- Jul 09, 2020

- 2 min read

Just In: Manage Verification Flows On the Fly

Compliance demands push companies to have multiple scenarios for different customer segments, based on anything from the location to the identification method. To set these scenarios, businesses go through tedious technical work with their developers, coordinate rules with their providers, and even decide to verify certain clients manually. Any of these options overcomplicate the work.

To change this, we are introducing the tidy yet power-packed feature that gives you the freedom to adjust compliance workflows within seconds, all by yourself.

The new feature is an add-on to our core platform, which is designed to make your compliance effortless and straightforward with the essential tools to manage all work with the snap of a finger.

1. What you want from your user: building verification levels

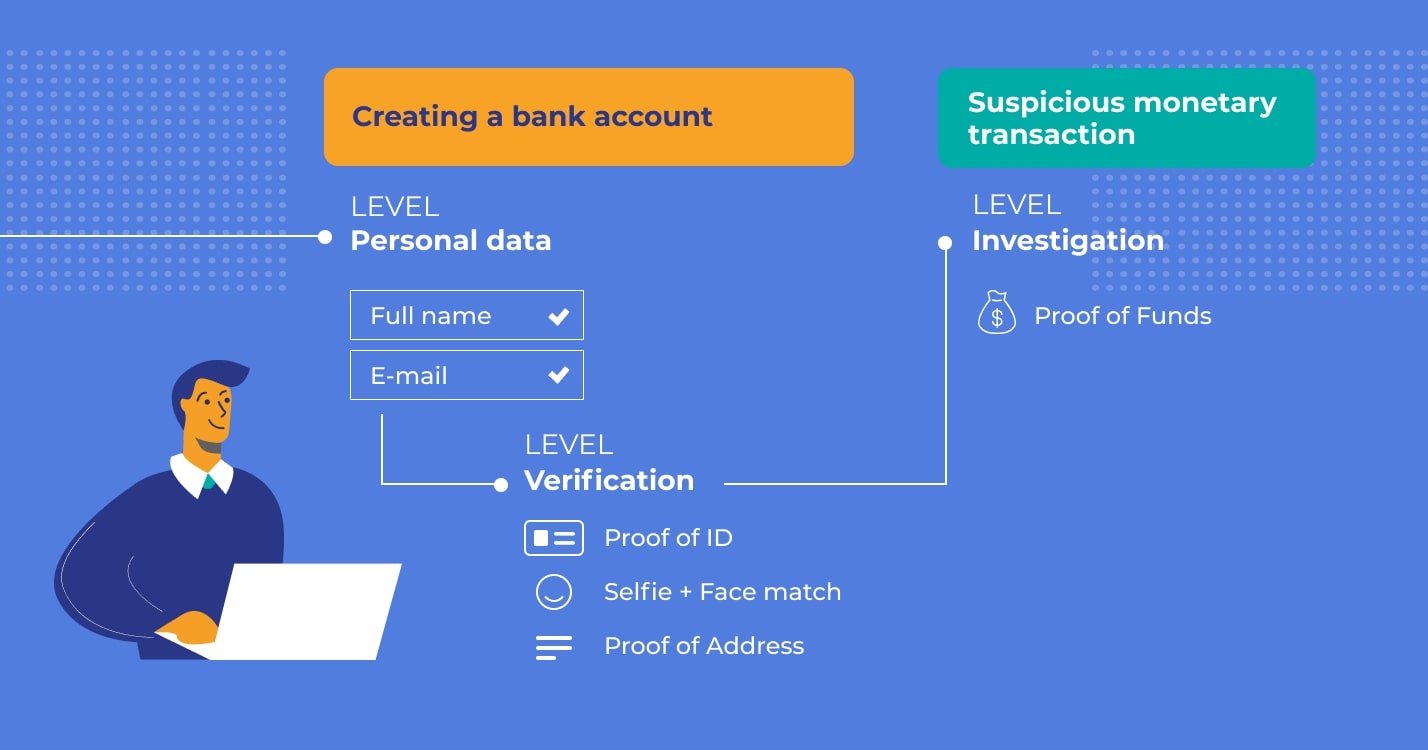

From now on, you have full power to create and control multiple, parallel verification levels in a few clicks, right from the compliance dashboard. Combine any of the checks, from the document and liveness verification to video streaming and payment methods.

Let's look at an example, a client needs to satisfy a couple of requests. The first request could be for a user to submit their ID document and pass the liveness verification. The second request could be to offer proof of funds, triggered by a large transaction. For other groups of clients, you can build a completely different chain of checks. With only the click of a button, you can quickly respond and tweak the verification levels according to any of your regulatory and business changes. Look, how simple it is!

2. How you want it: creating custom flows

If you want to change how the user interface looks like, you can piece together a custom flow in a jiffy. Simply download your own styles, write up engaging texts to help your users submit the right information, and remove certain default screens (if you find the workflow better without them). This is all done through the use of the compliance dashboard, with no code to write!

3. One-step integration, free of extra work

From now on, Sumsub integration will be a whole lot simpler. All you have to do, in order to get the solution running, is to insert the name of the required flow into the right place during the integration process. That's it! If something changes, your compliance team has all the keys to correct it.

Streamline your compliance efficiently. Get in touch.

Relevant articles

- Article

- 6 days ago

- 10 min read

AI-powered romance scams are rising fast. Learn how dating fraud works and how platforms and users can protect themselves from online deception.

- Article

- 2 weeks ago

- 11 min read

Arbitrage in Sports Betting & Gambling in 2026. Learn how iGaming businesses detect arbers using KYC & fraud prevention tools.

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.