Dmitrijs Krjukovs

Chief Operating Officer at Alteway

As a rapidly growing fintech company serving primarily EU/EEA residents, Alteway faced the challenge of scaling its compliance and fraud prevention systems to effectively support its expanding customer base.

The Challenge

Before partnering with Sumsub, Alteway relied on multiple tools and semi-automated processes that couldn’t keep up with growing AML and anti-fraud demands or provide the flexibility needed for KYC customization.

Key challenges were:

- Lack of workflow automation: Existing tools couldn’t gather additional customer information or automate workflows effectively.

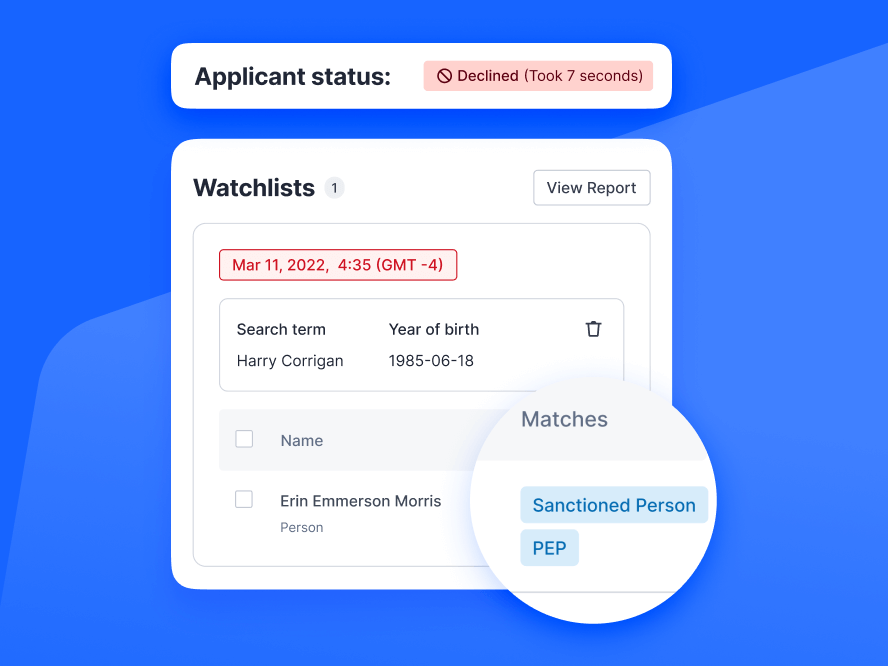

- Sanctions and PEP screening: A reliable system for Sanctions, Politically Exposed Persons (PEP), and Adverse Media checks were missing.

- User verification: Ensuring customers were present during checks was difficult without an advanced liveness solution.

- Fraud prevention: Existing processes lacked robust anti-fraud measures.

The company needed a solution to enhance compliance, improve efficiency, and support rapid growth while staying ahead of regulatory changes.

Why Sumsub?

Alteway chose Sumsub for its dynamic and evolving product suite, which offered key differentiators not found in competitors’ solutions. These included:

- Questionnaires and Workflow Automation: Streamlining data collection and process automation.

- Integrated AML Screening: Covering Sanctions, PEP, Watchlists, and Adverse Media checks.

- Advanced Liveness Verification: Ensuring customer presence and deterring identity fraud.

- Fraud Prevention Tools: Adding critical safeguards to minimize risk.

Dmitrijs Krjukovs

Chief Operating Officer at Alteway

The questionnaires and workflow automation were game-changers for us. These features stood out right from the start as key differentiators. We also saw Sumsub as a dynamic partner whose offerings evolve quickly to meet new challenges.

The Solution

Alteway adopted a range of Sumsub solutions designed to streamline compliance and boost efficiency, including:

- AML Screening

- ID Verification

- Address Verification

- Liveness

- Phone and Email Verifications

- Automated registry and structure checks

- AML compliance checks

- Automating customer questionnaires and internal processes.

Implementation

Using an MVP (Minimum Viable Product) approach, Alteway integrated basic features first and expanded functionality as they became more familiar with Sumsub’s capabilities. This agile approach allowed them to adapt to evolving regulations and internal needs.

Dmitrijs Krjukovs

Chief Operating Officer at Alteway

Integration isn’t a one-time event. As Sumsub introduced new functionality and regulations change, we adjusted and expanded our setup. We periodically add new features, fine-tune existing ones, or integrate additional capabilities to keep pace with our needs.

The Results

Sumsub’s solutions transformed Alteway’s compliance and fraud prevention operations, delivering measurable results:

- Faster processing: Achieving a median applicant verification time of just 9 seconds over the last six months.

- Higher approval rates: Approving over 85% of applicants, thanks to streamlined KYC processes.

- Enhanced fraud detection: Most declines were attributed to a robust risk framework and effective fraud controls.

Dmitrijs Krjukovs

Chief Operating Officer at Alteway

With Sumsub, we’ve been able to scale efficiently while maintaining high-quality standards. Without their solutions, supporting our growth and delivering reliable services to more customers would have been impossible.

Future Plans

Looking ahead, Alteway plans to develop its partnership with Sumsub by adopting new solutions such as the Travel Rule and Transaction Monitoring. With a focus on continuous improvement, the company remains committed to leveraging Sumsub’s tools to stay ahead of compliance challenges and support sustainable growth.