- Sep 04, 2018

- 4 min read

How to Choose the KYC / AML Provider for Token Sale and ICO

Key Parameters to Check

Since regulators' requirements are tightening, and fraudsters become more and more dodgy, KYC vendors are constantly improving their software to secure from the risk, but not every of them offer the best solution to cover ICOs needs.

How to find out if a certain KYC vendor will keep you transparent to regulators, give an ability to cash out your proceeds legally and wouldn't decrease your ICO conversion?

KYC vendors are constantly improving their software to secure from the risk, but not every of them offer the best solution to cover ICOs needs

Perfect fit for the ICO needs

Know Your Customer (KYC) procedure is a must for legal token sale now, but can be an obstacle as well. So, what are the requirements for choosing the right KYC during the ICO? We have been working in this sphere since 2015 and can advise you to consider the following key parameters when making a decision:

- Comprehensive end-to-end solution. The software should cover all the important parts — KYC, AML, and anti-fraud.

- Legal expertise. Your provider should know the differences between requirements in different jurisdictions, which countries need to be actually banned and which ones are safe.

- The conversion issue. To get on board more contributors and not to lost a part of the proceeds, KYC procedure should be user friendly and engaging, take as little time and efforts as possible and contain specific tools which raise the ultimate conversion.

- Security and data privacy. No doubt that all users' data should be secured and compliant with data privacy directives as GDPR or local Asian legislation — depending of the main jurisdiction of the ICO.

- Fast and easy start. Make sure that your provider can offer easy back-end and front-end integration. It will reduce your cost and raise the quality of solution. And one more thing — if you need to manage specific and rare customers requests, maybe your provider is not so comprehensive.

- Data is a complex separate issue, but make sure your provider checks not only Dow Jones Sanctions list.

Please check this guide if you are seeking buying advice on selecting a verification vendor for other use cases.

Security and data privacy compliance

Personal data is the hottest topic of the year. And also the difficult one. There are three approaches how to work with personal data: according to European, Asian and American legislations.

Local laws are very different. For example, in Korea, all sensitive information on documents should be hidden during online verification. Your provider should know how to handle personal data processing properly and which legislations are applied to your case.

Easy and fast start

API-first approach makes everything faster and more cost-efficient — the integration, managing, usage. You can save your budget and working hours of your team by offering the most delightful procedure to your users. Box solutions might fit you more, as it eneble to integrate front and back ends — the interfaces, the grey zones processing, all the tech as biometrics, OCR, etc.

Speak to one of our KYC experts today

TALK TO AN EXPERT

Data to check

The majority of sophisticated market players provide their own database of fraudsters together with other resources (governmental databases, integrated widest data sources, specific information for the needs of a particular customer).

Technology used

ML, AI, and biometrics, graphic editors detection.

Readiness to check

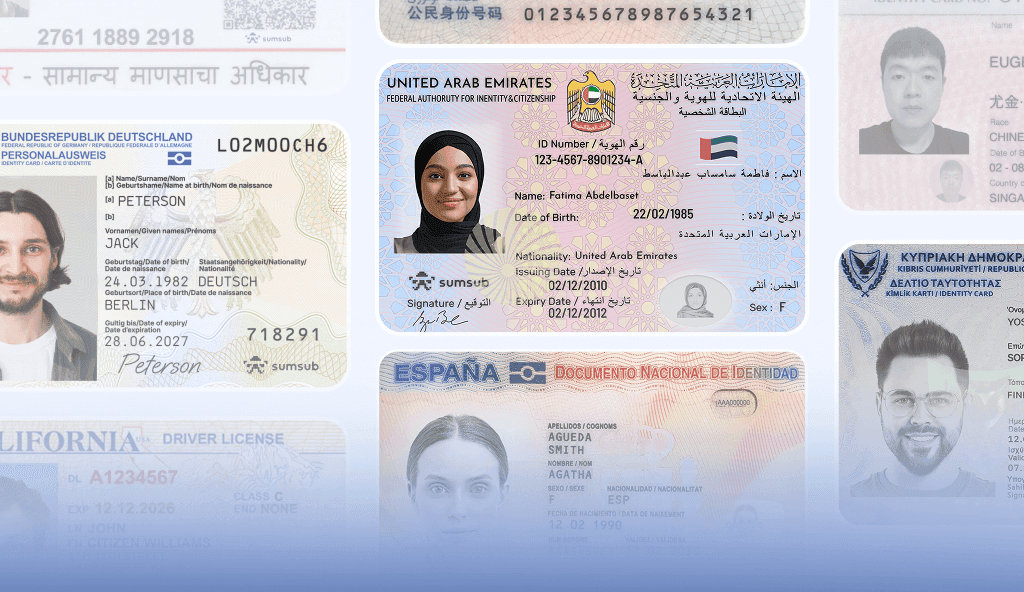

Test your provider to understand if a vendor really can verify your customers data properly. Test IDs — fake ones, expired, unusual IDs. Test also the speed and the friendliness of onboarding. Risk/conversion dilemma

The key issue that all ICOs face is how to make the KYC process easier and meet compliance requirements at the same time.

Comparing available solutions gives that essential balance. Fast and simple onboarding increases conversion. Ask your vendor, how the solution can help you with onboarding. And please keep in mind, that some vendors stay at the level of 10-15% of abandoned registrations, and that is the best result in this sphere if we are talking about the balance with compliance.

Scalability

The life cycle of an ICO is very short. The infrastructure of your KYC vendor must be ready to get on board a vast number of users at the same time. We had one case when one of our Korean ICOs used such a good marketing strategy, that from the start of a sale they received 10,000 registrations in 10 minutes. Their own website wasn't ready and dropped. We managed to finish the project just in time, but you should keep in mind this kind of risk. Scalability is a crucial aspect for you.

Pricing

Pricing is also a key aspect of KYC and a very important one when you are choosing a provider. The price always depends on the volume and number of checks you need. Compare the pricing rates by connecting providers directly. In most cases, the check happens between €1.5 — €4. It also correlates with the level of provided services and the vendor's expertise.

Legal expertise

Legal issues are a huge topic that deserves a separate discussion. How to cash out crypto funds in a bank? What to do with Politically exposed contributors? Who takes responsibility in case of regulator's suspicion — provider or the company?

Sometimes even legal consultants don't know the answers. That is why we prepared a checklist of how to estimate the quality of the legal part of KYC and choose the legal partner. Please, ask these questions to your shortlisted providers. It will definitely help you to understand the quality level of the future services.

Checklist

1. What is the proper jurisdiction to govern KYC procedures?

2. How to determine the level of due diligence in KYC procedures that would be reasonable: strict scrutiny vs. conversion?

3. What do you suggest for data protection and privacy?

4. What KYC reports do you provide: regulators' requirements as to the contents of KYC reports

5. How do you handle national proof of identity laws?

6. Revoking KYC procedures: are they allowed?

Relevant articles

- Article

- 3 days ago

- 11 min read

Check out how AI deepfakes are evolving and discover proven strategies for detecting and preventing deepfake threats to protect your business.

- Article

- 2 weeks ago

- 9 min read

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.