ChunHou Kok

Group General Counsel at DCS

DeCard is a next-generation card product launched in 2025 by DCS (formerly Diners Club Singapore). Founded in 1973, DCS has over 50 years of experience in card issuing and payment services, and now provides the infrastructure behind DeCard’s stablecoin-enabled offerings.

The product is designed to make stablecoin spending more practical and accessible for everyday use. At its core is D-Vault, a digital account that gives users access to a credit limit with flexible requirements. D-Vault also supports reconciliation and payment tracking, allowing users to manage spending and repayments through a single, integrated system.

For more advanced users, DeCard also offers DeCard Luminaries, a premium version aimed at Web3 professionals. Built on the same infrastructure, it introduces additional benefits and tools tailored to more complex financial needs.

The Challenge

Before integrating Sumsub, DeCard relied on a different provider for verifying proof of identity. However, proof of address, especially for applicants outside Singapore, had to be reviewed manually.

ChunHou Kok

Group General Counsel

The reason for looking for a new verification provider is that DCS only served SG residents before launching DeCard, so no automation was done previously. As we continue to scale, global automation is essential for us.

This manual process introduced several challenges. Verifying documents from a wide range of countries took significant time and effort, and the team wasn't equipped to manage the volume or diversity of address formats.

For applicants, this meant a longer wait and a less streamlined experience. From a compliance perspective, manually verifying proof of address also raised concerns. Without consistent checks in place, the team faced the risk of missing fraudulent submissions, which could create serious regulatory and operational issues down the line.

Why Sumsub?

ChunHou Kok

Group General Counsel

We chose Sumsub because it’s a well-known, trusted provider with high-confidence address verification capabilities and extensive global coverage. Its ability to support multiple types of identity documents, from passports to driving licences and national IDs, was a key factor for us.

The Solution

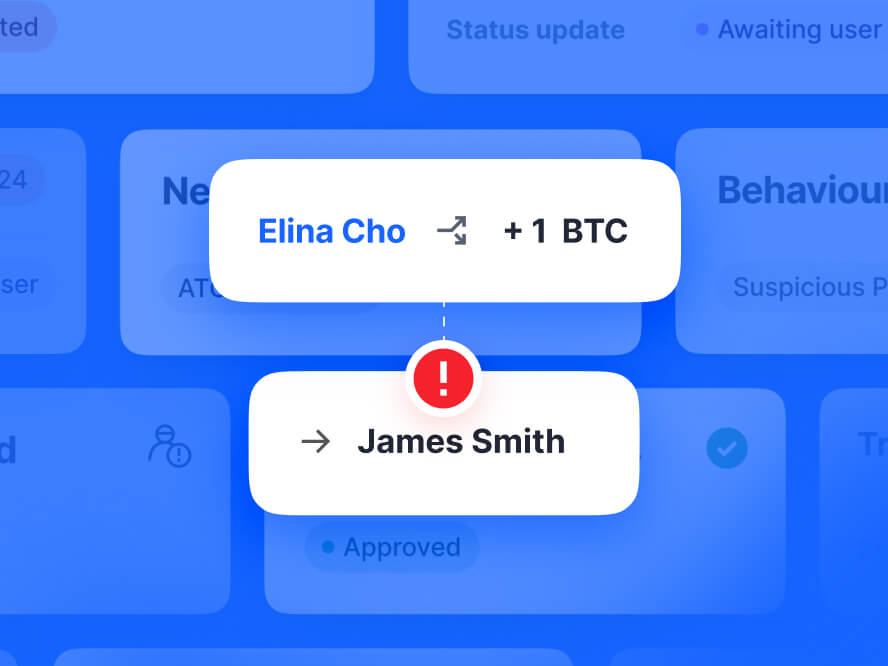

To streamline onboarding and reduce manual review work, DeCard now uses Sumsub to handle identity and address verification, liveness checks, and AML screening. Everything is integrated into the onboarding flow, reducing the need for manual steps.

The automation has increased consistency across markets and enabled faster approvals. One of the most important gains was in proof of address checks, previously a major bottleneck for international users.

The switch also addressed a key compliance concern—reducing the risk of fraudulent address documents slipping through manual reviews. With automated verification in place, the team has greater confidence in the integrity of user data and fewer operational bottlenecks.

The Results

ChunHou Kok

Group General Counsel

Since integrating Sumsub, we’ve seen a clear improvement in our onboarding performance. One pleasant surprise was how much the AI assistant improved our internal operations. It helped simplify routine tasks and made the whole process easier to manage.

Since integrating Sumsub, DeCard has significantly improved its onboarding flow, especially for the overseas markets. Previously, all non-Singapore residents had no automated approval path, but with Sumsub in place, the final approval rate for this segment has risen to approximately 85%, with average verification times under 6 seconds. This upgrade has reduced user friction at sign-up and supported faster activation of accounts.

Operational efficiency has also improved. With fewer manual reviews required, internal resources have been reallocated more effectively, allowing the company to scale its user base without expanding the ops team at the same pace.