Digital footprint screening

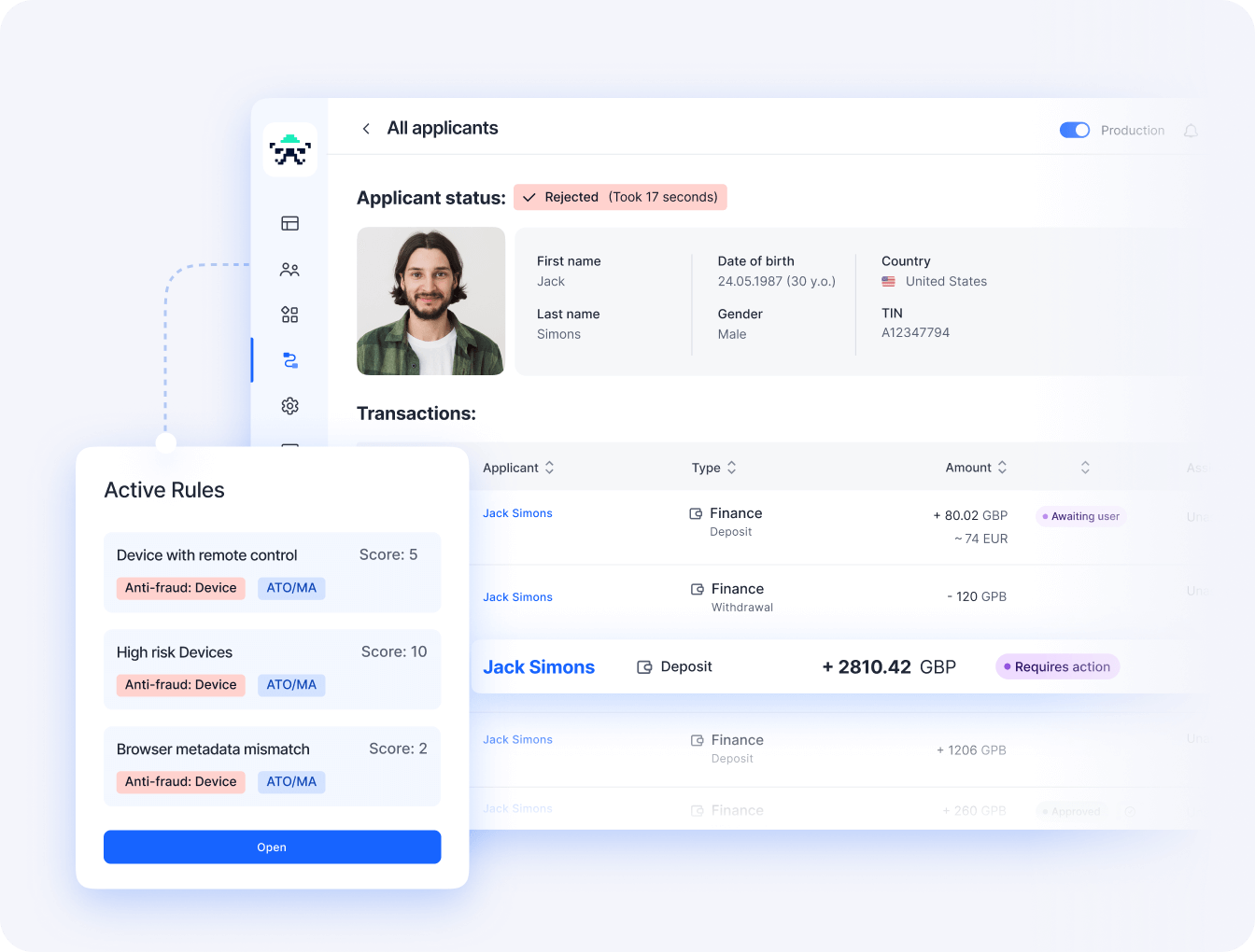

Assess user risk before committing to a KYC check

Investigate onboarding signals to catch fraud attempts even before a full KYC check takes place. Keep the entire user journey fraud-free with constant monitoring for risk signals.

Onboard only trustworthy users

Filter out suspicious users during onboarding using email, phone, IP, and device signals. Block fake accounts before they cost money or damage reputation.

Reduce onboarding friction

Trusted digital footprints get instant approval or light verification. Reduce friction for legitimate customers while maintaining security standards.

Get early risk signals

Pre-screen applicants to trigger full KYC only when needed. Save money on expensive verification processes and stay compliant efficiently.

Your first barrier against fraud

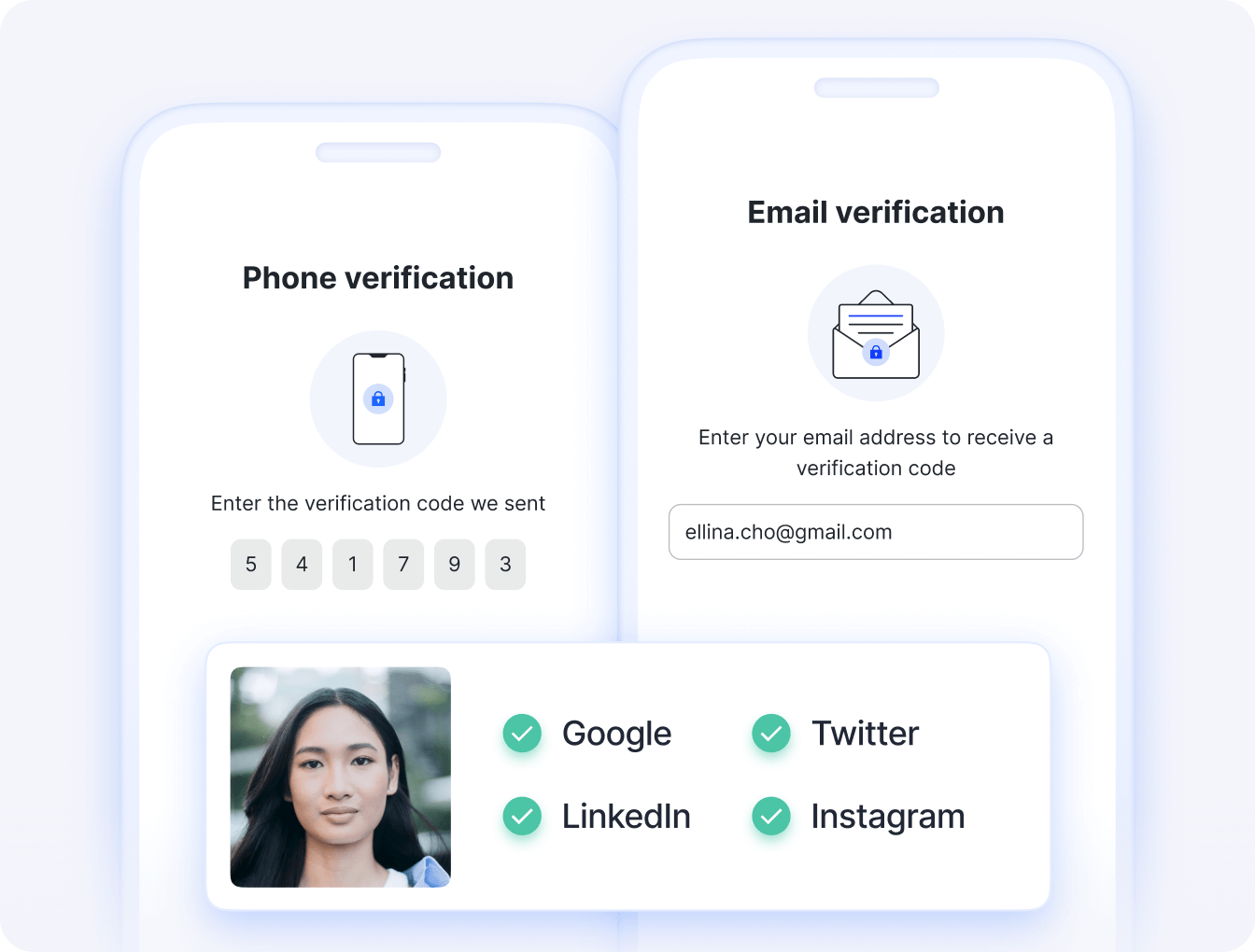

Pre-screen users instantly

Cover all fraud vectors at onboarding with email verification, phone validation, device intelligence, and IP analysis. Detect suspicious contact info, risky devices, and masked networks before users enter your system.

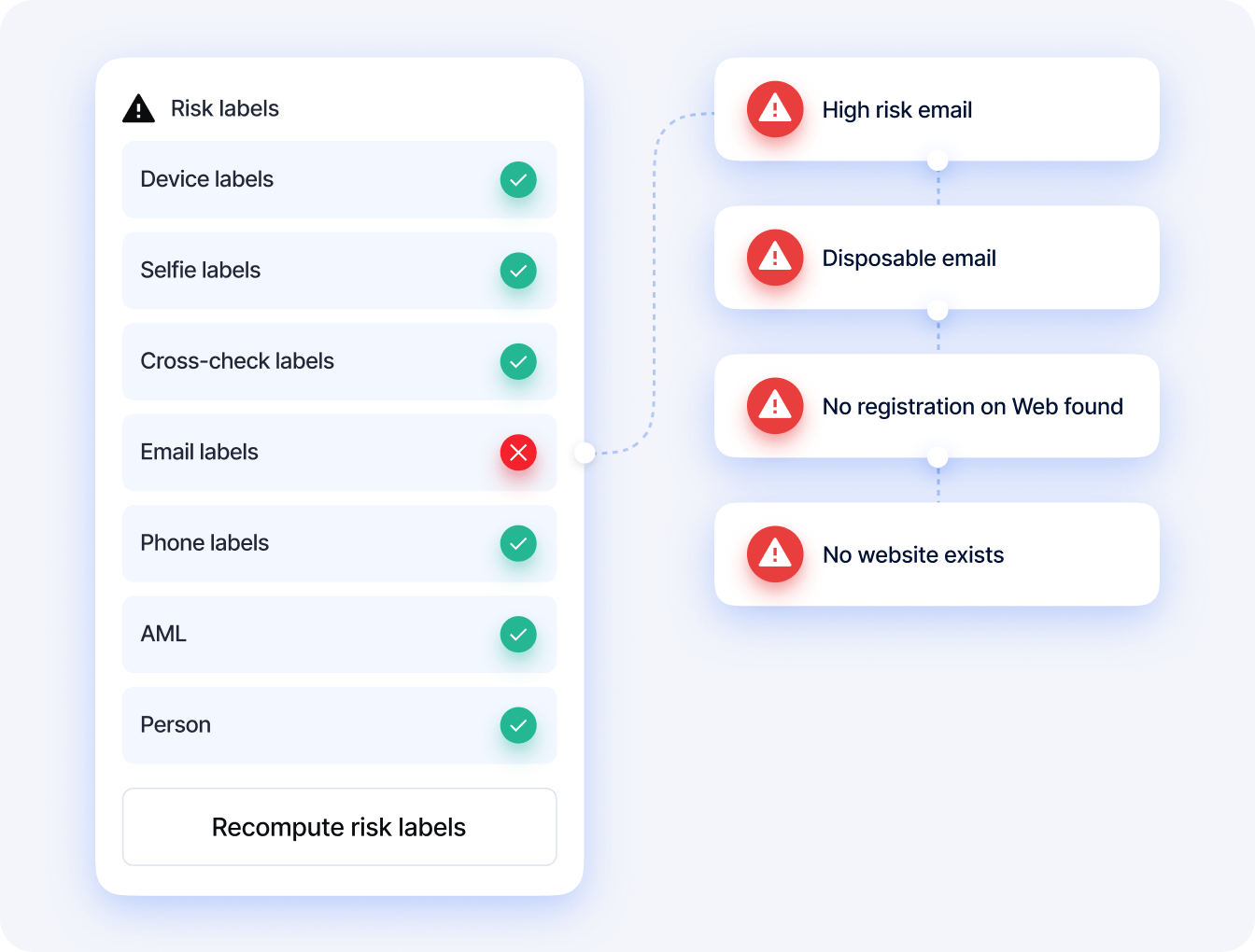

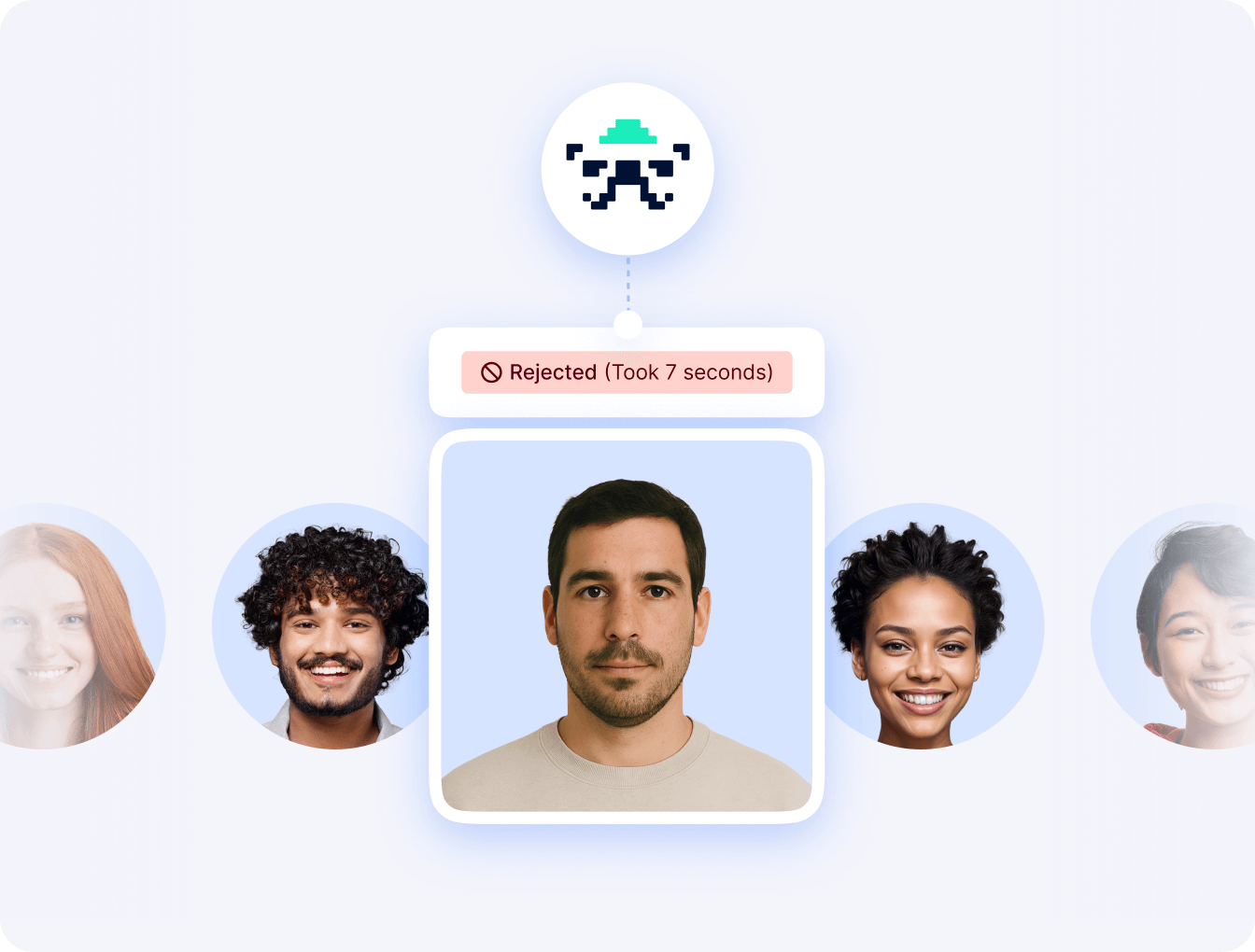

Boost accuracy with combined signals

Multiple data points reinforce each other, reducing false positives. Phone forwarding combined with disposable email and VPN usage can spot a clear fraud pattern that single checks miss.

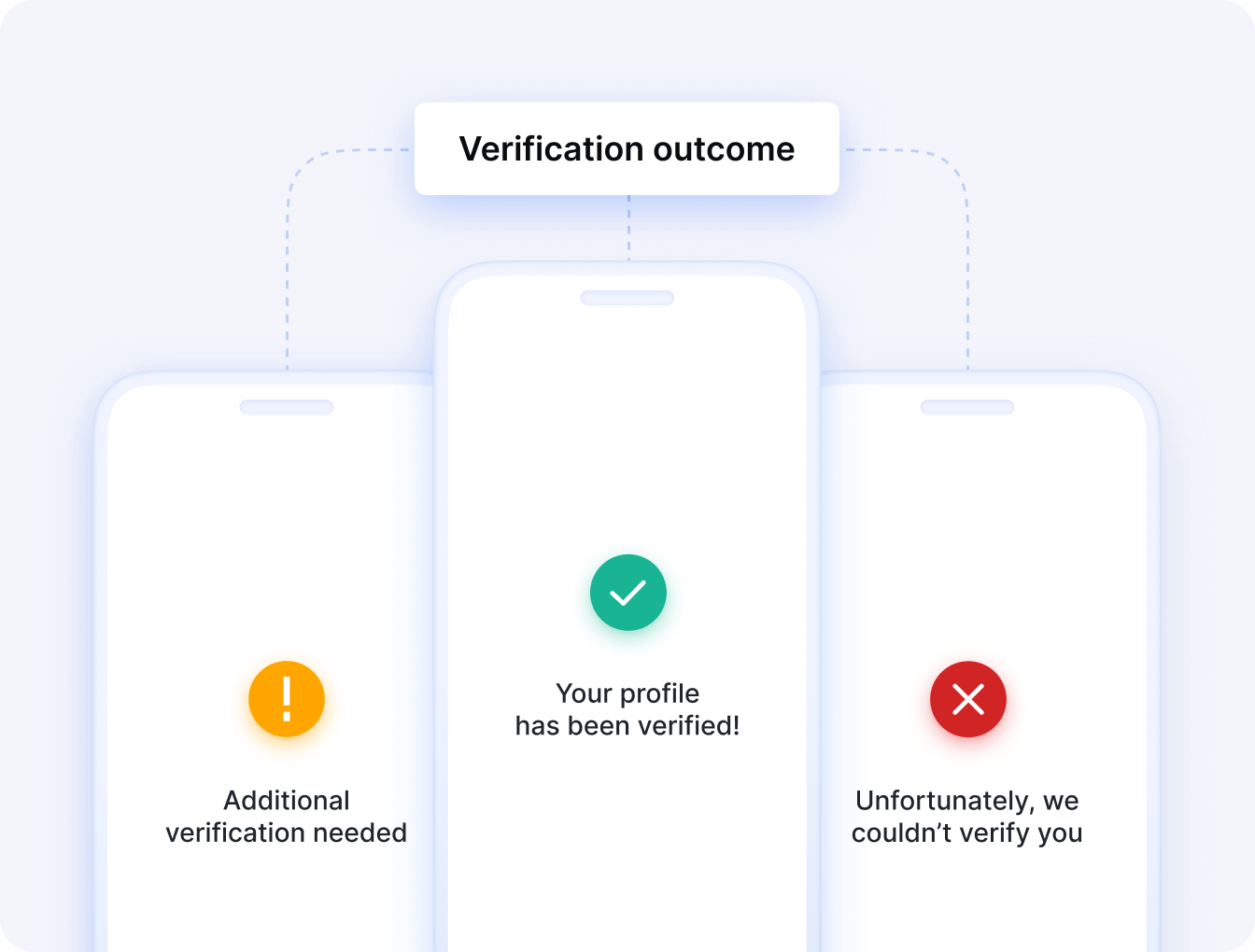

Balance security with usability

Trusted footprints get automatic approval while suspicious ones escalate to full verification. Trustworthy users proceed without delays while bad actors face additional scrutiny.

Save on verification expenses

Pre-filter fraudsters before expensive KYC processes. Reduce manual review workload and focus resources only on complex cases that require human oversight.

Monitor beyond onboarding

Track IP anomalies for suspicious logins, device changes for account takeovers, and new contact details for SIM swap attempts. Protect users throughout their journey with your business.

Choosing Your Ideal Solution?

Let the numbers do the talking: See how we exceed our competitors in key areas, as validated by user reviews on G2.

Integrations

Maximize pass rates with the right integration

Unilink

Skip the integration process entirely and add an identity verification link or QR code to your website. Your customers can pass verification immediately by simply clicking the link.

Don’t take our word for it.

Here’s what our clients have to say

Stop fraudsters

at the front door

See digital footprint screening in action! Book a demo to protect your onboarding process today.