- Apr 08, 2025

- 6 min read

The 6 Most Popular Forms of Money Laundering in Casinos

This article explains how criminals may exploit casinos for money laundering and highlights practical steps gambling businesses can take to strengthen their defenses.

Gambling is a prime target for money launderers due to its fast-paced environment, high volume of cash transactions, and the potential for illicit funds to be mingled with legitimate gambling proceeds. This makes it easier for criminals to disguise the origins of their funds.

The gambling industry is usually among the top AML-fined industries, following the banking and crypto sectors. That same year, Australian casino Crown received a staggering $450 million fine for violating AML/CTF laws.

Casinos still face challenges in preventing money laundering. The most important step is implementing effective Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) procedures. But this alone isn’t enough—casinos should also identify and address the suspicious activity and various money laundering tactics.

In this article, we explore the six most common types of money laundering in casinos and how companies can stay compliant—helping them avoid financial losses, protect their reputation, and maintain customer trust.

Global statistics on money laundering and fraud in the gaming industry

Fraud in the gaming industry is on the rise. According to Sumsub’s latest Identity Fraud Report, iGaming is among the industries experiencing the highest growth in fraud:

Where there is increasing fraud, there is always a risk of money laundering. This criminal activity has intensified since 2020, with Southeast Asia being heavily affected, according to the UN's 2024 report:

“While casinos and junkets have for years served as vehicles for regional underground banking and money laundering, the proliferation of online gambling platforms, e-junkets, and both illegal and underregulated cryptocurrency exchanges in Southeast Asia has changed the game, allowing for faster anonymized movement of funds. At the same time, the creation and success of these systems have helped expand the region’s broader, booming illicit economy, in turn attracting new networks, innovators, and service providers to the criminal ecosystem of Southeast Asia.”

Suggested read: Money Laundering in Malaysia 2025–How to Comply with New AML Regulations

Money laundering typically involves multiple stages, and casinos can play a role in each of them. Here, let's discuss the classic three-stage model of money laundering and how casinos may be involved.

- Placement: The first phase involves taking cash or other assets obtained through criminal activity and inserting them into the financial system. Often, criminals will deposit large amounts of illicitly acquired money in a way that draws minimal attention, for example by breaking it into smaller transactions or using various financial products. In a casino setting, this can be achieved by converting illicit funds into gaming chips. The main goal is to move funds from direct physical possession into the financial system.

- Layering: In the layering stage, a series of complex transactions is carried out to obscure the illegal source of funds. Criminals might move money through multiple bank accounts, transfer it to different jurisdictions, or mix it with legitimate proceeds from lawful businesses. In a casino environment, this can include moving between various gaming tables, exchanging chips for cash in multiple rounds, or even transferring funds between different casino accounts. By repeatedly changing the form and location of the funds, they make it increasingly challenging for authorities to trace the money back to its criminal origins.

- Integration: The final stage, where the criminally derived funds are channeled back into the legitimate economy, appearing to be legitimate earnings. In a casino environment, this might happen when an individual redeems chips for a check or a bank transfer from a casino - disguised as gambling winnings. The laundered money can be used to purchase assets or to invest in legitimate businesses.

Check out the details of each stage in this guide: The Three Stages of Money Laundering and How Money Laundering Impacts Business.

Let’s explore which tactics criminals usually use.

Popular money laundering schemes

Money laundering can take up different forms at casinos. Below are some of the key examples:

- Cash-in, cash-out

This is the simplest, most typical method of laundering money at a casino, also known as “chip walking”. A criminal simply exchanges money derived from criminal activity for playing chips and then converts them back into cash. This way, dirty money can get mistaken for gambling winnings. Some criminals may also split money into several different accounts, which will make them appear less suspicious. However, the simplicity of this approach also means that it can be easily detected by the authorities. For example, in 2013, a professional gambler was charged with almost $500,000 in illegal financial transactions, which were made through the good-old cash-in, cash-out scheme.

- Peer-to-peer gambling

Two or more colluding players transfer illicit funds by deliberately ‘losing’ chips or awarding big bets to the other. This creates an illusion of legitimate gambling proceeds that disguise the criminal source of the money.

- The Vancouver Model

This method received its name after a real high-profile money laundering case. Between 2008 and 2018, casinos in Vancouver were used to launder large sums of money from China. Since Chinese citizens are restricted from bringing more than $50,000 out of their country, criminal groups in Vancouver offered them a workaround. Instead, they could wire a large sum of money to the Chinese bank account of a Vancouver-based crime syndicate and receive cash in exchange upon arrival to Vancouver. The visitors could then take this cash to a Vancouver casino, make a few small bets, and then withdraw it as “winnings” to appear to look clean.

- Buying someone else’s chips

Criminals offer shady deals to purchase chips from other players or agree to settle gambling debts in exchange for a later payout in chips. This circumvents official oversight of chip sales and disguises the origin of funds.

- Abusing gambling accounts

Some players may use their gambling accounts as means of transferring funds. Abusing casino accounts for money laundering involves players depositing funds, engaging in little or no gambling, and quickly withdrawing the money, often to disguise the origin or movement of illicit funds. Red flags include frequent high-value transactions, low wagering or minimal gaming activity while depositing and withdrawing funds, and cross-border money transfers.

- Combining gambling and non-gambling methods

More advanced criminals further conceal traces of money laundered through casinos by blending it with virtual assets (cryptocurrencies, NFTs), then using it to purchase real estate.

This scheme can work in companies with poor AML/CFT frameworks. A criminal deposits crypto, gambles a bit, and then withdraws funds using a different payment method. The gambling winnings appear clean and can be used as seemingly legitimate money.

Sumsub has already written about money laundering in art and vehicle sales. You can read them to learn more about different types of assets used to launder money.

Red flags of money laundering in casinos

The 2009 Financial Action Task Force report “Vulnerabilities of Casinos and Gaming Sector” identified 25 money laundering red flags:

- Frequent deposits of cash, cheques, bank cheques, wire transfers into casino accounts

- Funds withdrawn from account shortly after being deposited

- Significant account activity within a short period of time

- Account activity with little or no gambling activity

- Casino account transactions conducted by persons other than the account holder

- Funds credited into account from the country of concern

- Large amounts of cash deposited from unexplained sources

- Associations with multiple accounts under multiple names

- Transfer of funds from/to a foreign casino/bank account

- Transfer of funds into third-party accounts

- Funds transferred from a casino account to a charity fund

- Multiple individuals transferring funds to a single beneficiary

- Structuring of deposits/withdrawals or wire transfers

- Using third parties to undertake wire transfers and structuring of deposits

- Use of an intermediary to make large cash deposits

- Use of gatekeepers, e.g., accountants and lawyers, to undertake transactions

- Use of multiple names to conduct similar activity

- Use of a casino account as a savings account

- Activity is inconsistent with the customer‟s profile

- Unexplained income inconsistent with the financial situation

- Transfers with no apparent business or lawful purpose

- Transfer of company accounts to casino accounts

- Use of false and stolen identities to open and operate casino accounts

- The customer name and the name of the account do not match

- U-turn transactions occurring with funds being transferred out of the country and then portions of those funds being returned

- Customer due diligence challenges, e.g., refusal, false documents, one-off/tourist, or passing trade.

- Requests for casino accounts from Politically Exposed Persons (PEPs)

QUIZ

How regulators combat money laundering in casinos

International organizations and national regulators are constantly working on combating money laundering through casinos. That’s why casinos typically have to establish policies corresponding with AML regulations. For example, UK regulators require casinos to take the following measures:

- Develop appropriate AML policies and procedures

- Adopt an effective risk-based approach

- Design an effective AML training programme

- Apply Customer Due Diligence and Enhanced Due Diligence checks

- Conduct regular business risk assessments

- Identify and monitor suspicious activity

- Report any knowledge or any suspicion to a dedicated FIU

- Maintain record-keeping mechanisms

Regulators impose strict requirements on companies to combat money laundering and levy heavy fines for non-compliance. For example, in 2025, an Alderney-based gambling business was fined £1m ($1.3m) after a Gambling Commission investigation revealed social responsibility and anti-money laundering failures.

Explore the nuances of gambling regulations across different jurisdictions:

Crypto Gambling Regulations in the US, UK, and Canada

Gambling in the UK: How to Get Licensed and Stay Compliant

Gambling and Betting in Australia—A Complete Guide 2025

Brazil Gambling Laws and Regulations: What to Expect in 2025?

AML software for casinos

The best AML software for a casino will depend on the size of the casino, its geographical location, and specific regulatory requirements. However, a reliable AML software would offer the following features:

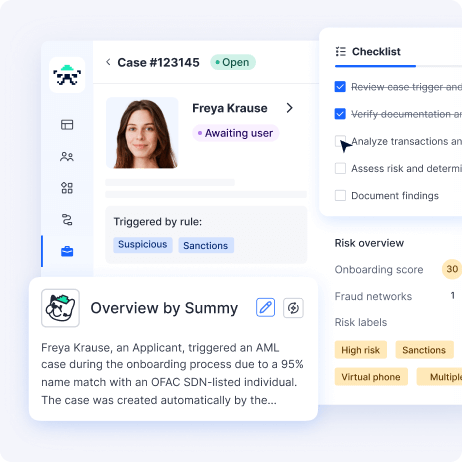

- Real-time transaction monitoring: To detect suspicious transactions as they occur.

- Risk profiling: Categorizing customers based on their risk level and monitoring high-risk behavior.

- Automated reporting: Automatically generating Suspicious Activity Reports (SARs) and ensuring compliance with regulations.

- Data analytics and machine learning: Using advanced algorithms to identify complex patterns that might indicate money laundering.

- Regulatory compliance: Ensuring the system complies with international AML standards (e.g., the Bank Secrecy Act in the US, the EU’s 5th Anti-Money Laundering Directive).

- Integration with casino systems: Ensuring the AML software integrates well with the casino’s existing player management, gaming, and transaction systems.

- Single dashboard: A centralized dashboard provides several benefits that are crucial for efficiency, compliance, and effective risk management in a casino setting.

Sumsub’s iGaming and casino AML software helps gambling businesses comply with regulations and stay fraud-free. Request a demo today!

FAQ

-

How are casinos used for money laundering?

Casinos are used by money launderers due to the simplicity of the money exchange process and the inability of many casinos to track down cash flow. Thus, people can exchange dirty money for chips, play with them for a bit, and then exchange them back for cash.

-

Which method is used to launder money in casinos?

There are five well-known methods of money laundering at casinos:

- Cash-in, cash-out

- Collaborating with another player

- The Vancouver model

- Buying someone else’s chips

- Using gambling accounts as banks

- Combining gambling and non-gambling methods.

-

What is the greatest risk of money laundering for casinos?

Casinos can face a variety of penalties, which might include fines and revocation of a license.

-

What are the red flag indicators of possible money laundering through gambling?

There are many red flags to look for. According to the Financial Action Task Force (FATF), some include:

- Inconsistent activity

- Multiple accounts under the same name

- Multiple beneficiaries sending money to the same account

- Checks issued to family members

- Transactions conducted by persons other than the account holder.

-

How do casinos stop money laundering?

It’s not a simple task to stop the spread of money laundering. However, companies can take measures that will help them stay compliant with regulations and minimize the number of illegal activities conducted through them. These steps include the implementation of adequate internal policies, the introduction of the risk-based approach, customer due diligence, risk assessment, and reporting. The complete guide on how to confront the spread of illegal activities can be found here.

Relevant articles

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.