Risk Department at Walbi

Walbi is an AI-driven cryptocurrency exchange designed to provide traders with tools for smarter and data-driven decision-making.

The platform's core solution is Lighthouse, an AI-powered trading assistant that analyzes market trends, news events, fundamental and technical indicators, and community reactions. By processing this data, Lighthouse generates actionable trading signals, helping users make informed real-time decisions.

Walbi's development began in February 2023, with its first user trade executed on July 1, 2023. The company has since grown into a global operation with over 30 professionals supported by advisors and external experts. With a focus on continuous innovation, Walbi fosters collaboration by bringing its team together in different locations worldwide to drive product advancements and enhance the trading experience.

The Challenge

Walbi initially attempted to handle the verification process in-house but quickly encountered several key challenges. Without specialized expertise, the process was slow, resource-intensive, and prone to inefficiencies. The lack of access to critical databases, such as global watchlists, and the absence of automated biometric matching made verification unreliable and difficult to scale.

Why Sumsub?

Walbi chose Sumsub as a verification partner to support its core mission of maintaining security and trust across the platform. As a global crypto exchange, Walbi needed a KYC/AML solution that could deliver fast, accurate, and fully compliant user verification.

Sumsub stood out for its flexible integration options, including user-friendly APIs and ready-to-use modules, global coverage, and advanced analytic and monitoring tools. These features allow Walbi to scale efficiently, automate onboarding, and focus on product development while maintaining a secure trading environment.

The main goal was to simplify user onboarding, reduce manual processing time, and maintain full compliance with international regulations. Sumsub's automated infrastructure enables Walbi to process high volumes of verification requests accurately and quickly, helping to minimize fraud risks and deliver a seamless onboarding experience. By leveraging Sumsub's advanced technologies and flexible workflow configurations, Walbi can quickly adapt to evolving regulatory requirements and continuously improve its services, building lasting trust with users and regulators.

The Solution

Walbi's current verification process is structured around a tiered system based on its internal policy. Users are subject to selective checks, with two levels of verification: one that requires Email Verification, and another that operates without it.

Sumsub's solution has made the process significantly faster and more convenient. Verification links are generated within seconds, and results are instantly accessible in one centralized dashboard.

Risk Department at Walbi

Sumsub's dashboard simplifies our workflow, allowing us to tag users, customize processes, and manage verifications effectively.

Besides the Email Verification, Walbi uses a range of Sumsub's solutions:

- ID Verification ensures that submitted documents are authentic and that users are who they claim to be, helping to reduce fraud risks significantly.

- Liveness uses biometric checks to verify that the user's photo matches the photo on their ID, protecting against spoofing and fake identity attempts.

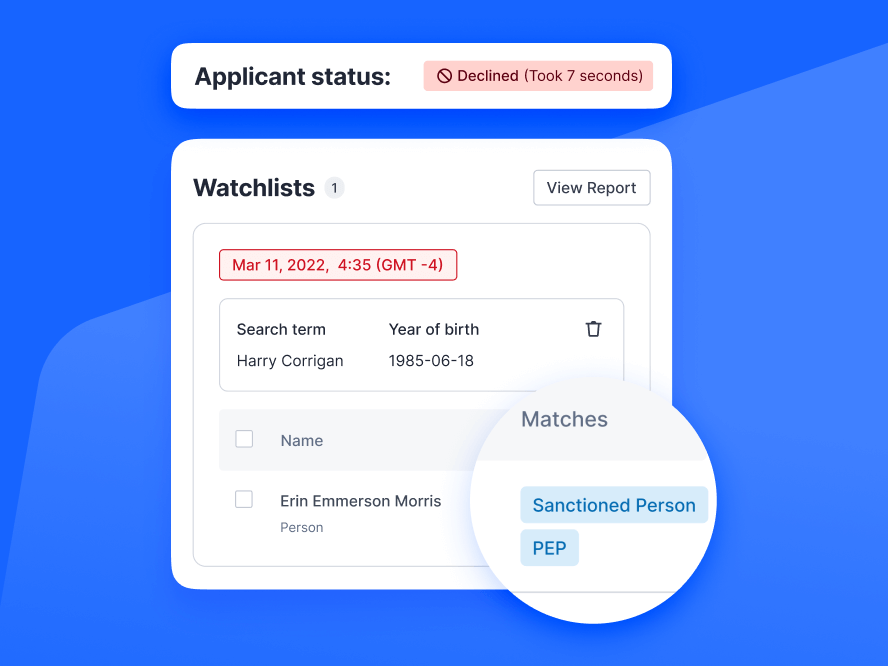

- AML Screening & Ongoing Monitoring check users against global sanctions lists, PEP databases, and other watchlists to support compliance with Walbi's AML policy and mitigate exposure to high-risk individuals.

The team is currently finalizing its technical integration using Sumsub's developer-friendly API and SDK tools, which will allow verification requests to be initiated directly within the platform.

Risk Department at Walbi

Currently, Walbi operates across multiple countries, and our KYC procedure, implemented in partnership with Sumsub, helps us meet regulatory requirements while maintaining a high level of security.

Implementation

The integration process with Sumsub has been smooth and efficient. With clear documentation, ready-to-use API and SDK tools, and ongoing support, Sumsub provided everything Walbi needed to implement the solution effectively. Although the full technical integration is still being finalized, the system already streamlines verification management and enables a seamless user experience.

The Results

By integrating Sumsub, Walbi has significantly strengthened its AML and fraud prevention efforts. Verification times, which previously could take up to 24 hours, have been reduced considerably. Even though KYC is not mandatory for every user, those who go through the process now benefit from a faster, more transparent experience.

This streamlined approach led to a 20% revenue increase in December 2024—just one month after implementing Sumsub—driven by improved user trust, higher engagement, and reduced losses from fraudulent activity. Conversion rates for verified users have more than doubled, particularly in emerging markets, where speed and ease of access are critical.

Risk Department at Walbi

Thanks to Sumsub, we've enhanced our AML and fraud control, minimized risks, and built greater user trust, directly benefiting our financial performance with a 20% revenue increase just one month after integration.

Future Plans

As Walbi continues to grow, the company focuses on expanding into new markets, launching additional products, and securing further regulatory approvals. Reliable and fast user verification will remain at the core of this strategy, making Sumsub a key partner in supporting scalability and compliance.

Looking ahead, Walbi is also exploring adding Sumsub's Transaction Monitoring solution. Integrating verification and monitoring tools into one streamlined platform would further enhance operational efficiency and risk management as the company scales.