- Spotlight

- Nov 19, 2025

Can Reusable ID Change Onboarding Forever?

In this post, Kat Cloud, Head of Government Relations at Sumsub, talks about reusable IDs and how they could impact onboarding in the future.

If you’ve ever had to upload the same passport photo and proof of address again and again for different apps, you know how frustrating digital onboarding can feel.

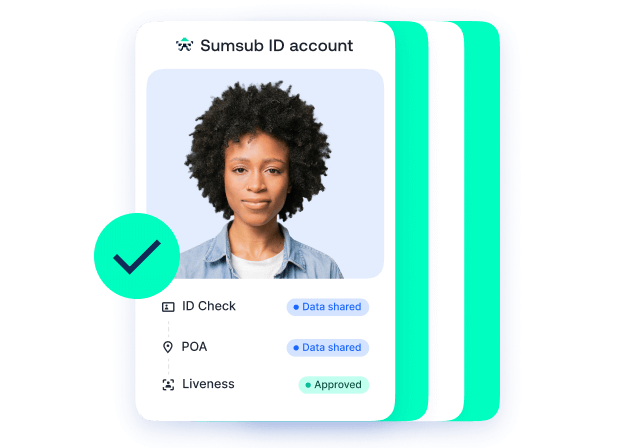

Reusable identity makes this hassle easier because, once you’ve proven who you are, that verified identity will travel with you—from your bank to your trading platform to your digital wallet—without ever having to compromise privacy or compliance. That’s the promise of reusable digital identity. This kind of solution could finally make digital onboarding easy, secure, and sustainable.

At Sumsub, we verify millions of users every month for businesses worldwide. We’ve seen firsthand how much time and trust are lost when people repeat the same KYC checks across platforms that all follow the same regulatory rules. The question is simple but profound: can reusable ID change onboarding forever?

We believe it can—but only if technology, regulation, and business incentives work together.

The great onboarding bottleneck

In the last ten years, digital verification has changed from something few people used to something essential. Every fintech, crypto exchange, and neobank must verify users before granting access. These checks are key for fighting fraud and meeting AML requirements, but they also create friction.

Our internal data shows that nearly one in three users verified through Sumsub already completed an identical process elsewhere. For them, re-verification is like déjà vu, and for businesses, it’s just wasted effort. Every redundant check costs money, makes drop-off rates higher, and frustrates legitimate users who just want to get started with the process.

Globally, financial institutions spend over $500 million annually on KYC compliance, and onboarding can take up to weeks for corporate customers. What I find interesting is that all these institutions are trying to answer the same question:

Is this person who they say they are?

Reusable identity changes that model because it allows users to “verify once and share everywhere.” Once verified, a user’s credentials can be securely reused (with their consent) on multiple services, which makes for faster onboarding and lower compliance costs.

Reuse is already here, and growing fast

Reusable identity is no longer just a distant concept, as it once was.

In Europe, the EU’s eIDAS 2.0 regulation will be implemented in 2026. It will allow for digital wallets to store verified credentials and work across countries. Estonia, Denmark, and Spain are already testing these models. Companies like Sumsub, Signicat, ID-Pal, and others are creating systems that can meet these rules and prioritize privacy.

According to research, the global digital identity verification market will exceed $20 billion by 2030, mainly based on reusable models.

At Sumsub, the Reusable Digital Identity suite lets verified users use their identity on any platform that works with Sumsub. It is based on three main ideas: user consent, ensuring compliance, and working well with other systems. This approach has shown clear benefits: it cuts onboarding times in half, increases pass rates by 30%, and significantly reduces compliance costs.

Everything is coming together. For reusable IDs to change the onboarding process everywhere, policies need to change alongside technology, and that rarely happens quickly enough.

The policy challenge: Trust and accountability at scale

When identity moves between organizations, trust must move with it. This creates difficult but solvable policy questions.

- Compliance continuity. A verified credential still needs to meet the AML and KYC rules for each new service. This means keeping clear records, using up-to-date information, and validating details without making users resubmit their documents.

- Data ownership. Reusable ID must be user-centric. The individual, not the platform, controls when and how their verified identity is shared. Consent should be explicit and reversible.

- Avoiding identity monopolies. For reusable IDs to work well, they need to be connected and not isolated. Open APIs and standard formats should allow different vendors and regions to work together easily.

- Shared liability. If a reused credential later proves fraudulent, there must be clear accountability among the verifier, the holder, and the relying party.

These are not obstacles; they are plans to build trust. With effective systems in place, reusable ID can actually strengthen compliance instead of reducing it.

A shared responsibility

Technology providers like Sumsub can set up the necessary systems, but it’s up to regulators to establish safety guidelines. Policymakers and industry players can take action now in these ways:

- Integrate reusable verification into AML/KYC frameworks. This lets verified credentials from accredited providers be reused across different institutions with equivalent assurance levels.

- Mandate user-centric consent. Give users transparent control over when and where their verified identity is shared.

- Promote interoperability through open standards. Encourage technical schemas that make credentials portable across borders and platforms.

- Define liability tiers. Establish rules for the responsible handling of outdated or compromised credentials, similar to existing data protection laws.

- Foster sandbox environments. Allow providers and regulators to test reusable ID systems together before having the public rollout.

The future: Trusted once, then trusted everywhere

Reusable identity changes how trust works online. It makes identity verification a shared service instead of a one-time task. This shift helps everyone, including users, businesses, and regulators, to benefit from it.

For users, it unshackles them from endless document uploads.

For businesses, it helps with faster growth and fewer compliance costs.

For regulators, this means a clearer and auditable picture of digital identity flows.

I believe the future of onboarding is checking users once, checking them right, and enabling them to move securely everywhere.

Reusable digital identity, such as Sumsub ID and other solutions, can indeed change the way onboarding works forever. Achieving that vision demands technology, cooperation, openness, and trust.

When that happens, the next time you sign up for a service, you won’t have to start from scratch. You’ll simply be recognized—safely, immediately, and on your own terms.

Relevant articles

- spotlight

- Nov 27, 2025

- spotlight

- Sep 25, 2025

In this article, Louie Vargas, Founder of the Network for Financial Crime Prevention, speaks about risk-based AML and its benefits.

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.