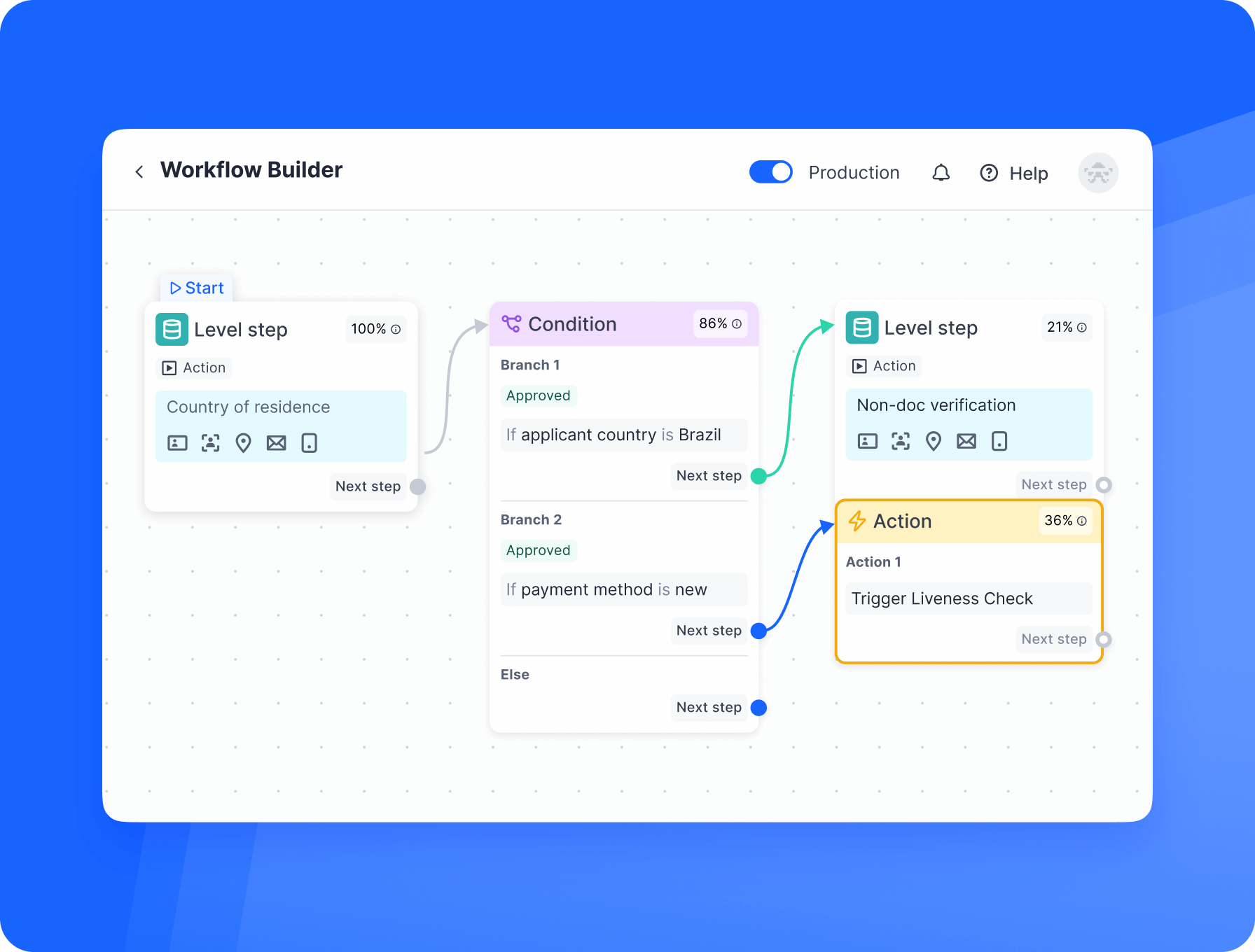

Simple integration with workflow builder

How it works

Choosing Your Ideal Solution?

Let the numbers do the talking: See how we exceed our competitors in key areas, as validated by user reviews on G2.

Our client’s opinion speaks loudest

FAQ

How do you check identity by phone number?

Identity is checked by phone using a phone number verification tool, which assesses activity, reachability, and digital footprint. This identity verification by phone process filters out risky users by identifying virtual numbers, suspicious activity, and non-disposable contacts.

What is a phone number validation tool?

A phone number validation tool is a service that confirms the authenticity and status of a phone number. It checks if the number is reachable, non-disposable, and correctly formatted, providing essential data for identity verification by phone. By using this solution a businesses can reduce fraud, filter out invalid numbers, and ensure that only genuine users proceed through the onboarding process.

What is email risk assessment?

Email risk assessment is the process of analyzing an email address to determine its legitimacy and assess its risk level. This tool checks whether the email is active, non-temporary, and has a verifiable digital footprint. Through email and phone verification, email risk assessment helps identify disposable emails, detect suspicious patterns, and assess the likelihood of fraud, ensuring that only trusted users are onboarded.