- Feb 09, 2026

- 7 min read

Hong Kong Stablecoin Regulation: HKMA Licensing Framework in 2026

New Hong Kong regulations are being put into practice in 2026 as the HKMA prepares to issue its first stablecoin licences. Here’s what issuers need to know.

Stablecoins are emerging as one of the most critical building blocks of the digital financial system. Reflecting this rapid growth, Citigroup recently updated its forecasts, estimating stablecoin issuance volumes of $1.9 trillion in a base case and up to $4.0 trillion in a bull case, revised upward from its April 2025 projections. No longer used solely as a bridge between fiat and cryptocurrency, fiat-referenced stablecoins are evolving into programmable financial instruments, enabling faster settlement, more affordable transactions, and new ways of supporting mainstream digital asset financial activity.

As demand and adoption grow, regulatory clarity is essential for jurisdictions seeking to remain or become financial hubs. In this context, the Hong Kong Monetary Authority (HKMA) is shifting from theory to practice, with Chief Executive Eddie Yue saying the authority plans to move toward granting a “very small number” of licenses to issuers of fiat-referenced stablecoins in a first wave in March 2026.

Hong Kong’s Stablecoins Ordinance took effect on August 1, 2025, intended to position the city as a global hub for digital asset innovation. It establishes a licensing regime for any issuer offering a stablecoin in Hong Kong, or issuing one overseas, designed to maintain a stable value against the Hong Kong dollar. Since then, dozens of companies have applied for licenses, including tech giants like Ant Group, which could have major implications not just for Hong Kong’s stablecoin landscape, but for the broader APAC region in general.

Hong Kong's Stablecoins Ordinance: Key facts

The Stablecoins Ordinance creates a formal licensing framework for issuers of Hong Kong dollar-referenced stablecoins. The regime applies to both issuers operating in Hong Kong and overseas issuers whose stablecoins claim to maintain stable value by reference to the Hong Kong dollar. Any entity seeking to issue a stablecoin that falls into these categories must obtain authorization from the HKMA and operate as a licensed stablecoin issuer.

Key parts of the Stablecoins Ordinance include:

- A stablecoin license being made mandatory for any company carrying on a regulated stablecoin activity

- Definitions of what constitutes a stablecoin

- Prudential conduct obligations similar to those affecting traditional financial services

- Supervisory powers allowing the HKMA to impose conditions, conduct inspections, and revoke licences

The Stablecoins Ordinance aims to protect consumers while giving companies carrying on a regulated stablecoin activity greater regulatory guidance.

Suggested read: Global Stablecoin Compliance: GENIUS Act, MiCA, Hong Kong, Singapore, and More Key Rules

HKMA stablecoin license requirements

The HKMA licensing framework also establishes thresholds and operational requirements similar to those applied to mainstream finance.

Minimum paid-up capital: HK$25 million threshold

Applicants for a stablecoin license must meet a minimum paid-up capital requirement of HK$25 million (approx. US$3.2 million). This can either be in Hong Kong dollars or an equivalent amount in another currency that is freely convertible into Hong Kong dollars or is approved by the monetary authority for this purpose.

The HK$25 million capital requirement is designed to make sure licensed stablecoin issuers have sufficient financial resources and liquid assets to meet their obligations as they fall due in potentially volatile markets. These funds cannot be used for dealing with any companies or parties, including shareholders, directors, and senior management.

Hong Kong presence and management requirements

Under the Hong Kong Monetary Authority’s approach to stablecoin regulation, issuers are expected to demonstrate:

- Relevant knowledge and experience

- Fitness and propriety

- Operational presence in Hong Kong

- Adequate and appropriate risk management policies and procedures for managing the risks arising from carrying on licensed stablecoin activities

- Adequate and appropriate systems of control for preventing and combating possible money laundering or terrorist financing

Application documentation and assessment process

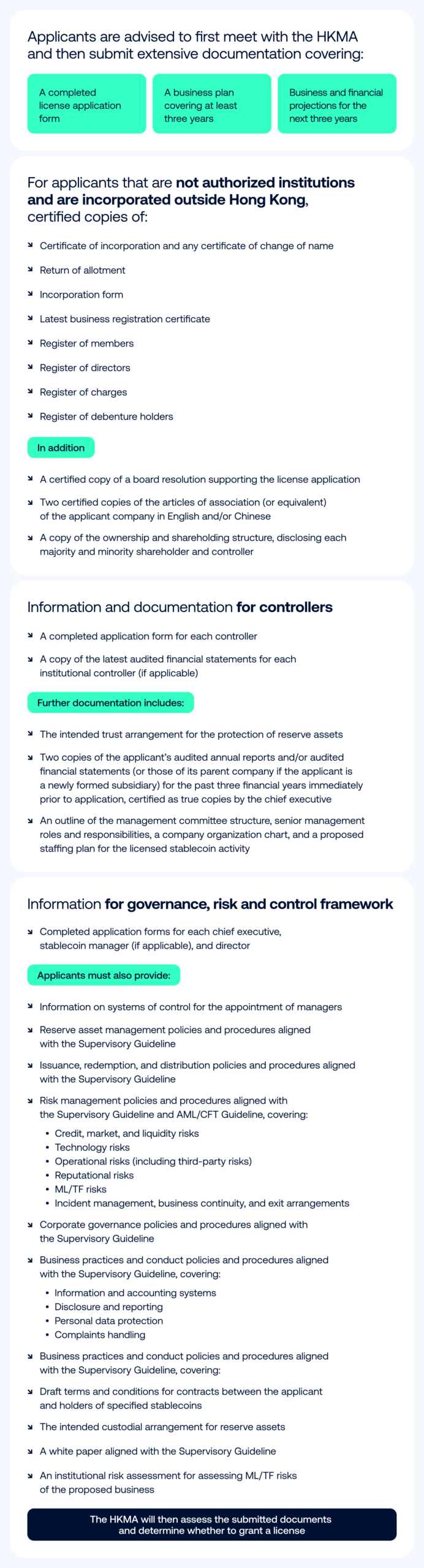

Applicants are advised to first meet the HKMA and then submit extensive documentation covering:

- A completed application form

- A business plan of at least three years

- Business and financial projections for the next three years

- For applicants that are not authorized institutions incorporated outside Hong Kong, certified copies of:

- A certification of incorporation and any certificate of change of name

- Return of allotment

- Incorporation form

- Latest business registration certificate

- Register of members

- Register of directors

- Register of charges

- Register of debenture holders.

Check the full list of documents here.

The HKMA will then assess the submitted documents and determine whether to grant a license.

Hong Kong Stablecoin reserve requirements

The HKMA has made clear that stablecoins must be supported by asset reserves segregated from any other pool of assets. Stablecoins must have at least 100% reserve backing with qualified reserves.

100% reserve asset backing: Mandatory coverage rules

All regulated stablecoin activity in Hong Kong must be backed by reserve assets equal to at least 100% of circulation. This is to address market concerns around undercollateralization.

There must be full backing at all times, with segregation of reserve assets from the issuer’s own funds, and clear redemption rights for users.

Qualified reserve assets under Hong Kong regulation

Under the new Hong Kong stablecoin regulations, not all assets qualify as reserves. The HKMA states that “reserve assets must be of high quality and high liquidity with minimal investment risks.”

Riskier instruments and volatile crypto assets are unlikely to be considered compliant.

Tokenized assets as reserves

Reserve assets for a Hong Kong-licensed stablecoin must be of high quality, high liquidity, and carry minimal investment risk, and are assessed on a case-by-case basis against these criteria. In practice, this high standard means that novel or less established asset classes—including tokenized assets—are unlikely to qualify as reserve assets unless they can demonstrably meet the HKMA’s requirements. As a result, early licensed issuers are expected to rely mainly on conventional, well-established asset types when structuring their reserve arrangements.

Suggested read: Breaking News, Explained: Hong Kong’s LEAP and Licensing for Stablecoin Issuers

KYC and AML compliance for Hong Kong licensed stablecoin issuers

Stablecoin issuer applicants are required to implement adequate and appropriate systems of control to prevent and combat money laundering, and to implement monitoring and anti-money laundering protections, which are essential parts of the new licensing regime.

Risk Assessment: Licensed stablecoin issuers should adopt a risk-based approach (RBA) to design and implement AML/CFT systems. This includes identifying, assessing, and understanding ML/TF risks specific to their business and taking commensurate measures to manage and mitigate those risks. Issuers must conduct institutional risk assessments that consider customer, country, product/service/transaction, and delivery channel factors, which form the basis of the RBA used to gauge vulnerability to ML/TF.

AML/CFT Systems: Licensed stablecoin issuers should establish AML/CFT systems that effectively manage and mitigate relevant risks, monitor their implementation, enhance them where necessary, and apply enhanced measures to higher-risk areas.

Customer Due Diligence: Licensed stablecoin issuers must identify and verify customers using reliable and independent sources, identify and verify beneficial owners, and obtain information on the purpose and intended nature of the business relationship.

Ongoing Monitoring: Licensed stablecoin issuers should continuously monitor business relationships through ongoing CDD to keep customer information up to date and relevant, and through transaction monitoring to assess consistency with customer profiles and identify complex, unusual, or suspicious transactions for further examination.

Stablecoin Transfers: Licensed stablecoin issuers must comply with AMLO requirements for stablecoin transfers, including the Travel Rule, to prevent unfettered criminal asset movement and detect misuse.

Terrorist Financing, Financial Sanctions, and Proliferation Financing: Licensed stablecoin issuers should establish and maintain effective policies, procedures, and controls to comply with terrorist financing, financial sanctions, and proliferation financing regulations.

Suspicious Transaction Reports: Licensed stablecoin issuers must file suspicious transaction reports (STRs) with the JFIU upon knowledge or suspicion that property is linked to drug trafficking, indictable offenses, or terrorist activities, including all relevant supporting details.

Recordkeeping: Licensed stablecoin issuers should maintain CDD information, transaction records, and other necessary documentation to ensure a clear audit trail.

💡Expectations around stablecoin AML compliance in Hong Kong mirror those applied to banks and licensed exchanges.

Security standards for licensed stablecoin issuers

Licensed stablecoin issuers are expected to meet high security standards as part of operating under a crypto license in Hong Kong. These requirements are designed to protect reserve assets, prevent unauthorized access, and ensure that issuance and redemption processes remain resilient against technical and operational risks.

Multi-Signature & Private Key Management Protocols

Robust private key management is a core security expectation. Issuers should rely on multi-signature wallet setups to ensure that no single individual or system can unilaterally authorize critical transactions. By distributing signing authority across multiple secure keys, issuers reduce the risk of insider abuse, key compromise, or single points of failure, aligning with best practices in crypto custody and operational security.

Smart Contract Security Audits

Where stablecoin issuance, transfers, or controls rely on smart contracts, strong smart contract security is essential. Issuers are expected to conduct regular, independent smart contract audits to identify vulnerabilities, logic flaws, or exploitable behaviors before deployment and after material updates. Ongoing attention to smart contract security helps reduce the risk of exploits that could impact token supply, reserves, or user funds.

Stablecoin Redemption Processing

Secure and reliable stablecoin redemption mechanisms are critical to maintaining confidence in fiat-referenced stablecoins. Issuers must ensure that redemption requests are processed accurately, promptly, and in line with documented procedures, with appropriate controls to prevent fraud, errors, or abuse. Clear redemption logic, supported by secure systems and auditable workflows, reinforces trust and supports compliance with regulatory expectations tied to a crypto license in Hong Kong.

💡The security measures described above reflect industry best practice informed by the Hong Kong Monetary Authority’s technology and operational risk principles, rather than requirements set out verbatim in the Stablecoins Ordinance or related legislation. Actual regulatory expectations may vary depending on an issuer’s business model, technology design, and risk profile.

Who is applying for a Hong Kong stablecoin license?

While the HKMA has not yet published a list of applicants, there has been significant interest from established tech giants like Ant International and JD.com, as well as crypto-native firms seeking regulatory legitimacy, fintech companies building regulated payment instruments, financial institutions exploring tokenized money, and infrastructure providers positioning Hong Kong as a regional base.

For many of these, a stablecoin license is less about issuing a single token and more about long-term positioning in regulated digital finance. Licensed Hong Kong stablecoin activity could function as infrastructure for payments, settlement, tokenized securities, and cross-border financial products.

Hong Kong's role in stablecoin regulation

The Hong Kong Monetary Authority’s stablecoin regulation framework is not just about domestic digital asset regulation. It is part of a broader competition to provide clear standards that allow stablecoin issuers to develop with minimal risk to users and existing financial ecosystems.

A notable feature of Hong Kong’s Stablecoins Ordinance is its extraterritorial reach. The licensing and compliance requirements apply not only to entities incorporated in Hong Kong, but also to overseas issuers that reference the Hong Kong dollar or actively market stablecoins to the Hong Kong public.

This expands the regulatory perimeter of the Ordinance, relating to overseas projects that may otherwise assume they fall outside local oversight. For global stablecoin issuers and intermediaries, the Ordinance reinforces the need to assess Hong Kong exposure as part of a broader licensing and compliance strategy, even where core operations are based elsewhere.

While Hong Kong’s regulatory developments reflect a broad push toward Web3 and digital asset innovation, particularly when considering its LEAP framework, it also has a distinct approach from mainland China’s more cautious stance toward digital assets.

Web3 Hong Kong: Competitive positioning as a crypto hub

Through structured crypto regulation, Hong Kong is attempting to distinguish itself from risky lightly regulated jurisdictions and overly restrictive ones. The Web3 Hong Kong strategy is one of encouraging innovation, but with a cautious licensing regime that prioritizes market integrity and consumer protections, bringing digital asset regulation in line with existing financial frameworks.

Hong Kong’s stablecoin framework represents a deliberate attempt to integrate stablecoins into the architecture of regulated finance. With defined capital thresholds, reserve requirements, governance standards, and AML obligations, the HKMA is signaling that stablecoin issuance must meet expectations closer to banking than to experimental Web3 projects.

If you’re tracking global digital asset regulation, now is the optimal moment to reassess how your organization approaches licensing exposure and compliance strategy across a shifting global regulatory landscape.

FAQ

-

What is the Hong Kong Stablecoins Ordinance?

The Hong Kong Stablecoins Ordinance establishes a regulatory regime requiring any issuer of a stablecoin to be licensed by the HKMA if the stablecoin is issued in Hong Kong, or if it is issued outside Hong Kong but purports to maintain a stable value by reference to the Hong Kong dollar. It introduces formal prudential, governance, and compliance obligations similar to those applied in traditional financial services.

-

How do I get a stablecoin license in Hong Kong?

Applicants must submit a detailed application to the HKMA demonstrating capital adequacy, governance, reserve management, security controls, and AML compliance. Approval depends on whether the regulator is satisfied that the issuer can operate safely and responsibly.

-

What are HKMA's stablecoin reserve requirements?

The HKMA requires licensed stablecoin activity to be backed by at least 100% high-quality, liquid reserve assets at all times. These reserves must be segregated from the issuer’s own funds and structured to support reliable redemption.

Relevant articles

- Article

- 2 weeks ago

- 8 min read

Digital trust is transforming Asia's digital economy in 2026. Explore trends in superapps, data sovereignty, IDV, and AI fraud prevention.

- Article

- 3 weeks ago

- 11 min read

Learn what KYC is and the steps users should take to onboard smoothly.

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.