- Feb 05, 2026

- 11 min read

How to pass KYC in 2026

Learn what KYC is and the steps users should take to onboard smoothly.

Sophisticated identity fraud is gaining pace, with rates almost tripling in 2025. To stay ahead of fraudsters and protect both customers and brand reputation, businesses need increasingly sophisticated layers of defense, starting with KYC.

“Know Your Customer” (KYC) verification is businesses’ first line of defense against identity fraud and other financial crimes, helping them understand who their customers are.

For regulated entities, KYC verification is a legal requirement, while for non-regulated, it is an essential practice to prevent fraud and protect their customers. For clients, it is important to understand how to get KYC verified so they can be confident in accessing the services they need.

Let’s dive into the world of KYC and everything you need to know about how to pass KYC in 2026.

What is KYC?

“KYC” means “Know Your Customer”. It is the process businesses use to verify that customers are who they say they are and to determine how likely they are to be involved in fraud or financial crime, such as money laundering. KYC is a regulatory requirement for many businesses, including those offering financial services. It also helps to protect legitimate customers and combat fraud.

The process of KYC verification includes the steps businesses must take to confirm the identities of their customers. User identification involves gathering a customer’s personal data, while verification ensures the accuracy of this data.

To identify a customer, businesses typically require at least the following information:

- Name

- Date of birth

- Address

To verify this data, businesses can use a document-based verification approach. This involves examining the customer's identity documents and proof of address (such as a utility bill) to confirm their authenticity and validity..

In many jurisdictions, however, a document-free verification approach is gaining popularity. Check here to learn what this is and where it’s compliant.

According to Anti-Money Laundering (AML) obligations, businesses must ensure customers are trustworthy by checking global sanctions lists, watchlists, blocklists, or adverse media.

For a more detailed answer to the question “What is KYC?” and related information, check out other articles by The Sumsuber:

- KYC Guide—What’s KYC and Why is It Important?

- KYC and AML—Key Differences and Best Practices (2026)

- KYC Onboarding—How to Ensure AML Compliance

- Effective Sanctions Screening: Best Practices for Preventing Financial Crime

- 5 Best Practices for Adverse Media Screening

How does KYC verification work?

The KYC verification procedure includes collecting essential personal information from the customer. Automated and manual verification checks are then used to validate the user’s identity, including ID document verification, proof of address checks, and, where higher assurance is required, liveness detection to confirm that a real person is present during verification. Advanced vendors also offer additional capabilities such as workflow customization, reporting, dashboards, collaboration tools, and other optimization features that support compliance teams.

For businesses that choose to use a document-based verification approach, the KYC verification process involves scrutinizing the documents for authenticity and cross-referencing them against various databases. In many jurisdictions, however, a non-documentary verification is enough to ensure that the client is who they say they are and complies with local regulations.

Additionally, under Anti-Money Laundering (AML) regulations, obliged businesses must ensure that the customer is not involved in illegal activities. This is done by checking the customer's information against global sanctions lists, watchlists, blocklists, and adverse media reports. By conducting these thorough checks, businesses can prevent fraud and comply with regulatory requirements, ensuring that they only engage with legitimate and trustworthy customers.

Common KYC risk factors

During the KYC process, various factors are used to determine a user’s risk profile, including:

- Geographic risk. For customers living or transacting with high-risk countries, including those with weak AML/CTF regimes or under sanctions.

- Customer risk. Where a customer is on a trusted watchlist (e.g., for Politically Exposed Persons), has a high net worth, is a business with a complex structure, or is otherwise considered to pose a higher risk of involvement in financial crime.

- Industry/sector risk. Certain sectors and industries are generally considered higher risk, such as casinos and other cash-intensive businesses.

- Product/service risk. Some products and services may be deemed inherently higher risk, e.g., those that offer anonymity.

- Device risk. Customers using devices and tools such as emulators and VPNs may pose a higher risk of involvement in financial crime, as these can be used to obscure their location and other identifying information.

- Behavioral risk. Customer behavior, such as suspiciously fast click rates and use of bots, can indicate a higher risk of financial crime.

- Financial risk. Any unanswered questions about a customer’s Source of Funds (SOF) or Source of Wealth (SOW) will indicate a higher risk of financial crime.

- Delivery channel risk. How an institution interacts with a customer can increase financial crime risk, including when a customer operates through an intermediary.

- User experience risk. How experienced a user is with a service can be a factor in risk profiles for traders specifically, as more experienced traders generally have more behavioral data, making it easier to spot unusual behavior patterns that could indicate illicit activity.

Suggested read: Source of Funds (SOF) and Source of Wealth (SOW): Key Differences and Compliance Requirements

How to verify documents

Verifying that customer documents are authentic and that the person using them is their true owner are both essential in the KYC process. This allows you to be confident about who a potential customer is, so you can accurately determine their risk profile. Having a robust process for how to verify documents is, therefore, absolutely critical.

Key steps in how to verify documents online and use them for customer risk profiling are:

- Request personal data (name, date of birth, address)

- Perform a liveness check to verify that the customer is a real and living person. This can be done through facial biometrics authentication (liveness), which allows businesses to confirm that the provided ID document is truly in the possession of the owner of the document.

- Verify that the customer’s documents are authentic. This step may include AML screening to check whether the customer is on adverse media, sanctions lists, PEP lists, etc. Sumsub’s AllDocs Verification tool offers versatile document processing to quickly check the veracity of a wide range of documents against trusted sources.

- Verify that the customer actually resides in their selected country by checking utility bills, bank statements, or other proof of address documents. This includes checking whether the customer comes from high-risk countries (e.g., Iran and North Korea) or countries under increased monitoring.

- Determine the risk category of the customer based on the results of the above checks. Depending on the calculated risk level, businesses can adjust their approach to the customer’s verification. Accordingly, a higher risk score will necessitate additional checks.

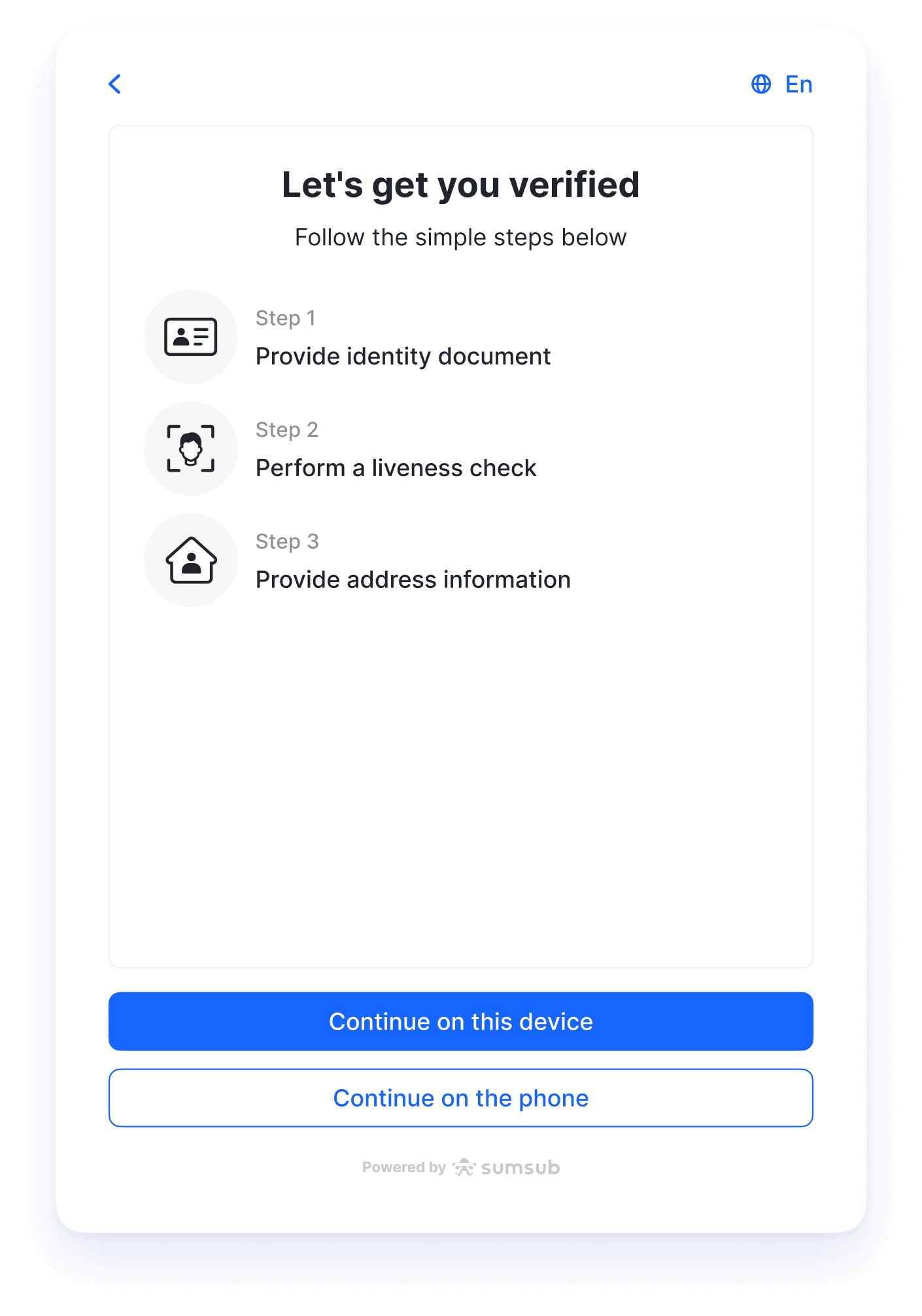

Let’s go over the exact steps to passing KYC verification with Sumsub.

KYC process steps

Before undertaking the Sumsub KYC process steps, you will usually need to make sure your web or mobile camera is connected and working. However, this may not apply to certain KYC verification methods, including questionnaire-only and some Non-Doc verification processes.

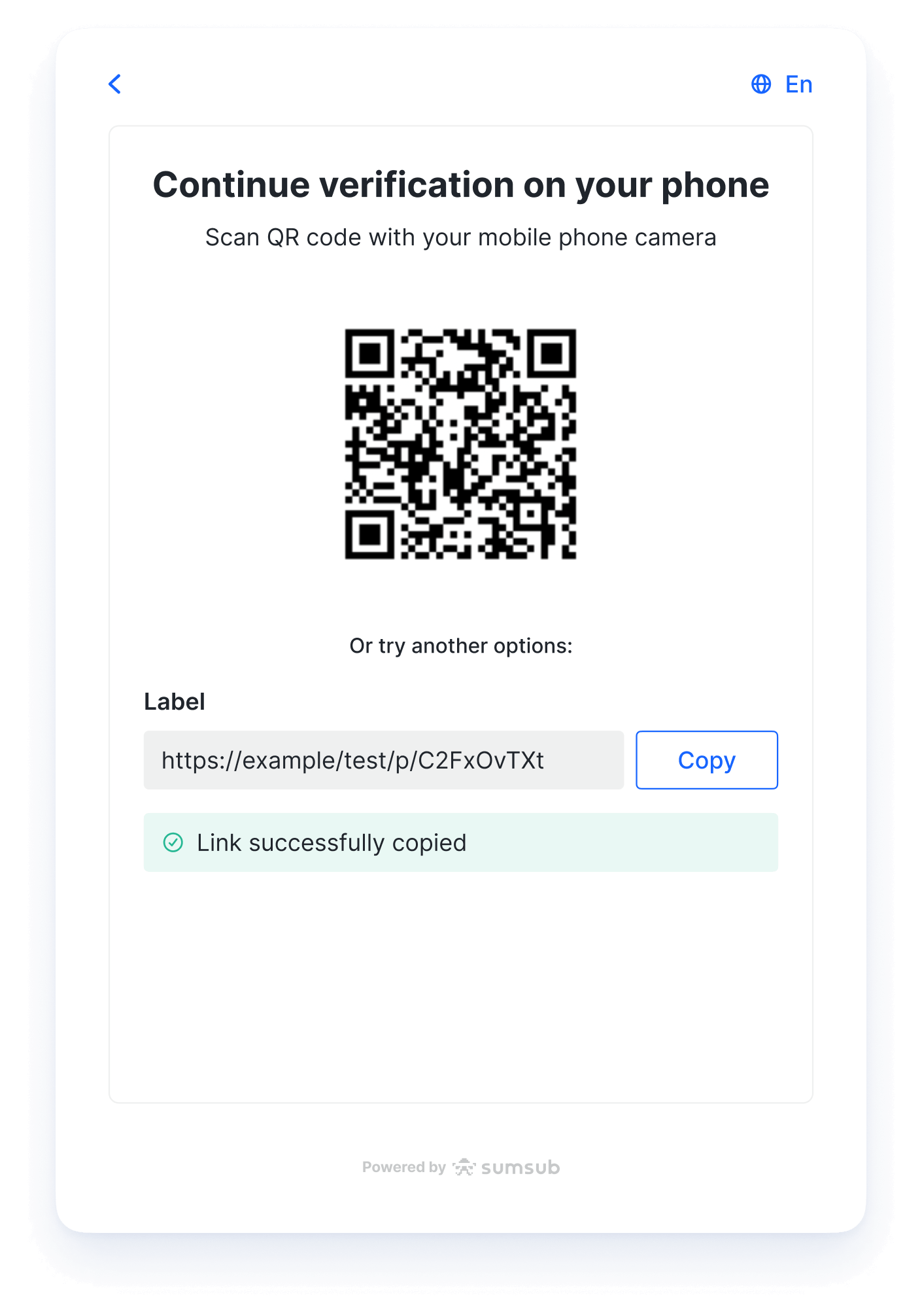

You will then need to click “Start” and follow the instructions displayed on the screen. You may begin verification on desktop and switch to mobile midway through, if necessary. To do so, press “Continue on your phone” to switch to mobile using a QR code or a link.

Step 1. Privacy Terms

Please review and accept our privacy terms by ticking the corresponding boxes. This gives Sumsub consent to process your personal data.

Step 2. ID Document

Select the issuing country and document type of the ID you wish to use.

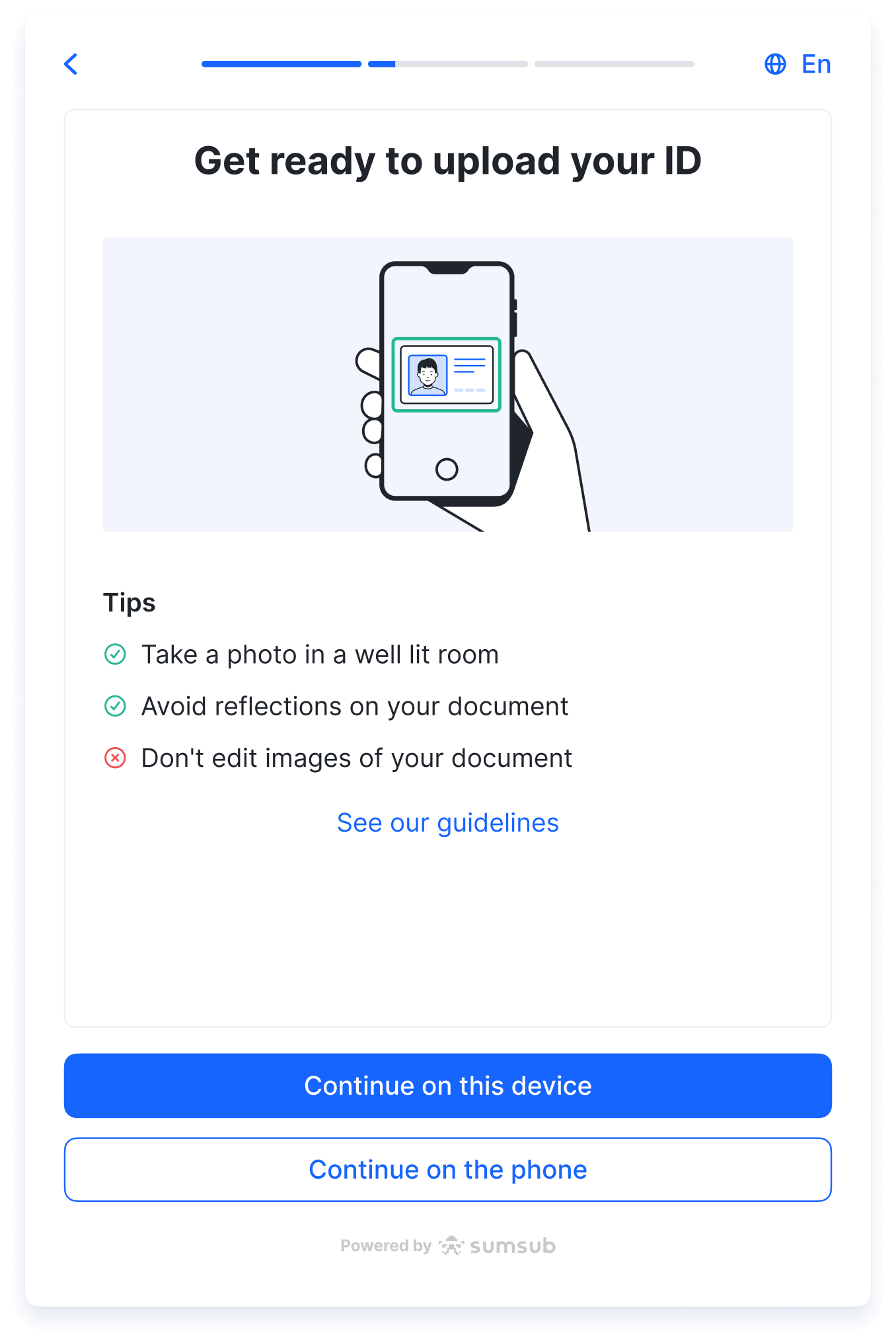

Upload photos of the ID document. You can use any official government document—ID-card, passport, driving license, etc.—valid for at least one month after the present date.

You can find more details on Sumsub’s ID document requirements at this link.

When taking photos, please note that:

- The information on the document must be clearly legible

- All corners of the document should be visible within the frame

- Two-page or two-sided documents must have all pages/sides photographed

- Acceptable file types are JPEG and PDF, at least 500KB in size.

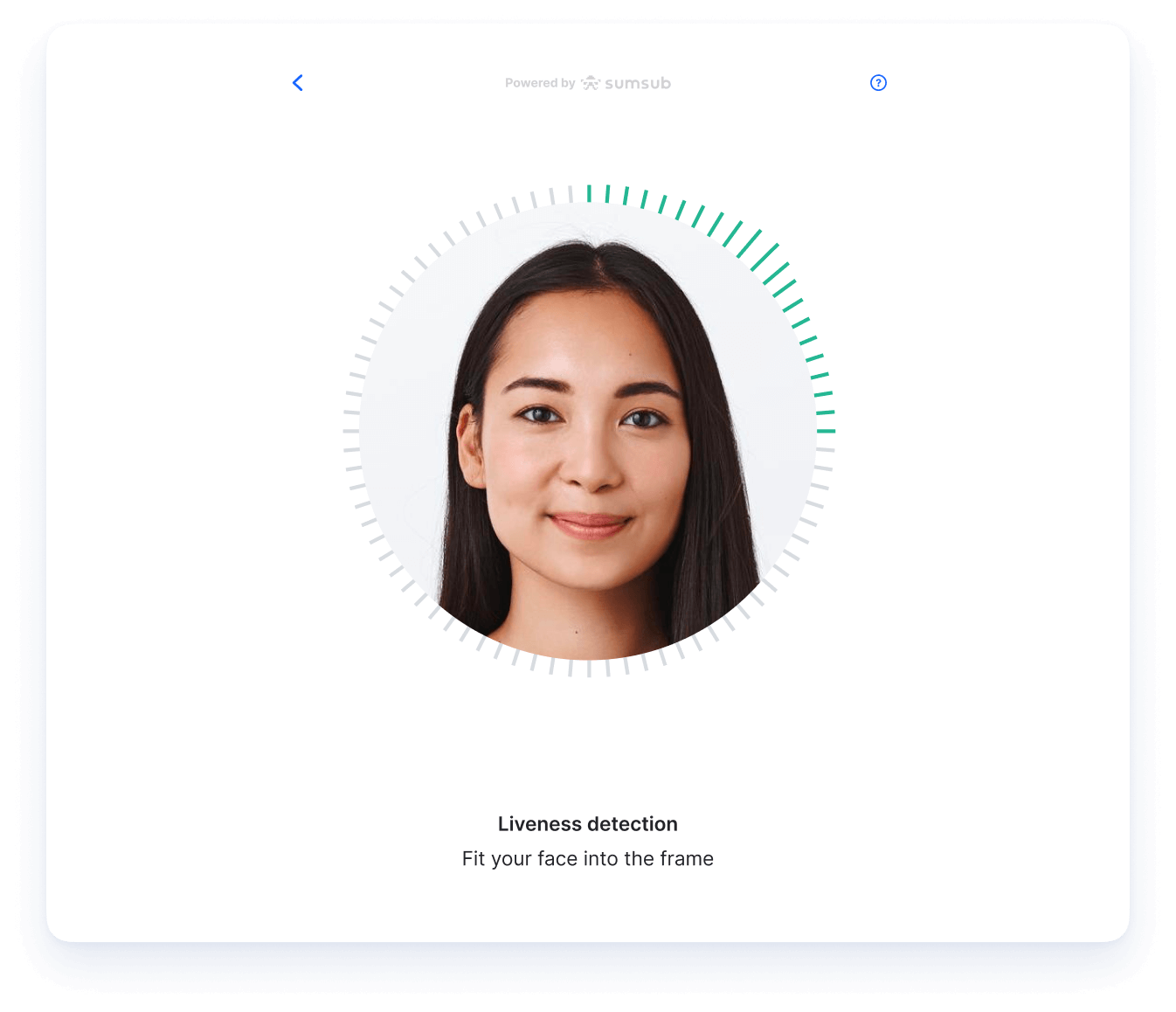

Step 3. Liveness Check

Face the camera and slowly rotate your head in a full circle to complete our liveness verification.

Liveness verification confirms that we are dealing with the document owner, rather than an imposter. Please keep your face within the frame throughout the procedure.

Learn more about what Liveness Detection is and how it works in this article:

Suggested read: Liveness Detection: Choosing a Solution That Won’t Let Fraudsters in

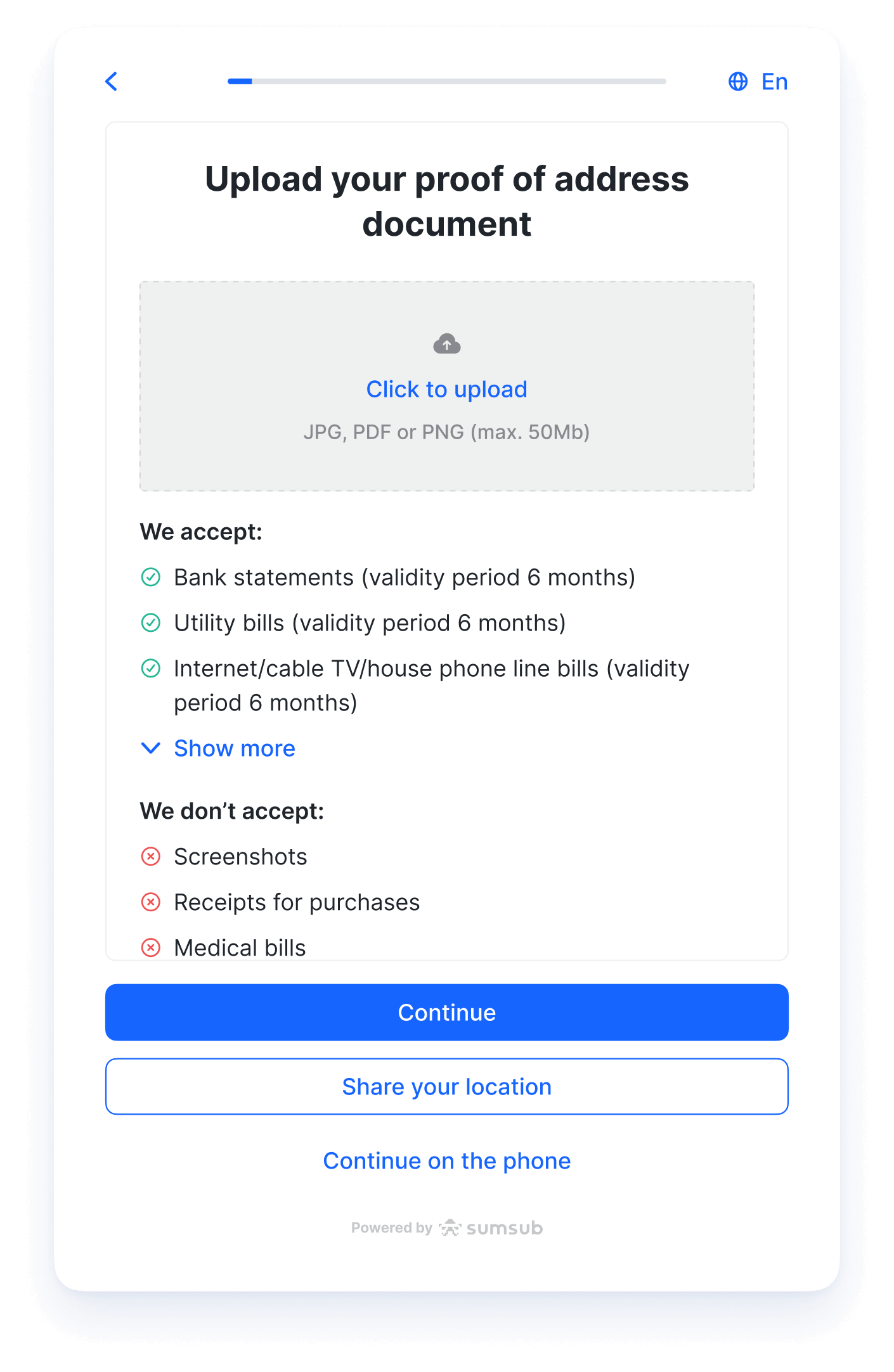

Step 4. Proof of Residence

Submit photos of proof of residence documents for validation—the same way you uploaded your ID document.

When taking photos, please note that:

- utility bills and bank statements must be no older than 3 months and be printed on an official form

- the document must contain your full name (the same as on your ID document)

- all corners of the document should be within the frame, with the address and date of issue legible

- the documents must differ from those used in step 2

Suggested read: Proof of Address in AML Compliance and Fraud Prevention (Step-by-Step Guide 2026)

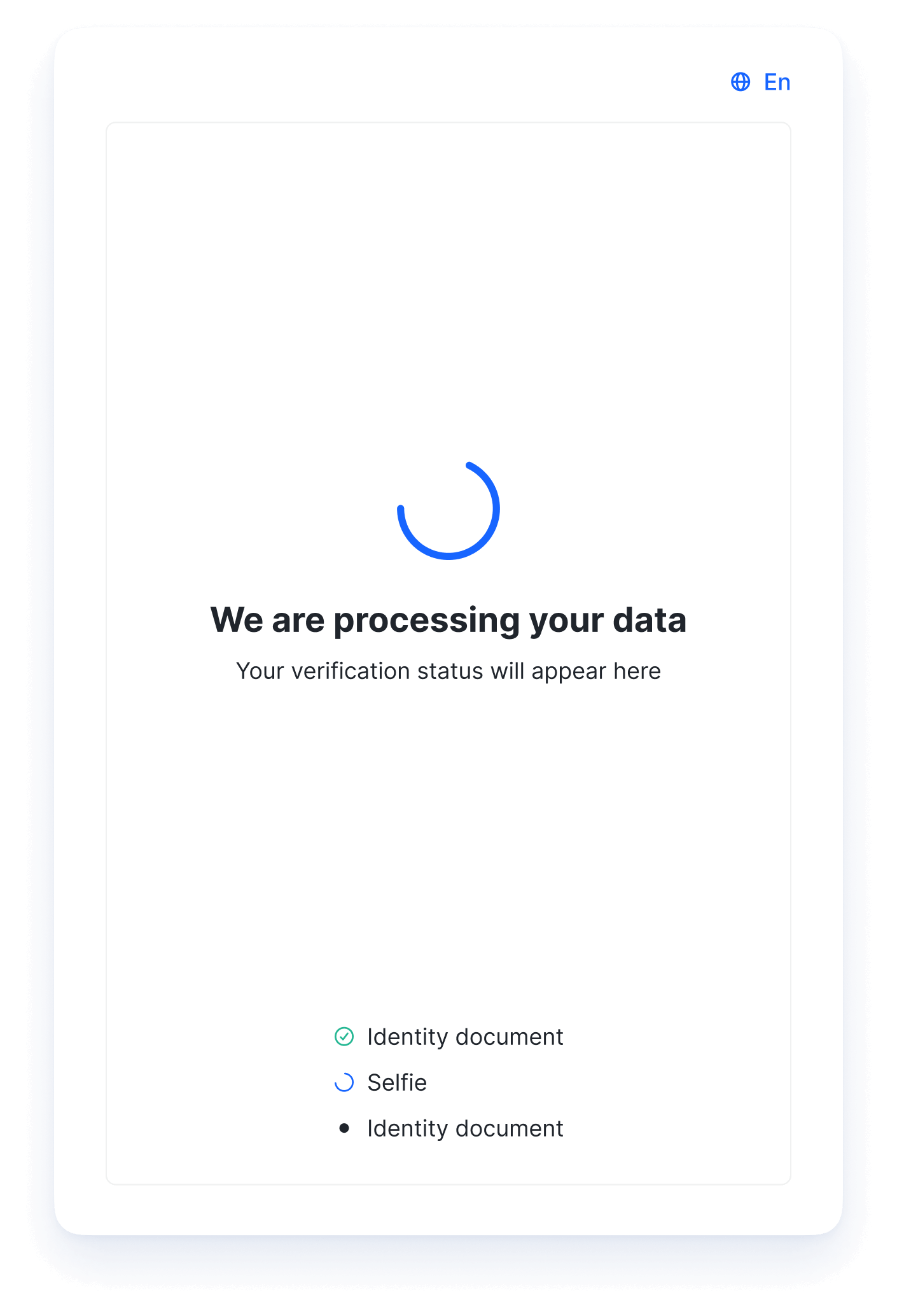

Step 5. Submitting your application

Now you’ll just have to wait while Sumsub checks your data. This won’t take long and the status of your application will be updated automatically. If something goes wrong, you’ll get a message with clear instructions on how to resolve the issue.

Why is KYC important for businesses?

KYC is necessary both for AML-regulated and unregulated businesses to verify the identity of their customers, ensuring they are legitimate and trustworthy. KYC helps prevent fraud, money laundering, and other illegal activities by confirming that customers are who they claim to be. Additionally, complying with KYC regulations protects businesses from legal penalties, license revocation, and reputational harm.

In late 2025, the Reserve Bank of India (RBI) imposed a monetary penalty of ₹91 lakh (approx. USD 11,000) on HDFC Bank for deficiencies in its KYC compliance and other regulatory areas identified during inspection. The penalty specifically cited failures related to KYC norms, highlighting weaknesses in customer identification and verification processes.

Suggested read: The Biggest Money Laundering Scandals of the Last 10 Years

Since KYC falls under AML requirements, any business subject to AML regulations must perform KYC procedures. Typically, these include financial institutions, crypto businesses, and iGaming platforms that offer their services continuously and without limitations.

However, KYC is also crucial for non-regulated businesses, such as marketplaces and car-sharing platforms. It helps filter out suspicious individuals and risky suppliers.

For business clients, it’s also crucial to conduct a “Know Your Business” procedure.

Suggested read: Understanding KYB and How it Relates to KYC (2024)

KYC best practices in 2026

Best practices for KYC include:

- Creating a compliant AML framework. This should be a detailed written document covering every step of your AML processes, including KYC.

- Appointing a compliance officer. An experienced compliance professional can ensure your processes are compliant and appropriate for your organization.

- Taking a risk-based approach. This means tailoring the KYC process and ongoing monitoring to the level of risk for financial crime that individual customers pose, which will be determined during KYC. Simplified Due Diligence can then be used for low-risk customers and Enhanced Due Diligence for high-risk customers.

- Carrying out effective training. All staff should have regular training on their AML responsibilities, including in relation to KYC processes. This helps to ensure no weak links and that there will be the maximum possible number of people able to spot potential issues.

- Employing appropriate technology. Technology is critical for modern KYC, offering benefits including automation to speed up processes, reduce workloads, and cut costs while improving compliance. Increasingly, AI-powered KYC tools are providing the gold standard for modern processes.

- Keeping accurate records. Accurate recordkeeping is a regulatory requirement and is key to tracking customer behavior over time. It can also provide crucial evidence if signs of possible financial crime are uncovered and during audits. Automated recordkeeping using AI tools can make this much faster and more accurate while reducing workloads.

- Arranging regular independent audits. This can show whether your current practices are compliant with regulations and identify any areas for improvement.

KYC challenges in 2026

⚠️ Challenge: Sophisticated fraud and synthetic fake IDs

Fraudsters are increasingly able to bypass basic KYC controls using advanced techniques such as synthetic identities, which combine real and fabricated information to create profiles that appear legitimate. These identities can pass static document checks and database lookups, especially when stolen or recycled data is involved. As fraud tools become more accessible, traditional, single-layer KYC approaches are no longer sufficient to reliably distinguish real users from high-quality fakes.

Suggested read: AI Fake IDs and the New KYC Risk

💡Solution: Level up your KYC tools

To address this, KYC must evolve into a layered, technology-driven process. Modern KYC solutions combine advanced document verification with AI-powered liveness detection to confirm that a real person is present during onboarding and to resist spoofing methods such as deepfakes, masks, or injected images. When paired with biometric matching and ongoing risk assessment, this layered approach significantly reduces the effectiveness of synthetic identity fraud while maintaining a smooth onboarding experience for legitimate users.

⚠️ Challenge: Customer use of AI agents

A growing number of people are now using autonomous AI agents to help them carry out various tasks, including dealing with their finances. Common uses for AI agents include executing transactions and making trades. While this can be perfectly legitimate, the speed with which AI agents work and the potential for the people using them to remain anonymous can create an increased risk of fraud and financial crime.

💡Solution: AI Agent verification

Regulated businesses are advised to adopt Know Your Agent (KYA) protocols as part of their verification framework. Sumsub’s first-of-its-kind AI Agent Verification tool enables businesses to link AI agents to verified human identities, reducing the risk of fraudsters operating anonymously.

Suggested read: From AI Agents to Know Your Agent: Why KYA Is Critical for Secure Autonomous AI

⚠️ Challenge: Onboarding friction

Passing KYC verification checks can be frustrating for customers when businesses poorly manage the process. If KYC is slow and cumbersome, customers can be put off and may choose not to continue.

💡Solutions: Automated KYC, Reusable KYC, and Non-Doc Verification

Automated KYC using AI-powered tools can make the process much faster. For example, Sumsub’s KYC verification takes just 20 seconds on average. Reusable KYC can also help by allowing companies to share customer verification data, so customers do not need to verify their identities every time they open an account with a new business.

Sumsub ID allows users to create a profile, upload their ID documents and pass a liveness check, get verified, and then share this data with different services. This avoids the need to repeatedly upload documents for each service you use, while also making verification 50% faster on average.

Non-Doc verification offers another way to reduce onboarding friction. Instead of uploading documents, users can be verified through alternative means, such as checking their personal information against trusted databases. This can make onboarding faster and less effort for customers.

⚠️ Challenge: Resource gaps

KYC can be resource-intensive, especially when relying heavily on manual processing. This can be a particular concern for businesses that are looking to scale rapidly, as resource gaps can lead to delays in verifying customers, creating friction during onboarding, and the potential for customers to give up and go elsewhere.

💡Solution: Automated KYC and Case Management

AI-powered automated KYC tools can reduce manual workloads and enable dynamic resourcing, allowing additional capacity to be quickly accessed to meet demand. Advanced Case Management tools that automate much of the process of investigating potential signs of financial crime can also significantly reduce KYC teams' workloads.

⚠️ Challenge: Variable standards of ID around the world

Many different types of ID exist, including passports, driving licenses, and national ID schemes. What anti-fraud measures they use and how effective these are vary considerably, so it is important to make sure KYC processes account for this. Failure to do so could lead to an increase in identity fraud due to inadequate verification of unfamiliar ID types.

💡Solution: Choose a KYC verification service with comprehensive coverage of different ID types and alternative verification options

A good KYC verification service should offer compatibility with a wide range of ID types, including all of the ones commonly used in the countries where you operate. Sumsub does support verification for 14,000+ identity document types worldwide, and its AI-powered verification is designed to handle this scale efficiently, including document authenticity checks, data extraction, and fraud detection.

The capacity to use alternative verification methods, such as non-document verification, can also be a significant advantage.

⚠️ Challenge: Customers with no or limited banking history

Around 1.4 billion adults worldwide remain unbanked or underbanked, which can make traditional risk assessment during onboarding difficult due to the lack of financial history.

💡 Solution: Risk-based KYC using alternative verification signals

Instead of relying on banking records alone, modern KYC solutions use a combination of document verification, biometric checks, liveness detection, and device and behavioural signals to assess risk. This allows organisations to onboard customers with limited financial footprints while maintaining compliance and fraud prevention standards.

How to save on KYC costs

To save on KYC costs, businesses can consider the following strategies:

- Automate the process: Implement automated KYC solutions that use advanced technologies, such as artificial intelligence and machine learning, to streamline the KYC verification process. This reduces the need for manual intervention, saving both time and labor costs.

- Outsource to providers: Partner with a reliable third-party KYC service provider that specializes in efficient and cost-effective KYC identity verification, and adopts the latest technologies and approaches, such as Reusable Verification or Non-Doc. They can offer scalable solutions that are usually more economical than maintaining an in-house team.

Your KYC cost will depend on multiple factors, including extra features like questionnaires, the level of support, and more. In Sumsub’s case, you can start with as little as $1 per online KYC verification.

Sumsub offers you a full-cycle verification solution that not only verifies users during onboarding, but also provides ongoing monitoring and Periodic Verification. According to our internal research,70% of fraud happens after the onboarding stage. Therefore, constant monitoring is crucial to prevent fraud, money laundering, and financial losses.

Moreover, you can adjust the platform according to your needs, set up verification logic with no code, and achieve the highest pass rates.

FAQ

-

What is KYC verification?

KYC verification is the process businesses use to confirm the identities of their customers and determine what level of risk they pose for financial crime, such as money laundering.

-

How long does online KYC verification take?

20 seconds is the average verification time with Sumsub.

-

Is KYC verification safe?

KYC verification is safe for businesses and their customers as long as the correct processes and reliable technical solutions are used. Risks such as regulatory non-compliance, failure to spot fraudsters, and data breaches can all be effectively managed with the right framework and staff training.

-

How does KYC address verification work?

There are three main options for customer address verification during KYC: document-based, non-document-based, and geo-based. Document-based address verification relies on customers providing copies of secure documents such as tax bills, utility bills, and bank statements. Non-document-based address verification involves checking a customer’s given address against trusted databases. Geo-based address verification is performed by checking the geolocation data of the device a customer is using.

-

What does a KYC verification service include?

What is offered by a KYC verification service will vary depending on the service provider. Key things to look for include reliable automation, which can make KYC faster, less labor-intensive, and cheaper, as well as robust tools covering ID Verification, Liveness & Deepfake Detection, Proof of Address Verification, and AML Screening. You will also want to ensure that your KYC verification service is compatible with the languages and regulatory regimes of the countries where you operate. Ultimately, you need a service that is tailored to your needs and gives the best chance of achieving and maintaining regulatory compliance.

-

How can I pass KYC verification?

In order to pass KYC, users usually need to upload an ID document (except in countries where Non-Doc verification is already accepted and compliant) and pass a liveness check.

Relevant articles

- Article

- Jan 28, 2026

- 9 min read

- Article

- 1 week ago

- 13 min read

How to check if a company is legit: a step-by-step guide for businesses and consumers covering registrations, licenses, reviews, and scam warning sig…

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.