- Jun 24, 2025

- 7 min read

How to Check if a Company is Legit in 2025: A Step-By-Step Guide

Why both businesses and end users need to know if they’re dealing with a legitimate company.

It’s becoming increasingly difficult to tell the difference between a legitimate and a fake company. This is, in part, due to phishing scams, where fraudsters impersonate legitimate companies to fool their victims into making false payments or disclosing personal data. According to Statista, over 963,000 unique phishing sites were identified globally in Q1 2024.

But phishing is just one piece of the puzzle; other types of fraud have also been on the rise in recent years. In 2024 alone, consumers reported over $12.5 billion in fraud losses—a 25% increase from the previous year—with investment scams accounting for $5.7 billion and business and job opportunity scams causing a staggering $750.6 million in losses—an increase of nearly $250 million from 2023, as the Federal Trade Commission reports.

These disturbing trends underscore the importance of due diligence online, both for end users and for businesses. So let’s dive into the most common scams and how to check if a company is legit.

The most common types of business scams

The FTC advises that scammers often pose as legitimate entities to fool their victims—be it a business or a user. These impostor scams, or impersonation scams, involve clones of trusted entities, such as government agencies or well-known companies, which are used to deceive victims into providing money or personal information. Impostor scams topped the list in terms of reported numbers, with total losses reaching $2.95 billion in 2024.

To perpetrate these scams, fraudsters typically employ phishing techniques. This is when fraudsters reach out to their victims by email, text, or otherwise, providing a link to a fake website. Once the person clicks on that link, they’re redirected to a fake website that may look identical to a legitimate entity—say, a bank or government portal—where they’re prompted to enter sensitive information such as passwords, credit card numbers, banking PINs, etc.

What’s more, creating these clone websites is easier than ever, making it increasingly difficult for consumers to distinguish between a legitimate business and a scam.

Suggested read: The Hidden Cost of Opportunity: How to Spot Scams in the Freelance Marketplace

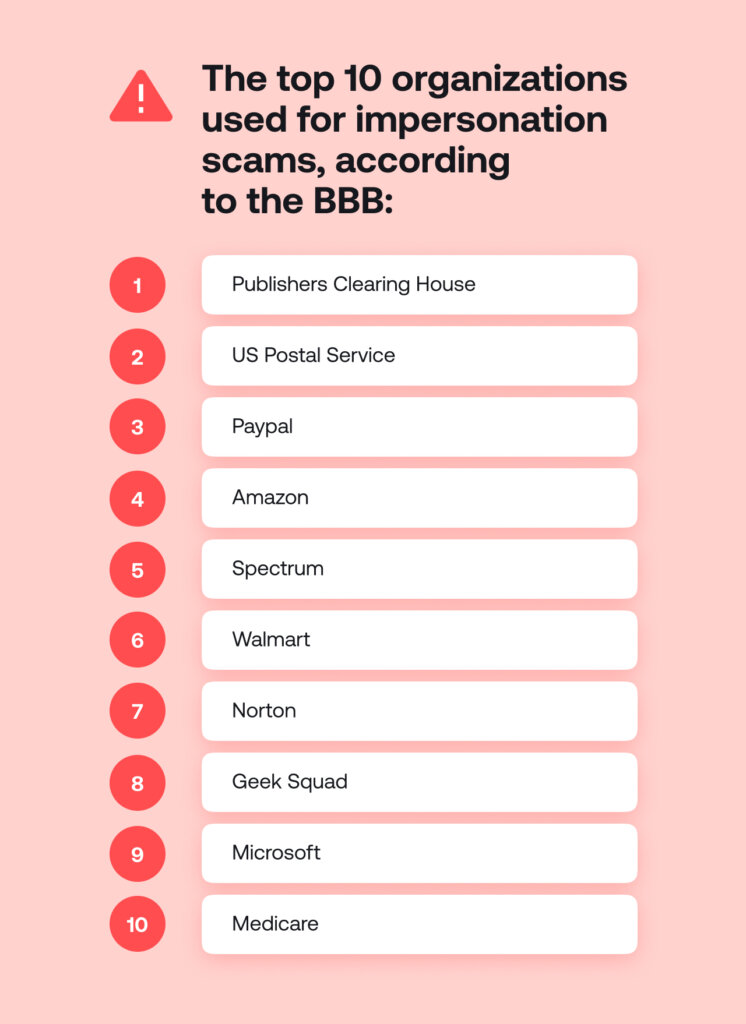

The most commonly faked entities

According to the recent Better Business Bureau report, the Publishers Clearing House was the most-impersonated organization reported to the BBB Scam Tracker in 2024, overtaking the US Postal Service, which fell to second place.

Postal service and delivery impersonation scams

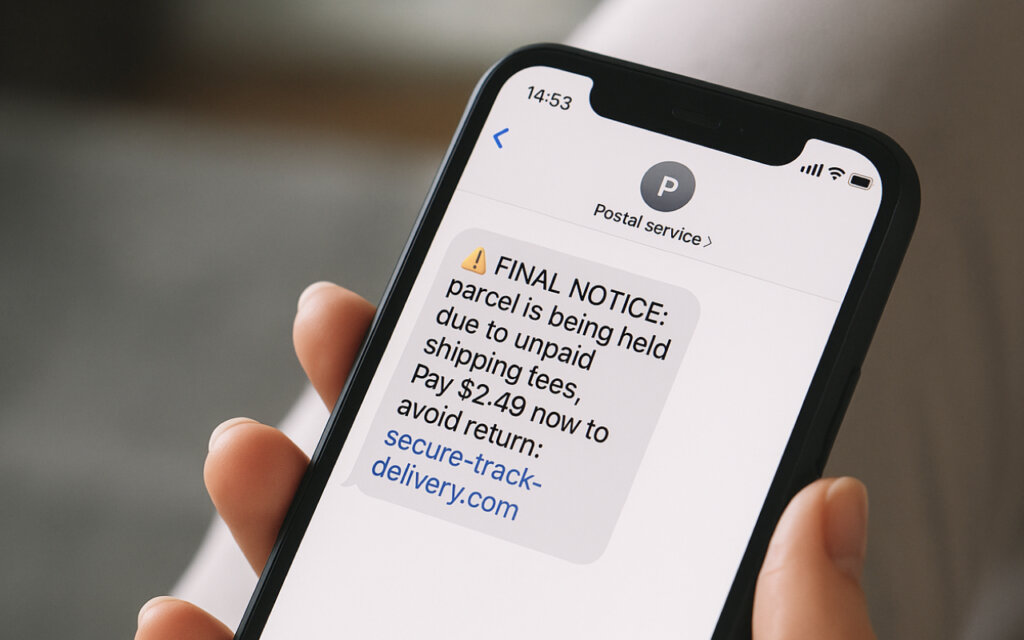

How many times a week do you get an SMS from a so-called “postal service” or “YPS” pretending to be “UPS,” asking you to pay a tax or urgent fee to receive a parcel? Probably more than a few.

Scammers often impersonate well-known postal or delivery services—like UPS, DHL, or national post offices—to trick victims through smishing, or SMS phishing. Typically, the victim receives a text message claiming there’s a delivery issue, customs fee, or package delay, with a link to a fake website that resembles the real service.

Once on the site, victims may be asked to enter personal information, payment details, or even download malware. In 2024, reported losses to text scams (which include many delivery impersonation scams) reached $470 million, more than five times the amount reported in 2020.

These scams create a sense of urgency and appear legitimate, making it easy for people to fall for them. Therefore, users should always verify tracking numbers and never click on suspicious links in unsolicited messages, and businesses should always remind their customers to do so.

Government impersonation scams

In addition to postal and delivery services, scammers frequently impersonate government agencies—from local police departments to federal authorities and tax offices. The goal is to pressure the target into sending money to resolve an ‘urgent issue’. This approach typically includes dire warnings or threats to create a sense of urgency.

According to the FTC, losses from government impersonation scams surged from $618 million in 2023 to $789 million in 2024, with losses via cash or bank transfer up by $171 million year-over-year. Additionally, consumers reported losing $20 million in cash payments just in Q1 2024, with a median loss of $14,740.

How to check if a company is legit or a scam in 2025

Scammers often create convincing websites and online profiles to pass as legitimate businesses. However, there are some clear signs that can help you separate real platforms and businesses from frauds—if you know where to look. Here are the key steps to verify a business before you engage.

🔍 Verify company registration

Start by visiting official government registries to confirm the business is registered. Most countries provide free online access to company databases. For example:

- US: EDGAR (SEC)

- UK: Companies House

- EU: EUID database

- APAC: ACRA (Singapore), Companies Registry (Hong Kong), ASIC (Australia), etc.

- LATAM: Receita Federal (Brazil), Corporations search (Puerto Rico), Ministerio de Economía, Fomento y Turismo (Chile), etc.

📜🖋️ Verify licensing—for regulated businesses

If a business operates in a regulated industry—like finance, crypto, gambling, or payment processing—it should have a valid license from the proper government authority.

You can check the license independently through official government registers to make sure the business is legal and follows all required rules and regulations. For example:

No listing? That’s a red flag.

It is important to note that scammers may unlawfully use the company details of existing, legitimately operating businesses. Therefore, it is recommended to conduct a complex review of the business, including the steps outlined below.

☎️ Review contact information

Legitimate companies give out verifiable contact details, including a phone number, physical address, and business email. Try calling the number: if it’s disconnected or answered vaguely, you should proceed with caution.

The 2024 BBB study found that 73% of business impersonation scams involved fake or unverifiable contact details, often using VoIP numbers or masked email domains.

🌐 Check the online presence

A trustworthy business will have a professional, complete website. Look for:

- HTTPS (secure site)

- A detailed Privacy Policy and Terms of Service

- Company name and details, information about the team, services, and company background

Be wary of websites with poor grammar, no legal pages, one-page sites, or generic content. AI-generated scam websites are on the rise and can seem highly convincing at first glance.

⭐ Read customer reviews

Search for feedback on platforms like Google Reviews, Trustpilot, or Better Business Bureau. Instead of just looking at ratings, analyze patterns—multiple complaints about the same issue are a major red flag.

In 2024, the FTC noted that review manipulation played a role in thousands of e-commerce fraud cases. If all reviews are overly positive, vague, and posted on the same day, that’s a sign of fake engagement.

📱 Check social media networks

Most legitimate businesses have some kind of presence on platforms like LinkedIn, Facebook, or Instagram. Review their activity: Are they engaging with users? Do they post consistently? Is the tone and content professional?

A blank or brand-new profile can be a warning sign.

🏛️ Verify through industry associations

Many established businesses are members of professional associations or local chambers of commerce. Look for badges or certifications and then verify them directly on the organization’s website.

For example, tech firms may be members of IT industry associations, fintechs may appear in regulatory sandboxes, and certified financial advisors should be listed with official regulators like the SEC or FCA.

⚠️ Look for red flags

Even if a business looks legit on the surface, watch out for these red flags:

- Urgent requests for immediate payment

- Unusual payment methods (crypto, gift cards, wire transfers)

- Deep discounts that seem too good to be true

- Spelling errors, inconsistent branding, or copy/paste legal pages

According to the FBI’s 2024 IC3 Report, scams involving high-pressure tactics and nontraditional payment requests caused over $2 billion in losses.

🕵️ Conduct background checks

If you’re about to make a large investment, sign a contract, or onboard a new partner, consider hiring a third-party due diligence service or using online business intelligence platforms. These can uncover litigation history, regulatory flags, and hidden ownership.

Suggested read: Customer Due Diligence (CDD): The Process and Its Types

Red flags to watch out for

Even if a company seems legit at first glance, here are signs something’s wrong:

- High-pressure tactics: Urging you to act immediately

- Unusual payment methods: Asking for crypto, gift cards, wire transfers

- Fake sense of authority: Posing as IRS agents or legal departments

- No physical presence: No office, no phone number, no trace

- Emotional manipulation: Romance, job offers, or miracle health products

- “Too good to be true” promises: Deep discounts or guaranteed investments

A recent case from Florida saw $12 million lost to fake government officials contacting victims over the phone—just one of thousands of similar reports. Let’s check out other real-life cases:

Case studies: Real-world scams to learn from

How “deepfake Elon Musk” became the internet’s biggest scammer

In August 2024, a deepfake video featuring an AI-generated Elon Musk went viral, promoting a fake cryptocurrency investment scheme. The scam was so convincing that it duped 82‑year‑old retiree Steve Beauchamp into depositing a staggering $690,000, believing the video and company behind the pitch were genuine. Indeed. How could a company associated with such a famous person be fake? The New York Times called this “the Internet’s biggest scammer” due to the sophistication of the AI-generated voice and visuals, which even flawlessly mimicked Musk’s accent and facial movements.

Suggested read: 8 Crypto Scams to Be Aware of in 2025: A Guide for Businesses and Users

How Thailand’s iCon group used celebrity endorsements to scam investors

In October 2024, Thailand’s iCon Group, which positioned itself as a health‑and‑wellness MLM brand, collapsed amid reports of large-scale fraud. Over 2,170 victims lost a total of 841 million baht (~$24 million). The company used well-known celebrities for endorsements, creating trust and credibility, before failing to deliver promised returns. Scrutiny led to court-ordered asset seizures totaling 125 million baht.

Tools for business verification

Many industries must verify their business partners in accordance with AML compliance regulations, conducting a Know Your Business (KYB) procedure. These industries include finance, payments, crypto, gambling, and more.

While regulated businesses are required to conduct KYB, non-regulated businesses are highly recommended to do so, as it helps keep fraudsters away, avoid losses, and prevent reputational damage.

Sumsub works to understand the specific requirements of each business and offers a comprehensive, tailored KYB check that fully automates company verification and AML screening. This includes six unique modules that can be combined through our Workflow Builder:

- Corporate Registry Check

- Control Check

- UBO Verification

- AML Screening

- Questionnaires

- Corporate Documents Review

The client can choose how many modules they need and combine them as they like (only company name and country are mandatory for corporate registry checks). Clients can also add additional levels of verification and make them mandatory for users if needed.

On top of that, Sumsub has one key technology to automate the KYB process: ACDR (Automated Company Document Reading). This feature, powered by AI, uses advanced OCR technology to extract all the needed information from corporate documents in any script, supporting over 140 languages. The extracted information is verified within seconds against corporate registries for accuracy and authenticity.

-

How can I check if a company is legitimate?

Search for the company in an official government registry, verify contact details, review customer feedback on independent platforms, and look for red flags like pressure to pay urgently or poor website quality.

-

How to verify a business in the UK?

Use the official Companies House website to check the company’s registration number, filing history, and status.

-

How to check a fake company in the USA?

Look up the company through EDGAR (SEC) for public companies, or check state business registries via the SBA’s directory. You can also do a license search to check if the company has a valid license.

-

How to verify an online company?

Examine the website’s security, legal pages, and company info; then, cross-check its registration, reviews, and online presence across social media and professional platforms.