Guillermo Contreras

Chief Executive Officer of DitoBanx

DitoBanx is a regulated fintech group focused on accelerating digital asset adoption across Latin America and beyond. Established in El Salvador, with additional regulated entities and operational hubs in the U.S. (Wyoming), Mexico, Guatemala, Costa Rica, Panama, San Salvador, and Colombia, DitoBanx currently operates with a team of around 50 employees and serves over 100,000 registered users.

The company operates across three main verticals:

- Retail Services: a multi-currency digital wallet offering instant stablecoin and Bitcoin accounts, local payment rails, cross-border remittances, Mastercard cards, and micro-insurance.

- Tokenization: a licensed platform for digitizing and fractionalizing real-world assets, including real estate, equity, investment funds, and future cashflows.

- White-Label Infrastructure: a digital asset correspondent banking, branded remittance rails, credit origination, and co-branded Mastercard programs for institutions.

Its clients range from individuals and SMEs seeking faster, lower-cost payments to large enterprises looking for compliant tokenization and turnkey digital asset infrastructure. To date, DitoBanx has tokenized over $400 million in projects, with a pipeline exceeding $300 million, while rapidly expanding its retail presence across multiple LatAm markets.

The Challenge

Before partnering with Sumsub, DitoBanx operated with full regulatory oversight, which meant identity verification was a core requirement from day one.

To meet those requirements, the team relied on a mix of manual reviews and in-house processes. While this setup initially worked, it soon began to show its limitations as the company scaled.

One of the first major challenges was scalability. As user numbers grew, manual checks slowed down onboarding and strained internal resources. Consistency was another issue, with varying regulatory frameworks across Latin America and the U.S. making it difficult to maintain a unified standard. From a user experience perspective, delays in verification created friction in a space where speed and ease of use are crucial to staying competitive.

At the same time, managing different document types, sanctions lists, and compliance databases across six or more countries became increasingly unsustainable. The operational complexity was growing faster than the internal tools could keep up with.

It became clear that the existing approach wouldn’t support the company’s growth. The team needed a verification solution that could scale, improve accuracy, minimize onboarding delays, and adapt to local compliance regulations.

Why Sumsub?

DitoBanx chose Sumsub primarily because it offered a comprehensive set of tools that could cover all of their core compliance needs in one platform. While many other providers focused on specific parts of the process, Sumsub allowed the team to centralize flows like KYC (Know Your Customer), KYB (Know Your Business), Travel Rule compliance, transaction monitoring, phone and email validation, and form capturing.

Guillermo Contreras

Chief Executive Officer of DitoBanx

Sumsub acts as our centralized compliance hub, automating what used to be fragmented manual work, while allowing our compliance team to focus on higher-level risk management.

Having all of this in one place helped reduce the complexity of managing multiple systems, especially as the company expanded into new countries. It also made it easier to maintain consistency across markets and regulatory frameworks.

Another important factor was industry trust. Knowing that some of the largest players in fintech and crypto were already using Sumsub successfully gave the team confidence that the platform could handle similar challenges around growth, compliance, and geographic expansion.

The Solution

DitoBanx has fully integrated Sumsub into its compliance workflows, organizing verification into two main streams: KYC and KYB. This setup allows the team to manage both retail and institutional onboarding efficiently across multiple jurisdictions.

User Verification:

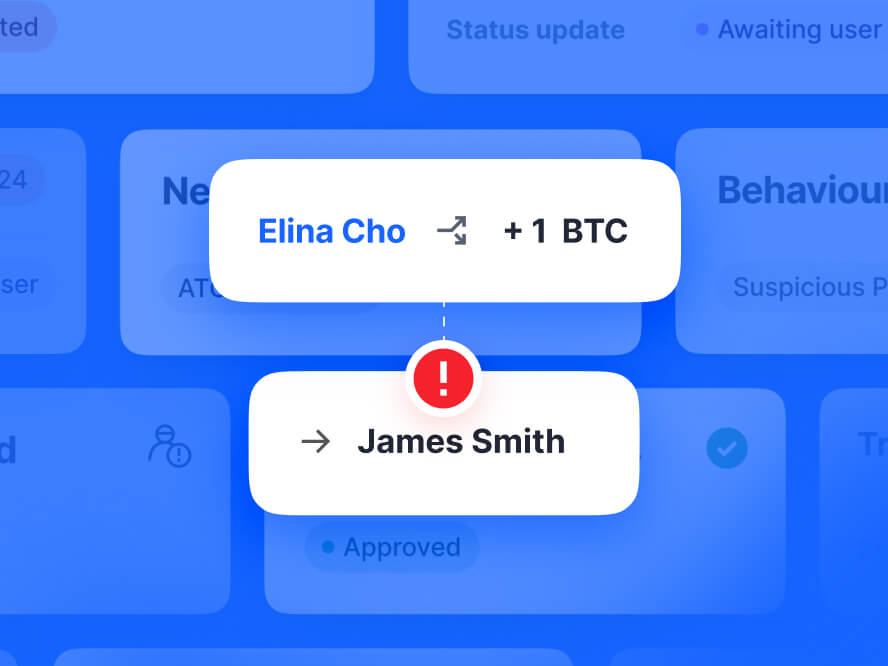

- Users sign up through the DitoBanx platform and are routed directly into Sumsub’s verification flow.

- Identity checks include Document Verification, Facial Recognition and Liveness.

- Additional layers include Email and Phone Verification and AML Screening.

Business Verification:

- Verification flow includes checks of business registration documents, ownership structures, and verification of authorized signatories.

- Additionally, Sumsub performs AML Screening, Sanctions and PEP checks, and UBO Verification.

By using Sumsub, DitoBanx is now able to:

- Monitor and manage compliance operations through a single dashboard, improving clarity and audit-readinesscess that is not only faster, but also more reliable and scalable across all targeted markets.

- Localize verification flows for each country’s specific compliance standards.

- Automate recognition of local ID types and database checks.

- Apply jurisdiction-specific AML/KYC rules without having to maintain separate systems.

Implementation

The integration process with Sumsub was smooth and efficient. From a technical perspective, the APIs were clearly documented, which made it easy for DitoBanx’s development team to implement without unnecessary delays or friction.

Beyond the technical setup, Sumsub’s approach also aligned with DitoBanx’s high standards for compliance and security. Overall, the solution met and in many ways exceeded expectations for ease of integration, regulatory readiness, and operational reliability.

The Results

Since integrating Sumsub, DitoBanx has seen significant improvements across key onboarding and compliance metrics:

- Verification time dropped from around 24 hours (due to manual reviews) to under 17 seconds, drastically reducing wait times and improving user satisfaction.

- Pass rates increased by over 30%, driven by better document recognition and localized coverage of Latin American ID formats.

- Fraud and false positives were reduced by 40%, allowing the compliance team to focus on higher-risk cases rather than spending time on avoidable errors.

The business and operational benefits have also been clear:

- Automating verification reduced the need for large manual review teams, resulting in a 25–30% decrease in compliance operating costs.

- Faster onboarding led to higher conversion rates, helping increase user acquisition and transaction volumes.

- Compliance staff now spend less time on routine checks and more on strategic tasks, allowing the team to scale across new countries without proportional increases in headcount.

- Centralized reporting and secure data handling reduced the internal effort required for regulatory audits.

Guillermo Contreras

Chief Executive Officer of DitoBanx

Sumsub allowed us to grow faster and more efficiently while keeping costs under control, which has a direct positive impact on both our top and bottom line, reducing false positives by 40% and cutting verification costs by nearly 30%.

Beyond business metrics, DitoBanx also saw a positive shift in user trust and brand perception. While verification is often seen as a friction point, users appreciated the professionalism of the process, reinforcing confidence in DitoBanx as a regulated and trustworthy institution. Internally, the shift to automation also improved team morale. With fewer repetitive tasks, the compliance team was able to focus on higher-value work, contributing to stronger engagement and reduced burnout.

Future Plans

DitoBanx is targeting rapid growth across Latin America. The team plans to scale more than 5 times within two years, with Mexico and Colombia leading adoption. On the product side, they’re building stablecoin infrastructure for institutions and remittance providers to power faster, compliant cross-border payments. Expansion into new markets, including the Dominican Republic, Argentina, Peru, Chile, and Ecuador, is also underway, reinforcing their mission to deliver secure, scalable digital asset infrastructure across the region.

Guillermo Contreras

Chief Executive Officer of DitoBanx

As we scale toward 500,000 users and expand into new markets across Latin America, Sumsub will continue to be a core pillar of our growth. Their all-in-one compliance infrastructure allows us to launch quickly, meet strict regulatory requirements in every jurisdiction, and maintain the trust of our customers. For us, Sumsub isn’t just a provider — it’s an enabler of both our regional expansion and our product innovation roadmap.