AML & fraud case management software

Shortcut financial crime investigations with informed decisions

Powerful Case Management for AML, fraud, KYC, and compliance teams—with ready-to-use investigation workflows that fit the way you work.

70%

Reduction in

case resolution time

case resolution time

15%

Efficiency boost, freeing up 3 compliance officers according to Forrester TEI

$2.6M

Sumsub helps clients save on compliance costs, according to Forrester TEI

Case resolutions have never been faster

Welcome to the all-new AI-powered Case Management solution.

One place for investigation

—from alert to action

Right decisions

to avoid risks

to avoid risks

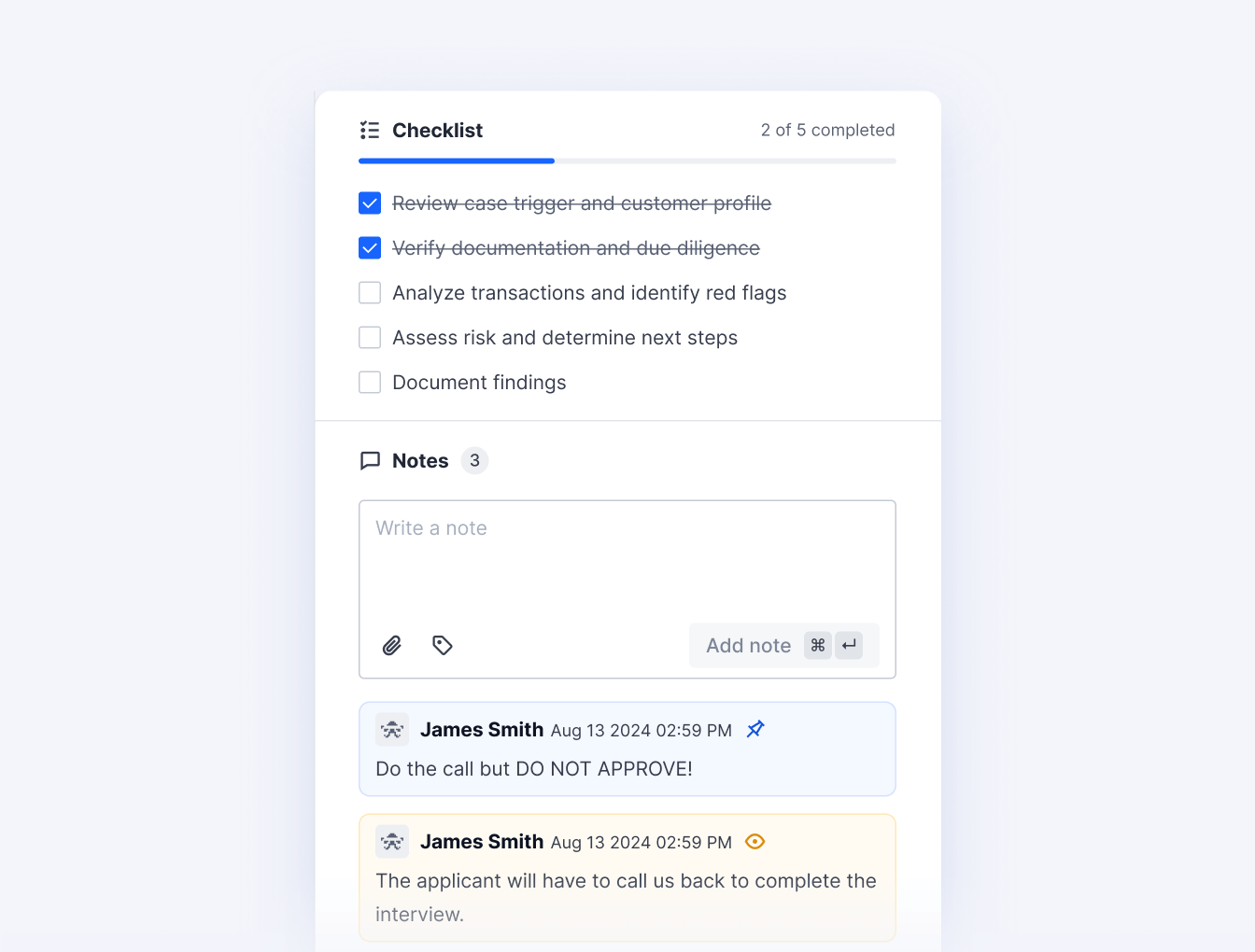

Ensure every case is handled with full context. With workflows, checklists, and all data in one place, your team can make faster, more confident decisions.

Boost your teams

productivity

productivity

No more chasing down information or switching between systems—just fast, efficient case resolution, from alert to investigation to reporting, all in one dashboard.

Report suspicious

cases

cases

Easily generate and export FIU (financial intelligence unit) reports directly from the case interface, and stay audit-ready with a complete investigation trail.

Seamless work across

teams

teams

Every member of your team stays on track. Share progress, follow the full paper trail—or keep sensitive data hidden, thanks to flexible permissions.

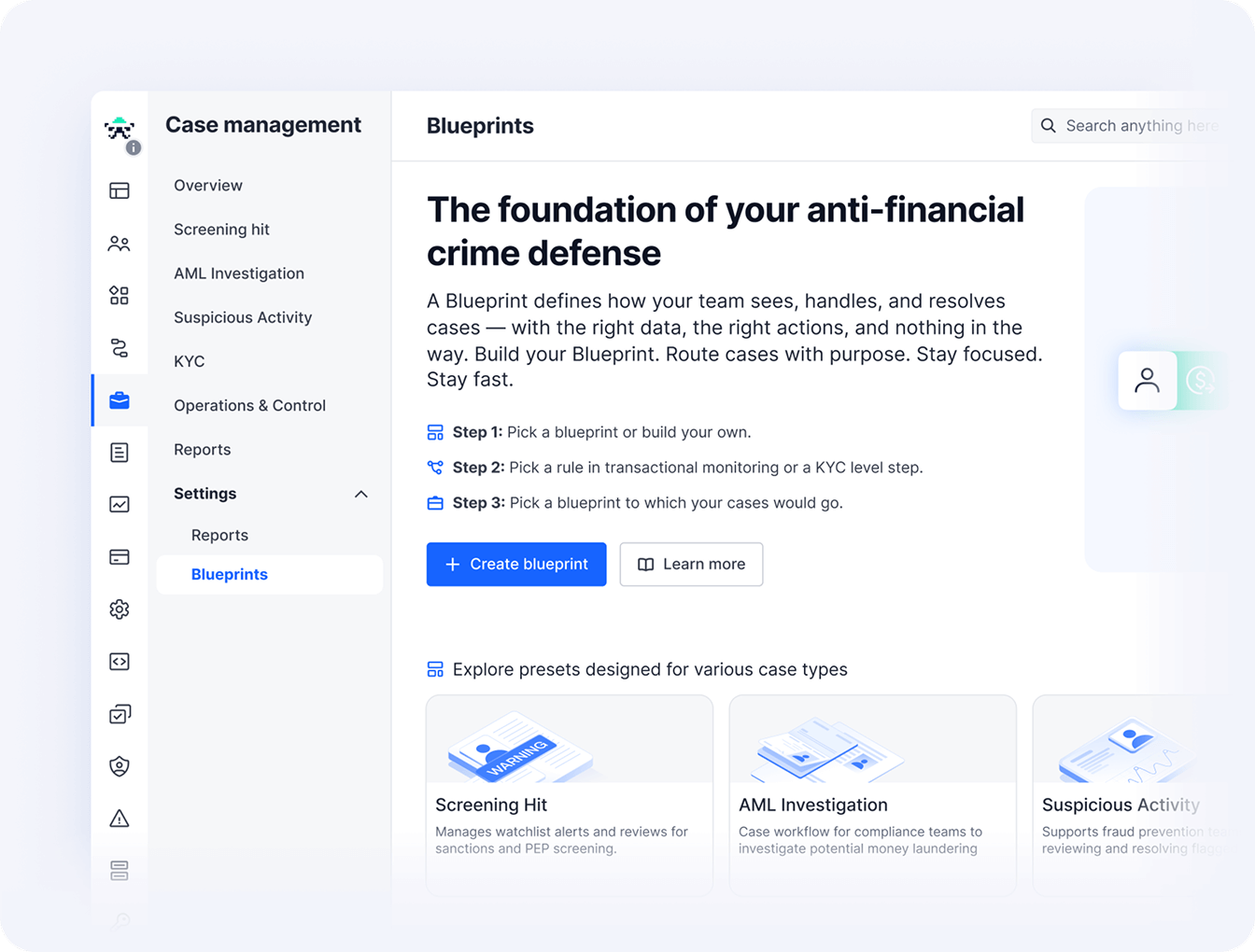

Four powerful pre-built blueprints

Get started instantly with blueprints—customizable, ready-to-use flows built to streamline

case management for different teams.

AML Investigation

Suspicious Activity

Screening Hit

KYC Case

AML Investigation

Stay compliant and audit-ready. Designed for compliance teams to efficiently manage workflows and investigate potential money laundering with full traceability.

Meet your new colleague — Summy, AI Copilot

Summy provides an intelligent summary of the case along with the individual’s context, including their background, transaction history, and behavioral patterns based on existing data. It also suggests potential next steps for resolving the case, such as reviewing payment methods or analyzing transactions.

Powered by AI, Summy drives smarter investigations and accelerates decision-making, helping your team stay one step ahead.

Powered by AI, Summy drives smarter investigations and accelerates decision-making, helping your team stay one step ahead.

Designed for humans. Powered for precision.

Reduce errors, move faster, and focus on what really matters

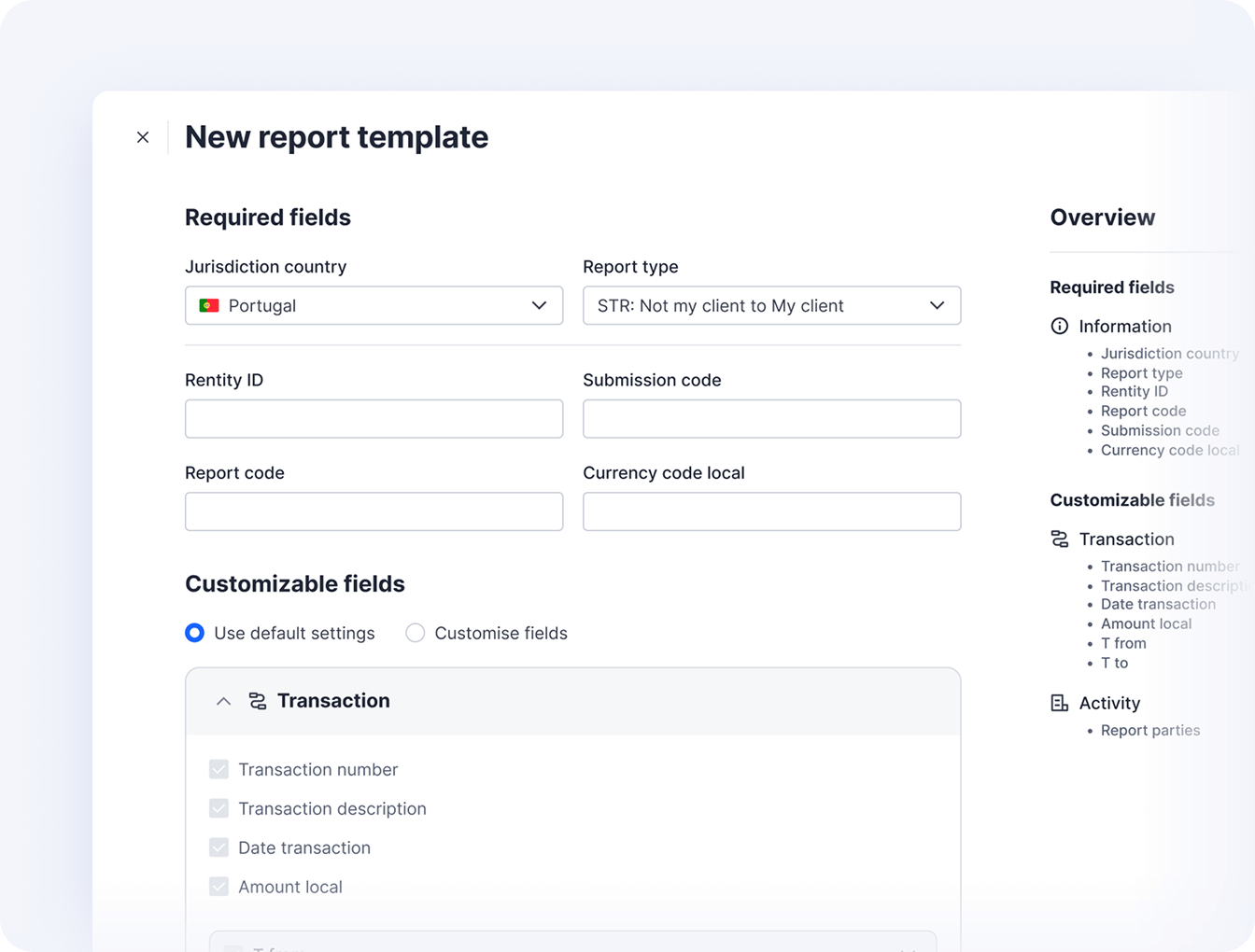

Easy FIU reporting

Automate compliance reporting with structured, audit-ready filings for FIU reporting—goAML, CTR, STR, and other regulatory reports.

Checklist enforcement

Never miss a step. Require task completion before a case can be closed—reducing mistakes and improving consistency.

Easy to start, easy to use

No setup required. Case Management comes built-in in all our products—no technical background needed.

Let the numbers do

the talking: get

240% ROI

Platforms and operators that work with Sumsub save costs and get 240% ROI on average, according to the "Total Economic Impact™ Of Sumsub's Verification Platform" study by Forrester Consulting.

240%

ROI

3.21m

NPV

4.55m

Benefits PV

< 6

month payback

Don't take our word for it.

Here's what our clients have to say

Choosing your ideal solution?

Sumsub is G2’s Top Pick

Surpass competitors with a partner who knows how to excel, as validated by user reviews.

Grid® Report for Identity Verification