- Dec 18, 2025

- 13 min read

Digital IDs Are Here: How Reusable Identity Is Transforming Everyday Life

Learn about the global shift to digital ID and reusable identity, including key government policies, plus what it all means for identity verification and concerns about issues such as privacy.

Meet James. When he needs to pay a tax bill, he logs into the government portal—only to be asked yet again to upload his passport and proof of address. Then, when he switches to his online banking to make the payment, he faces another round of authentication and repetitive document checks. Later, buying a new TV online triggers another identity verification request, and even accessing social media from a new device forces him to prove who he is once more. In a world without digital identity, James is stuck confirming his identity over and over, service after service.

Now imagine a different experience. James completes a single, secure identity verification through a trusted digital ID provider. From then on, he simply reuses it. Paying his tax bill? He approves a quick request to share his verified digital ID—no paperwork, no friction. His bank recognizes him instantly. The online retailer only needs a limited verification token, which James grants with a tap. Even social media logins become effortless. With digital ID, James proves who he is once and uses that trusted identity everywhere, seamlessly. Currently, more than 5 billion people worldwide have access to some form of government-recognized digital identity credential with an adoption rate of around 32%, according to World Bank figures. This suggests around 1.6 billion people have a digital ID, although the capabilities of different countries’ schemes vary considerably.

Let's dig into what is going on around the world with digital ID, including where it’s available and the key trends, as well as how reusable identity could be the key to unlocking the technology’s full potential.

What is a digital ID? Definition, how it works, and key features

A digital ID is an electronic form of identification that proves who the person is online or in digital systems. It may include reference, or link to verified attributes—such as names, dates of birth, or addresses—and can be implemented through digital certificates, mobile identity apps, or secure online accounts.

There is often an overlap with physical ID documents—a digital ID can act as an electronic version of a document (e.g., national ID card). However, digital IDs can also be entirely separate from any national ID card scheme, depending on the system in question.

The capabilities of digital IDs can vary significantly from one scheme to another. Some can only confirm the validity of an identity and the information provided in connection with it (such as a name and ID number). Others can verify that the person using that identity to access a particular service is who they claim to be.

Modern digital IDs generally rely on biometrics—face scans and fingerprints—to verify the holder’s identity. They can be used for a number of purposes: verifying your identity (online and/or in person), proving your age, voting, proving your right to work, accessing government and private sector services, etc.

Many digital ID schemes are operated by national or regional governments, such as the soon-to-be-introduced EU Digital Identity Wallet. But there are also some private systems with strong uptake. Sweden’s BankID is owned and run by seven Swedish banks and is used by more than 8 million Swedish citizens (out of a population of around 10.7 million).

Digital ID vs Reusable ID: What's the difference?

Digital ID is a broad term that refers to any electronic credential used to verify a person’s identity online. A reusable identity is a specific type of digital ID that allows a user’s verified information to be reused across multiple services.

With a reusable identity, a user typically verifies their identity once through a trusted platform and can then rely on that verification across participating services, reducing the need for repeated checks. Reusable identity systems may also support greater user control, such as selective disclosure—allowing users to share only the specific attributes required for a given interaction (for example, confirming age without revealing full identity details).

While some digital IDs are designed to be reusable, many are limited to a single service or context, which is what distinguishes reusable identity as a more advanced form of digital ID.

Digital wallets vs digital ID: What's the difference?

Some people make a distinction between a digital wallet, such as that being introduced in the EU, and a digital ID, such as Estonia’s well-established eID scheme. In this context, a digital wallet is a data management tool used to store various digital credentials and personal information, whereas a digital ID is a government-issued digital proof of identity.

One advantage of a digital wallet system is that it allows individuals to select which data they store and what they choose to share. A benefit of a digital ID system is that it creates a single standardized means of identifying yourself online.

The two systems are not mutually exclusive, and it is perfectly possible to have a digital wallet that contains a digital ID while also having the option to store other types of personal information.

Is digital ID the same as an electronic ID card?

No. An electronic ID card is only one possible form of digital identity, and the two terms are not interchangeable.

The term electronic ID card typically refers to a government-issued national ID card with an embedded chip (such as those issued in Finland). Digital ID, by contrast, is a broader concept that includes any digital means of proving identity—ranging from government eID systems to service-specific solutions like online banking credentials or mobile identity apps.

The global shift toward digital IDs: What’s happening now?

There has been considerable focus on digital ID recently. Digital ID will be offered across the EU by the end of 2026 under the terms of the eIDAS 2.0 regulation, while the UK government has announced plans to introduce compulsory digital ID for workers in the near future.

At least 81 countries around the globe offer some form of government-recognized digital ID that can be used to authenticate people when accessing online services, but many of these are quite limited. While many digital ID systems can verify that the person using an identity online is who they are claiming to be, this is not always the case.

For digital ID to reach its full potential, it must allow robust verification of both the identity and the person using it to access online services. This is what a number of countries have introduced, and others are actively working on, including the EU, which will make digital ID available in all 27 of its member states from late 2026 through its EU Digital Identity Wallet.

Key trends in digital ID (2026)

Adapting to digital ID is crucial for banks, payment providers, and other sectors where identity verification is an integral part of their operations. Accepting digital ID and embedding it into KYC and other AML compliance processes can make this simpler and more secure.

In many cases where digital ID has been introduced, it has quickly become nearly essential for accessing many critical government and private sector services. For example, in Australia, using the myID digital identity system is now required for most government services, and this is similar for citizens of the UAE with its UAE Pass and Singapore with its Singpass ID system.

One of the most exciting trends in digital ID right now is the concept of ‘reusable identity verification’. This means that a person's digital identity would be verified once (e.g., by a national digital identity scheme), and then various organizations would accept this digital ID without the need for additional verification. This can make verification simpler, faster, and more secure for both organizations and users, helping to create a ‘frictionless future’.

Suggested read: Breaking News, Explained: Global Digital ID Regulations and Shifts (2026)

Are digital IDs mandatory? Government policies and regional differences

At the moment, most countries offer some form of digital ID scheme to their citizens. However, in many countries where these schemes are voluntary, they are often the simplest or only way to access essential government services, making them less optional for most people.

Below is a breakdown of some of the leading countries that currently have or soon will have digital ID schemes, as well as whether they are mandatory or voluntary.

A comparison of digital ID scheme requirements around the world

| Jurisdiction | Name of scheme | Date of introduction | Mandatory or Voluntary |

| Australia | myID | Oct 2019 (as myGovID)Nov 2024 (rebranded as myID) | Voluntary (but now the primary way to access many government services) |

| Belgium | myGov.be | May 2024 | Voluntary (but physical version is automatically issued at age 12) |

| China | Cyberspace ID | Jul 2025 | Voluntary |

| Colombia | Cédula de Ciudadanía | Dec 2020 | Voluntary (but physical version is automatically issued at age 18) |

| Costa Rica | Identidad Digital Costarricense (IDC) | Sep 2025 | Voluntary |

| Denmark | MitID | Oct 2021 | Voluntary (but it is required for many essential services) |

| Estonia | e-ID | Jan 2002 | Mandatory |

| EU | EU Digital Identity Wallet | Dec 2026 | Voluntary |

| France | France Identite | May 2022 | Voluntary |

| Hong Kong | iAM Smart | Dec 2020 | Voluntary |

| Iceland | Rafræn skilríki | Nov 2018 | Voluntary (but required for online banking) |

| India | Aadhaar | Sep 2014 | Voluntary (but required for many services and benefits) |

| Japan | My Number Card | Jan 2016 | Voluntary |

| Nigeria | e-ID | Aug 2014 | Voluntary (but required to vote) |

| Poland | mObywatel | Mar 2019 | Voluntary (but some form of national ID is mandatory for over 18s) |

| Singapore | Singpass ID | March 2003 | Voluntary (but compulsory to access many government services) |

| South Korea | Mobile Residence Card | Jan 2025 | Voluntary (but physical version is automatically issued at age 18) |

| Spain | MiDNI | Apr 2025 | Voluntary (but physical version is mandatory for over-14s) |

| Switzerland | e-ID | Late 2026 | Voluntary |

| UAE | UAE Pass | Oct 2018 | Voluntary (but mandatory to access government services) |

| UK | BritCard | TBC | Voluntary (but mandatory for employment purposes) |

| Ukraine | DIIA | April 2020 (for the ID element) | Voluntary (but a physical ID card is mandatory for over-14s) |

Examples of digital ID schemes around the world

China

China launched its Cyberspace ID scheme in July 2025, offering a voluntary way for Chinese citizens to verify their identity online. It can be used across various government and private services online.

Users can access the scheme by downloading a government app, entering their national ID, and completing a facial recognition scan. The app will then generate an encrypted digital identifier code, which they can then use to verify their identity online without needing to share their real names or other identifying information with service providers.

China has a history of requiring identity verification for online services. The country’s near-ubiquitous instant messaging, social media, and mobile payment app WeChat requires real name verification from users. Each account must be linked to a valid mobile phone number tied to a real person whose identity has been verified by Chinese telecom and banking services.

EU Digital Identity Wallet

The EU Digital Identity Wallet will be available in all EU member states by December 2026. This will be a secure platform for people to store personal information, including digital ID.

This scheme will be voluntary, although, as an EU member state, Estonia is likely to continue requiring mandatory digital IDs. The scheme is facilitated by the EU’s eIDAS Regulation, which has been the key to ensuring mutual recognition of eIDs issued by EU countries across member states.

Denmark

Denmark’s MitID was introduced in October 2021 to replace the previous NemID system. It was developed in partnership between the Danish government and financial institutions to offer a more secure digital ID solution. It can be used as an app, code display, audio code reader, and as a chip. MitID is available to all Danish citizens from the age of 13.

While it is not compulsory for Danish citizens to have MitID, it is now required in Denmark for many essential services, such as online banking and receiving official communications from authorities. People who opt not to have MitID must contact any organizations that require it to find out how to access their services without the digital ID.

Estonia

The Estonian digital identity, e-ID, was first released in January 2002, while the latest version was rolled out in November 2018, featuring changes such as improved security elements. It is issued at birth to all Estonian citizens and comes in three formats - a chip-based physical ID card, a SIM-based Mobile-ID for phones, and an app-based Smart-ID.

It is mandatory for all Estonian citizens to have a digital ID, although this could change when the EU’s planned digital wallet is introduced. Estonians’ e-ID can be used for everything from online voting and digitally signing documents to accessing healthcare, banking, and online shopping.

Spain

Spain’s MiDNI scheme is an app that can be used to store an electronic version of the national ID that is compulsory for all Spanish citizens aged 14 or over. It was launched in April 2025 and provides a secure QR code that is equivalent to the physical version of the card.

The Spanish digital ID can be used for tasks such as proving your identity in person, verifying your age, and voting. It cannot currently be used to prove your identity or sign documents online, making its applications more limited than some other countries’ versions.

UK

BritCard is a proposed digital identity card for UK citizens. It is intended to form part of the UK’s planned digital wallet scheme, GOV.UK Wallet. It will be used to prove identity details, such as the holder’s name, age, address, and immigration status.

It will not be compulsory to have a BritCard, but it will be required to work in the UK. Other planned uses include age verification and identification for dealing with government agencies. The UK digital ID scheme is still in development, so no final details or launch date have yet been confirmed.

Why governments are accelerating digital identity programs

There are various reasons why more and more governments around the world are moving to introduce digital ID schemes, including:

- Fraud prevention. Identity fraud remains a common issue, and fraudsters are becoming ever more sophisticated. Digital ID can provide a highly secure means of verifying people’s identities, reducing the potential for fraud.

- Faster, more accessible public and private services. Many governments are adopting a digital-first approach to delivering key public services as part of strategies such as the UK’s Blueprint for Modern Digital Government. Fast, secure digital identity verification helps to ensure people can access these services quickly and safely.

- Efficiency. Digital ID can speed up processes and reduce bureaucracy, especially as it can allow innovative technology such as AI to automate key parts of identity verification processes. This can save governments and organizations money, as well as provide a faster, simpler experience for users who need to confirm their identity to access digital services.

- Preventing illegal working and access to benefits. Digital ID can simplify the process of restricting access to employment and state benefits. One of the main stated aims of the UK’s digital ID scheme is to prevent people from working in the country who do not have the legal right to do so. Meanwhile, in India, using the Aadhaar system is necessary to access state benefits. With illegal immigration being a common concern in many countries, using digital ID to address these issues can be a popular policy for governments.

Digital ID concerns: Privacy, surveillance, security, and digital rights

While digital ID offers many potential benefits, there are also various public concerns about the possible negative impacts these systems can have. Nearly 3 million people have signed an online petition in the UK opposing digital ID, demonstrating the strength of feeling on this issue.

Governments and service providers who require or accept digital ID will need to be mindful of these fears so they can be addressed in the way systems are designed and operated.

Some leading areas of concern are:

- Privacy. Some people worry that digital ID could make it easier to track their activity online, e.g., governments and other organizations being able to see what websites they have visited and which services they have used.

- Personal safety. Being identifiable online could also make it easier for people with bad intentions to track down and harass people they encounter on the internet. For example, in China, it is compulsory to use your real name on social media.

- Security. A lot of sensitive personal information will be linked to digital IDs, with the exact type of information depending on the scheme. Keeping this data secure has to be a top priority and is, understandably, a major source of concern for many people, including the potential for criminals, hostile nations, and other malevolent actors to target this data.

- Data protection. It is not just hackers that people are worried about. In 2025, in just three months, 94 million data records were exposed in data breaches across the world. Around 1 in 5 (19%) of these breaches are caused by simple errors, such as sending data to the wrong person, meaning malicious action is not always necessary for private information to be exposed.

- Digital rights. While users are generally expected to act responsibly online, mandatory digital ID systems could still undermine practical anonymity by linking real-world identities to online activity. This may reduce abuse and misinformation, but it also risks chilling freedom of expression, particularly in sensitive or high-risk contexts.

- Restrictions on access to online services. Digital ID could make it easier for governments to control and limit their citizens’ internet activity, such as blocking an individual’s access to particular platforms or the internet as a whole. People may also self-censor their online activity if required to use their digital ID to access certain services (e.g., one adult website reported a 77% drop in traffic from UK visitors after mandatory age checks were introduced in the country in 2025, although other explanations for this change have been suggested).

- Accessibility. Currently, around a quarter of the world’s population (26.8%) does not have access to the internet, potentially limiting their access to digital ID. Identity verification solutions, such as apps, could also create an accessibility issue, as many people do not have access to smartphones.

- Technical difficulties. Digital IDs can also be vulnerable to disruption, as Estonians found out in 2019. Users of the country’s (then recently introduced) Mobile-ID service experienced 24 hours of issues with the system, including difficulties accessing online banking. While the problem was quickly identified and rectified, it highlights the need for these systems to be robust in protecting citizens’ access to essential services.

To address these concerns, governments and digital ID providers will need to ensure their systems are robust, with the very best security features. Regulations will also need to strike a balance between citizens’ rights and concerns, and the need for reliable online identity verification. Innovative solutions, such as reusable identity, can play a crucial role in addressing some of these issues.

How reusable identity addresses the biggest digital ID challenges

Reusable identities are digital IDs that can be used across multiple services without the need for constant reverification, making onboarding with different services faster and less cumbersome. The idea is that you have your identity verified once by a trusted service, such as a national digital ID scheme, and then this gives you a digital credential that is accepted for identity verification purposes by multiple organizations.

Reusable identity can also address concerns about security and data protection as it allows users to store their digital identity and associated personal details with just a single service, which would ideally be highly secure. However, there are also concerns that storing everything in a central database could increase the potential for harm, as a single data breach at a central database would expose people’s entire identity data. For this reason, some privacy experts prefer the option of decentralized data storage. Then, only limited information would need to be shared with individual services, reducing the spread of users’ personal data and the risk of exposure from data breaches.

Privacy worries can also be managed with reusable identities, as users can control which information they share with different services. For example, the EU Digital Identity Wallet will allow users to share only the minimum necessary information required for each service, limiting the potential for privacy breaches.

Privacy can be further enhanced with technical solutions such as zero-knowledge proofs. These allow someone to provide a digital credential to prove a key piece of information (such as being above a certain age) without needing to disclose specific, identifying information (such as their date of birth). China’s Cyberspace ID is an example of this type of system.

However, there is one current issue with most reusable ID schemes that will need to be addressed to help them reach their full potential. At the moment, most reusable ID schemes are nation-centric, which means they don't work for cross-border service access. This is a problem that will have to be solved if reusable ID is to become the default solution for identity verification worldwide.

Real-life use cases: Everyday scenarios where digital IDs make life easier

Digital ID can make life easier for users and service providers in a variety of scenarios, for example:

Using online banking safely

In 2025, 40% of companies and 52% of users were victims of fraud, according to Sumsub’s annual Identity Fraud Report. Having a digital ID can allow people to securely access online banking services and make it harder for fraudsters to impersonate them.

Accessing age-restricted websites

Concerns about online safety have resulted in government actions, such as the UK requiring age verification for age-restricted websites. Digital ID offers a simple, secure way to do this.

Proving your right to vote

Many countries, such as the UK, require proof of your right to vote. In Nigeria, digital ID can already be used for this purpose, and Estonia’s e-ID facilitates online voting, demonstrating that the technology has the potential to simplify the democratic process.

How Sumsub simplifies KYC and onboarding

Reusable identity can simplify user onboarding and Customer Due Diligence (CDD) for both service providers and users. By allowing previously verified identity information to be reused—subject to appropriate safeguards and consent—it can reduce the time and effort required to verify a person’s identity and maintain strong security standards. This approach has the potential to save businesses time and resources, while making onboarding faster and less cumbersome for users.

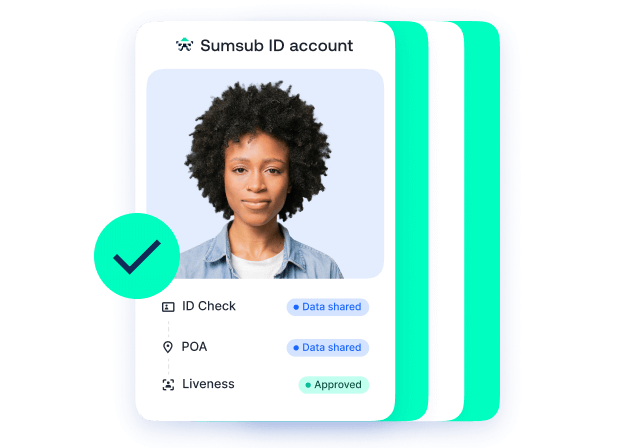

Sumsub ID is a reusable identity solution that enables users to create a secure digital identity profile in which verified documents and data can be stored and reused across supported services. This can help reduce repeated identity checks and improve the onboarding experience for both users and businesses. For service providers, reusable identity solutions may contribute to higher completion rates, lower user drop-off, and more efficient compliance processes.

A related development is reusable KYC, which allows identity information—verified by one provider—to be reused by others, where permitted by regulation and with the user’s consent. Rather than repeating the same CDD checks from scratch, service providers can rely on previously verified data, supplemented by risk-based controls and freshness checks. When implemented correctly, this can make KYC more efficient without undermining its integrity or regulatory obligations.

Sumsub’s reusable KYC framework is designed to support the sharing and reuse of identity data in a controlled and configurable way. It can help reduce repeat onboarding steps and streamline user journeys, while supporting compliance with applicable regulatory requirements across multiple jurisdictions, subject to local laws and supervisory expectations.

FAQs

-

What is a digital ID?

Digital ID is a form of personal identification that can be used through electronic channels, such as online and with physical card readers. Digital ID can take various forms, including physical cards with integrated circuit chips, apps, code displays, and audio code readers.

-

Why are digital IDs being introduced?

Digital IDs have been introduced in various countries and will be rolled out in more for a number of reasons. These include making it easier and more secure to access online services such as banking, reducing identity fraud, and making it harder for people to work illegally.

-

Are digital IDs mandatory?

Digital IDs are usually voluntary at the moment, but they are the best or only way to prove your identity for a number of purposes in some other countries. This means they are effectively compulsory for most people in a far greater number of jurisdictions. Many other countries have not yet introduced digital ID, so they are certainly not mandatory worldwide. However, in some countries, digital IDs are the only option to get access to certain public services in a digital format.

-

What are the benefits of digital IDs?

Benefits of digital IDs include allowing users to quickly and straightforwardly access government and private sector services while making identity verification faster and more efficient for service providers. Digital ID can also help to prevent fraud, as well as to combat illegal working and control access to state benefits (depending on how they are used in different countries).

-

Are digital IDs safe to use?

How safe digital IDs are to use depends on the technology and operators of the schemes. For example, the EU Digital Identity Wallet is designed to meet the highest security standards through measures such as requiring member states to certify the wallets they issue and carry out regular audits to affirm that any risks are addressed.

-

How does reusable identity protect privacy?

Reusable identity can protect privacy by allowing users to only provide their full details to one trusted identity verification provider, then control which details they share with individual services. This reduces the amount of personal information about a user that various services hold, thereby limiting the potential for issues such as data breaches.

Relevant articles

- Article

- 5 days ago

- 9 min read

- Article

- Dec 22, 2025

- 7 min read

When sales spike during holidays, so do the scams. Learn about the top fraud threats, red flags, and tools businesses and consumers can use to protec…

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.