- Spotlight

- Jun 13, 2025

Digital Identity Needs a Rethink: Lessons from the Sumsub Multiverse

In this article, Devie Mohan, co-founder of Burnmark, talks about the discussions on digital identity at Sumsub Multiverse London 2025.

During the Sumsub Multiverse London 2025, I had the privilege of joining a panel titled "Challenges, Technologies, and Opportunities of Digital Identities" alongside industry leaders Marie Austenaa (Head of Digital Identity, Visa Europe), Ilya Brovin (Chief Growth Officer, Sumsub), and Robert Kotlarz (Founding Director, OneID). What struck me throughout our discussion was how rapidly digital identity is evolving—and how urgently we need to rebuild the trust that technology has both enabled and disrupted.

Paper is out—the future doesn’t need documents

One thing that’s become clear in our field is that traditional document-based verification is reaching its limit. Identity cards, passports, and printed proof of address may have served a purpose in the past, but they are constantly being replaced by digital alternatives, and for a good reason.

Document-free verification systems, which use biometric data, device information, and behavioral signals, are simply faster, more scalable, and harder to fake. They’re also much more inclusive. At our panel, we talked about how these methods remove barriers for people who may not have easy access to traditional documents, including displaced individuals, the underbanked, and those in post-conflict zones. Digital identity, when done right, doesn’t just streamline access—it democratizes it.

One identity to rule them all

We’re also seeing momentum behind a more unified approach to identity—what we might call multi-platform trust. Systems like single sign-on (SSO) and identity federation allow people to use one secure digital identity across multiple platforms, without the need to verify themselves over and over again.

The need to upload the same document for every new app or service is more than just a nuisance. This sort of fragmentation is not only inefficient but also a security risk. Reusable identity systems solve this by shifting the burden away from users and placing it in the hands of well-secured, reusable infrastructure. This is especially important for cross-border fintech, online banking, and global healthcare platforms: systems where speed, trust, and compliance all collide.

Suggested read: Digital Identity in 2025: The Complete Guide

Embracing decentralization

A key point raised during our panel (one I personally find compelling) is the move towards decentralized identity systems. These systems return control over personal data to users themselves rather than storing it in vulnerable central databases.

Take the UK’s Self ID and Digital Driving Licences as an example. These programs are ushering in secure, user-controlled IDs that can be used across public and private services. Internationally, we’re seeing fascinating cases as well:

- In Buenos Aires, the local government launched a decentralized identity protocol (QuarkID) within its miBA platform, allowing over 3.6 million residents to control and present their identity credentials with unprecedented privacy.

- Bhutan recently passed the NDI Act to build a fully decentralized ID ecosystem, blending blockchain with government services to put citizens in charge of their own data.

These aren’t just pilot projects—they’re real-world examples of how the identity standard is shifting.

Regulation isn’t slowing us down, it’s speeding us up

While regulators have long supported digital identity in principle, what we’re seeing now is a dramatic shift in the scale and depth of collaboration. Today, governments and regulators are actively encouraging progress in digital identity.

During the panel, we acknowledged the global wave of national digital ID systems: projects that would’ve sounded futuristic just a few years ago. In the UK alone, companies in the digital ID sector have raised over £826 million since 2015, with strong market confidence and regulatory support.

Identity standards are starting to come together on a global scale, which opens up new possibilities for recognizing identities across borders and having shared compliance frameworks. This kind of regulatory clarity is crucial for the fintech and banking sectors and also for areas like public health, education, and really any field where having an identity is key to gaining access.

Your wallet will carry more than cash

The digital wallet of 2025 isn’t just for WePay, Alipay, or Apple Pay. Increasingly, wallets are becoming the personal vaults where individuals store and manage their digital identities.

This is more than a tech trend to us: it’s a sign of deep behavioral change. According to recent findings, 44% of UK consumers expect to use digital wallets for identity-related purposes within the next three years.

Balancing convenience and security is a real challenge for both regulators and innovators. If we get it right, digital wallets could transform into the go-to tool for citizens to interact with the government and the marketplace.

Trust, consent, and control: The road ahead

Digital identity isn’t just about logging in. It’s about belonging. It’s about access. And increasingly, it’s about control.

The future lies in user-centric identity systems that prioritize consent, data protection, and ease of use. Whether we’re talking about government services or decentralized finance platforms, the same truth applies: if people don’t trust the system, they won’t use it. So far, when it comes to digital identity, studies by Juniper Research have shown that over 50% of UK voters support the use of digital ID cards.

At the Sumsub Multiverse, our discussion ended on a shared note of optimism. Yes, the challenges are real—fragmentation, fraud, regulation—but the progress we’ve seen is equally real. If we continue to build digital identity systems that are secure, interoperable, inclusive, and transparent, we’ll unlock a level of access that has never been possible before.

Ultimately, that is what identity is about: not just proving who you are, but helping you get where you want to go.

Relevant articles

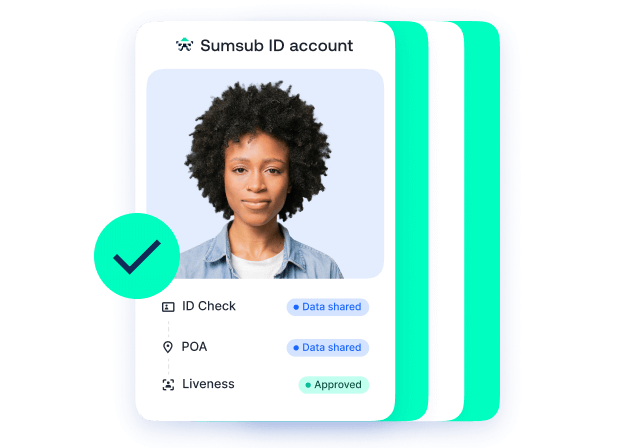

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.