- May 31, 2024

- 3 min read

Combating Multi-Accounting: How Sumsub Can Help the Most Affected Industries

Learn about the threats that multi-accounting poses and how you can minimize them with Sumsub.

Multi-accounting is when multiple accounts are created by an individual for exploitative purposes. This could involve repeatedly accessing free trials, discount codes, or other bonuses. Multi-accounting is also a way to circumvent bans from a platform.

In short, multi-accounting can facilitate a variety of fraudulent activities. That’s why we at Sumsub have written this guide, covering the red flags of multi-accounting and the preventative measures companies should take. Without these key tips, companies leave themselves open to money laundering, regulatory fines, and reputational damage, or worse.

Multi-accounting red flags

Multi-accounting isn’t inherently fraudulent. However, in some cases, the practice can facilitate fraud and money laundering—which, if undetected, can wreak havoc on your business. Therefore, companies need to be able to notice the signs of multi-accounting promptly, and take action if needed.

Here’s what to look out for:

- Multiple accounts created from the same device or IP address

- Rapid creation of numerous accounts within a short time frame

- Similar or identical account information (such as email addresses, names, or payment methods) across multiple accounts

- Unusual patterns of account activity, such as frequent logins from different locations or at unusual times

- Abnormal purchasing behavior, such as multiple accounts using the same discount code or attempting to make unusually large purchases

- Attempted misuse of promotional offers, referral programs, or rewards programs by creating

- Inconsistent or suspicious user behavior, such as accounts frequently switching between different identities or personas

- Anomalies in transaction patterns, such as accounts frequently transferring funds between each other or engaging in unusual buying and selling patterns

- Attempts to evade security measures, such as using VPNs or proxy servers to hide the true origin of accounts

Real use cases

- iGaming: Players may create multiple accounts to manipulate game outcomes, exploit bonuses, or engage in cheating. Bonus abuse is the most widespread form of multi-accounting in iGaming, amounting to 69.9% of total fraud in the industry.

- E-commerce: Multiple accounts may be used to engage in fraudulent transactions, exploit customer discounts, bypass purchase limits, manipulate reviews, artificially inflate product ratings, or engage in price gouging.

- Fintech: Individuals may open multiple accounts with financial institutions to take advantage of sign-up bonuses, exploit promotional offers, circumvent limits on certain transactions, or engage in illegal activities such as money laundering. Neobanks have been largely used by money mules—a type of multi-accounting scam when seemingly innocent individuals are recruited to open accounts in banks and neobanks to transfer illegally obtained funds. According to the Sumsub Identity Fraud Report, money muling networks have been one of the top-5 global fraud trends.

- Crypto: Multiple accounts may be used to commit money laundering, phishing attacks, and “pump and dump” scams.

- Employment and freelancing platforms: Some users may create multiple accounts on job boards or freelancing platforms to bypass restrictions on the number of applications they can submit or to misrepresent their qualifications.

- Travel: Multi-accounting is used here to create reputation-harming fake reviews and false bookings.

- Various online subscription services: Individuals may create multiple accounts on subscription-based services to exploit free trial periods, access content restricted to certain regions, or share accounts with others without authorization.

- Online communities: Users may create multiple accounts on forums or online communities to evade bans, engage in trolling or harassment, or manipulate discussions and opinions.

- Social media: This industry was most susceptible to fraud last year, according to the Sumsub Identity Fraud Report. Some users create multiple accounts on social media platforms to inflate their follower counts, amplify their influence, or evade bans or restrictions imposed on their primary accounts. Content creators may use multiple accounts to manipulate views, likes, or comments on their content.

How Sumsub can help

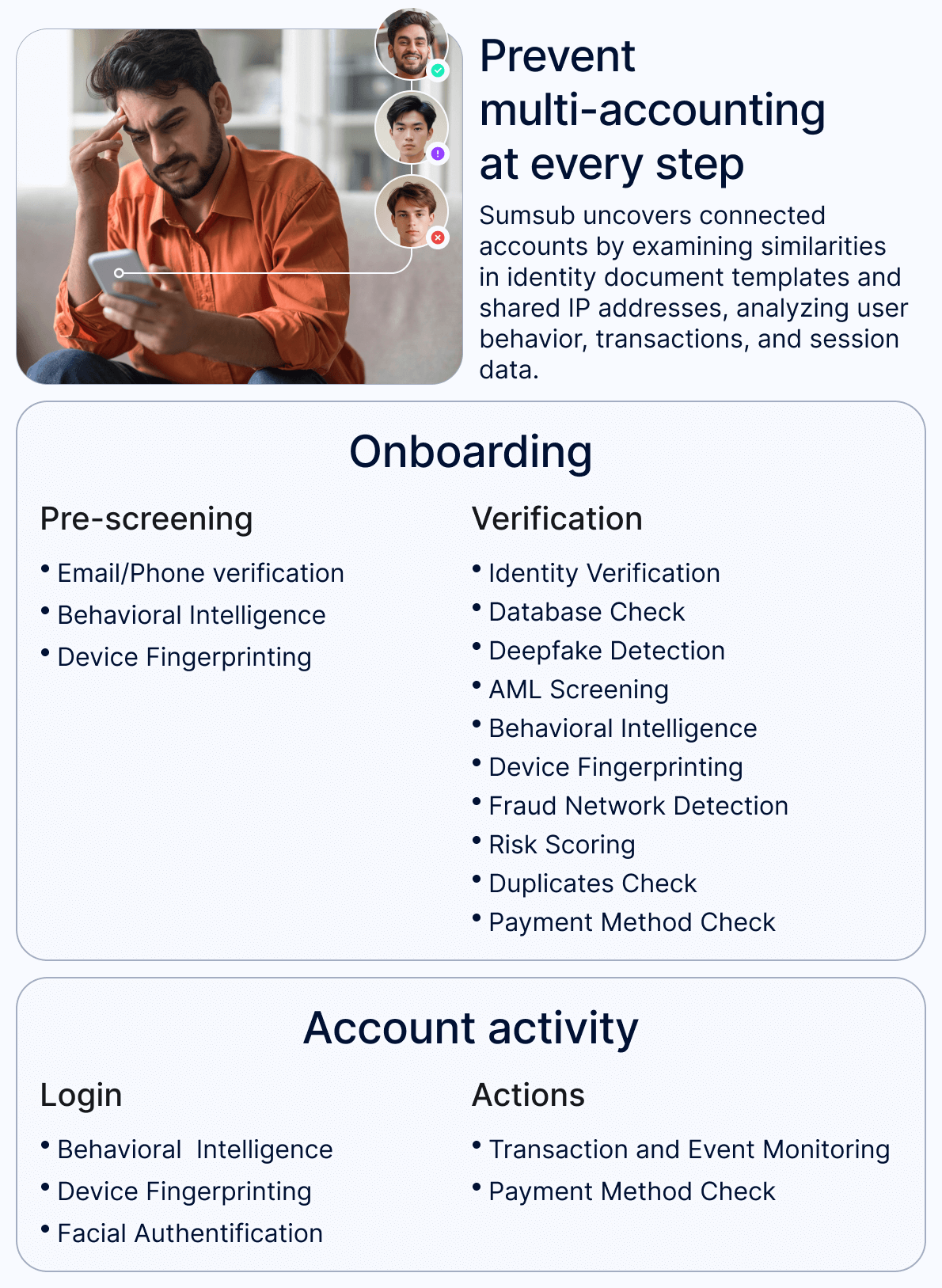

Sumsub offers an AI-driven solution that uncovers connected accounts by examining similarities in identity document templates and shared IP addresses, while analyzing user behavior, transactions, and session data. This enables you to prevent multi-accounting at every step of the user journey:

After setting up an account with Sumsub, you can install ready-to-use rules from our rules library or create your own scenarios according to your local specifics and regulations.

You can learn more about customizing our solution here.

With the ability to customize triggers, this solution can be adjusted for the needs of any industry and any business. It detects 95% of multiple accounts early on, thus helping businesses avoid monetary losses.

Relevant articles

- Article

- Feb 5, 2026

- 20 min read

- Article

- 1 week ago

- 6 min read

What counts as proof of address in the UK? See accepted documents and how to open a bank account if you’ve just moved to the country.

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.