- Dec 10, 2025

- 5 min read

What The Fraud Summit 2025: Inside the Two Days that Rewired Fight Against Fraud

A look back at the panels, breakthroughs, and sessions that defined Sumsub’s first APAC anti-fraud summit.

On November 19-20, Sumsub hosted the inaugural What The Fraud Summit 2025 in Singapore, bringing together leaders from the payments, digital assets, banking, fintech, and compliance sectors. Held at Andaz, Singapore, the summit focused on real-world insights, hands-on workshops, new product announcements, and the launch of Sumsub’s annual Identity Fraud report.

From the moment doors opened, the room felt hungry: for clarity, for community, for solutions that actually work.

The main day of the summit started with one of the most unforgettable bits: a deepfake of Peter Sever, Sumsub’s co-founder and CSO, taking the stage before the real Peter walked out. It was a playful moment—but also a sharp demonstration of just how easy it has become to manipulate identity in 2025.

I’m the real Peter, and this deepfake was created in minutes. The cost? Almost nothing. Just a couple of cheap tool subscriptions. The impact—potentially devastating for any business or individual. This is an era where the technology designed to help people can be turned against them.

He emphasized that fraud today is coordinated and increasingly AI-powered—and that defending against it requires a united front, starting from the summit’s very site. Along with Jacob Sever, Sumsub’s co-founder and CIO, he explored the digital journey of the APAC region: how it has emerged as the central hub for groundbreaking transformation and why it faces the rising threat of digital crime.

Sessions & insights

Across various sessions, a clear picture emerged: fraud is no longer a string of isolated incidents; it’s an industry. And like any industry, it’s scaling and specializing, globally.

💡The Fraudemic Era—What’s Next?

After Severs’ speech, the stage was taken by Raja Kumar, the President of the FATF from 2022 to 2024. He warned that we are now in a "fraudemic era," with fraud losses exceeding $450 billion.

He pointed out the rise of Fraud-as-a-Service, which is driven by money-mule networks, AI-based scams, and cross-border crime groups. New threats like synthetic identity fraud are increasing and costing banks more and more. Criminals are moving illicit money quickly using cryptocurrencies, decentralized finance, and other mixing services. It shows that technology is both a tool for crime and a battleground.

Raja Kumar called for countries to work together, strengthen laws, and quickly adopt advanced analytics and AI to keep up with increasingly clever criminals.

💡Money in Motion: The New Era of Digital Payments

This session, led by Holly Fang, President of the Singapore FinTech Association, featured two key leaders in the payment industry. Lawrence Chan, CEO of NETS, and Hassan Ahmed, Country Director of Coinbase in Singapore, discussed important trends that are shaping the future of payments.

They talked about how real-time transfers, mobile wallets, embedded finance, and central bank digital currencies are changing finance. As traditional finance merges with digital innovations, trust and regulations will play a big role in determining which companies succeed and which don’t. Both of the speakers raised a thought-provoking question: Are digital wallets evolving faster than banks can keep up, and could they become the main bank account for many people?

💡Crypto Goes Mainstream: Lessons from Financial Institutions

Mainstream adoption of cryptocurrency is now a matter of how quickly and safely it will happen. This panel examined how traditional banks are incorporating crypto into their services, such as banking, payments, and managing funds. It covered issues like compliance challenges, security risks, and the growing interest from institutions. The discussion centered on how crypto is evolving from an experimental concept to a regulated and widely used financial tool.

The session was held by Chin Tah Ang (General Manager, Singapore, Crypto.com), Chee Keong Teo (Associate Partner, APAC Assurance Blockchain, EY), Konstantins Vasilenko (Co-founder, Paybis), and Amy Zhang (Head of APAC, Fireblocks).

💡How Money Vanishes: Inside Two Fraud Cases

This session, led by Hemanshu Parekh, provided insights into real-life fraud investigations. Instead of discussing complex risk models or theoretical fraud patterns, he focused on two actual cases: a major corporate fraud and a network of money mules.

In the first case, a once-healthy energy company became involved in a web of dishonest practices, including self-dealing and asset stripping. The fraud grew in stages, starting with expansion, then hidden ownership transfers, and finally leading to the company’s collapse. This case showed how criminals can change their behavior once they start making easy money.

The second case centered on money mule networks, which Hemanshu described as hives instead of pyramids. These networks are complex and operate on a large scale. He explained how different levels within the networks work, how money moves, and how thousands of people get involved in these scams. His main point was that understanding the types of crime, rather than just looking for warning signs, helps institutions spot issues early.

The session concluded with a call for teamwork. Hemanshu urged people to share information about crime patterns, work together across countries, and combine human skills with machine learning to catch crimes before they escalate.

💡Misuse vs Missed Uses of AI

A breakout session led by Guy Sheppard, Head of AI Strategy and Adoption at Standard Chartered Bank, and Lawrence Wee, Director of Business and Ecosystems at IMDA, sparked engaging discussion through live voting.

The session examined two sides of AI in finance: its risks, like bias, privacy issues, and automated fraud, and its significant potential in compliance, risk modeling, and customer protection. Audience polls changed instantly as the speakers challenged beliefs, assessed risks, and pointed out where financial institutions need to catch up.

The conclusion the speakers and spectators reached was that the main issue in the industry is not whether to use AI, but how to avoid its misuse while promoting responsible innovation.

💡Breakout stage presentations

Two panels on the breakout stage showed where fraud prevention is heading and how businesses can prepare.

Pavel Goldman-Kalaydin, Sumsub’s Head of AI, spoke of the rise of agentic AI in his panel “On the Path to Anti-Fraud Superintelligence.” He warned that adaptive AI systems will soon be able to probe defenses autonomously, because they will learn how to bypass them. Pavel argued that anti-fraud must evolve in the same direction—toward systems that can generate new hypotheses, run experiments, and detect schemes we’ve never seen before.

Ilya Brovin’s (Chief Growth Officer, Sumsub) presentation, “One Identity, Many Touchpoints,” considered another important point: most fraud happens not during onboarding but later, across many interactions. He explained that linking identity verification to ongoing monitoring of behavior and transactions creates a complete risk profile that becomes stronger with each user interaction.

Together, the two talks made it clear: to stay ahead of fraud, we need to combine long-term AI development with a constant and integrated approach to identity and risk.

Major WTF Summit announcements

1. Introducing Singapore Non-Doc Verification (Singpass Integration)

One of the biggest launches of the summit: businesses can now verify Singaporean users thanks to Singpass integration in Sumsub’s Non-Doc Verification solution.

That means:

- No document uploads

- Identity verified in ~4.5 seconds

- Higher pass rates

- Fewer fraud attempts are slipping through

- A much smoother user experience

The integration sets a new standard for how trust frameworks in APAC should look. As one of the attendees called it: a real game-changer.

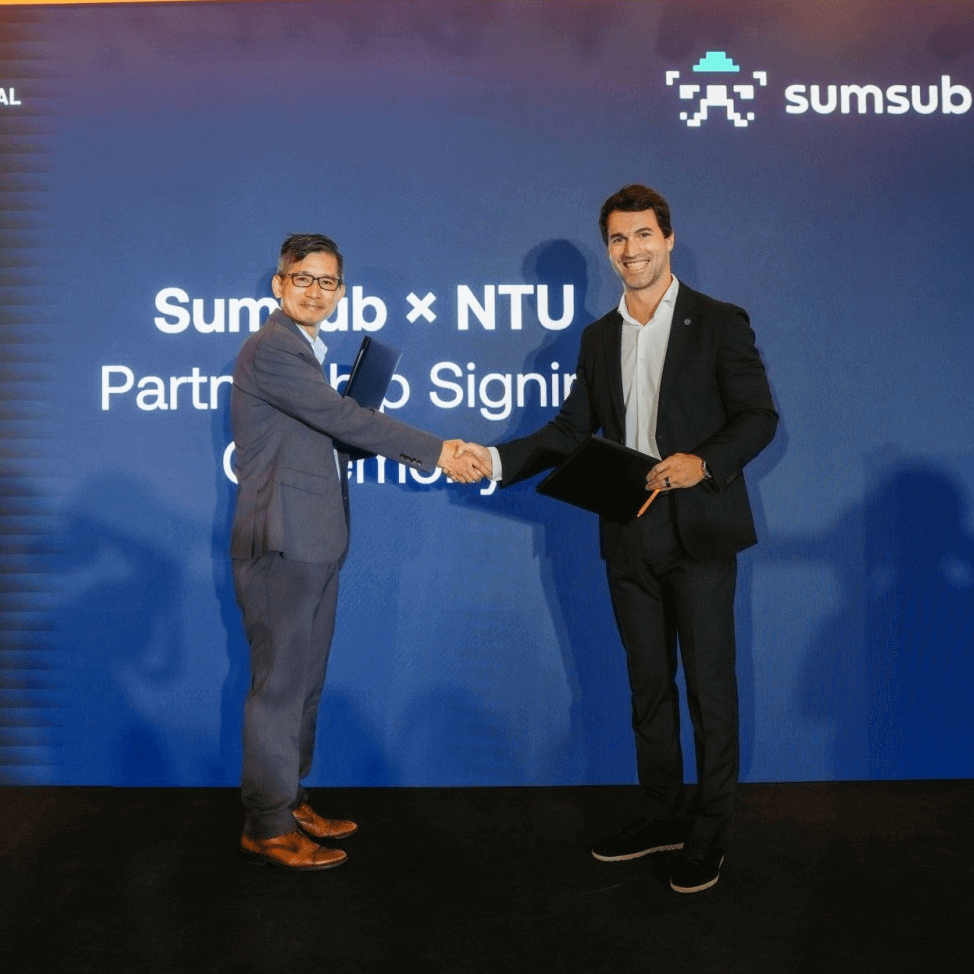

2. Deepfake-Proofing the Internet: Sumsub × NTU Research Collaboration

Professor Adams Wai Kin Kong of NTU at the What The Fraud Summit

At WTF, Sumsub announced a new research project with Nanyang Technological University—one of Asia’s leading research institutions—focused on AI-resistant invisible watermarks for personal images.

The goal is simple and deviously fraud-proof:

To make publicly posted images unusable for deepfake creators, while still looking perfectly normal to the human eye.

It's an ambitious step toward safeguarding online presence and a new frontier for anti-abuse technology.

Deepfake technologies are advancing rapidly, and their misuse poses growing risks to individuals, businesses, and society. Through this collaboration, we are advancing watermarking techniques that can help enhance trust by safeguarding personal identities before misuse occurs. By developing defences that work at scale and in real-world online environments, this research will contribute to Singapore’s broader efforts in building digital trust and ensuring a safer online ecosystem.

—Professor Lam Kwok Yan, Associate Vice President (Strategy & Partnerships) and Executive Director of Digital Trust Centre, NTU

3. Release of the Identity Fraud Report 2025–26

The summit featured an early release of the Identity Fraud Report 2025-2026, Sumsub’s comprehensive fraud analysis covering:

- The “Sophistication Shift” in fraud

- Global and regional identity-fraud rates

- The rise of agentic AI attacks

- Scam network patterns

- Emerging dynamics in different fraud types

- Country-by-country breakdowns of fraud spikes and stabilizations

Printed copies, distributed during the WTF Summit, disappeared within minutes—proof that the industry is thirsty for data, not guesswork.

Download your copy hereFraud isn’t slowing down—but neither are we

WTF Summit 2025 proved that progress happens when the right people are in the same room with the same urgency. Two days of shared intel, live demos, hard data, and zero sugarcoating turned a roomful of experts into something closer to a coordinated counter-force. Fraud may be global, automated, and annoyingly inventive—but it’s not unchallenged.

We are now in the whirlwinds of the world’s fastest fraud evolution, but hosts and attendees of the WTF Summit know the answer to it, bringing forward a united message: “We need to stay ahead. Not just keep up, ahead.”

Relevant articles

- Article

- 2 weeks ago

- 10 min read

AI-powered romance scams are rising fast. Learn how dating fraud works and how platforms and users can protect themselves from online deception.

- Article

- 4 days ago

- 6 min read

What counts as proof of address in the UK? See accepted documents and how to open a bank account if you’ve just moved to the country.

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.