- Feb 16, 2022

- 3 min read

How Can Banks Benefit From Facial Biometrics Solutions?

What can businesses do to increase customer conversion while lowering regulatory costs and security risks?

In recent years, the use of online and mobile banking has increased, while more and more physical branches have shut down. In 2021 alone, as many as 1.9 billion individuals actively used online banking services. That same year, the six largest UK banks—Santander, Lloyds, Halifax, HSBC, NatWest, and Barclays—confirmed the closure of over 300 branches.

As the world shifts to online banking, digital security has become a top priority for banks and their customers. In the past, SMS passwords, pin codes, and single-factor authentication seemed to be enough. But nowadays, cybercriminals are using more sophisticated methods, such as spoofing and bypassing. Accordingly, banks now need to implement more robust security solutions.

Old-school authentication methods (like passwords and pin codes) have proven easy targets for today’s hackers, but facial biometric verification (liveness) is a different story. This article details how liveness proves most secure—all while bringing together speed, security, regulatory compliance, and better user experience.

What is liveness?

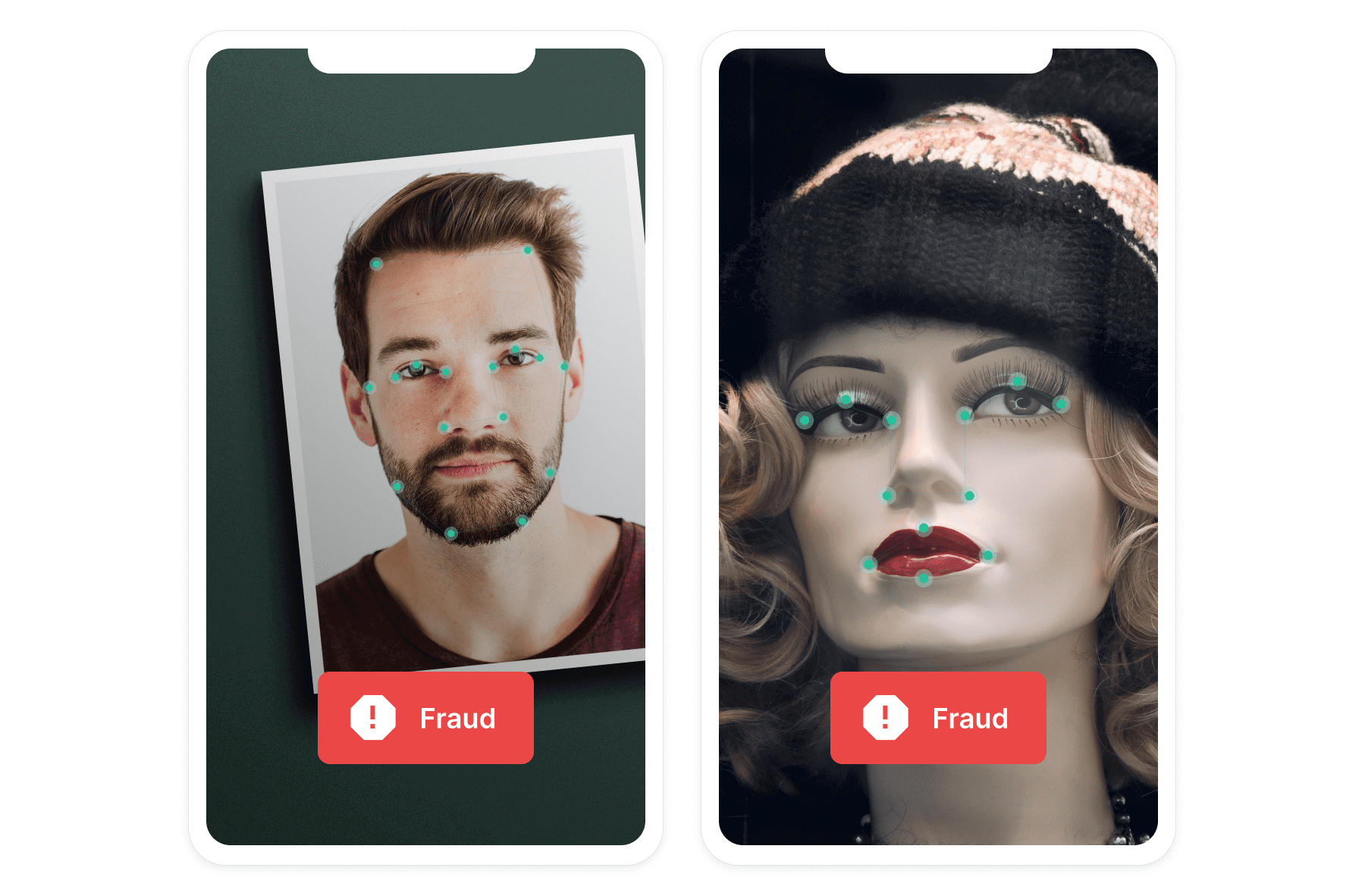

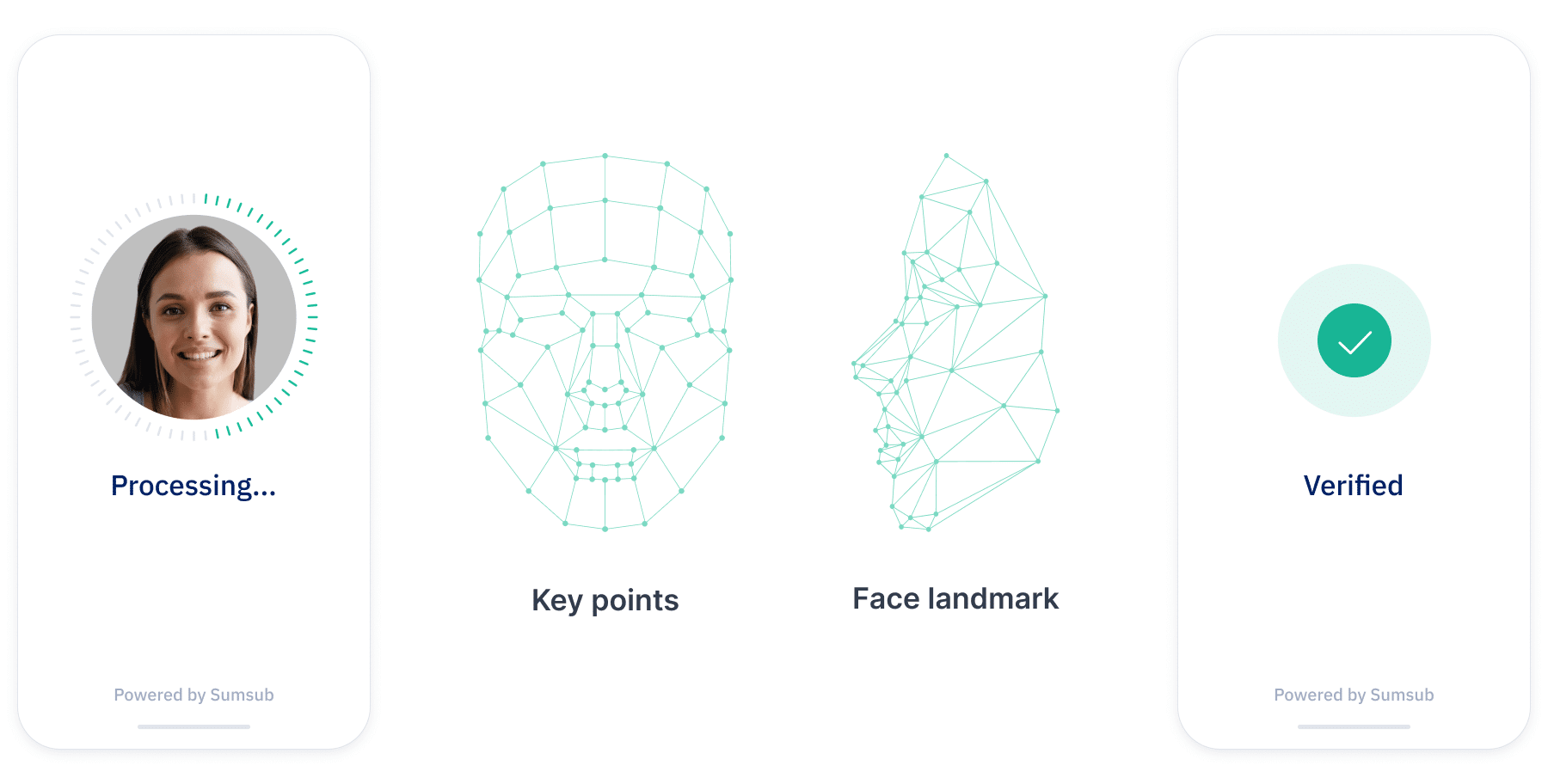

Liveness is a biometric facial recognition technology that helps businesses ensure that users are truly present during identity checks. The technology determines if a user’s face is genuine (rather than a mask, video, photo, or other forms of impersonation) by:

- shielding for the depth and texture of images;

- detecting natural emotions and muscle movements.

Liveness detection technologies determine whether the scanned face is genuine

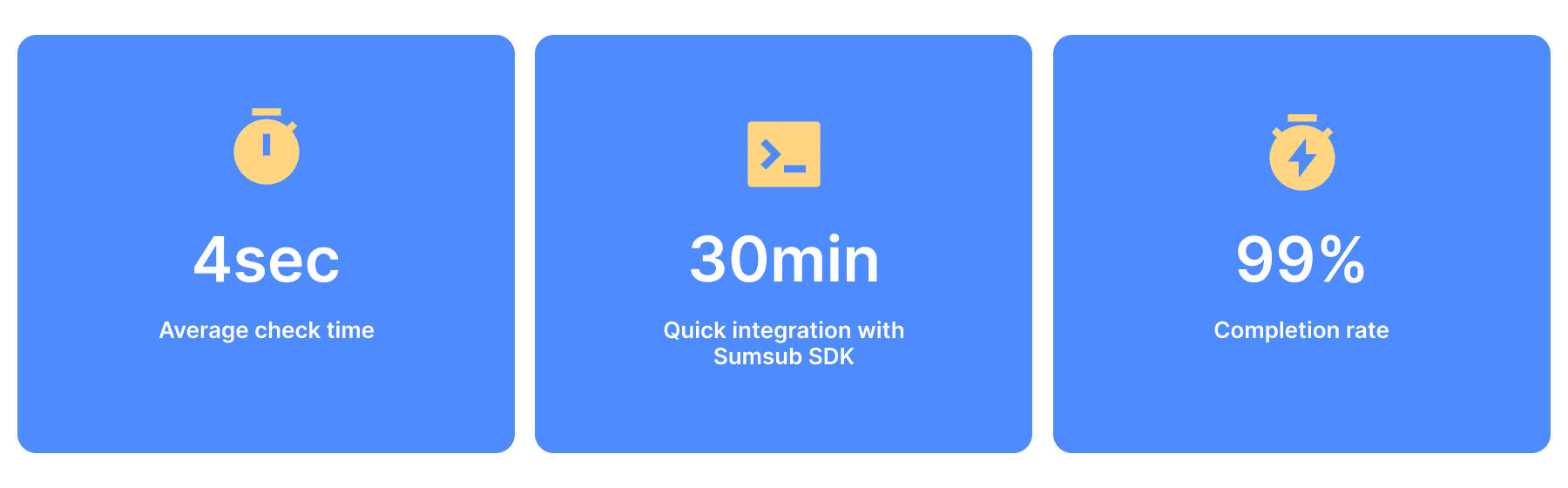

Sumsub’s in-house liveness solution authenticates users’ faces by asking them to quickly move their heads on camera. The technology is GDPR-compliant, ensuring the safety of all biometric data processed. Security is further enhanced by iBeta testing under ISO/IEX 30107-1 and regular penetration tests. This means that the solution encrypts any customer data transmitted during the check, preventing replay attacks.

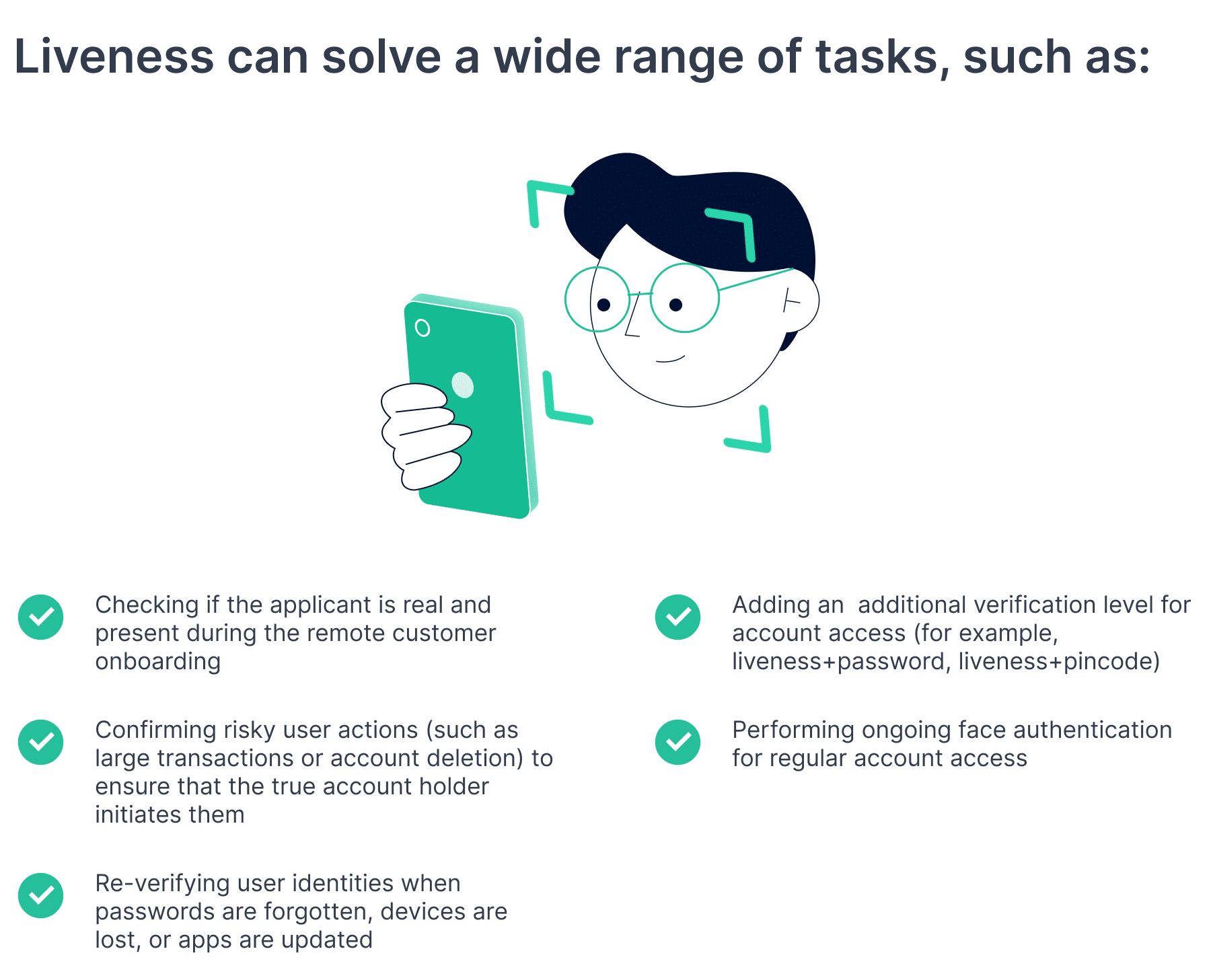

When can liveness help?

Liveness helps with customer onboarding and providing safe and streamlined access to existing accounts.

Talk to our experts and learn how facial biometrics can take your business to the next level.

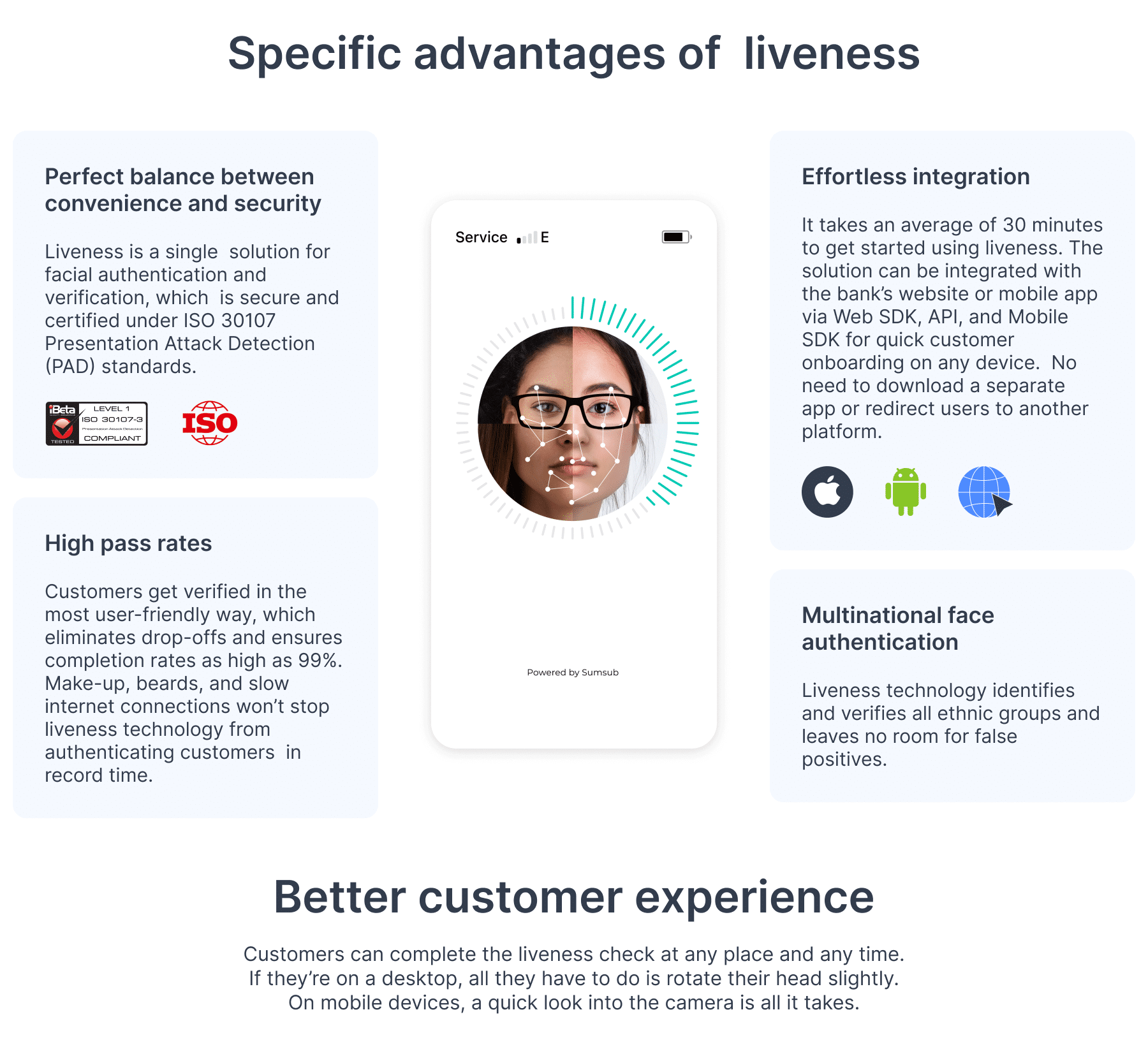

Liveness solution advantages

Benefits for businesses and customers

Liveness can be used as a separate solution—either for ongoing face authentication or as part of KYC/AML procedures. This can help regulated banks with:

- staying compliant with AML regulations;

- onboarding customers quickly and effortlessly;

- performing continuous customer checks.

Also, Sumsub’s Liveness prevents forced face authentication. In other words, the system detects visible signs of coercion and violence and will reject such cases. This could include situations when the user is physically held by other people during the liveness check.

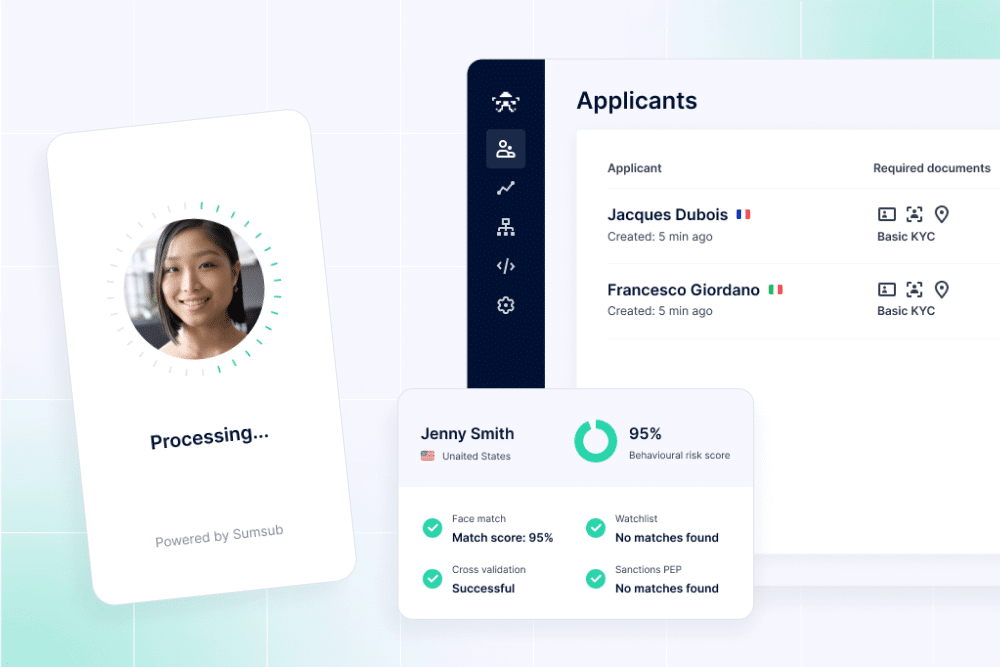

Customer journey

To pass the check, all users need is a working web or mobile camera. They need to follow the brief instructions that appear on the screen:

1. Position your face to fit the frame;

2. Rotate your head while looking straight into the camera.

After the user’s data is accepted, the authentication status will update automatically. If there are no low scores on facial recognition or positive hits against the blocklist, the customer passes the check.

The liveness solution deals with biometric data as follows:

- Automatically recording a short video of the customer’s face and taking six random photos.

- Creating a 3D face map of the customer’s face to be used for authentication.

- Matching the customer’s 3D face map with the picture on their submitted ID document.

- Cross-checking the customer’s 3D face map with faces listed on a blocklist of known fraudsters.

In the digital age, online banking should be safe and easy. The same should be expected from the solutions banks use to verify their customers. That’s why liveness solutions are based on biometric authentication, which is specifically designed to prevent duplicate accounts—and, by extension, account takeovers.

With greater security, also comes greater convenience. Thanks to liveness, banks can eliminate the need for additional equipment and human operators, thereby significantly reducing costs. Meanwhile, clients benefit from a secure authentication method that takes just 2-4 seconds to complete on any device, all while forgetting about outdated security protocols like passwords, pin codes, and visits to physical branches.

If you can spoof our liveness solution, we’ll make sure to recognize your efforts.

Relevant articles

- Article

- 2 weeks ago

- 9 min read

- Article

- 6 days ago

- 6 min read

What counts as proof of address in the UK? See accepted documents and how to open a bank account if you’ve just moved to the country.

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.