Fraud is no longer a distant threat—it has become one of the fastest-growing operational risks for digital businesses worldwide. Approximately every 100th user was involved in a fraud network in 2024, according to Sumsub’s Identity Fraud Report. Around $485.6 billion was lost to fraud scams and bank-fraud schemes globally in 2023.

These numbers show a fundamental shift: it’s no longer “if” fraud happens, but “how well” you are equipped to prevent it. That demands more than one-time onboarding checks: it demands continuous identity verification, device and network intelligence, behavior analysis, and flexible rules over the entire end-user journey—that evolve as fraud tactics evolve.

Here’s how Sumsub helps organizations strengthen their fraud prevention efforts, backed by real examples from industry leaders.

Why companies may need a fraud prevention solution

Fraud is becoming increasingly sophisticated and costly. For digital platforms, whether fintechs, banks, marketplaces, or Web3 projects, the threat is twofold. On one hand, fraudsters are exploiting automation and AI tools to create synthetic identities, deepfakes, and coordinated fraud rings. On the other hand, customers expect instant onboarding and frictionless payments—leaving businesses little room for delays or manual checks.

This puts companies under pressure to:

- Detect and block fraudulent users in real time, before damage occurs

- Prevent multi-accounting, account takeovers, and bonus abuse

- Maintain a balance between tightening protection and providing a seamless user experience

- Protect revenue and brand reputation while keeping the user experience satisfactory

That’s why a modern fraud prevention solution must combine identity verification, device, network, and behavioral analytics, along with ongoing monitoring, to provide teams with both the data and automation they need to stay ahead of growing threats.

Suggested read: Hot New Fraud Trends in 2025: AI Scams, Pig Butchering, and Mobile Payment Attacks

How to choose the right fraud prevention solution

When selecting a fraud prevention tool, businesses should look for flexibility, coverage, and scalability. Here are the key features that matter most:

- Full lifecycle protection. Choose a solution that monitors users beyond onboarding—covering transactions, account changes, and suspicious device or network activity.

- Device and behavioral intelligence. Look for advanced signals such as device fingerprinting, IP and network checks, and behavioral pattern analysis to spot fraudsters early.

- Pre-built and customizable rules. Fraud evolves quickly, so the ability to adapt workflows and risk rules without coding is crucial for maintaining a fraud-free environment.

- Unified platform for identity and fraud. Combining KYC and fraud prevention under a single integration ensures consistent data and facilitates easier investigation and management of fraud & compliance.

- Accurate detection, fewer false positives. AI-driven decisioning and strong case management help with the detection of real threats without ruining user experience.

- Global coverage and compliance. A strong solution supports multiple jurisdictions and complies with data protection standards like GDPR and SOC 2.

- Scalability and support. As user volumes and fraud attempts grow, the system should scale easily while offering dedicated support and measurable ROI.

What sets Sumsub’s Fraud Prevention solution apart

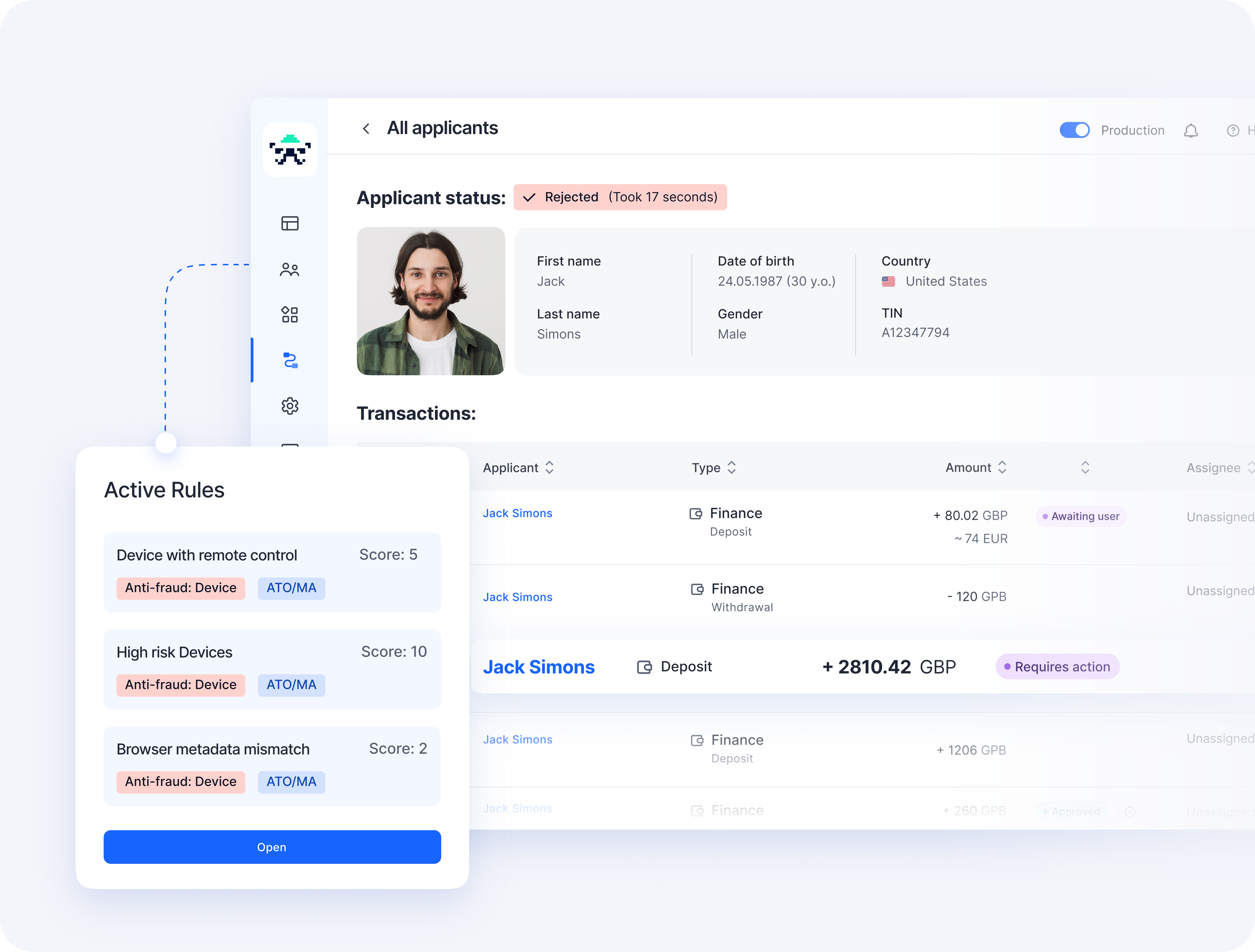

Sumsub’s solution combines device intelligence, identity verification, fraud network detection, and other useful features in one effective product.

Here are some features that stand out:

- Unified identity + fraud engine. Most vendors specialize in either KYC or fraud detection. Sumsub integrates both, allowing fraud signals to be tied directly to verified identities for stronger accuracy. By using KYC as a targeted step-up challenge, the platform not only detects fraud but also actively prevents it, making sure that risky users are verified before they can cause harm, without causing friction for genuine customers.

- Fraud Network Detection. Advanced Fraud Network Detection identifies groups of connected fraudsters across IPs, devices, and behavioral patterns—stopping organized rings before they scale.

- Device intelligence. The feature combines advanced device signals and flexible risk rules to help block bots, multi-accounting, account takeovers, and fake signups, without disrupting legitimate users.

- AI-powered decisioning. Proprietary machine learning models analyze billions of data points to flag anomalies with high precision and minimal false positives.

- No-code customization. Sumsub’s workflow builder lets businesses use pre-built rules and adjust risk rules and verification paths instantly, without developer input.

- Rich fraud dataset. With over 2 million fraudster identities known in its unique database, Sumsub is able to block nearly 100% of fraudulent attempts.

- Global reach with local compliance. Covering 200+ countries and territories, Sumsub makes sure that every fraud detection process aligns with local regulatory standards.

- AI-powered deepfake detection. Sumsub’s Liveness detection uses artificial intelligence to accurately detect deepfakes, lookalikes, AI avatars, or any other advanced spoofing attempts.

There are dedicated solutions for every use case and industry—from crypto to finance to iGaming to trading and ecommerce. They include features such as prevention of new account fraud, identity fraud, account takeovers, payment fraud, policy abuse, and much more.

How clients benefit from Sumsub’s fraud prevention

iFAST Global Bank: Keeping fraud at bay across global markets

As a global wealth management fintech operating in multiple jurisdictions, iFAST Global Bank needed a scalable solution that would allow it to maintain strict compliance requirements and onboard global clients easily. The lack of automation made it difficult for the company to be efficient and consistent, and the process itself was time-consuming.

Integrating Sumsub’s Fraud Prevention into its existing KYC workflows proved easy, within a short amount of time. iFAST Global Bank unified user verification, fraud network detection, and risk scoring within a single platform. Sumsub’s Fraud Prevention features have improved the company’s security and compliance, particularly in regions with high financial crime risks, strengthening the bank’s fraud detection and prevention efforts.

- Merged identity and fraud checks across regions

- Real-time alerts on linked fraudsters through device and network intelligence

- Reduced manual reviews and improved onboarding efficiency

- Got a broader network of clients, including crypto platforms and Web 3.0 services

Michael Dare

Fraud Investigator at iFAST Global Bank

The Fraud Network Detection feature has significantly helped us identify groups of fraudulent users in emerging markets. By analyzing shared IP locations, devices, and fingerprints, we have been able to detect and prevent multiple fraudulent accounts operated by the same network.

Wirex: Stopping fraud without compromising user experience

Wirex, a global crypto and payments platform, needed to protect its growing user base from potential fraud while maintaining the speed and accessibility that users expect. Traditional systems either slowed down onboarding or failed to adapt quickly enough to emerging threats.

Implementing Sumsub’s Fraud Prevention was a complex task, but the efficient cross-communication of both teams allowed them to cooperate and integrate the solution effectively. Wirex gained real-time risk analysis across the entire user journey—from onboarding to transaction monitoring. The platform’s adaptive AI and Behavioral Biometric Fraud Detection helped Wirex analyze and spot abnormal activity with greater speed and efficiency.

- Fraud Monitoring and Behavioral Biometric Fraud Detection helped create dynamic profiles that fraudsters cannot replicate

- Early detection of suspicious behavior through Fraud Network Detection

- Seamless integration with Wirex’s existing KYC process

Paul Chapman

Global Head of Financial Crime Operations at Wirex

Sumsub has made managing risks easier and helped us provide a better customer experience.

Results that speak for themselves

Sumsub’s Fraud Prevention helps businesses of all sizes secure their ecosystems without slowing growth. This way, companies can stop fraud before it happens—while keeping user journeys smooth and compliant across markets.

- Faster fraud detection and response, thanks to instantaneous flagging, and our end-to-end identity verification and fraud prevention

- Fewer false positives through AI-driven risk scoring and adaptive thresholds

- One integration for global identity and fraud management across 200+ countries

- Significant cost savings from reduced manual reviews and fewer successful fraud attempts

In practice, businesses implementing Fraud Prevention report immediate improvements in both security and efficiency. Fraud rings and multi-account abuse are detected earlier, preventing damage before it has a chance to happen. Meanwhile, fraud and risk teams spend less time chasing false positives and more time refining strategy.

The benefits extend beyond risk mitigation. By combining identity verification and fraud analytics into a single system, companies get a more accurate risk picture and faster decision-making across markets. Within weeks of deployment, multiple clients have seen onboarding friction drop, fraud detection accuracy rise, and overall performance improve—proving that effective fraud prevention can go hand-in-hand with user-friendly onboarding.

Amram Adar

Co-Founder and CEO at Oobit

With Sumsub, we’ve managed to reduce user fraud to practically zero. Since we began using Sumsub, fraud is just one less thing we’ve had to worry about.

Future-ready strategies for fraud prevention

Fraud prevention can’t rely on static blacklists or outdated pattern-matching. Fraudsters now use automation, AI-generated identities, and social engineering at scale—making adaptive, data-driven defenses essential. Fraud today moves faster than manual review queues can handle.

To stay ahead, risk and compliance teams should embrace these strategies:

- Adopt continuous monitoring. Fraud is no longer a one-time threat at onboarding; it evolves with every transaction and login attempt. Real-time risk scoring and behavioral analytics are key.

- Use device and network intelligence. Fraud doesn’t happen in isolation. Platforms that connect fraud signals across devices, IPs, and users can detect organized attacks early.

- Automate and iterate. Machine learning models that learn from new data daily are far more effective than static rules updated quarterly.

- Balance security with user experience. Smart automation allows firms to stop bad actors without slowing legitimate clients.

In short, the future of fraud prevention lies in adaptability and scalability. Businesses that continuously learn, test, and refine their defenses will not only stop more fraud but also grow faster with customer trust intact.