AML Sanctions screening software

Smarter, faster compliance with AI-powered AML Screening

AI-powered AML Orchestration

AI-powered compliance

for all your needs

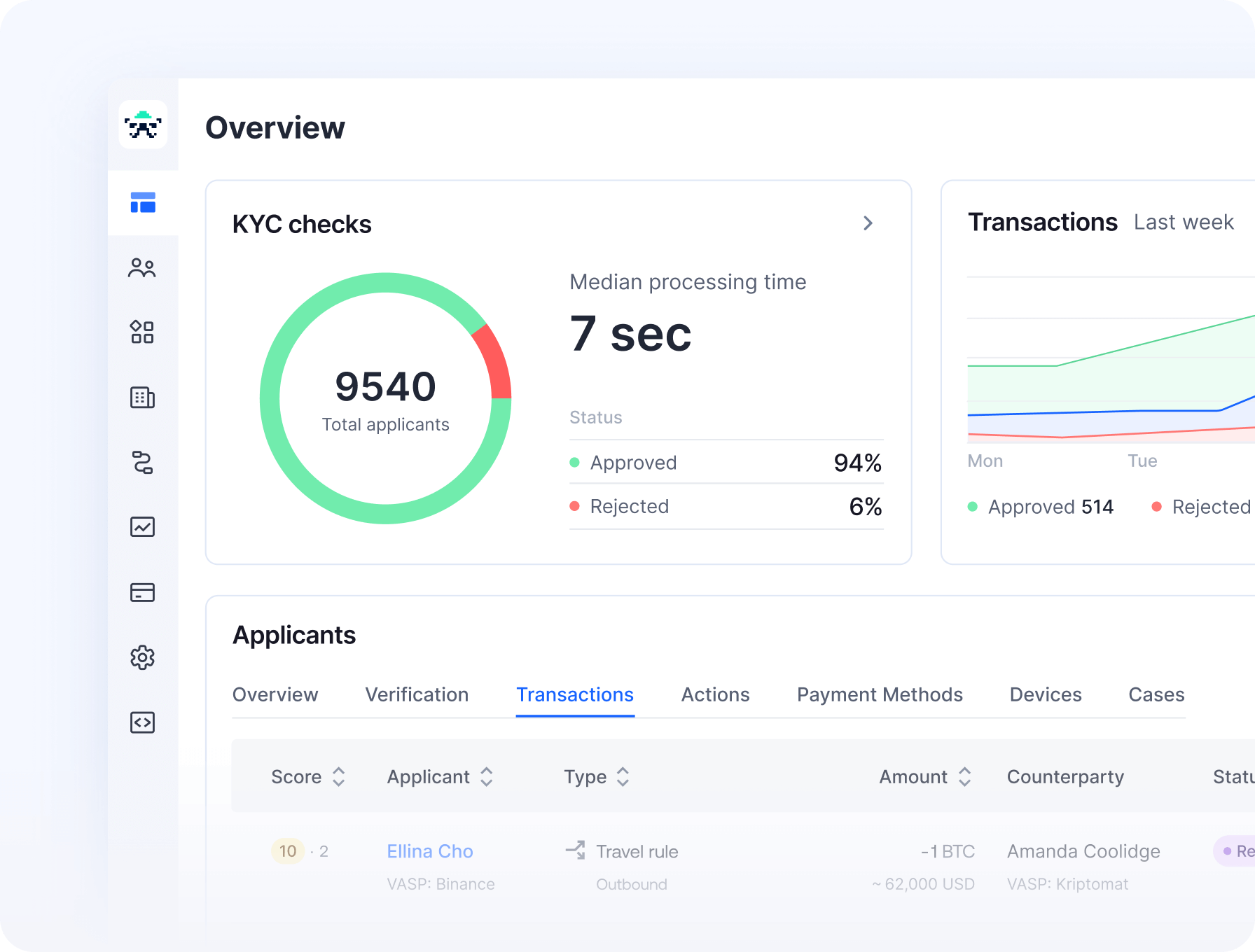

Screen new customers before KYC

Manage your full AML needs in one platform

Automate with AI, validate with human expertise

Real-time AML monitoring

of all required sources

Sumsub leverages over 40,000 independent sources across 240+ countries and territories, screening them simultaneously for each compliance case and translating when needed.

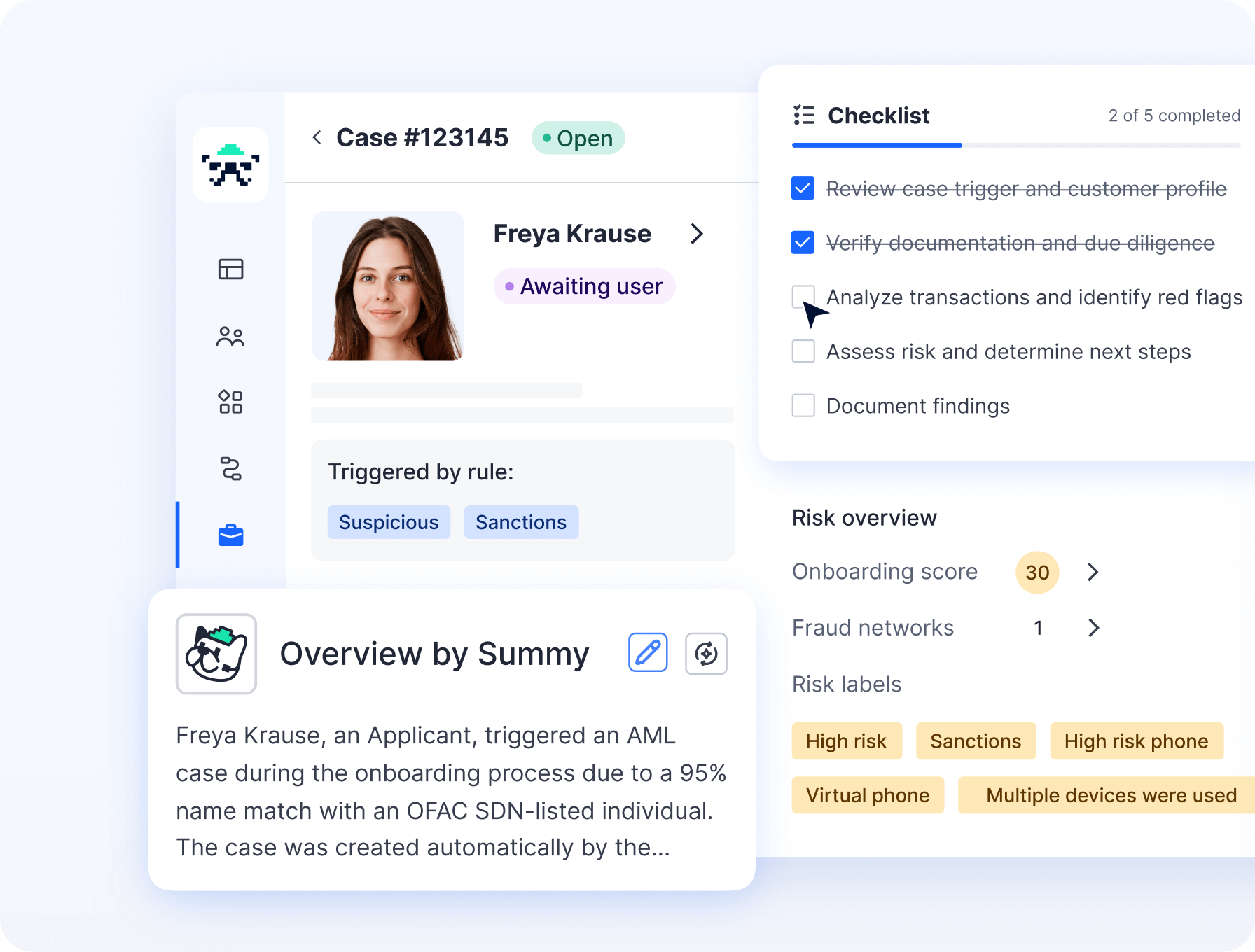

Unify Case Management, analytics,

and FIU reporting with AI

with our free online course

Here’s what to expect:

Don’t take our word for it.

Here’s what our clients have to say

Learn more about AML

- Guide

Finance AML/CTF Compliance 101

Discover how to stay ahead of regulators with practical steps, real cases, and a toolkit to keep your financial business safe and audit-ready

Read more

Read more- Guide

Anti-Money Laundering Audit Readiness guide

Download our readiness guide for checklists, and insights to prepare for your next audit

Read more

Read more- Webinar

AML in 2026: Regulation, Strategy, and Financial Crime Risks

Learn to understand AML from all sides: what regulators expect, how to build strategy, and what works day-to-day.

Watch now

Watch now- Article

KYC vs AML: Complete Global Guide to Key Differences and Best Practices (2025-26)

Everything that businesses need to know about KYC and AML.

Read more

Read more- Docs

How AML screening and monitoring work

Explore AML screening and monitoring algorithms in Sumsub.

Read more

Read more

Let the numbers

do the talking

Platforms and operators that work with Sumsub save costs and get 240% ROI on average, according to the “Total Economic Impact™ Of Sumsub’s Verification Platform" study by Forrester Consulting.

FAQ

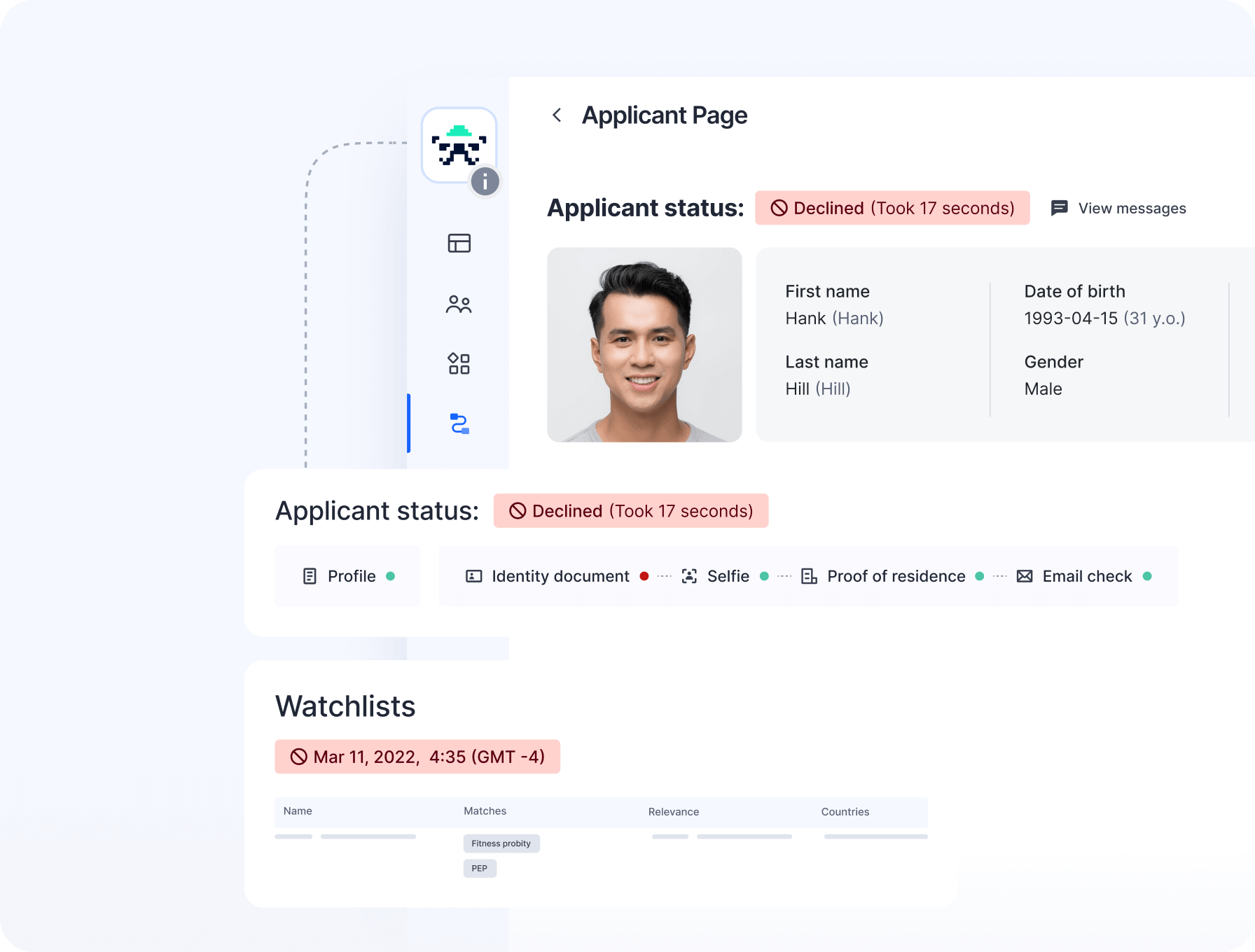

What is the AML screening process?

The AML (anti-money laundering) screening process is a method of checking customers and entities using their names and other associated information against multiple types of sources (sanctions, PEPs lists, etc.) to identify sanctions, financial crime, terrorist financing and reputational risks. Many companies are mandated by AML regulations to conduct AML screening on their clients and third-party relationships as part of CDD and KYB requirements. These checks assist firms in preventing money laundering by verifying the identity of individuals and companies and assessing the likelihood of any involvement in financial crimes.

What is sanction screening in anti-money laundering?

Sanction screening in anti-money laundering and KYC involves checking individuals and entities against various databases, including sanctions and terrorist watchlists. This process helps prevent individuals or entities linked to money laundering, terrorist financing, or other illegal activities from becoming customers. Businesses typically use specialized sanctions screening software to conduct these checks.

What is AML watchlist screening?

AML watchlist screening is the process of checking individuals and entities against lists are created and maintained by law enforcement, governments and other relevant authorities. Such lists include wanted persons and criminal suspects. This screening helps identify high-risk customers who may be involved in ML, TF or other illegal activities.

What is a PEP check?

A PEP check involves screening individuals who hold prominent public positions to identify politically exposed persons (PEPs). While not universally mandatory, regulatory bodies often require PEP screening to mitigate the risks of corruption, bribery, and money laundering. Requirements may vary by jurisdiction and industry, and companies typically use automated PEP screening software to comply.

What is sanction screening software?

Sanction screening software is a tool that helps businesses comply with AML regulations and identify AML risks by checking customers against sanctions databases. It automates the process of detecting high-risk or compromised individuals, saving time and ensuring businesses are notified of updates to sanction lists in a timely manner, helping to prevent and detect financial crimes.

What is AML screening software?

AML screening software is a tool used by businesses to comply with anti-money laundering regulations. It helps screen individuals and entities against various watchlists, such as sanctions lists, PEP lists, and other databases, to identify high-risk customers involved in illegal activities like money laundering or terrorist financing. The software automates the screening process, saving time, reducing manual effort, and ensuring businesses remain compliant with regulatory requirements.

How to prevent online gambling fraud?

To prevent online gambling fraud, use thorough identity verification in online gambling. Use advanced technologies like biometrics, AI, and machine learning in your verification process. Continuously monitor for suspicious activities and stay updated on the latest fraud trends and regulatory changes.