- Feb 12, 2025

- 4 min read

Arbitrage in Sports Betting: How Can Businesses Detect It? (2025)

How does arbitrage betting really work and does it actually harm betting businesses? This article answers these questions and more, revealing how KYC tools can be used to detect arbers.

The size of the global iGaming industry is expected to rise to $114.4 billion by 2028—an increase of over 86% in seven years. Mobile gambling is predicted to account for 51% of the total iGaming market by 2027.

So, more people are trying their luck in iGaming, using a wide range of strategies. This includes arbitrage betting, or “arbing”, which is when a player bets on all possible outcomes of an event and makes a profit no matter who wins. Bookmakers consider this to be a risk to their businesses, so they take proactive steps to detect and restrict it. Let’s dive into the finer details.

What is arbitrage betting?

Arbitrage betting (or “arbing”, “arbs”, or “sure bets”) is a gambling strategy that involves placing bets on all possible outcomes of an event in order to guarantee a profit. An arber can do this on multiple platforms to ensure a profit regardless of the result. Some even automate this practice by using bots to place multiple small wagers. These bots scan numerous betting platforms for favorable odds and place multiple small wagers simultaneously, thereby maximizing efficiency and reducing the time required to identify and act on arbitrage opportunities. Typically, arbers seek to cover their tracks so they don’t wind up on the bookmaker’s radar.

Examples of sport arbitrage

In a tennis match, arbing would mean placing two bets: one on each player to win. A football match would require three bets: one on each team plus one on a draw. Arbers place bets at different betting companies or at the same betting company. To guarantee profit, arbitrage bettors calculate the right combination of odds and bets, which are called arbitrage opportunities.

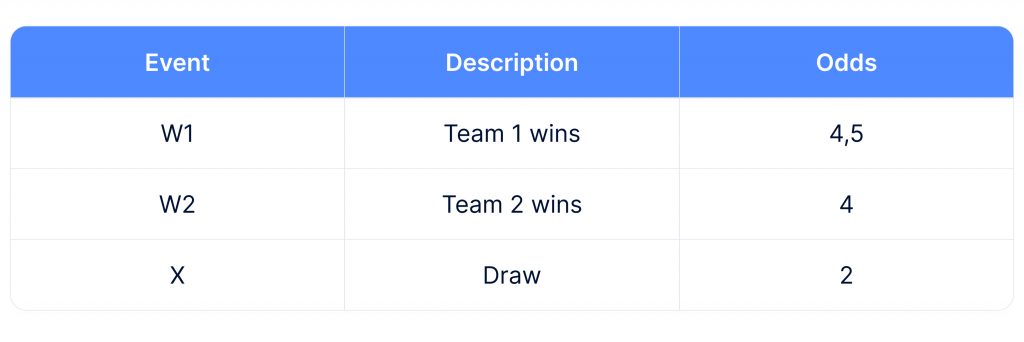

Let’s take a look at this imaginary sporting event. Due to human or technical error, the bookmaker has set the following odds for the match:

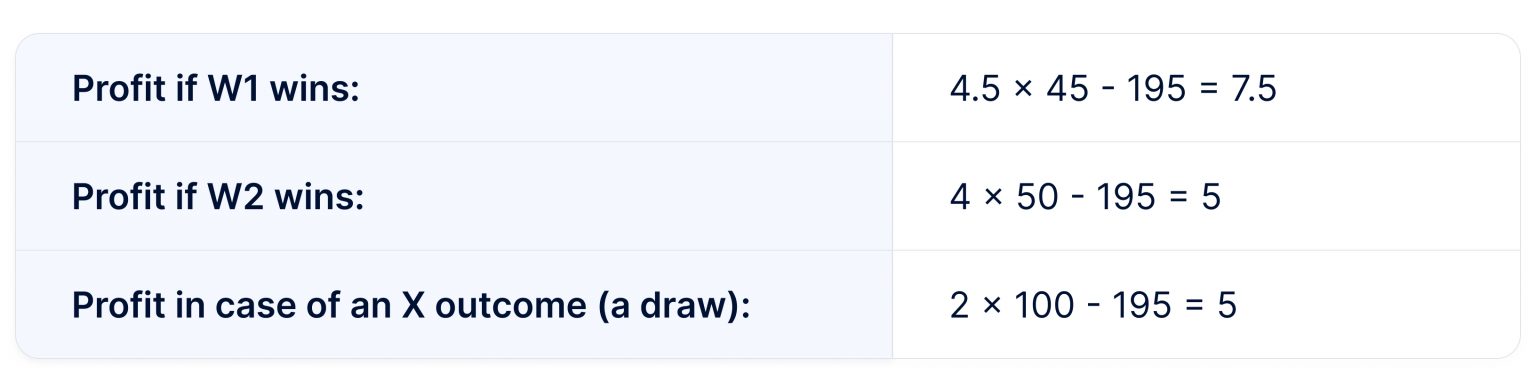

Let’s say the player bets $195:

- $45 on W1

- $50 on W2

- $100 on X

It turns out that the player will receive guaranteed profit for any outcome of the game due to the inefficiency of the bookmaker’s odds.

To identify arbitrage opportunities such as the one above, players need to constantly monitor the odds of one or several bookmakers and calculate potential income using both manual or automated solutions.

When do arbitrage opportunities occur?

Arbitrage opportunities occur when bookmakers imprecisely calculate probabilities. This can happen when the bookmaker:

- Fails to react to live events in real time. In dynamic sports such as basketball and tennis, odds can change multiple times per minute. This means that bookmakers often have no time to react and change the odds.

- Sets the odds too high. The betting market is highly competitive. Booking companies are interested in both retaining existing bettors and gaining new ones. This leads to odds getting set higher and higher, as bookmakers wrestle for market share.

Arbitrage opportunities can stem from a single bookmaker or from a difference in odds for the same event between several bookmakers. Let’s see how bettors take advantage of these opportunities in more detail.

Legality of arbitrage betting

Arbing is not illegal in any country where gambling and betting is permitted. Therefore, arbers will not face any legal consequences.

However, businesses suffer from it, and betting companies try their best to prevent it. Usually, the Terms & Conditions of gambling platforms prohibit multiple bets on the same event and multiple accounts to avoid arbitrage. When arbing is noticed, bookmakers limit accounts or cancel bets.

Arbitrage betting vs money laundering patterns

Money laundering is the illegal process of disguising the origins of illicit funds to make them appear legitimate.

While both—arbitrage betting and money laundering—involve moving money through betting platforms, they serve different purposes—arbitrage aims for profit through market inefficiencies, while money laundering seeks to clean “dirty” money. They can be confused because both involve multiple transactions and unusual betting patterns, but the intent and legality clearly distinguish them.

Suggested read: The Three Stages of Money Laundering and How Money Laundering Impacts Business

What do betting companies do when they detect arbers?

Bookmakers often react ambiguously. Some actually welcome arbing as it helps them sharpen their odds and enhance their modeling. But the majority see arbers as unwanted customers and enact penalties against them, which include:

- Putting limits on bets. In this case, the gambler is either banned from setting higher bets or limited to a fixed minimum amount—usually a few dollars/euro.

- Canceling the bet. When the bookmaker detects a user engaged in arbing, they can void all of their current bets. Typically, all the funds in the account are paid back.

- Shutting down the account. This is the strictest penalty that bookmakers can issue against arbing. If the user has money on their account when it’s blocked, the bookmaker can either refund it or leave them with nothing.

As arbers can threaten the profits of bookmakers, detecting them is quite a big deal for betting companies.

AML/KYC tools for detecting arbers

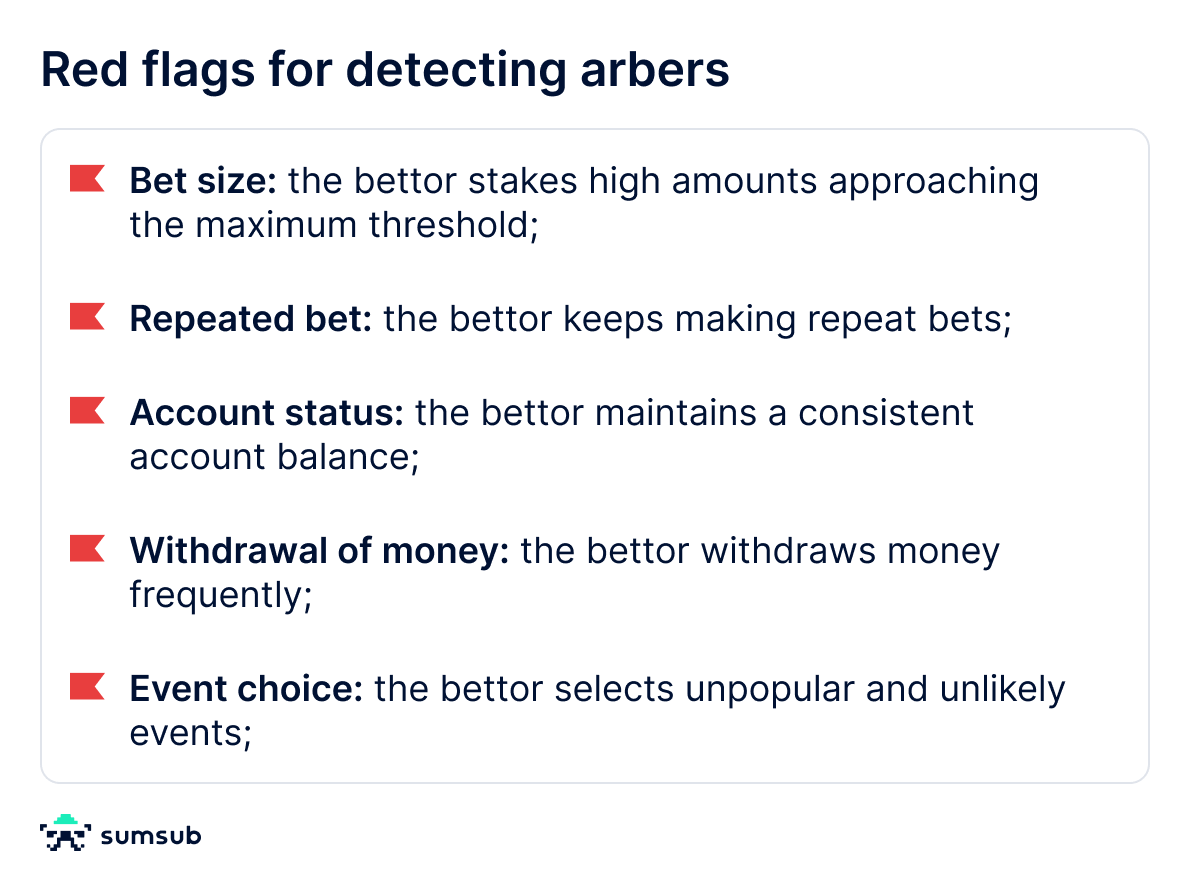

Arbitrage detection is handled by the security departments of betting companies. Using special algorithms, employees calculate players falling under the arber category according to the following parameters:

In most jurisdictions gambling operators are obliged to comply with AML regulations. Standard AML/KYC procedures required by law also help detect and avoid arbitrage betting.

The following procedures will help detect arbers:

- Liveness. This biometry-based user identification solution confirms account ownership and prevents multiple accounts per user

- AML Screening: A search against external databases can sometimes reveal a bettor’s involvement in financial crime or other illegal activities (applicable not only to arbers)

- Bank card verification: Betting companies can conduct user identification and verification by bank card as supplementary security features, so that the bettor is only allowed to use pre-approved payment methods.

All in all, if companies want to ward off arbers, detecting multiple accounts and keeping an eye out for red flags are essential steps to take.

See how Sumsub’s Prooface liveness tool can protect you from arbing. Request a demo today.

FAQ

-

Is arbitrage betting legal?

Yes, arbitrage betting is legal.

-

What are arbitrage betting strategies?

There are two of the most common arbitrage strategies:

- Bonus Hunting Arbitrage: This strategy involves taking advantage of various bonus offers across different betting platforms. It typically occurs when a player opens a new account with a bookmaker, who often provides a bonus for depositing a minimum amount. This approach is often considered bonus abuse. You can check the details in this article.

- Cross-Market Arbitrage: This strategy involves placing bets across different markets to exploit discrepancies in bookmaker pricing by using two or more markets.

-

What does ARB mean in betting?

ARB (or arbing) is a gambling strategy that involves placing bets on all possible outcomes of an event in order to guarantee a profit.

-

Is arbitrage legal in gambling?

Arbitrage is not illegal in gambling, as there are no laws against it.

-

What is an example of arbitrage gambling?

For instance, in tennis, arbing would mean placing two bets: one on each player to win.

-

How can you spot an arbitrage bet?

- Monitor for red flags (such as bet size, repeated bets, whether the bettor withdraws money frequently, etc.)

- Use liveness detection to confirm account ownership, which can detect multiple accounts per user.

Relevant articles

- Article

- 3 weeks ago

- 4 min read

The fraud game has changed. WTF is your move?

- Article

- 2 weeks ago

- < 1 min read

The world’s most anxious compliance officer shares his personal take on how he thinks effective transaction monitoring should be done.