How To Build A Successful Cryptocurrency Exchange In 2023: Best Jurisdictions And Step-By-Step Plan

Merkeleon on launching a thriving crypto exchange

Inflation has hit global markets hard, with more people losing trust in fiat and looking to crypto as an alternative way to save and accumulate capital. In 2021, the global crypto exchange market totaled $30.18 billion and is expected to advance at an annual rate of 27.8% from 2022 to 2030, a Grand View Research report says.

According to the recent update by CoinMarketCap, there are 270 operating crypto exchanges and almost 1 billion crypto users worldwide. So it’s time to maximize the efficiency of your crypto platform to meet users’ needs.

About the author

The author of this article is Alexey Sidorowich, Chief Commercial Officer at Merkeleon, a provider of turnkey B2B software for the crypto market.

Alexey is a crypto enthusiast with more than 10 years of experience in SaaS software business development and growth marketing with a focus on the crypto and e-bidding industries.

About Merkeleon

Merkeleon was born in 2008, with the sole goal to make novel technologies available for businesses. For more than 10 years, Merkeleon has facilitated the efficient launch of products for e-commerce, auction and crypto services. And the work goes on.

Best European Jurisdictions for Crypto Exchanges

Europe’s regulatory conditions for crypto vary drastically from jurisdiction to jurisdiction. Let’s compare some of these countries to see the differences.

Czech Republic

In the crypto community, it’s well-known that the Czech Republic is a friendly jurisdiction. The Czech National Bank (CNB) allows companies to offer cryptocurrency-related services provided that they comply with AML requirements.

The Czech Republic introduced national regulation which requires every cryptocurrency enterprise to be supervised by the Czech government. Accordingly, AML rules apply to everyone who offers services involving cryptocurrencies—buying, selling, storing, managing, or intermediating sale and purchasing or catering to other crypto services as a business.

Estonia

Estonian legislation on crypto activities has been amended several times, with new provisions added each time. Still, this jurisdiction remains one of the most popular European destinations for crypto businesses, thanks to its clear requirements for establishing a crypto company.

The Money Laundering and Terrorist Financing Prevention Act that came into force in June 2022 increases transparency of crypto companies, prohibits anonymous accounts, and requires crypto platforms to have a minimal capital of €250,000 (around $243,000) in order to operate. Although Estonia’s many regulations are considered strict, they’re actually an immense market advantage because they grant investors guarantees and shield startups from failure.

Cryptocurrencies in Estonia are controlled just like fiat, meaning they are legalized and can serve as a means of payment.

Suggested read: How the New Estonian AML Act Affects Virtual Currencies [Updated 08.04.2022].

Lithuania

The Lithuanian regulator that oversees crypto companies is the Financial Crime Investigation Unit (FCIU). Companies can get two types of permissions to operate in the country: one for exchange companies and another for custodial wallets. As a Lithuanian crypto license applicant, you must implement appropriate KYC and AML algorithms to comply with this jurisdiction.

Suggested read: How to Comply With AML Regulations and Licensing Requirements in Lithuania—an EU Fintech Hub.

Poland

Crypto companies in Poland need to register with financial authorities. The registered entities are liable to AML/CFT regulations, supervised by the Financial Supervision Authority (KNF).

By implementing the EU AMLD 5, the Polish government sought to make the crypto industry more transparent and less prone to illegal activity. As a result, crypto platforms now have to register with the Register of Virtual Currencies, governed by the Ministry of Finance.

Steps to launching a crypto exchange:

- Establish the fundamentals:

First things first, you need to establish the core foundations of your exchange. This means:

- Determining your target audience. In other words, who’s gonna use your platform? Novice traders? Professionals? Both?

- Deciding on a monetization model, which will play a key role in your compliance obligations later on.

- Decide on an in-house or outsourced approach

Decide whether you will build everything yourself or delegate to a turnkey solution. White-label cryptocurrency exchange software helps save time and costs. Whereas your independent search will require lots of effort, time, and money until you can settle with reputable providers and partners.

- Think about software

In the next stage, you must decide on the functionality of your platform. Client verification and identification—that is KYC, KYT, AML—are absolutely crucial if you aim to work on the European market legally. Other key features include liquidity management, trading tools, and strict security measures, like DoS and DDoS protection, two-factor authentication, data encryption, and other methods of protection.

Suggested read: How crypto businesses can balance compliance and pass rates while onboarding more users

- Choose your jurisdiction

A major pitfall lies in choosing the appropriate jurisdiction for your business. This jurisdiction should have a crypto-friendly attitude, market demand, corporate legislation, and sophisticated infrastructure. Also, the jurisdiction you choose should be open to emerging digital trends, as well as the growing role of cryptocurrencies in the daily life of its citizens. The jurisdictions we discussed above fit perfectly.

- Build your team

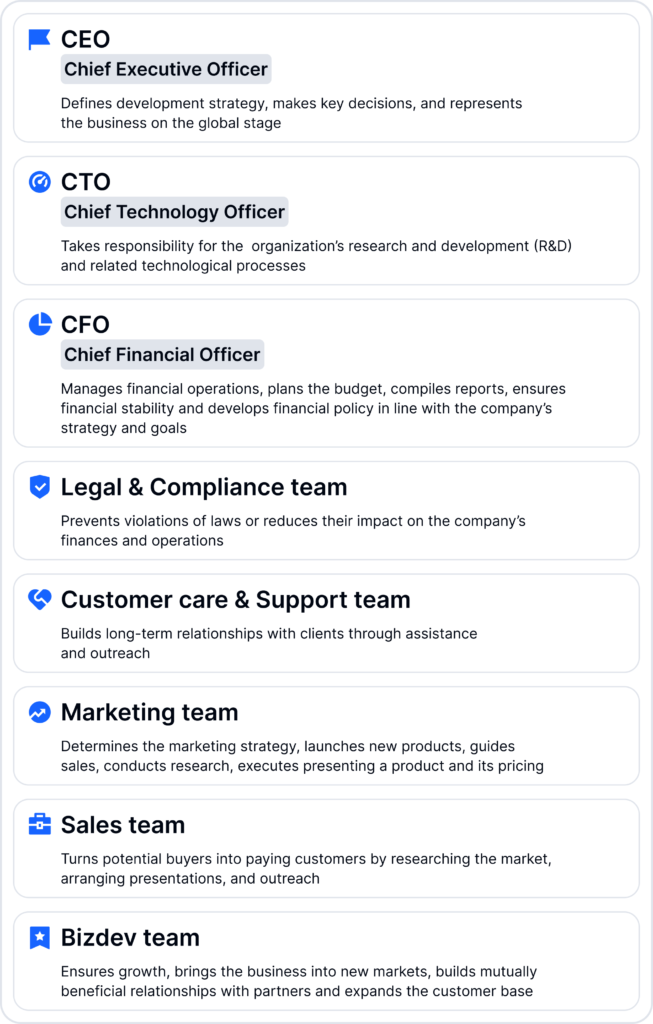

For a successful crypto exchange, you can’t do without a team of specialists. Here are the main ones:

Key Takeaways

All told, we want to add that the majority of users, 60% of them, prefer to store their virtual currencies in crypto exchange, as these platforms guarantee security, enable transactions fiat-to-crypto and vice versa, while providing a convenient user interface. Now is the time to seize the opportunities stemming from this growing market, but there’s certainly a right and wrong way to launch an exchange. Following the steps laid out by this article should get you on the right track.