- Sep 03, 2025

- 7 min read

AML Investigation and Case Management: Learn How to Effectively Spot and Report Money Laundering

Learn why efficient AML case management is essential for your business.

Money laundering is a huge global problem. Between $800 billion and $2 trillion is laundered each year, according to the United Nations Office on Drugs and Crime, which amounts to 2-5% of global GDP. In the past, financial institutions were the primary instrument for laundering illicit funds. Today virtually all businesses—from art to sport—can fall victim to money laundering. Therefore, more industries are now attracting scrutiny from regulators and businesses in these industries need to be completely on top of their compliance obligations. Some businesses may not even be aware that they’re being used by criminals for money laundering. However, they can still bear responsibility for it. When a crime is missed, the consequences can be painful. For instance, Canada’s TD Bank was issued a $3 billion penalty by US authorities in 2024 for failing to comply with AML regulations. This included $1.8 billion from the US Department of Justice (DOJ) and $1.3 billion from the Financial Crimes Enforcement Network (FinCEN).

Regulators around the world constantly review and update their approach to AML. New regulations are frequently introduced, such as the EU’s new AML package, which aims to standardize and strengthen the approach to money laundering prevention across member states.

Therefore, all businesses should think about developing a robust AML program with reliable, efficient AML investigation and case management capabilities. Let’s discuss this in more detail.

What is AML case management?

AML (Anti-Money Laundering) case management refers to how investigations into potential money laundering or other financial crime are handled by a financial institution. Case management ensures that each case is thoroughly investigated, documented, and reported, where necessary, in accordance with regulatory requirements. Additionally, it helps to improve AML programs by providing valuable insights and data analysis.

What is an AML investigation?

An AML investigation in the context of case management is the process of reviewing alerts or suspicious activities to determine whether they indicate potential money laundering or related financial crimes. It involves gathering evidence, analyzing customer and transaction data, and deciding whether to close the case, escalate it, or file a Suspicious Activity Report (SAR) with the regulator. AML investigations are typically handled within case management as part of the compliance workflow.

When should an AML investigation be triggered?

At what point an AML case will require investigation by a compliance offer should be outlined in a company’s AML Compliance Program. The program should set out specific red flags and triggers that will mean a case requires investigation, such as large or frequent cash transactions, rapid and unexplained transfers, complex and/or layered transactions, transactions inconsistent with a customer’s profile and background, and transactions involving high-risk countries, high-risk industries, or individuals.

Why AML case management matters

Reliable AML case management is essential for businesses to effectively identify, investigate, and stop financial crime, including money laundering. If instances of potential financial crime are not properly managed, then a business could face regulatory investigation and enforcement action. So, proper AML case management helps businesses to maintain regulatory compliance and minimize the risk of penalties.

Suggested read: The Three Stages of Money Laundering and How Money Laundering Impacts Business

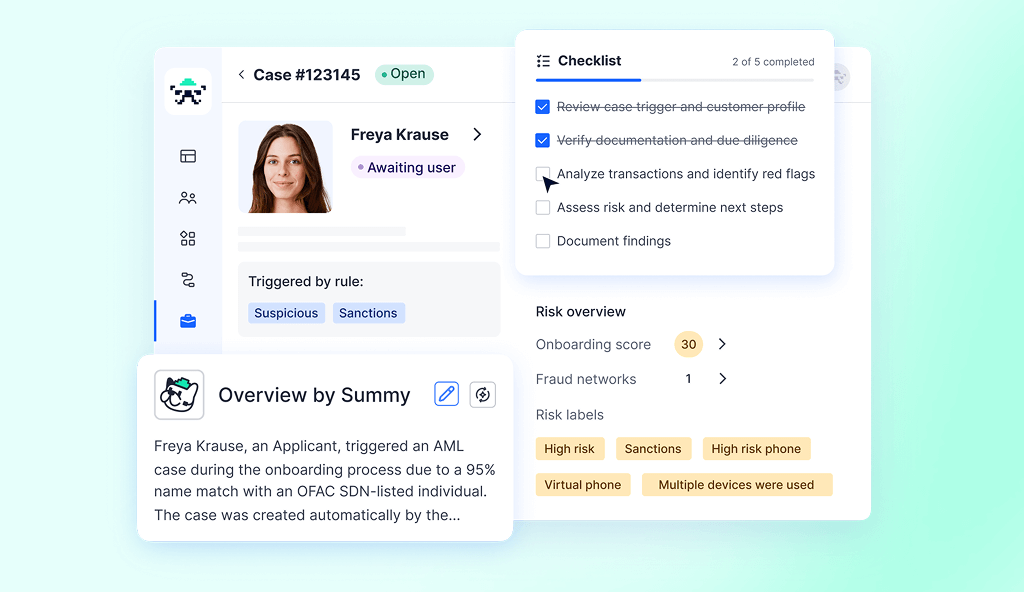

An effective AML case management tool generates cases for investigation using predefined criteria and assigns them to compliance officers. Each case allows the officer to analyze applicant data and documentation, including AML matches, payment methods, platform activity, and potentially suspicious transaction patterns.

AML case management tools can be critical to striking the balance between the cost of compliance and the risks of non-compliance. It is critical that businesses understand what these tools can do for them and how to choose the right solution for their needs.

Core features of AML case management tools

AML case management tools generally offer a variety of features, including:

- Automation: Combining all relevant data into a case and sending it to the appropriate case manager for actioning.

- Prioritization: Checking cases against set blueprints to identify high-risk cases requiring swift review.

- Data availability: Consolidating all relevant data in one place.

- Alert triage: Ensuring that any instances of potential financial crime are assessed and assigned to the right person or team based on the level of risk. Alert triaging makes sure the right people are involved at the right time while supporting efficient resourcing.

- Workflows: Setting out a structured pathway for dealing with an AML case. Good workflows ensure the proper steps are taken to achieve regulatory compliance and informed decisions can be made about whether or not to raise a report with a regulator. AML case management tools should include templates, customized for different teams working on a financial crime investigation (often referred to as ‘blueprints’).

- Audit trails: Providing evidence of the steps followed in AML case management as well as detailed, reliable case documentation and record keeping for audit purposes.

- Documentation: Allowing all required details of an investigation and decision to be recorded in one place. AML case management tools can automate parts of this process, saving time and reducing the potential for mistakes.

- Escalation logic: Assisting and, in some cases, automating the process of deciding when to escalate a case. This can ensure high-risk situations are escalated promptly and that this is dealt with consistently.

- Integrations: Facilitating seamless sharing of data and triggering of actions across different pieces of software, such as your CRM and tools for KYC, transaction monitoring, and fraud prevention.

- Reporting: Generating reports automatically in compliance with regulatory requirements, saving time and providing assurance of accurate reporting.

How does AML case management work? (Step-by-step process)

The AML investigation process usually includes the following steps:

- Initial alert. The process begins when an alert is triggered, which is usually done by automated monitoring systems.

- Case review. Investigators review the initial alert to determine its validity and decide if further investigation is required. Some alerts may be dismissed as false positives.

- Customer Due Diligence (CDD). If the alert needs further attention, investigators perform additional CDD to gather additional information about the customer or entity involved. In some cases, Enhanced Due Diligence (EDD) may be necessary, especially for high-risk customers such as Politically Exposed Persons. A case can also be escalated within a company, for example to a Money Laundering Reporting Officer (MLRO).

- Transaction analysis. Investigators check the specific transactions associated with the relevant alert, looking for patterns, anomalies, transactions inconsistent with the customer’s background and unusual behavior that may indicate money laundering or other illicit activities.

- Source of funds check. Investigators do this to trace the origin of the funds and assess whether they have a legitimate source.

- Suspicious Activity Reporting. If the investigation reveals evidence of suspicious activity or potential money laundering, investigators file a Suspicious Activity Report (SAR) with appropriate regulatory authorities or another FIU report, depending on the jurisdiction. If money laundering or suspicious activity is confirmed, the institution may need to freeze accounts, cooperate with law enforcement, and take additional compliance measures as required by regulations.

- Record keeping. Thorough documentation of the investigation process, findings, and actions taken is crucial for compliance and regulatory reporting.

- Ongoing monitoring. After the AML investigation is complete, ongoing monitoring of customers and transactions should be continued to prevent crime.

Creating the right workflow for your requirements helps to ensure a compliant money laundering investigation process.

Common challenges in manual AML case handling

Where AML case management relies heavily on manual handling, a number of challenges can arise. Manual processes are slower, and teams may struggle to keep up with demand—especially when a business is scaling rapidly.

False positives are a big issue in manual AML case management. Manual or semi-automated systems often flag a high number of transactions as suspicious, but without adaptive learning, they cannot adjust to a customer’s legitimate behavior (like regularly exceeding a threshold). This creates unnecessary workload for compliance teams.

In-house tools like spreadsheets can also create problems. While still used in some smaller institutions or legacy setups, they have significant drawbacks: lack of scalability (inefficient for managing large volumes of cases and transactions), poor auditability (limited transparency and difficulty maintaining a clear audit trail for regulators), security risks, and the absence of real-time monitoring.

These are just some of the challenges that good AML case management software can help to alleviate by reducing reliance on manual case handling in AML investigations.

How to choose AML case management software

Choosing the right AML case management software starts with evaluating your business needs and risks, and requires balancing compliance, efficiency, and cost. To choose the right AML software, consider:

- A risk-based approach. Software that facilitates a risk-based approach can support efficient AML by allocating resources based on different levels of risk and a business's overall appetite for risk.

- Business requirements. Be clear exactly what results you need to achieve, beyond simple regulatory compliance. For example, reducing operational costs and improving accuracy.

- Regulatory requirements. The software must meet compliance requirements for the jurisdictions in which you operate.

- Customizability. You must be able to customize your AML software to deliver the processes and workflows you need as part of your compliance program. This should include the ability to build an investigation process that helps to reduce human error e.g. through the use of checklists that every officer should complete in order to resolve a case.

- Automation capabilities. Many repetitive tasks can be automated by AML case management software, saving time, reducing the potential for errors, and allowing resources to be better deployed elsewhere. AI can be critical to AML case management automation, so choosing software with good AI integration can be a smart move.

- Integration capabilities. AML software that seamlessly integrates with your other systems, such as your CRM, can significantly speed up and streamline case management.

- Scalability. Your AML software must be able to scale with your business, offering support for the level and speed of growth you anticipate without compromising on effectiveness, efficiency, or cost.

- User experience. A good user experience is critical to making sure your team can use your AML software effectively and efficiently. Clunky UX is likely to waste time, increase the risk of human error, and may stop processes being followed correctly.

- Information control. Your software should support different levels of permission for different users to protect sensitive information.

- Customer support and training. To get the most out of your AML case management systems, you need to choose a vendor that offers excellent customer support and appropriate training for your team.

- Frequency of updates. AML risks and regulatory requirements change all the time, so your software will need to be kept constantly up-to-date.

- Vendor reputation. Choosing a reputable vendor not only increases your chances of finding a good AML software solution, it can also demonstrate your commitment to meeting your compliance obligations.

- Real world results. Any AML case management software is only as good as the results it actually achieves in practice. Always ask to see real customer case studies and data that demonstrates what a piece of software can do for you.

The Future of AML Case Management: Emerging Trends for 2025

As with most industries, AI is being rapidly adopted in the world of AML. AI-powered tools can offer various forms of intelligent automation for AML case management, helping compliance teams to act faster, and more accurately. AI can provide time and cost-saving features such as alert behavioural insights, case summaries, and action recommendations.

Secure cross-border data sharing will be critical for the future of AML programs, as highlighted earlier this year in a speech by Ireland’s Central Bank Deputy Governor Derville Rowland. This will help to address issues such as criminals who have their accounts closed by a financial institution in one jurisdiction being able to open new accounts in another jurisdiction.

The right approach to AML case management is critical to ensure you stay on top of these and any other emerging trends.

Sumsub’s AML case management solution

A good AML case management system can help you to work faster, more efficiently and more effectively. Sumsub’s AML case management solution offers benefits including reduced operational costs, improved accuracy in detecting signs of financial crime, better triaging of cases for more efficient resourcing, and reductions in errors and miscommunications.

Our tool can handle every stage of AML case management, from case creation and prioritization through the review stage and escalation (where needed), to record keeping and generating reports. You can create specific blueprints for a wide range of scenarios, ensuring the proper processes and workflows are followed for each case.

FAQ

-

1. What is an AML case?

An AML case is created when a business detects potential signs of money laundering that need to be investigated. A structured process of case management should then follow, including analyzing the situation to decide whether a report needs to be made to the relevant regulatory authority.

-

2. What does an AML case manager do?

An AML case manager is responsible for handling and tracking cases related to potential money laundering or other financial crimes. They ensure compliance with regulations by following a systematic sequence of steps, including alert generation, case validation, customer due diligence, transaction analysis, source of funds checks, documentation, reporting, and ongoing monitoring.

-

3. What is the AML investigation process?

The anti-money laundering investigation process involves detecting, analyzing, and reporting potentially illegal financial activities to prevent money laundering and other crimes, typically following a series of steps including alert generation, customer due diligence, transaction analysis, and reporting.

-

4. What are the best AML case management tools?

The best AML case management tools are the ones that meet your business goals. They will, of course, need to ensure cases are handled in a compliant way, but also offer benefits such as automation, reducing operational costs, and speeding up case reviews and investigations. Understanding your goals can, therefore, allow you to choose the right tools for your requirements.

-

5. Why is AML case management important for compliance?

AML case management is an essential process for businesses to meet their regulatory compliance obligations. A systematic approach to managing AML cases means potential financial crime can be detected, investigated, and reported promptly and effectively in line with the relevant regulatory requirements.

Relevant articles

- Article

- 1 week ago

- 11 min read

Arbitrage in Sports Betting & Gambling in 2026. Learn how iGaming businesses detect arbers using KYC & fraud prevention tools.

- Article

- 1 week ago

- 4 min read

Discover January 2026's biggest fraud cases and cybercrime investigations. From billion-dollar scam busts to global money laundering takedowns—get th…

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.