- Apr 16, 2019

- < 1 min read

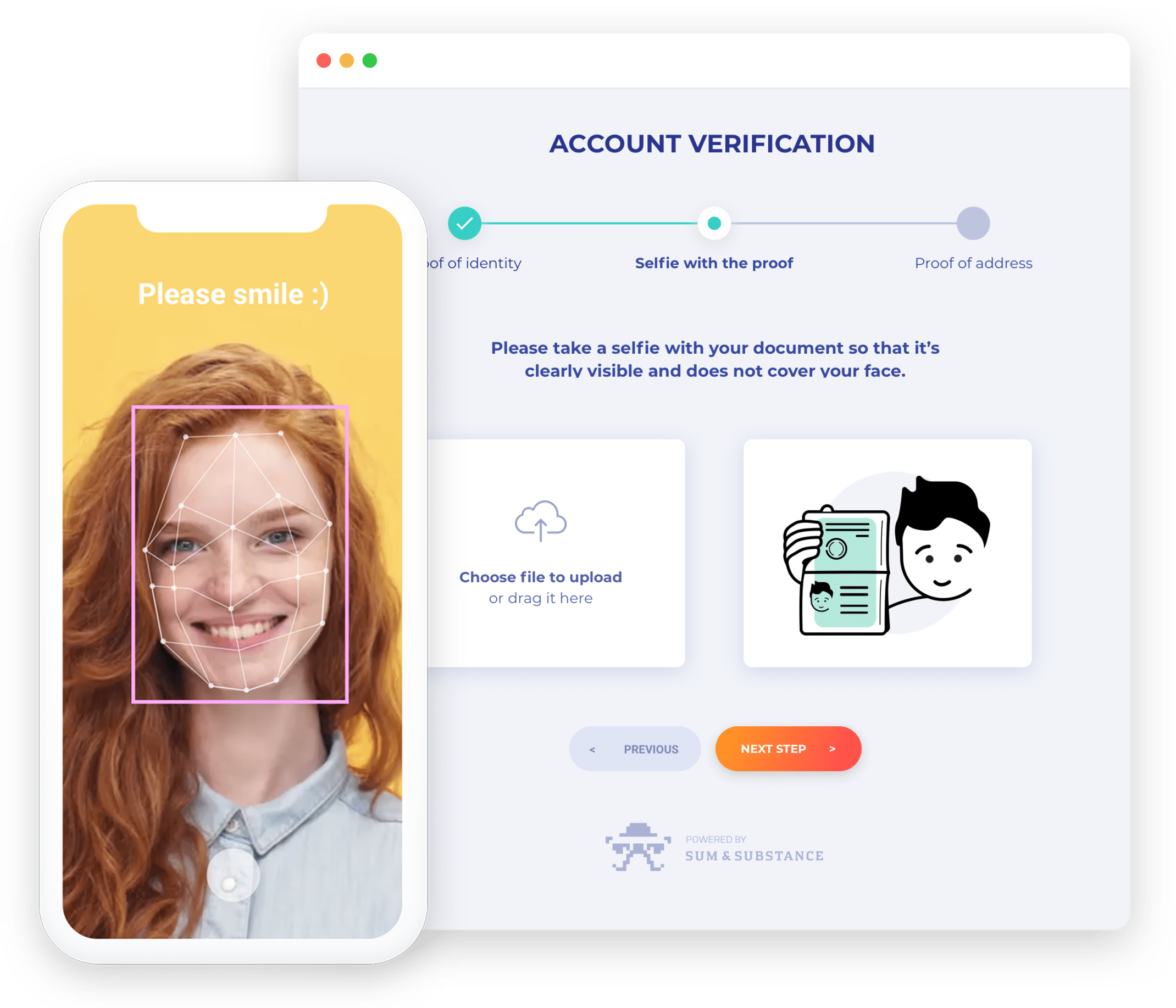

Real-Time ID Verification

ID verification is used by thousands of companies worldwide to comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, improve risk management, and prevent fraud.

The procedure includes documentary verification (checking of the authenticity of physical identity documents) and at a higher level non-documentary verification (matching the identity information against various databases, sanctions registers, and blacklists).

Fields of Application

- eCommerce

- Gambling

- Sharing Industry

- Trading

- Finance

- Online Education

The Sumsub ID verification solution comprises the latest AI-based technology that features computer vision and machine learning.

How it works

Acquisition

- Auto select of the best angle for ID capture

- Front and back ID scanning

Retrieval

- Smart data extraction: recognition of handwritten and crumpled documents

- Autofill

Verification and validation

- Integrity and authenticity check

- Validity check

Let's do it the Sumsub way!

- Nicely: The platform is designed to make the user enjoy every step of verification.

- Effortlessly: Flexible automation allows to reduces manual workload by 60-90%.

- Smartly: The checks can be performed via single and multi-account web SDK, mobile SDK, API, widget, Android, or iOS.

- Safely and securely: All customer and related data is encrypted and protected, in accordance with GDPR, PDPA, and CIS (FZ-152).

Relevant articles

- Article

- 5 days ago

- 6 min read

What counts as proof of address in the UK? See accepted documents and how to open a bank account if you’ve just moved to the country.

- Article

- 3 weeks ago

- 20 min read

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.