- Jul 15, 2024

- 4 min read

Guide to Digital Document Verification for Compliance and Fraud Prevention

Learn the essentials of online document verification to ensure your business is fraud-proof.

According to the 2023 Industry Research Co Report, the global Digital Identity Verification market is expected to reach USD 29,261.94 million by 2028, underscoring the escalating importance of this technology. Online document verification not only supports compliance with Know Your Customer (KYC) regulations but also provides critical protection against identity fraud, which have significantly increased in recent years. According to the Sumsub Identity Fraud report 2023, the the percentage of fake IDs in developing countries has risen by an average of 163%, while the percentage of fake passports has increased by an average of 147% making the introduction of anti-fraud technologies a top priority in modern business environment. Let’s dive into the document verification process and see advanced solutions which will help your business combat the identity fraud trends.

What is document verification?

Document verification is the procedure of checking that an ID or a supporting document, provided by a user, is genuine, hasn’t been altered and truly belongs to them. This is a crucial part of an onboarding process which includes identification—verification—authentication.

Document checks help to reduce the risks related to identity fraud, comply with local regulations, and avoid financial and reputational losses.

Suggested read: Fraud Detection and Prevention—Best Practices 2024

How does document verification work?

Document verification typically involves checking the document against several criteria:

Authenticity: Verifying that the document is not forged or altered.

Validity: Ensuring the document is current and has not expired.

Integrity: Confirming that the document has not been tampered with.

Cross-Referencing: Information provided in the documents may be cross-referenced with other documents or sources to detect any inconsistencies or discrepancies.

Ownership: Verifying that the document belongs to the person presenting it. Such technologies as Liveness & Face Match allow to verify a user's identity online, substantially lowering the risk of identity fraud.

Note: In case when a document doesn’t include a photograph, a supporting document is required.

Document verification use cases

Let’s look at the most common situation where document verification is required:

- Identity confirmation required during client registration stage

- Banking/Financial operations

- Legal and Compliance

- Employment

- Other cases

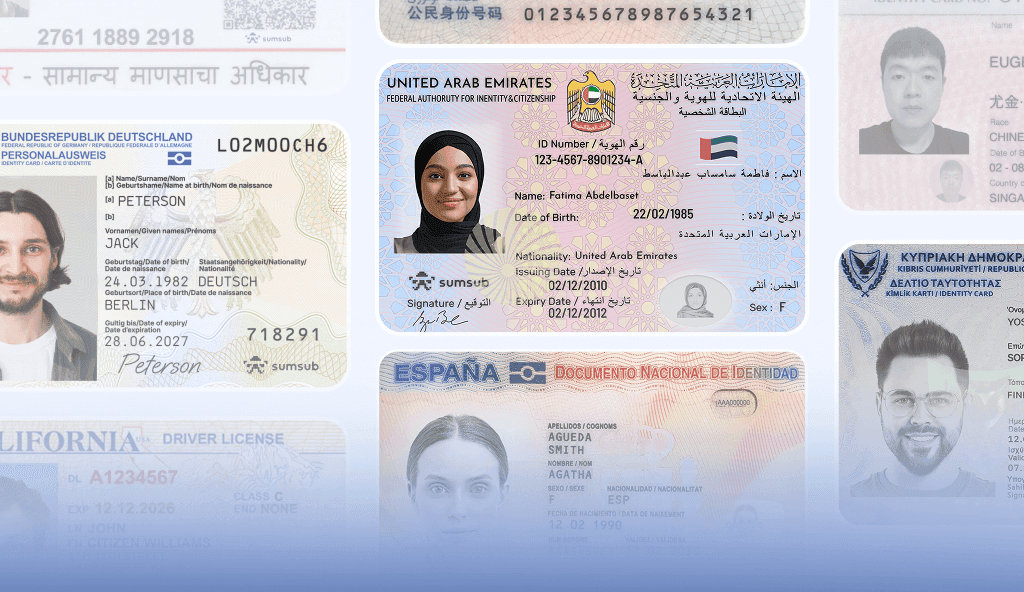

Generally, the key documents to be verified are the personal identity documents. Most commonly accepted ID documents are:

Passports: International travel documents that also serve as proof of nationality.

Driver’s licenses: Official documents permitting specific types of vehicles to be driven.

National ID cards: Government-issued identity cards used to validate personal details.

Social Security cards: Used primarily in the US to verify an individual’s identity for social security services.

Note: Every jurisdiction has its own types of documents valid for identity confirmation. For example, UK citizens can prove the ID with a firearm/shotgun certificate. Therefore, every case must be considered individually, according to the jurisdiction it falls within.

Banking

Verifying identity in banking and financial operations, such as opening accounts or processing loans, the documents used are:

Bank statements: Used to verify financial stability and proof of address.

Credit card statements: Similar to bank statements, used for verifying financial details.

Tax returns: Important for verifying income details and tax compliance.

Utility bills (electricity, water, gas): Commonly used to prove a person's residence.

Lease agreements: Contracts that can be used to verify an address and the terms of tenancy.

Source of Wealth documents such as property ownership documents: Titles and deeds that prove ownership of property.

Legal

For legal and compliance purposes:

Criminal background checks: Verify whether an individual has a criminal record by accessing official and/or public databases

Immigration documents: Such as visas or green cards, which prove legal status and work eligibility.

Birth certificates: Verify age and citizenship.

Court documents: Useful in legal situations to verify involvement and outcomes in legal proceedings.

Employment

For the cases of authenticating work permits, educational qualifications, and professional certifications the documents are:

Employment contracts: Verify terms of employment and the legitimacy of the job offered.

Pay slips: Proof of employment and financial earnings.

Educational certificates: Diplomas, degrees, and certifications verifying educational qualifications.

Professional licenses: Documents that prove a person is qualified to perform a specific profession.

Online services

Document verification services may also be required in cases such as registering on online marketplaces for buyer or seller verification, providing proof for trading platforms, gambling platforms or for traveling purposes.

Suggested read: Fraud and Money Laundering in E-commerce: How Proper Identity Verification Can Prevent It (Guide 2024)

Steps of document verification

Step 1. Collection: Documents are collected via uploads.

Step 2. Analysis: Documents are checked for visual authenticity signs, data consistency, and any tamper-evident marks. The system accurately extracts the data in all major languages, including Chinese, Korean and Japanese.

Step 3. Verification: Data extracted from documents is cross verified against external or internal databases.

Step 4. Decision: A conclusion is made whether to accept, reject, or flag the document for further review.

The Sumsub document verification service is able to capture and validate over 14 000 documents from 220+ countries, including government-issued IDs, utility bills, driving licenses, residence permits, etc.

Types of document verification

There are three most widely spread document verification types:

- Manual

- Automated

1. The traditional method of authentication is manual verification. Is it conducted by human operators who review, cross-reference and compare the information from copies to the original documents. This method is more time consuming, carries increased operational costs, there is more room for human error and may therefore be inefficient.

2. Automated verification uses software to scan, read, and verify documents through digital means. This technology is key to accurate document validation services and lowers the risk of human error.

How to automate document verification?

To automate document validation, integrate AI-based verification software that can process images and data quickly and accurately. This often involves:

- Implementing OCR (Optical Character Recognition) to extract text

- Using AI to assess authenticity features like watermarks or holograms

- Setting up APIs to cross-reference information with multiple databases and establishing close partnership to ensure real-time access to the data.

How long does document verification take?

The duration can vary significantly:

- Manual verification may take from a few minutes to several hours, depending on complexity.

- Automated document verification systems can process documents in 30 seconds, making them suitable for real-time applications.

- Document-free verification may also only take several seconds to complete. Sumsub’s Non-Doc verifies users in 4.5 seconds on average by requiring minimal user data and authentication steps.

Tools for document verification

- Optical Character Recognition (OCR) is an AI-powered technology that captures complex data of different types of documents, such as scanned papers, PDF files, or images captured by a digital camera, and converts into editable and searchable data.

- Pattern Recognition involves the identification and interpretation of patterns in data. It uses machine learning algorithms to recognize patterns in the visual features of documents. It helps identify and authenticate various security features such as logos, watermarks, or even the specific layout characteristic of certain documents like passports or driver’s licenses.

- Machine Readable Zone (MRZ) Decryption involves reading encoded data, which is usually found on official travel documents and some IDs and consists of two or three lines of encoded data that can be read by a machine.

Relevant articles

- Article

- 2 weeks ago

- 11 min read

Learn what KYC is and the steps users should take to onboard smoothly.

- Article

- Jan 15, 2026

- 8 min read

AI-generated fake IDs are bypassing traditional KYC: learn why businesses need to rethink their identity verification in 2026.

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.