Gianluca Sacco

COO at VALR

Founded in 2018 and headquartered in Johannesburg, South Africa, VALR is a global cryptocurrency exchange working to bridge traditional finance and the world of digital assets. With over 1.6 million registered users globally and a remote team of 100+ employees, VALR offers a full suite of products, including spot trading for over 100 crypto assets, perpetual futures with up to 60x leverage, an institutional OTC desk, staking, tokenised stock, crypto earn products as well as a range of other differentiated and innovative crypto solutions designed to meet the needs of both retail and institutional clients.

While retail traders form a significant part of VALR’s customer base, the company also serves over 1,100 institutional and corporate clients worldwide. VALR is the largest crypto exchange by trading volume in Africa and holds a Financial Services Provider licence with Category I and II approvals from the country’s Financial Sector Conduct Authority (FSCA). VALR is also registered as an ‘accountable institution’ with the South African Financial Intelligence Centre (FIC). Internationally, VALR continues to expand with regulatory approvals in Poland and provisional authorization in Dubai, and partnerships with leading service providers, including MoonPay, to support access in over 180 countries.

The Challenge

As regulatory pressure increases globally, VALR faces a growing need to adapt. In South Africa, its home market, compliance with the FATF Travel Rule became a legal requirement in 2025. That meant VALR needed a way to securely exchange originator and beneficiary information for crypto transactions.

Key challenges included:

- Need to strengthen financial crime prevention. As transaction volumes increased, so did the risk of potential exposure to bad actors and scam activity. VALR sought a solution to screen every crypto wallet and transaction and verify every counterparty against global watchlists before anything was finalized on-chain without adding friction or delays.

- Fragmented global regulatory standards. With no universal standard, VALR had to connect with multiple protocols, such as TRP and GTR, to exchange originator and beneficiary data with VASPs (Virtual Asset Service Providers) worldwide. Building these integrations in-house would have been costly, time-consuming, and difficult to maintain.

- The “Sunrise” issue. Another challenge was dealing with transactions involving VASPs in jurisdictions that hadn’t yet implemented the Travel Rule, or with self-custodial wallets like MetaMask or Ledger. Without a reliable process in place, these gaps exposed the platform to potential compliance risks.

Why Sumsub?

VALR engaged Sumsub for its unified approach to compliance and its ability to handle the full lifecycle of crypto transactions under the Travel Rule.

Key priorities driving the decision:

- Rather than juggling multiple providers, VALR sought a single platform to cover AML/CFT and Travel Rule, as well as KYC obligations.

- Interoperability was crucial. Sumsub’s architecture supports multiple major Travel Rule protocols (e.g., TRP, GTR), allowing VALR to communicate effectively with a broad network of VASPs around the world.

- With frequent high-volume trading campaigns and continued user growth, Sumsub’s infrastructure could scale to meet VALR’s demand without becoming a bottleneck.

In terms of implementation, the following features were particularly important:

- Sumsub integrates with blockchain analytics tools like Elliptic and Chainalysis to identify whether a crypto address belongs to another regulated VASP or to an unhosted wallet. If the address is unhosted, Sumsub runs additional checks to confirm the user's ownership, enabling withdrawals to self-custodial wallets without disrupting the user experience.

- Risk scoring and sanctions checks are embedded into the Travel Rule workflow. This allows for counterparty screening before funds move, supporting both regulatory readiness and internal risk controls.

The Solution

Gianluca Sacco

COO at VALR

Sumsub's Travel Rule solution has become a key part of our daily compliance workflow, particularly for outgoing crypto withdrawals. It supports both automation at scale and the oversight required for regulated financial infrastructure.

1. Automating Travel Rule workflow

One of the most impactful features has been the protocol manager. The system identifies which Travel Rule protocol is supported by the counterparty VASP, and automatically routes the transaction accordingly.

Sumsub also manages the secure exchange of required Travel Rule data, such as originator and beneficiary names and wallet addresses. This data is encrypted and transmitted to the receiving VASP, supporting compliance with FATF Travel Rule standards in all jurisdictions where VALR operates.

To maintain oversight, compliance officers use a centralized dashboard that consolidates alerts, logs all actions taken, and provides a full audit trail. This simplifies internal reviews and regulatory reporting without compromising visibility.

2. Verifying wallets and real-time monitoring

Beyond data exchange and automation, wallet verification and transaction monitoring are critical for maintaining a strong compliance and risk posture.

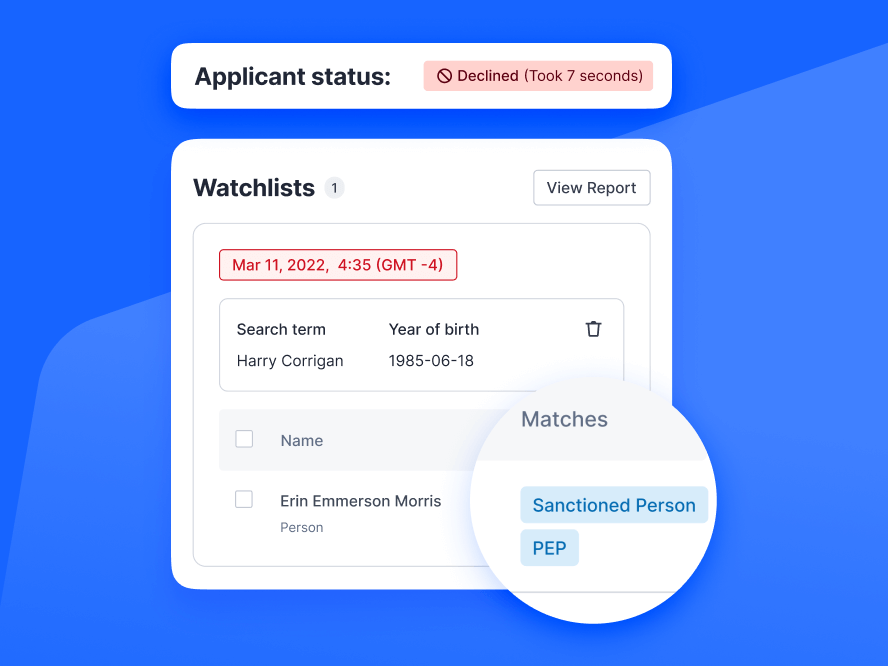

VALR leverages a combination of features from multiple providers, including making use of Sumsub’s complementary Travel Rule features, such as the VASP address book, and risk signals from integrated blockchain analytics providers to identify whether the destination address belongs to a regulated VASP or an unhosted wallet. Once the wallet type is confirmed, counterparty data is screened against major global sanctions lists (including OFAC, UN, HMT, EU) and adverse media sources through integrated AML Screening feature.

At the same time, Sumsub’s transaction monitoring capabilities further assist to assess the wallet’s risk score, flagging links to illicit activity or suspicious behavior, and can automatically reject or escalate transactions that pose a threat.

3. Third-party integrations

VALR also makes use of Sumsub’s integrations with major blockchain analytics providers like Chainalysis. This expands visibility into on-chain behavior and strengthens risk scoring by revealing:

- Connections to risky or unsanctioned counterparties

- Cross-chain transaction patterns

- Indirect exposure to illicit funds

Gianluca Sacco

COO at VALR

Bringing all this data into a single dashboard has helped our compliance team make faster, more informed decisions, especially during high-volume trading periods.

The Results

VALR noted the following benefits of the partnership with Sumsub:

- Sumsub has strengthened VALR’s ability to meet global regulatory requirements, particularly in jurisdictions with active Travel Rule enforcement, such as South Africa. With automated decisioning, real-time data exchange, and AML checks built into the workflow, the team is further equipped to handle compliance at scale.

- Automating VASP attribution, protocol selection, and sanctions screening has reduced reliance on manual review, freeing up internal resources for higher-value oversight.

- VALR uses Sumsub’s rules engine, including the South Africa Jurisdictional rule bundle and others, to tailor compliance workflows based on transaction size, counterparty risk, and regional regulations. This flexibility ensures that controls are appropriately applied without overburdening the user experience.

Gianluca Sacco

COO at VALR

Sumsub’s Travel Rule solution has become a core part of our compliance infrastructure. It supports automation across protocol selection, sanctions checks and jurisdiction-specific rules, helping us adapt to evolving regulatory requirements, without slowing down our operations.

Beyond core compliance automation, the integration has delivered several strategic advantages. Most notably:

- Protocol Coverage. By supporting multiple Travel Rule protocols (GTR, CODE, Sygna), the system facilitates smooth interoperability across a broad range of counterparties, which is critical for a global exchange like VALR.

- Data Privacy. Compliance with GDPR and PII requirements are implemented to support the secure handling of sensitive customer data securely throughout the verification and transaction process.

Future Plans

As VALR expands into new markets, Sumsub continues to support the company in navigating diverse regulatory environments. Its protocol-agnostic design and automated jurisdictional rule bundles are designed to help the team with continued compliance as Travel Rule standards evolve. Real-time AML checks and wallet risk scoring are already built into the flow, making it easier to scale without increasing compliance overhead. With support for emerging use cases, like unhosted wallet verification and non-compliant counterparty VASP handling, Sumsub helps future-proof VALR’s compliance infrastructure for global growth.