Thomas Taraniuk

Head of Partnerships, EU/UK at Sumsub

Shah Ramezani

CEO & Founder of Noah

Evelina Hoque

Chief Compliance Officer at Noah

Nikrad Nassiri

Head of Product and Delivery at Noah

Stephen Mansfield

Reusable Identity Product Leader at Sumsub

Noah is a payments infrastructure provider specializing in real-time global money movement. The platform facilitates the integration of fiat and crypto operations, providing businesses with USD and EUR virtual accounts, stablecoin settlement, and cross-border payouts in over 70 currencies. Its suite also includes a Global Payouts API and a Rules Engine designed to automate treasury and compliance workflows within a single integration.

To support its global operations, Noah maintains a Virtual Asset Service Provider (VASP) license in the EU and is a registered Money Services Business (MSB) in both the United States and Canada, ensuring adherence to regional regulatory standards.

The Challenge

Before integrating Sumsub, Noah and its clients faced onboarding flows that were slow and inconsistent. Identity checks required significant manual review, leading to frequent errors and difficulty managing the wide variety of ID types across different jurisdictions. This friction led to high drop-off rates during the activation phase, directly impacting conversion.

As Noah scaled, the manual workload became a bottleneck, stretching onboarding times beyond the expectations of users. Expanding into new markets also required constant, manual adjustments to compliance workflows. One of mutual fintech clients noted that "the identity step was the biggest reason users abandoned onboarding. It was simply too slow."

The need was clear. Noah required an automated, global verification solution that could handle multi-jurisdiction complexity while keeping the user experience smooth. To support that, Noah partnered with Sumsub. The collaboration created a single, unified stack where Sumsub powers verification, screening, and ongoing compliance, while Noah handles global payment orchestration and settlement.

Evelina Hoque

Chief Compliance Officer at Noah

As our volume grew, we needed a verification engine that could keep pace. Sumsub matched the speed we needed, while raising our compliance and fraud standards across every market.

Why Sumsub?

Noah chose to partner with Sumsub after recognizing its extensive footprint and proven reliability within the global financial services sector. From the first conversation, it was clear that Sumsub could improve accuracy and speed while significantly reducing the operational strain of manual compliance.

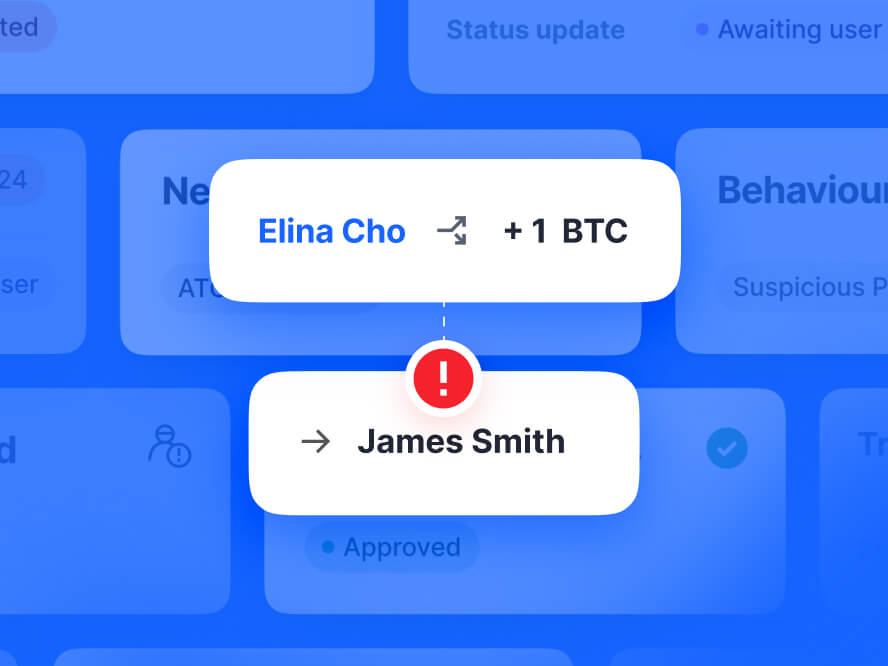

Noah now uses Sumsub across its entire onboarding and compliance stack, including KYC, KYB, Sanctions and PEP Screening, Adverse Media Checks, Transaction Monitoring, and Travel Rule enforcement. Using Sumsub’s Workflow Builder, Noah tailors specific flows for each of its licensed entities in Canada, the US, and Lithuania. This allows them to meet AML and CTF requirements in each jurisdiction without sacrificing the user experience or building separate systems.

Evelina Hoque

Chief Compliance Officer at Noah

Sumsub gave us the flexibility to stay compliant across three jurisdictions without building three separate onboarding systems. The workflow engine and analytics have been game changers.

This unified stack ensures that verification is automated, fraud detection is AI-driven, and high-risk users are instantly routed for Enhanced Due Diligence (EDD). The platform also keeps Noah consistently audit-ready, providing complete activity logs and continuous monitoring within a single dashboard.

Thomas Taraniuk

Head of Partnership UK/Europe at Sumsub

Noah was scaling fast and needed verification that could scale with them. Our goal was to provide speed, accuracy, and compliance reliability in one place - making an operational constraint into something that actively enables Noah’s business model.

The Solution

A central element of the partnership is Sumsub’s Reusable KYC. This feature allows users who have already completed verification via any Sumsub-powered service to onboard with Noah in just a few clicks. Instead of resubmitting documents or repeating liveness checks, users simply provide consent to securely share their verified identity with Noah.

For end-users, this removes the primary friction point in the onboarding journey. For Noah’s clients, it directly reduces drop-off rates and increases user activation.

Nikrad Nassiri

Head of Product and Delivery at Noah

Reusable KYC has become a growth feature, not just a compliance feature. The reduction in friction is immediately visible in every onboarding funnel.

Noah’s internal data confirms the high demand for this efficiency, with nearly half of its enterprise prospects specifically requesting Reusable KYC because of its impact on conversion rates. Lemoncash, a LATAM-focused wallet using Noah’s infrastructure, noted: "The moment Reusable KYC went live, our onboarding funnel changed. Users stopped abandoning the process at the identity step. For us, this was the breakthrough."

Importantly, Noah still keeps compliance checks in place. Noah still performs risk based assessments, including fresh sanctions and PEP screening, while benefiting from the efficiency of shared verification data. Users get the convenience of not repeating verification, and Noah maintains full regulatory oversight.

Noah maintains full regulatory oversight throughout this process. While benefiting from the efficiency of shared verification data, the company continues to perform automated, risk-based assessments, including fresh sanctions and PEP screening. This ensures users enjoy a frictionless experience while Noah remains consistently compliant.

The Results

The integration of Sumsub into Noah’s infrastructure has delivered measurable improvements:

- Document errors were reduced from 18% to 7%. Additionally, screening reviews became 50% faster due to Sumsub’s integration with ComplyAdvantage, eliminating the need for staff to switch between multiple systems.

- Drop-off rates fell by 56%, while the success rate for completed and approved onboardings saw a 220% YoY increase.

- Monthly onboarding capacity nearly doubled, supported by a 165% growth in completed KYCs.

- Onboarding time dropped by 63%, and auto-approval rates increased by 60%, reducing manual workload and speeding up activation for new users.

Shah Ramezani

CEO & Founder of Noah

What these results show is not just a faster onboarding flow, but a new standard for how compliance should work at scale. Sumsub helped us transform a major operational bottleneck into one of Noah’s core advantages.

For Noah, these results translate into faster deal cycles, a stronger compliance posture across all jurisdictions, and an efficient operation capable of supporting high user volumes and new product launches. The partnership has established a high-velocity, multi-jurisdiction onboarding framework.

Client Impact

Noah’s clients saw an immediate impact: faster user activation, a more intuitive onboarding flow, and a significant drop in verification-related support tickets. Lemoncash shared that "the onboarding step used to be our biggest barrier. With Noah and Sumsub, that barrier is gone."

Reusable KYC amplified this impact via a shared identity layer. For users across the Sumsub ecosystem, this accelerated both initial sign-ups and every subsequent interaction. Verification has evolved from a hurdle into a strategic advantage, enabling Noah’s clients to scale with speed and confidence.

Future plans

Noah and Sumsub see Reusable KYC as the foundation of a shared identity network for the next generation of financial services. As the ecosystem of Sumsub-powered platforms grows, Noah and its clients benefit from a ready-made base of pre-verified users, leading to higher conversion and faster market entry.

The roadmap focuses on dynamic risk-based flows that combine reusable profiles with real-time signals, such as transaction patterns and device signals and user behaviour, ensuring friction is only applied when necessary. This allows Noah to maintain low fraud rates while providing a frictionless experience for legitimate users.

Stephen Mansfield

Reusable Identity Product Leader at Sumsub

The Sumsub/Noah partnership is about redefining how identity works across payments. Reusable KYC is just the starting point. We see a future where trusted identity moves seamlessly with the user, compliance will adapt dynamically to risks, and great platforms like Noah can expand globally without rebuilding their compliance stack every time.

Noah and Sumsub remain committed to a consent-driven, audit-ready framework that aligns with global data protection standards. Over time, Noah expects Reusable KYC to become a default expectation rather than a nice-to-have, turning identity verification from a cost centre into a growth engine for global fintechs.

By combining automated verification, reusable identity, and fraud detection, the joint stack maintains high regulatory standards while streamlining the user experience. Together, Noah and Sumsub enable fintechs to launch across markets with reduced friction and consistent compliance coverage.