- Oct 06, 2025

- 10 min read

What Is a Money Mule? Red Flags, Examples, and Prevention in 2025

Discover one of the fastest-growing fraud trends, and learn how businesses can protect themselves from this threat.

Money muling is a form of money laundering where criminals employ other individuals to move illicit funds. The problem is widespread. In the UK alone, a 2025 poll of 2,000 adults revealed that 21% had been asked to receive funds into their bank account, apply for a loan in someone else’s name, or open a new account—all in exchange for cash.

In the UK, over 225,000 people acting as money mules were identified in 2024, which represents a 23% increase from the previous year. In Singapore, over 3500 suspected money mules and scammers were investigated in the first six months of 2025 in relation to scam cases with a value of more than S$123 million (USD91 million).

Various factors are driving this rise, such as the increased ease of opening accounts, the high volume of transfers, and economic uncertainty, which makes people more susceptible to offers of quick, easy money. A lack of public awareness about what money muling is, that it is a criminal offence, and the potential consequences also contributes to the issue. Yet, for companies, money muling means criminal activity is flowing through the business, and then regulators can step in, imposing penalties, tighter scrutiny, and even restricting operations.

Businesses must, therefore, be extremely vigilant and ensure they are meeting their regulatory obligations to identify and prevent money muling.

What is a money mule?

A money mule is a person recruited by criminals to move money as part of the process of laundering illicit funds. They may move cash in person, transfer funds digitally, or send funds via mail or a courier. Money mules may be aware they are involved in moving illegally obtained funds, or they may be unwitting tools of criminals.

Key traits of typical money mules include:

- Where permitted by law, conduct criminal-records checks; otherwise, rely on adverse media, sanctions/PEP, device/network analytics, and risk-based CDD.

- Unemployment, being a student, suffering economic hardship, and/or being a new arrival in a country.

- Under 35 years old and often as young as 12 years old

- Multiple customers using the same device to access their accounts (indicating account details may have been sold to a criminal for money muling)

Money mules are recruited through online job offers, dating sites, remote villages, or darknet forums. Recruiters can lure individuals by promising easy money or creating job adverts that appear like legitimate offers.

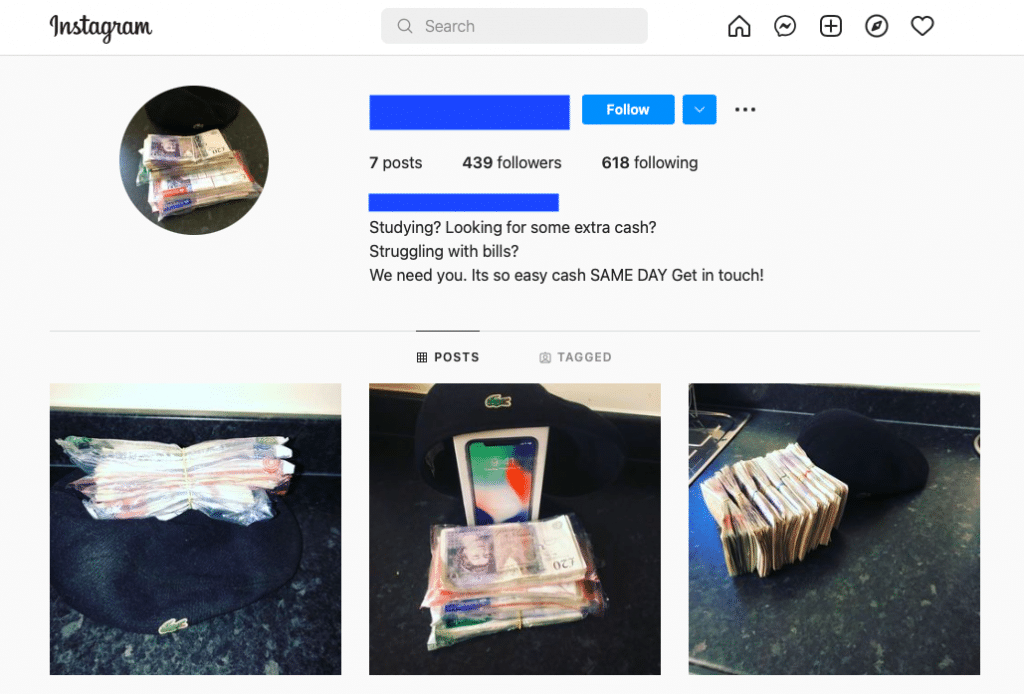

Here’s an Instagram account of a potential mule recruiter. Such recruiters often take pictures of large sums of money and promise easy cash to lure young people.

How does money muling work?

Money muling involves the following steps:

- Criminals recruit a mule through an online job offer (e.g., through forums, email, and social media), a dating site, text message, and direct messages (e.g. through WhatsApp) or directly in person.

- The mule opens an account with a bank or other financial platform or uses their existing account.

- Money is sent to the mule’s account from a criminal source, such as a fake company, or deposited in person.

- The criminals instruct the mule on when and where to move the money. They can request the mule make a wire transfer, withdraw cash, deposit it in another account, or give account access to another person.

- The money mule gets a cut for their participation.

It’s tough to track illegal money movement involving unknowing individuals, who usually have verified payment accounts classified as low-risk. Although mule accounts may appear low-risk at onboarding, firms must therefore apply ongoing AML monitoring and risk-based thresholds that adapt to behavioral changes.

So, what sorts of people become money mules?

Who can become a money mule?

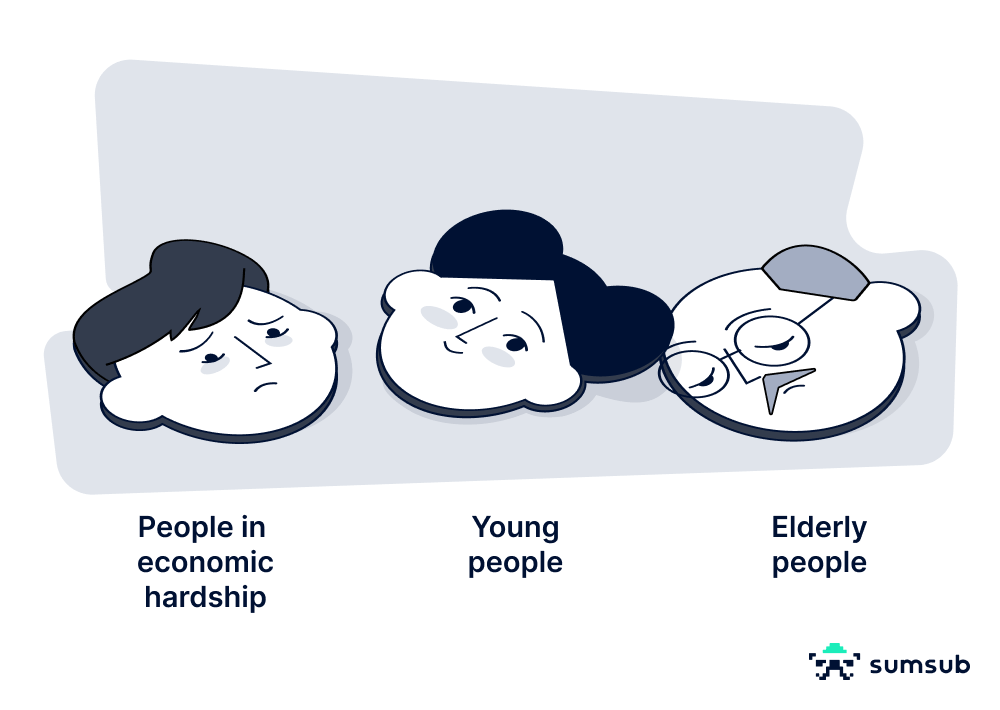

Europol, an organization that fights terrorism and other organized crimes, describes the categories of people most often targeted for money muling:

- People in economic hardship. These include unemployed individuals, students, and immigrants.

- Young people. Criminals target young individuals the most, sometimes even recruiting teenagers. A BPFI study found that 18-24 year olds were by far the most likely to have been approached by someone wanting to use their accounts to transfer money or to know someone who had been approached. A 2025 report revealed that in Ireland, thousands of teenagers have been targeted by one of the world’s most violent cybercrime gangs to act as money mules. The Black Axe crime gang has used young people aged between 17 and 22 as part of their efforts to launder €84 million ($98 million) through Irish banks.

- Older people. In 2024, Lloyds Bank reported a 73% rise in money mule accounts held by people over 40, suggesting that older people are increasingly being targeted.

FBI: Glenda, an 81-year-old victim of a romance scam, describes how she became a money mule and is now paying the price

All in all, businesses should conduct proper due diligence for all age groups, even for elderly customers who look the least suspicious.

Suggested read: Romance Fraud: “What The Fraud?” Podcast

4. Businesses in financial difficulties. Criminals can also open business accounts for money muling. They may target businesses in financial difficulties and offer them the opportunity to act as ‘middle men’ in financial transactions that appear legitimate, but actually involve the proceeds of crime. By using business accounts, criminals can move large sums of money in a way that appears less suspicious.

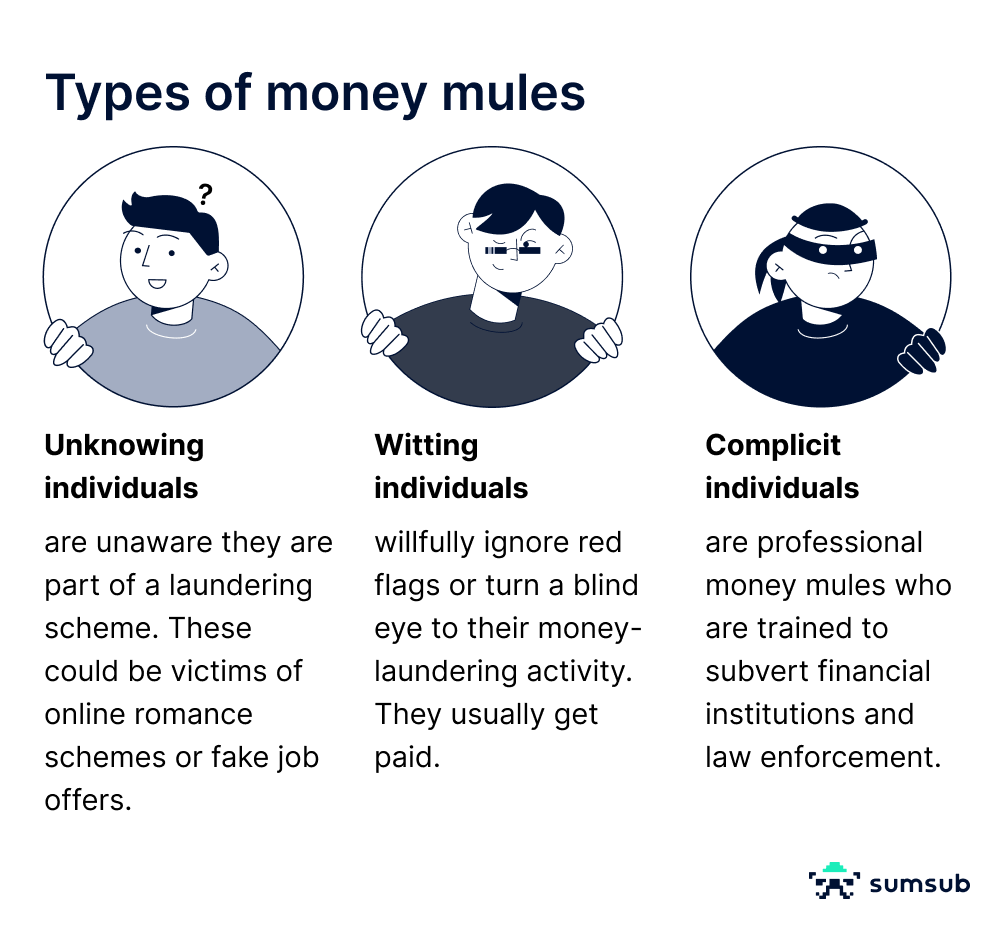

Do money mules know what they are doing? Types of money mules

Some money mules know they are supporting criminals, while others are unaware. According to the FBI, money mules can be divided into three types:

- Unknowing, or unwitting, individuals. These people are unaware they are part of a laundering scheme. These could be victims of online romance scams or fake job offers.

- Witting individuals. These people willfully ignore red flags or prefer not to notice money laundering activities. They usually get paid.

- Complicit individuals. These are professional money mules who are trained to subvert financial institutions and law enforcement.

Is being a money mule illegal?

Yes. In most jurisdictions, money muling is a serious crime that can lead to very serious penalties, such as up to 14 years of imprisonment in the UK and 30 years in federal prison in the US.

If an individual suspects they might be a mule, they must stop communicating with the criminal and warn the police.

There can also be significant risks for businesses that fail to prevent money mule activity. These include the potential for regulatory investigation and penalties, as well as serious reputational damage. The UK’s Financial Conduct Authority (FCA) recommends that “firms should have a proportionate and risk-based approach to help make sure their platforms are not being exploited and their customers are not being put at risk by criminal groups”.

Penalties for money muling in different countries

Money muling is generally not a specific offence in most jurisdictions, but those acting as money mules can be prosecuted for various offences in different countries. The following table sets out some of the types of offences and maximum penalties that can apply to money mules.

| Country | Relevant Offence/s | Maximum Penalty | Source/s |

| Australia | Money laundering | Imprisonment for 25 years, 1500 penalty units (equal to AU$495,000 as of September 2025), or both. | Division 400 of the Criminal Code Act 1995 |

| Singapore | Various, including: Unauthorized disclosure of access code (when giving control of an account to another person for the purpose of money laundering),Assisting another to retain benefits of drug dealing or benefits from criminal conduct in certain circumstances, etc. | Under the CDSA (e.g., ss. 44, 47), key laundering offences carry up to 10 years’ imprisonment and S$500,000 (individuals) | Computer Misuse Act 1993; Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act 1992 |

| UK | Money laundering | 14 years of imprisonment | CPS Money Laundering Offences Guidance; NCA Money Muling Guide; Proceeds of Crime Act 2002 |

| United States | Conspiracy to commit money laundering | 20 years in federal prison | FBI Guide to Money Mules |

Money laundering through money mules

Europol reports that more than 90% of money-mule transactions identified in EMMA operations are linked to cybercrimes. However, they could also be linked to something more vicious, like human and drug trafficking.

The FBI explains that money mules can move funds through bank accounts, cashier’s checks, virtual currency, prepaid cards, or money service businesses. This helps criminals avoid Customer Due Diligence (CDD) procedures, hiding their identities and sources of funds.

Money muling networks usually utilize the following techniques to launder money acquired through investment scams, phishing, messenger app fraud, help desk fraud, crypto fraud, counterfeit bank cards, and more:

- “Bank drops”

Money launderers need to deposit illicit funds without the bank’s knowledge. To do this, they’ll pay someone with a clean banking history—somewhere in the range of $50 to $100—to open up a bank on their behalf. Typically, online “neobanks” are preferred over traditional banks for this purpose.

- Online payment methods, including gift cards

These are often furnished to money mules of a younger age demographic, who then purchase items and deliver them to the criminals. These items are subsequently sold on popular e-commerce platforms, and a share of the illegal proceeds is provided in cash or goods to the mule.

- Bank impersonation

Criminals can use deceptive tactics, including bank impersonation, to compromise people’s banking credentials. This often targets more vulnerable populations, particularly seniors.

- Fabricated identities

Not all money mules have to be real people. In fact, perpetrators often fabricate identities—often through the use of AI—which can then be used to open up fraudulent bank accounts. These fake identities can be advanced enough to bypass KYC, underscoring the need for advanced security measures and monitoring beyond the onboarding stage.

Suggested read: What Are Deepfakes?

Which businesses do money mules target?

Several types of businesses are particularly vulnerable to money mule scams due to the nature of their operations and financial transactions. These include:

- Financial institutions. Banks, credit unions, and other financial institutions are prime targets due to their involvement in processing and transferring funds. Money mules may attempt to use these institutions to launder illicit funds or to facilitate fraudulent transactions.

- Online retailers. E-commerce businesses are often targeted because they process large volumes of transactions, making fraudulent activities easier to go unnoticed. Money mules may use stolen credit card information to make purchases through online retailers, exploiting vulnerabilities in payment systems.

- Money service businesses. Companies that provide money transfer services, such as Western Union, are at risk because they facilitate the movement of funds across borders. Money mules may attempt to use these services to transfer illicit funds or to receive payments from victims of various scams.

- Travel agencies. Travel and tourism businesses, tour operators, and other companies related to this industry may be targeted by scammers looking to book fraudulent trips or use stolen credit card information to make travel reservations.

- Cryptocurrency platforms. Crypto exchanges and trading platforms have become targets for money mule scams. Cryptocurrencies offer a certain degree of anonymity, as transactions can be conducted without revealing the identities of the parties involved. This makes it easier for money mules to transfer funds without being easily traced or identified, providing a layer of secrecy for conducting illicit activities.

Suggested read: 8 Crypto Scams to Be Aware of in 2025: A Guide for Businesses and Users

- Job recruitment platforms. Websites or platforms that connect employers with potential employees are often exploited by scammers posing as legitimate businesses offering work-from-home opportunities. These scams involve recruiting individuals as money mules under the guise of legitimate job offers.

- Dating platforms. Money mules can be recruited through dating apps and platforms, often as part of romance scams where perpetrators build relationships with victims to gain their trust. Once trust is established, the scammer may deceive the victim into unknowingly participating in illegal activities, such as receiving and forwarding illicit funds. These scams exploit the emotional vulnerability of individuals seeking companionship, making them more susceptible to manipulation.

These businesses should be especially concerned with robust money mule detection and prevention measures.

Common money mule red flags

Red flags of a potential money mule include:

- The customer is unemployed, retired, or a student. This is not inherently a red flag, but these types of customers are at higher risk of becoming money mules. International students may be more likely to be targeted as a way of moving money from their home country to their country of study, as happened recently with a Chinese student studying in Australia who became an unwitting money mule.

- Receiving funds from unknown sources. The customer has recently started to receive funds with a dubious origin that they can’t explain.

- Transfers that don’t fit the customer’s normal behavior profile. The nature of the customer’s money transfers has changed: for example, suddenly depositing or withdrawing large amounts in cash, which they did not previously do.

- Multiple deposits from different locations in a short time frame. The customer received high deposits in quick succession from different locations or third parties.

- Short intervals between deposits and withdrawals. The customer receives deposits and then soon after withdraws the amount.

- Transactions involving high-risk jurisdictions. The customer’s incoming or outgoing payments come from high-risk countries.

- Cash deposits into multiple accounts. The customer deposits cash via ATMs across multiple accounts using a single card or mobile number.

- Multiple customers’ accounts being accessed from the same device. Suggesting that those accounts may now be controlled by a single person for money muling purposes. For example, more than 120 people in Llanelli, Wales, were found to have opened online accounts and handed the details over to money launderers in exchange for cash in February 2025.

- Reluctance to provide personal information for verification purposes. For example, during standard KYC checks when opening an account.

The presence of a single red flag may not be a sufficient basis for suspecting criminal activity. For instance, a customer being a student isn’t a red flag in itself. But if this customer suddenly starts to make surprisingly large transactions, it might be a sign of money muling activity.

Overall, businesses can monitor customer activity to reduce the risk of exposure to money mules.

How businesses can detect and prevent money muling in 2025 and 2026

Businesses can’t afford to let money mules exploit them. In fact, if a business fails to detect internal money laundering activity, it can be charged with aiding and abetting these crimes under AML regulations.

At the same time, it’s hard to catch money mules, since these are usually ordinary people with a clean banking history. Therefore, it’s recommended to employ a complex approach to due diligence, including background checks, as well as automated transaction and profile monitoring that can notice even slight changes in customer behavior:

- Detecting mules during onboarding. Professional money mules can use stolen identities to open accounts on financial platforms. Therefore, businesses need to conduct a proper CDD procedure that verifies the customer and their documents, assigns a behavioral risk score, searches blocklists, and performs adverse media screening. A background check is highly important, since there’s a possibility that a money mule was convicted of a crime in the past. It’s also important to find connections and similar patterns in the behavior of different users (such as background, device, IP address, etc.).

- Device intelligence and behavioral analytics. Device intelligence helps identify money mules by tracking the devices used for account access, flagging suspicious patterns such as multiple accounts accessed from the same device or unusual locations. Behavioral analytics monitors user actions, detecting anomalies in transaction behavior that may indicate someone is moving funds on behalf of criminals.

- Ongoing monitoring of all user activity. Businesses should consider ongoing monitoring of existing customer profiles, such as login details, personal data changes, geolocation, behavior, and IP location. It’s important to pay attention to even subtle changes.

- Transaction monitoring. This is a type of automated technology that detects unusual transactions in real-time. It conducts analysis that verifies the source and destination of funds and determines possible connections to money laundering.

- Fraud network detection. You can uncover interconnected patterns of suspicious activity on your platform using Sumsub’s AI-powered Fraud Network Detection solution. This tool provides businesses with the ability to identify fraud networks, including money mule networks, before the onboarding stage through AI. This allows you to apprehend an entire fraud network rather than just a single fraudster.

If a money mule or a money mule network has been detected, business should file a FIU report (SAR or STR, depending on the jurisdiction) and apply risk-based account restrictions per law/policy (avoiding tipping-off). Share information only via lawful channels (e.g., statutory gateways/safe harbors), not informal notifications.

FAQ

-

What is a money mule and how does it work?

A money mule is someone who receives funds derived from illegal activity and then transfers those funds to a third party. They may do this in person through cash deposits and withdrawals, using postal services or couriers, or via online banking. Typically, a money mule will be recruited by criminals, receive funds from them, and then transfer those funds to someone specified by the criminals. They may also hand over their accounts to the criminals’ control. Money mules may be told to keep a percentage of the funds as payment or receive a payment for opening and handing over accounts.

-

How do scammers recruit money mules?

Scammers use various tactics to recruit money mules. One common approach is to recruit through fake job adverts and offers via social media, emails, instant messaging, etc. Other scammers may use romance fraud to convince someone to use their accounts to receive and transfer illicit funds. People are also sometimes approached online or in person and asked to help with a transfer, often with a false reason as to why they cannot complete the transfer themselves.

-

How do you identify money mules?

Money mules can often be identified by unusual financial activity, such as receiving funds from unknown sources, transferring money to unfamiliar accounts, or frequently making large deposits and withdrawals.

-

What are the signs of a money mule?

There are several red flags of a mule account, for example, when the customer is unemployed, retired, or a student; when the customer has recently started to receive funds with a dubious origin that they can’t explain; or when the customer deposits cash via ATMs across multiple accounts using a single card or mobile number.

-

How can companies detect mule activity before onboarding?

Companies can use various tactics to identify potential money mules during Know Your Customer (KYC) and Customer Due Diligence (CDD) checks as part of the onboarding process. These applicants can then be turned down for an account, and the relevant authorities will be notified. Tools, including facial recognition, device profiling, and geolocation, can all help with identifying potential money mules. Checking block lists, carrying out thorough background checks, and effective behavior risk scoring can all help to screen out those at risk of opening money mule accounts. AI-powered fraud network detection is also a powerful tool to identify money mule networks.

-

What are the penalties for being a money mule?

The punishment for a money mule can vary depending on the jurisdiction and the severity of the crime, but it typically includes potential fines, imprisonment, and a criminal record.

Relevant articles

- Article

- 2 days ago

- 6 min read

What counts as proof of address in the UK? See accepted documents and how to open a bank account if you’ve just moved to the country.

- Article

- Jan 8, 2026

- 28 min read

Dive into the world of fraud with the ‘What The Fraud?’ podcast! 🚀 In this episode, Tom is joined by Alex Wood, a counter-fraud expert and member of…

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.