- Sep 23, 2024

- 3 min read

How to Prevent AI-generated Fraud: Use Cases

Learn about how spot AI-generated fraud

A recent report by the Association of Certified Fraud Examiners (ACFE) and the Institute of Internal Auditors (IIA) highlighted that the global cost of fraud exceeds $5 trillion annually, with AI-driven schemes contributing significantly to this figure. This is because AI is now being used to create more deceptive and convincing fraud schemes. However, the fight against fraud must also leverage AI.

We at Sumsub prepared this article on AI-generated fraud and how to prevent it effectively. .

What is AI-generated fraud?

AI-generated fraud uses machine learning to create highly convincing fraud schemes. The growing sophistication of AI makes such fraud increasingly difficult to detect, requiring advanced AI-driven solutions to combat them effectively.

What types of AI-generated fraud are there?

AI has enabled the creation of novel, more dangerous forms of fraud, such as:

- Deepfakes: Deepfakes are synthetic media in which a person’s likeness is replaced with someone else’s through advanced artificial intelligence techniques, often used to create convincing but false images or videos.

- Synthetic identity fraud: AI can be used to create fake identities by blending real and fabricated information. These synthetic identities are used to open accounts and commit financial fraud.

- Account takeovers: AI automates password cracking and credential stuffing attacks to hack r accounts by analyzing breached data and exploiting patterns.

- Automated scam calls and messages: AI uses natural language processing and voice synthesis to generate automated scam calls and messages that mimic trusted entities, tricking individuals into revealing personal information or making payments.

- Document forgery. AI can be used to create convincing forgeries from any country—and not all IDV providers are able to spot them.

Fighting AI with AI

As AI-generated fraud gets more sophisticated, the methods to combat it must evolve accordingly. The traditional approaches to fraud detection, such as device fingerprinting and rule-based systems, are no longer sufficient in the face of these threats. Instead, businesses must adopt AI-based defenses to stay ahead of fraudsters. This includes:

- Behavioral monitoring: AI can be used to analyze user behavior to spot unusual patterns that may indicate fraud, such as sudden changes in browsing habits or unusual account access.

- Anomaly detection: Advanced AI systems can identify fraud in real time by learning from past incidents, adapting to new threats, and spotting anomalies.

- Predictive analytics: AI can predict where and when fraud is likely to occur, allowing businesses to take preventive measures.

Use case #1: Anomaly detection

Anomaly detections uses AI to analyze over 600 historical data signals to assign weight to each applicant’s action/transaction. This is to pinpoint when an applicant is displaying abnormal patterns of behavior, which may indicate fraud.

Here’s a bit more info about how anomaly detection works: Sumsub gathers data on each client’s transactions (financial data, device information, counterparty details, and more), which serves as a benchmark dataset that all further transactions are compared to. From there, Sumsub then assigns all further transactions an anomaly score, which our clients can act on accordingly. Furthermore, our clients can set up specific rules to automate the measures taken based on these anomaly scores.

Anomaly detection analyzes events without needing preset rules. Over time, companies can create specific rules or use a library of existing rules to enhance the detection process.

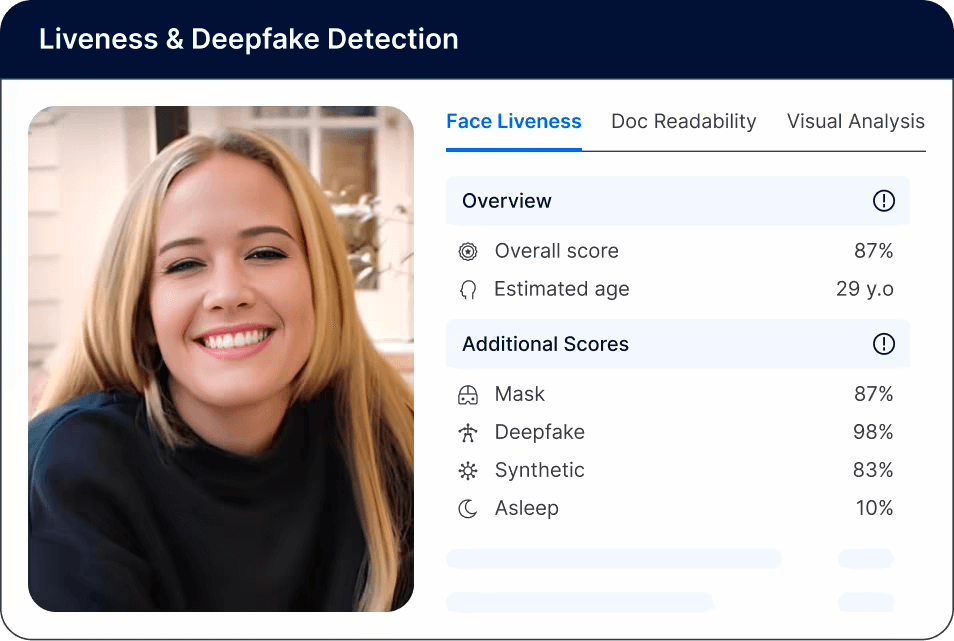

Use case 2: Detecting deepfakes and photoshopped content

As AI-generated fraud becomes more sophisticated, detecting deepfakes and has become a critical challenge. Fortunately, Sumsub’s technologies allow companies to identify these deceptive practices.

- Deepfake Detection: AI-driven deepfake detection involves using machine learning algorithms to analyze video and audio content for signs of manipulation. These algorithms can identify inconsistencies in facial expressions, voice patterns, and other subtle cues that indicate the presence of a deepfake.

- Photoshop Detection: Similarly, AI technologies are being employed to detect photoshopped images.

- Cross-Referencing and Verification: Combining AI with cross-referencing techniques can enhance the detection of both deepfakes and photoshopped content. AI systems can cross-check media against known sources and databases to verify its authenticity.

Use case 3: Fraud network detection

Sumsub’s Fraud Network Detection solution prevents multi-accounting by unveiling connections between accounts. Even if such users leverage VPNs, we can identify their device fingerprint or analyze document photos/selfies.

Conclusion

The battle against AI-driven fraud is a continuous and ever-evolving challenge. As fraudsters leverage AI to create more sophisticated and convincing schemes, it is imperative that businesses do the same to protect themselves and their customers.

AI is both the problem and the solution in this context. While it enables fraudsters to operate with greater efficiency and deception, it also provides the tools necessary to detect and prevent these activities.

Businesses must recognize the importance of adopting AI-driven anti-fraud measures, as traditional security methods are no longer sufficient. By investing in advanced AI technologies, businesses can stay ahead of fraudsters, safeguarding their operations and maintaining the trust of their customers.

Relevant articles

- Article

- 2 days ago

- 11 min read

Check out how AI deepfakes are evolving and discover proven strategies for detecting and preventing deepfake threats to protect your business.

- Article

- 1 week ago

- 9 min read

Discover how airlines prevent fraud through biometric boarding, identity verification, and AI-powered detection, and how to stay protected from trave…

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.