Vugar Usi Zade

Chief Operating Officer at MEXC

MEXC is a global cryptocurrency exchange founded in 2018. The platform serves more than 40 million users across 170+ countries and provides access to over 3,000 digital assets, including emerging tokens and tokenised real-world assets (RWAs).

The exchange operates a zero-fee spot trading model and runs ongoing participation programmes such as airdrop events, which saved its users more than $1.1 billion in trading fees in 2025 alone.

On the infrastructure side, MEXC is committed to security and simplicity. The platform is supported by a dedicated Guardian Fund and maintains a 1:1 Proof of Reserves framework, aiming to provide a stable and reliable trading environment for users of all experience levels.

The Challenge

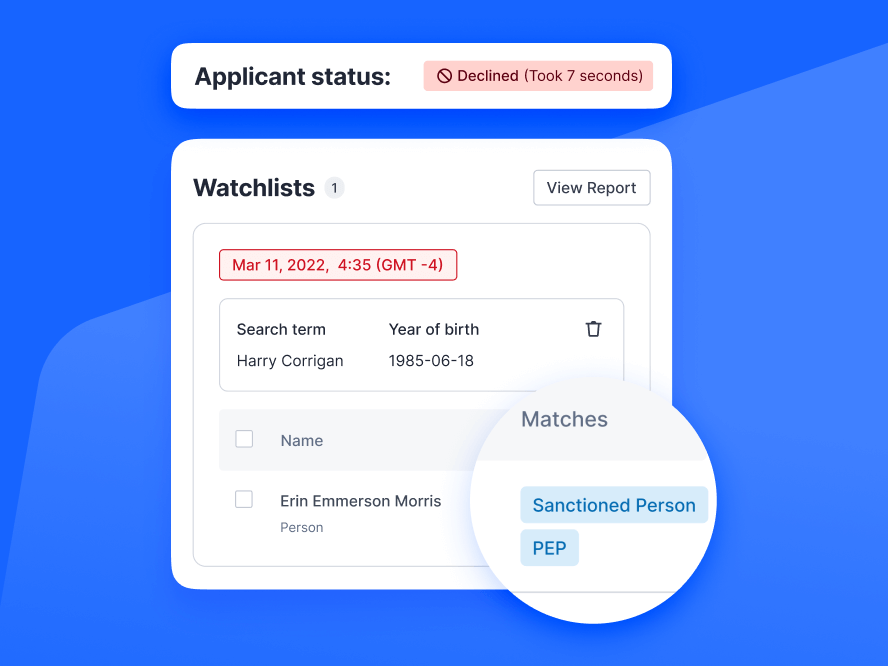

Before Sumsub, MEXC relied on a mix of manual reviews and fragmented automated tools for different checks. While the hybrid setup worked at a smaller scale, growth exposed three issues: fragmented verification across manual reviews and tools, scalability limits that created onboarding bottlenecks, and rising sophisticated fraud (including syndicates and deepfakes) that was harder to stop early without adding friction for legitimate users.

As MEXC scaled across many jurisdictions and sustained rapid growth (130% YoY growth), the verification stack needed to move at the same pace as the product. That led to the decision to move to a unified, automated provider. The goal was to strengthen fraud controls at the entry point while keeping onboarding as close to zero-friction as possible for genuine users.

A major factor was also regulatory complexity. Operating globally meant handling diverse local requirements, from AML frameworks in Europe (including MiCA) to evolving standards in emerging markets. MEXC wanted a way to centralize compliance logic while automatically adapting verification flows to local rules, rather than building and maintaining separate manual processes for each region.

Why Sumsub?

Vugar Usi Zade

Chief Operating Officer at MEXC

Compliance and security are non-negotiable for us, and we needed a partner whose verification and anti-fraud capabilities could keep pace with our growth. Sumsub stood out as a reliable choice, and they’ve consistently supported us with strong product performance as we scaled.

The Solution

Two capabilities have been especially important: ID Verification (supported by high-precision OCR) and Liveness Detection, which help confirm identity quickly while keeping the experience smooth for genuine users.

Depending on the market, MEXC also uses Non-Document Verification (for example, in Nigeria, Brazil, India, Argentina, etc.). Combining documentary and non-documentary methods helps the team verify users more quickly and efficiently, while reducing exposure to fraud risks such as synthetic identities and fake documents.

With automated review in place, MEXC reduced reliance on manual checks, improving consistency and operational efficiency while maintaining accuracy and meeting ongoing international compliance requirements.

Implementation

MEXC implemented Sumsub through both API and SDK integrations, embedding verification directly into the user onboarding flow. Well-structured, example-rich documentation and an intuitive testing environment allowed the technical team to complete the integration quickly.

Vugar Usi Zade

Chief Operating Officer at MEXC

Throughout the process, Sumsub team offered crucial support. They not only promptly addressed technical queries but also provided best-practice recommendations from a business perspective, helping us optimize our verification workflow design.

The Results

Since integrating Sumsub, MEXC has noticed the following improvements:

- User approval rates increased from 60% to 85%.

- Verification that previously took 2 to 4 hours is now delivered in up to 15 seconds.

- The shift to an automated-first workflow has allowed the compliance team to manage large user volumes with greater accuracy and lower operational overhead.

Vugar Usi Zade

Chief Operating Officer at MEXC

Before Sumsub, our hybrid review process could take from two to four hours per user. Now, users are verified in seconds. This jump in efficiency allows us to onboard users almost instantly while maintaining tighter control over fraud.

Future Plans

Looking ahead, MEXC’s roadmap focuses on expanding the product scope, strengthening user protection, and scaling globally:

- Multi-asset expansion. MEXC plans to expand beyond crypto to support more asset classes in a single interface, including tokenised equities, synthetic commodities, precious metals (gold and silver), and other real-world asset products.

- Zero-fee trading at scale. Zero-fee trading is expected to become a commitment in 2026, extending beyond spot crypto to additional markets, including equities and commodities.

- User protection and ecosystem investment. MEXC plans to expand its $100M Guardian Fund and launch a new $30M fund to support education, Web3 innovation, and academic research partnerships.

- Transparency and AI-driven infrastructure. Priorities include stronger proof-of-reserves reporting, enhanced security standards, and greater AI integration into the platform.

- Regional growth and local presence. MEXC plans to deepen its footprint in Southeast Asia, Turkey, Latin America, Eastern Europe, and the Middle East, including establishing physical hubs and innovation centres in selected markets.

Sumsub will support this growth by helping MEXC scale automated verification and compliance controls across new regions, higher user volumes, and new product lines without creating unnecessary friction for legitimate users.