- Jun 02, 2022

- 6 min read

Video KYC: the Requirements and the Benefits

In Germany, Switzerland, Liechtenstein, Estonia, and other jurisdictions with strict regulatory requirements, selfie-based solutions may not enough for AML compliance.

This leaves video identification as the most viable and sometimes the only available option for carrying out KYC in these regions.

What is video KYC?

Know Your Customer (KYC) is the process of identifying and verifying customers. Identification means gathering a customer’s personal data; verification means checking that this data is accurate. Businesses carry out KYC procedures to understand the purpose and intended nature of a business relationship or transaction, build risk profiles of their new customers and perform other due diligence measures.

Video identification, or “video KYC,” allows users to confirm their identities in a live video interview with an identification operator. This process can be performed either by a third-party service provider or by identification operators employed by the business. Video identification steps may differ based on the user’s risk profile, but usually include the video interview itself, AML screening and document. verification.

Who needs video KYC?

The types of entities obligated to perform video KYC differ by jurisdiction. For instance, regulatory authorities in Germany identify the following as requiring video KYC:

- credit institutions;

- financial services institutions;

- payment institutions;

- e-money institutions;

- e-money agents;

- investment management companies, branches of EU management companies, and foreign Alternative Investment Fund (AIF) management companies;

- insurance providers;

- cryptocurrency service providers.

Find out how video KYC solutions help businesses scale. Contact us today.

Where is video KYC needed?

National AML laws often include video KYC requirements either as an obligation or as an option for high-risk customers and transactions. The jurisdictions in which video identification may be used for KYC include:

- Canada

- Malaysia

- Singapore

- India

- Estonia

- Lithuania

- Latvia

- Austria

- Ireland

- Liechtenstein

- Germany

- Malta

- Switzerland

- Spain

- Portugal

- Luxembourg

- Hungary

- Netherlands

- Slovakia

- UK

- Romania

- Poland

- Belgium

- France

- Greece

- Slovenia

For example, video identification is a must in Germany and Estonia. In Germany, this type of verification is required during customer onboarding. The requirements and details are set by BaFin, Germany’s financial regulator. Here are some of them:

- identification can be conducted only by specially trained staff;

- video identification must be conducted in real-time and without interruptions;

- end-to-end encrypted channels for video chat must be applied to ensure safety and privacy;

- the need for high-quality images for the employee to check the provided ID document and its optical security features.

Businesses failing to comply with AML requirements may face fines, license revocation, seizure of assets, and even criminal liability.

In case you need a detailed guide on BaFin, find it here:

A (Very) Big Breakdown of BaFin’s Requirements for AML & KYC

Video KYC procedure requirements

Below are common requirements for video identification of persons in non-face-to-face business relations. Please note that these may differ by jurisdiction.

Here is a typical step-by-step procedure:

- Prerequisites for a successful interview with the user

Users should prepare the following identity documents and means of identification:

- ID document: ID card/residence permit card/ driving license/another identity document (for foreign citizens—a valid document issued in their respective country, etc.);

- web camera and microphone;

- quality internet connection;

- web browser.

The organization/service provider should be ready with the following:

- trained employees to conduct video identification;

- means of conducting video identification in real time and without interruption.

Also, it’s necessary to check the quality of connection from both sides to ensure the transmission of clear, recordable and reproducible synchronized sound and image, which is sufficient to understand the transmitted content clearly.

2. Consent

At the beginning of the video interview, the user provides explicit consent to the entire identification process as well as to photos or screenshots of them and their identity document being taken. This consent is recorded.

3. Verification of documents that establish the following:

- For natural persons:

- full name;

- date of birth;

- citizenship;

- place of birth;

- residential address;

- activity profile;

- purpose and nature of the business relationship;

- connection of the person’s economic or family interests with a certain country;

- expected volumes of the services used by the person in similar cases;

- the beneficial owner (if another person benefiting from the person’s economic activities), if any;

- whether the person is a politically exposed person etc.

- For legal or appointed representatives of legal entities:

- business name;

- registry code;

- location and places of operation, including branches located in foreign countries;

- the entity’s legal form;

- legal capacity, lawful and contractual representatives;

- beneficial owner(s) and, if appropriate, whether they are politically exposed persons;

- economic connections with a certain country;

- contracting states of the European Economic Area and third countries;

- most important business partners;

- activity profile;

- main and secondary areas of activity;

- purpose and nature of the business relationship etc.

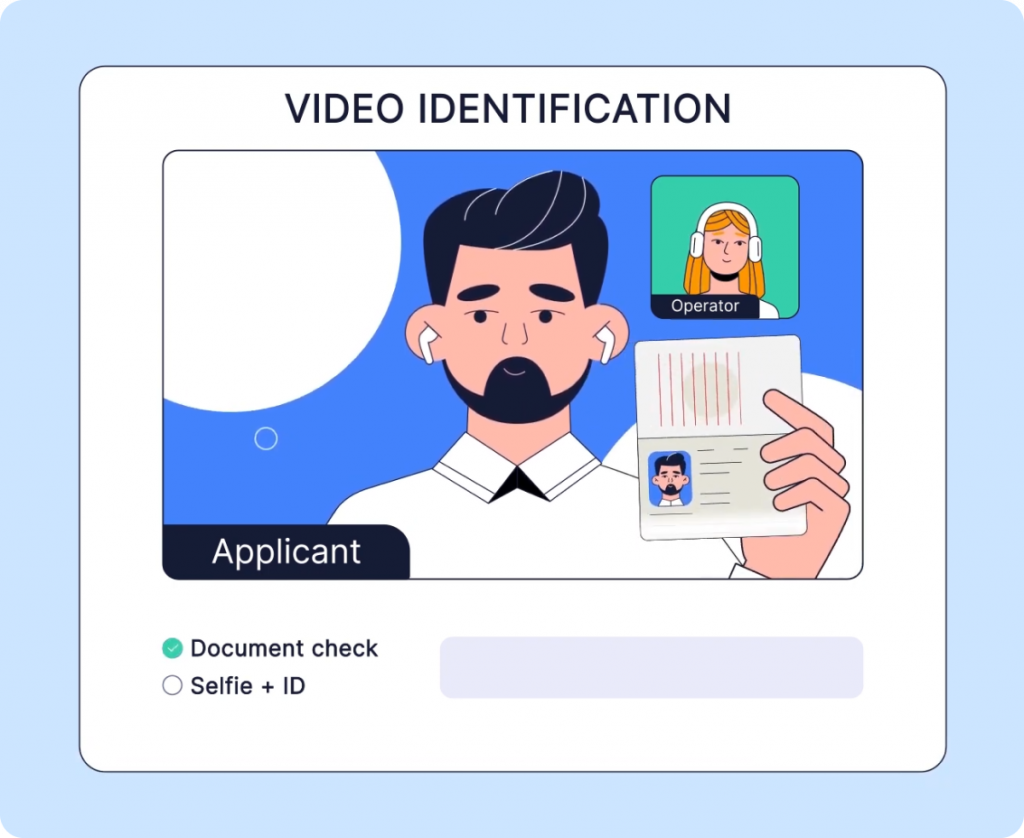

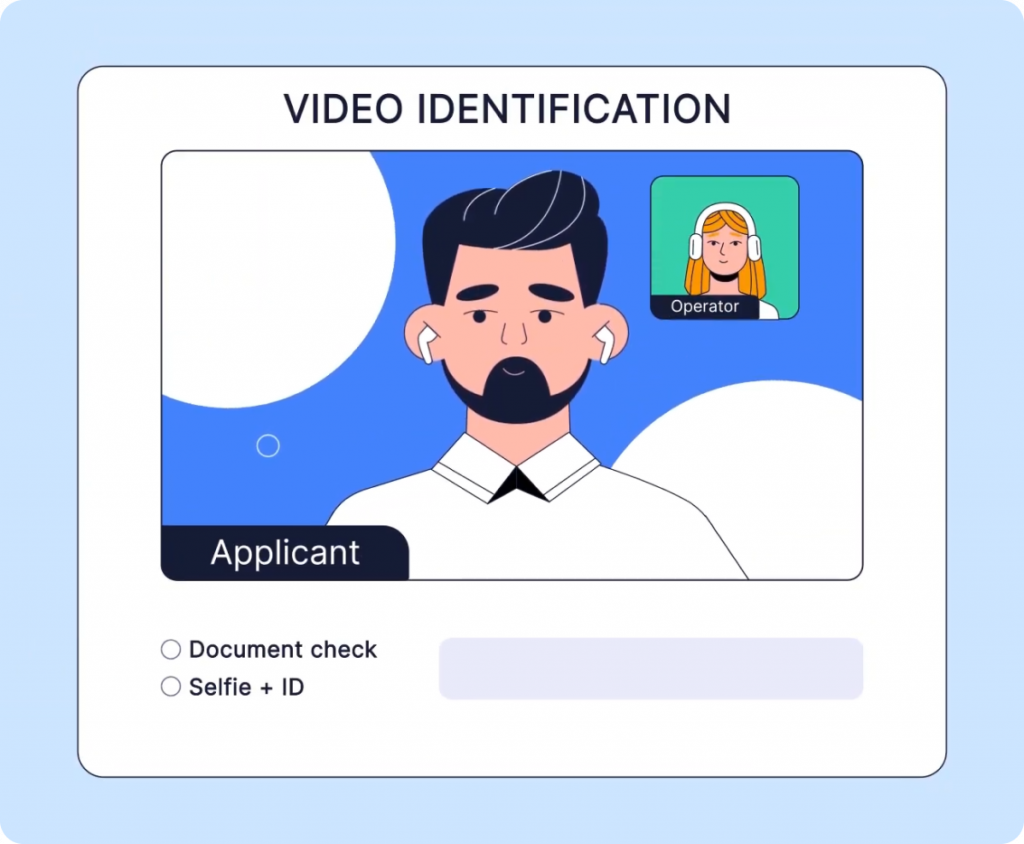

4. The user’s video identification interview

The interview process may differ depending on the regulatory requirements, but there are common steps, such as:

- Checking the identity document

Users demonstrate their identity document (and other documents if needed) in front of the camera and upload them via the dashboard. The system and operator assess the document and ask to carry out additional procedures if necessary.

Document evaluation criteria:

- all features are visually identifiable in white light and accessible for the purposes of inspection (e.g., layout, number, size and spacing of characters, as well as typography);

- integrity and lack of manipulation (such as a photo being physically attached to the document) are verified;

- the date of issue and the date of expiry of the identity document match (i.e., the date of issue is not in the future);

- the period of validity of the identity document presented is checked (does not contradict the standards for identity documents of this kind);

- the orthography of the digits, authority code and typefaces used are examined to ensure that they are correct.

- Verification of the user to ensure that the photo and other data contained in the identity document match the user.

During the video identification process, the user’s head and shoulders should be:

- visible and framed;

- clear of shadows;

- uncovered;

- clearly distinguishable from the background and other objects;

- recognizable.

The user may be instructed to:

- change their position and place themselves and the document in the frame;

- remove items covering their head or face, i.e. glasses;

- answer specific questions assessing the reliability of the submitted documents, covering the following information:

- user’s date of birth / date of incorporation of the legal entity;

- user’s address / location and place of business of the legal entity;

- user’s residential address / business location and places of operation of the legal entity;

- purpose and nature of establishing the business relationship.

5. Recordkeeping

Depending on the jurisdiction’s AML rules, it may be required to record and retain the entire video identification process, including all of its individual steps. Retention of both visual and sound recordings is required in accordance with the user’s consent.

This data may be kept for several years (depending on the jurisdiction) in accordance with recordkeeping requirements.

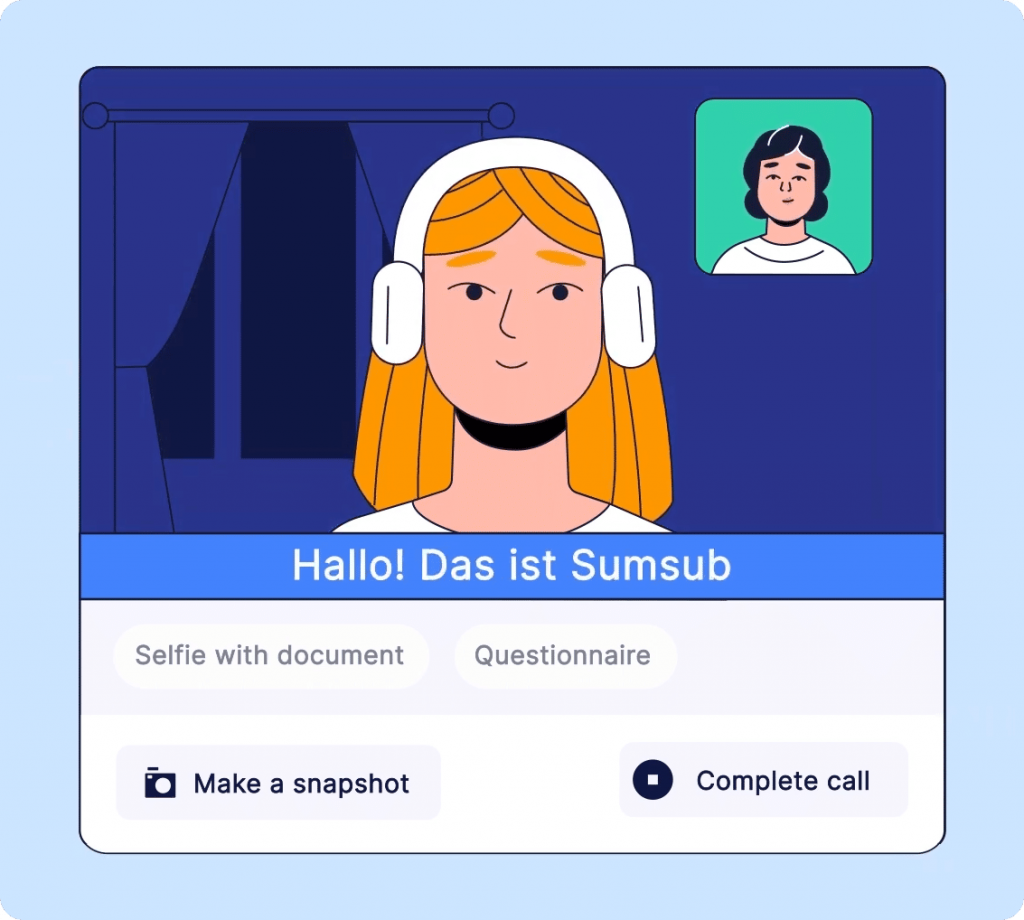

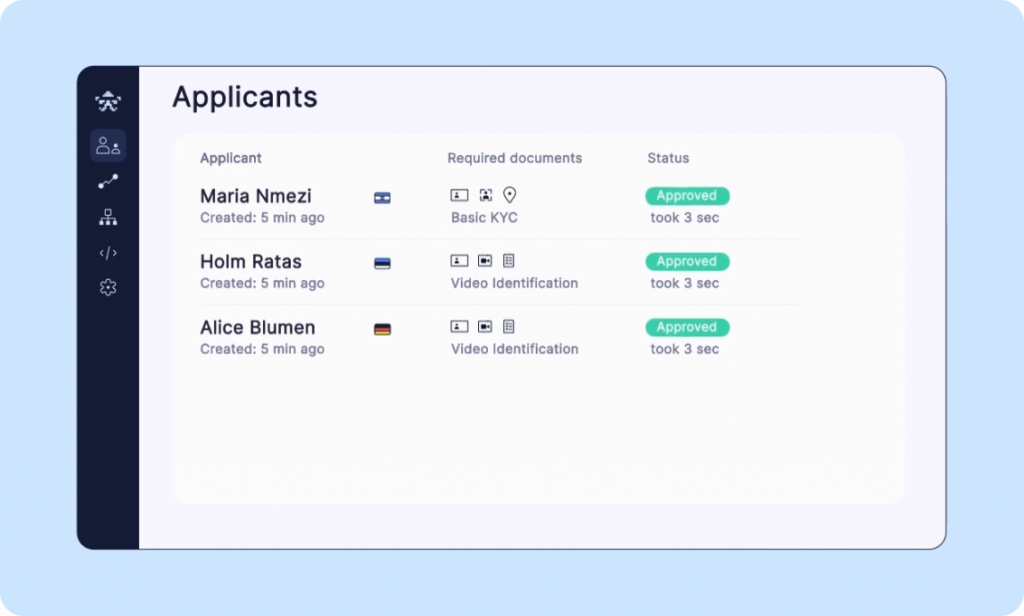

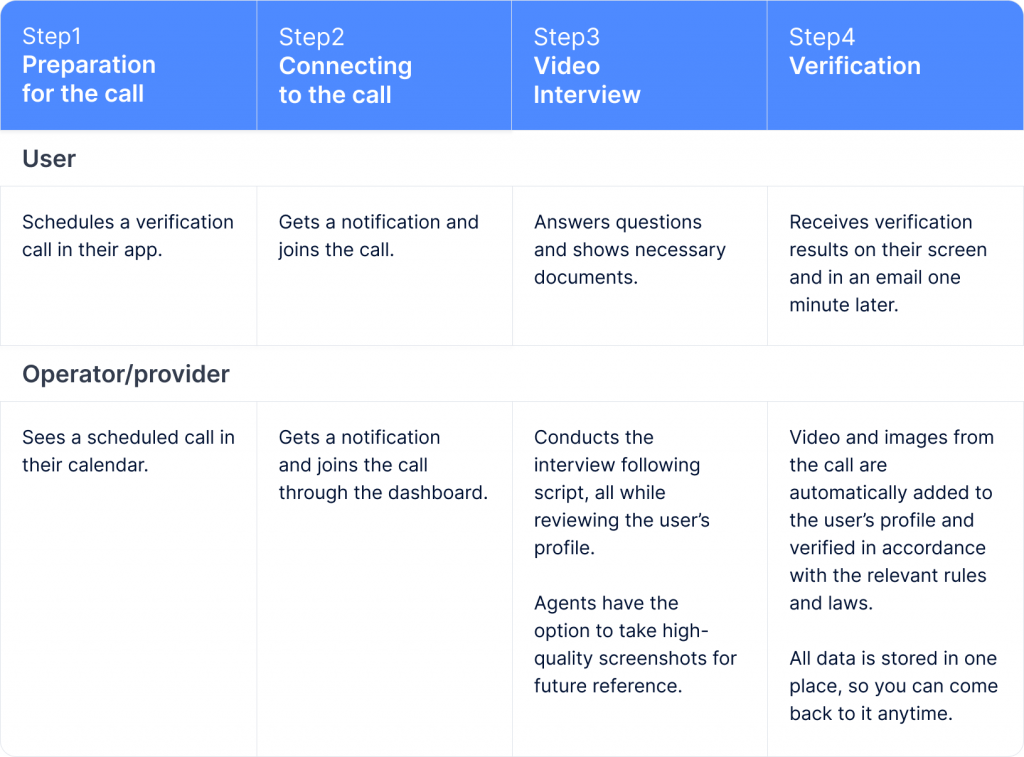

Video KYC, while complicated, can still be smooth and comprehensible with the right solution. Sumsub covers all the regulatory requirements in a 4-step process and onboards users in just 3-5 minutes.

Sumsub’s Video Ident Process

There are two ways to use Sumsub’s Video Identification solution:

- Integrate the Video Identification Platform only. This is an option for businesses to conduct proper video verification by combining their in-house operators with Sumsub’s Video Identification platform. The Sumsub team will be there to provide helpful tips, best practices, and template scripts.

- Delegate it all to Sumsub’s experts.This end-to-end option is tailored to the needs of the company. Trained operators onboard honest users, deny fraudsters, and ensure the required level of compliance. They conduct interviews in English and German 24/7/365.

How businesses benefit from automated Video KYC solutions

Digital video KYC is a complex procedure but it still can help businesses to onboard users remotely and securely. And even though it requires more than standard doc+selfie verification, all-in-one digital KYC solutions can ensure compliance with regulatory requirements, protect against fraud and keep conversion high.

KYC/AML regulatory compliance. Regulated industries such as banking need to ensure full compliance with local AML laws. This is to protect themselves from money laundering, terrorist financing and regulatory penalties. Digital onboarding solutions help them to manage all the requirements in a time- and cost-effective manner.

Fraud protection. Online businesses in the E-commerce, peer-to-peer and car sharing sectors are constantly combating fraud. Fraudsters use fake documents and stolen identities to access such services with malicious intent. That’s why more and more businesses count on video identification solutions to ensure that only authorized and real customers are entering their services.

Conversion rate. Businesses are very concerned about losing customers during the onboarding process. Fortunately, video KYC is much friendlier than the manual alternative.

Businesses can decide which users get video-verified according to their risk profile and transaction volumes. This way, they can choose between standard KYC to maximize their pass rates or video KYC if it is legally required or risks are high.

Conclusion

It’s difficult for businesses to find a globally-scalable solution that works for both video and document-based checks. The options might be expensive, bad for conversion, or not flexible enough to set up different kinds of checks for different user groups.

Sumsub’s video identification solution isn't just a tool for automated video checks. It’s a ready-made system that combines compliance expertise, a powerful technological platform, and trained operators.

Contact the Sumsub team to set up a tailored video KYC flow in compliance with your regulations.

Relevant articles

- Article

- 2 weeks ago

- 11 min read

Learn what KYC is and the steps users should take to onboard smoothly.

- Article

- Jan 15, 2026

- 8 min read

AI-generated fake IDs are bypassing traditional KYC: learn why businesses need to rethink their identity verification in 2026.

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.