- Sep 20, 2022

- 3 min read

The 2022 FIFA World Cup is Coming—How Major Sporting Events Affect Bookmakers

Whether it’s the World Cup, Olympics, or the Super Bowl, major sport events bring much-desired traffic to betting platforms. But with increased traffic come more fraudsters.

Major sporting events have always attracted criminals. In 2021, at the Tokyo Olympics, hackers launched half a billion cyberattacks against organizers.

Criminals target everyone from organizers to viewers, and betting platforms are no exception. It’s easier for criminals to blend in among honest users, as platforms might pay less attention to proper verification when dealing with high traffic loads.

Read further to learn what to expect during the upcoming 2022 World Cup and how to avoid threats.

Traffic surges

The 2022 World Cup in Qatar is likely to be the most watched in the tournament’s history, with 5 billion viewers expected according to FIFA President Gianni Infantino. Of course, some of these viewers will want to place bets.

The 2018 World Cup saw €136 billion ($155 billion) bets placed worldwide. This year, that number is likely to be even higher due to the expected volume of viewers. Also, American fans will also throw their hats into the ring, as more and more states legalize betting following the removal of a federal ban.

Based on our experience with traffic spikes from previous major sporting events, we expect to see a traffic surge of over 400% at bookmakers during this World Cup.

As user traffic increases and verification takes more time, it might be tempting for betting platforms to cut some corners. This is especially true for those bookmakers used to performing manual verification, which can take more than 24 hours in regular circumstances, let alone during major events.

Bookmakers know that if verification takes too long, users will go to competitors. And so they might be willing to sacrifice verification accuracy in favor of speed. However, these sorts of compromises inevitably lead to regulatory sanctions. For instance, the owner of Ladbroker received a UK largest-ever £17 million ($20.6 million) fine after failing to enforce player safety and anti-money-laundering measures.

Fraud spikes

Fraud is on the rise in the gambling industry. In Q1 2022, fraud was up 50.1% compared to Q1 2021. There also was an 85% increase in fake account registrations compared to Q4 2021. We expect that the coming World Cup will attract even more fraudsters.

The list of fraud schemes that bookmakers experience is extensive:

- Arbitrage betting;

- Multi-accounting;

- Identity theft;

- Account takeover;

- Money laundering;

- Affiliate fraud.

Know Your Enemy: We’ve prepared an interactive guide to help you get to know gambling fraudsters and how to stop them. Check it out here.

Cybersecurity threats

Major sporting events and hacking go hand in hand—and the bigger the event, the more mischief it attracts. These can be individual hacker groups looking to make a quick buck or politically-oriented groups wanting to steal sensitive information.

Cyber attacks range from hacking game broadcasts and CCTV cameras to stealing the personal data of athletes, organizers, and viewers. For instance, at the 2020 Tokyo Olympics, hackers leaked the personal data of the event’s ticket holders and volunteers. During the Beijing Winter Games 2022, the official anti-Covid-19 application was found to be spying on athletes.

Bookmakers are also at risk, as they deal with a large volume of personal data. Therefore, extra attention should be paid to gathering and storing user data securely, as well as increasing the overall hack-resistance of the platform.

How to avoid threats while enjoying high traffic

During major sporting events, the challenge for bookmakers is to onboard users without reducing pass rates, all while staying AML compliant and maintaining security.

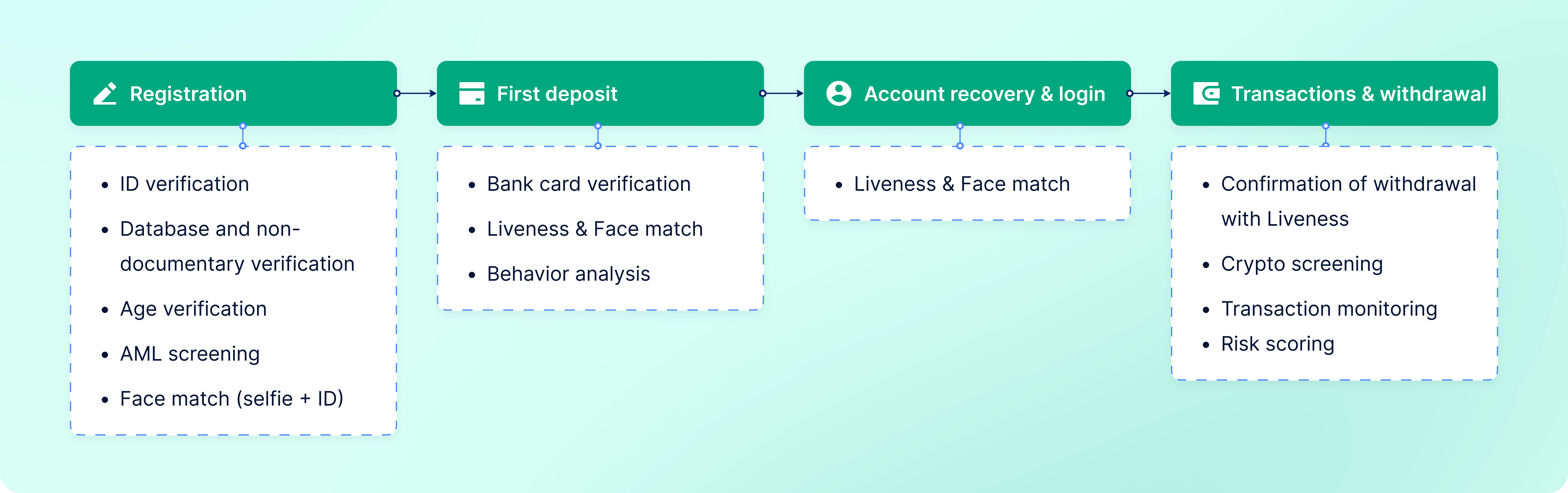

The solution is to build an automated verification flow that allows users to onboard easily and go through enhanced checks only where and when they truly matter.

Above is a list of checks that bookmakers can employ at each stage of the customer journey. Here are a few suggestions on how to make this flow even smoother:

Request a minimal number of checks at registration. When a user signs up for the first time, platforms can limit verification procedures to collecting names and verifying phone numbers or email. This way, the user gets acquainted with the service and is more motivated to go through the full verification procedure when they actually want to place a bet.

Introduce simplified due diligence. For low-risk users, bookmakers can introduce a simplified check using one document—if it contains both identity and address information. This lets users avoid uploading additional documents to verify their address, thereby increasing pass rates.

Add additional verification checks when users make their first deposit. This could include bank card verification and face recognition to ensure that the true bank holder is making a deposit.

Introduce face recognition to avoid fraud. Doing this at the registration stage fights back against multi-accounting. Adding it when users log in or recover their account ensures that fraudsters can’t hack in. And it’s perhaps most critical to employ at the withdrawal stage, where the most fraud tends to occur.

Adding these checks to the flow can reduce verification time and still guarantee security. For instance, CopyBet switched from manual verification to Sumsub’s automated solution, and reduced their medium onboarding time to 1.6 minutes and time-to-value from 24 hours to 10 minutes—all while eliminating fraud.

Relevant articles

- Article

- 3 days ago

- 7 min read

Everything you need to know about the #1 defense against fraudsters and money launderers.

- Article

- 1 week ago

- 7 min read

Why both businesses and end users need to know if they’re dealing with a legitimate company.