Automated KYC Solution

Onboard real users, keep fraudsters out

Know your customer at every stage

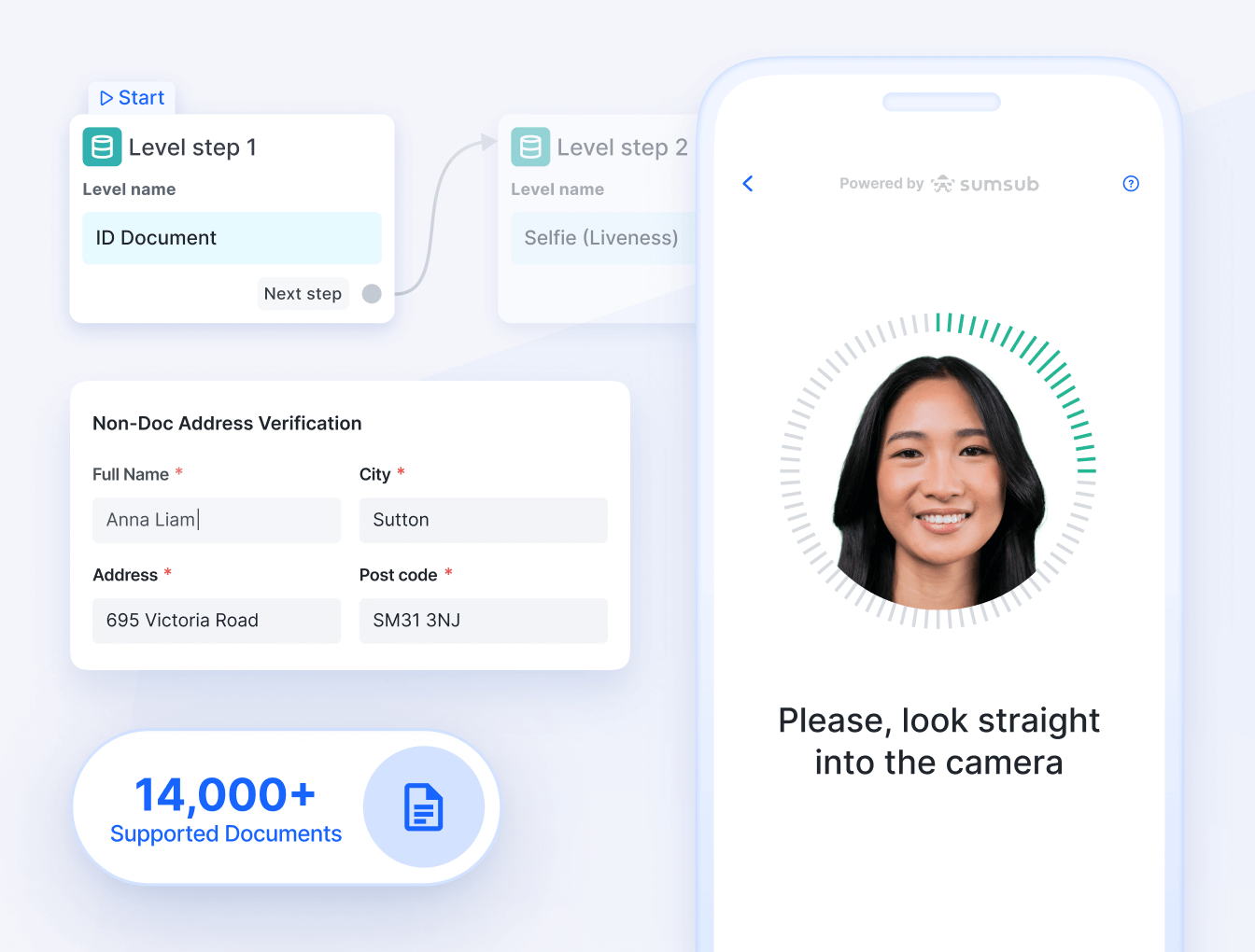

Onboarding

- Verify identities in 20 seconds with cutting-edge ID Verification, Liveness & Deepfake Detection, Proof of Address, and AML Screening.

- Onboard users faster with Non-Doc Verification and Reusable KYC. Enhance user experience in 50+ languages, minimizing drop-offs with seamless onboarding.

- Mitigate risks before they arise with AI-powered Fraud Prevention and customize verification flows with a tailored Workflow Builder to suit your business needs.

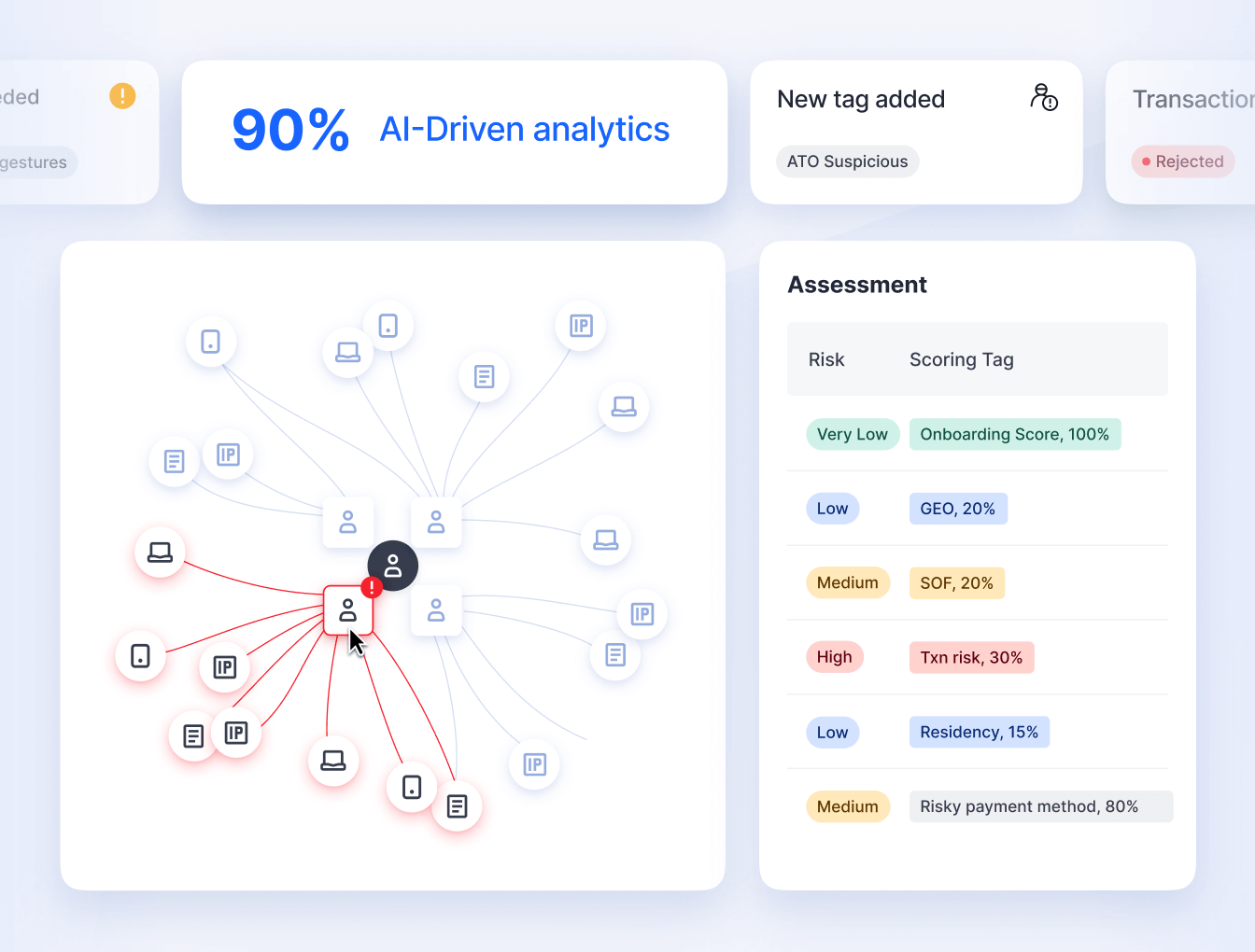

Risk Monitoring

- Automatically track user behavior to detect anomalies and stay compliant with evolving regulations.

- Proactively identify suspicious activity before it escalates with Sumsub's AI-driven risk engine.

- Make predefined, data-driven decisions based on the client's risk score—and your own risk appetite.

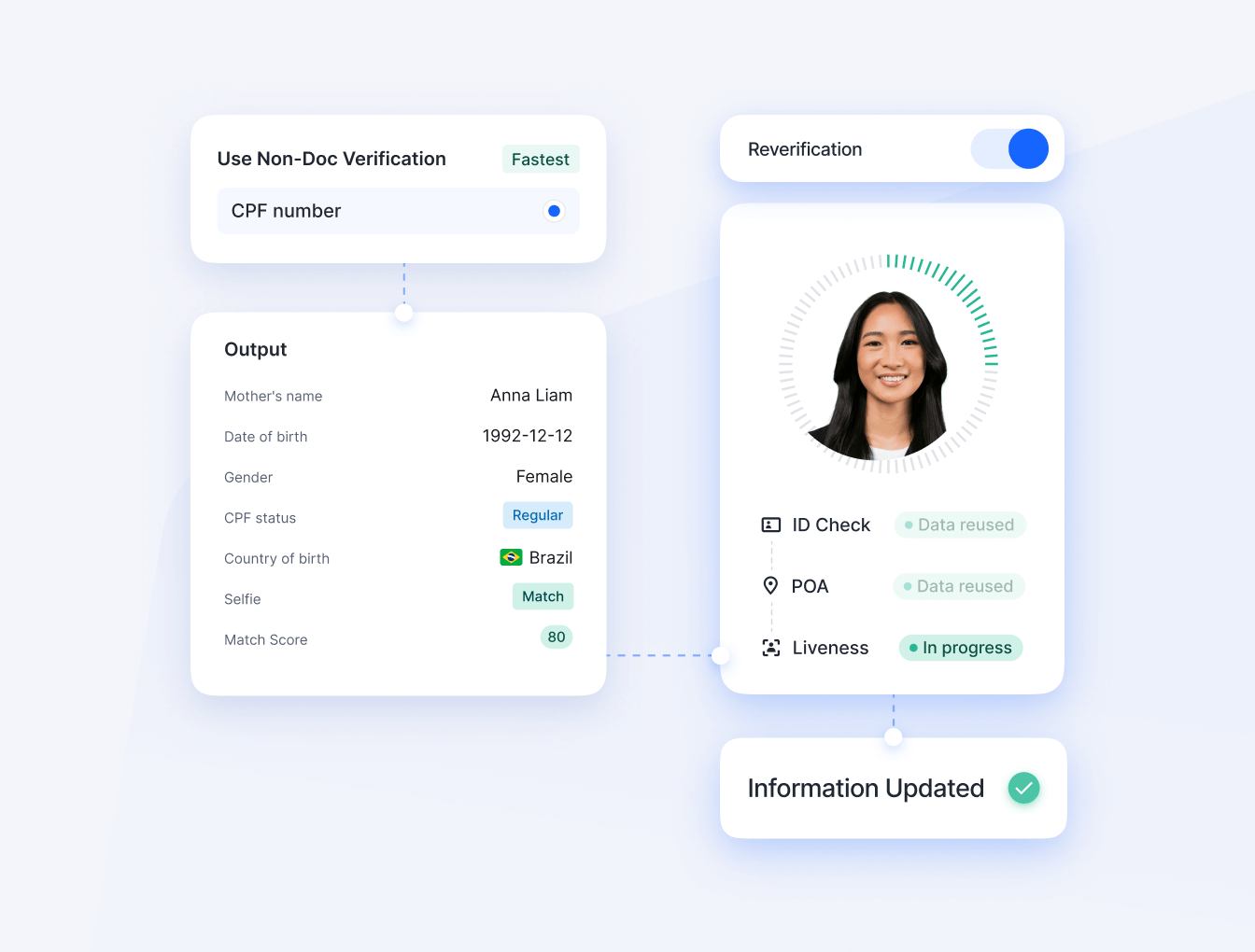

Reverification

- Effortlessly revalidate identities and reassess risks over time to enhance security and maintain compliance.

- Keep customer data accurate and up to date without disrupting operations, improving decision-making and customer trust.

- Detect suspicious activity early by continuously monitoring changes in risk profiles, allowing for proactive fraud prevention.

Let the numbers

do the talking

Platforms and operators that work with Sumsub save costs and get 240% ROI on average, according to the “Total Economic Impact™ Of Sumsub’s Verification Platform" study by Forrester Consulting.

Simplify onboarding in any industry

Learn more about KYC

Trusted by 4,000+ happy clients.

Here’s what they have to say

Choosing your ideal solution?

Sumsub is G2’s Top Pick

Surpass competitors with a partner who knows how to excel, as validated by user reviews.

FAQ

What is KYC automation?

Know Your Customer (KYC) automation refers to the use of AI-driven technology to streamline the identity verification process. Automated KYC verification reduces manual efforts by collecting, analyzing, and validating customer data from official documents, biometrics, and global databases, ensuring compliance with regulations while minimizing fraud risks.

Can KYC be fully automated?

While automated KYC checks can handle most aspects of identity verification, full automation is often not possible due to regulatory requirements and the need for human oversight in complex cases. Businesses can use automated KYC solutions to verify documents, conduct biometric authentication, and assess risk levels, but manual review may still be required for high-risk profiles.

What are AI solutions for KYC?

AI-powered solutions for KYC include facial recognition for biometric verification, optical character recognition (OCR) for document scanning, machine learning for fraud detection, and real-time database checks for risk assessment. Know Your Customer automation helps businesses verify users quickly, enhance security, and stay compliant with AML (Anti-Money Laundering) regulations.