- Oct 09, 2025

- 3 min read

Global Fraud Index: Initial Insights and What You Need to Know in 2025

Why is fraud thriving in some countries and on the decline in others? Sumsub’s Global Fraud Index gives exclusive insights by exploring the conditions shaping fraud risk worldwide.

Fraud is universal, but fraud resilience isn’t. To capture the scale and complexity of fraud, Sumsub has published the 2025 Global Fraud Index—the second edition of the report, following its first release in 2024—a comprehensive study assessing fraud susceptibility across 112 countries. Rather than counting incidents of fraud—which you can find in The Sumsuber News section—the Index layers in structural indicators to reveal why fraud flourishes in some countries but not others.

Which country has the highest perceived corruption? Which one shows the greatest fraud readiness? And how do these factors influence fraud levels?

The Index offers a clearer picture of global fraud dynamics and gives businesses, policymakers, and risk teams sharper insight to stay ahead of an ongoing crisis.

Four pillars of fraud resilience

The Global Fraud Index assesses 112 countries across four weighted pillars to offer a comprehensive overview of fraud risk and how prepared each country is to access the necessary KYC/AML services:

- Fraud Activity (50%) measures the severity of fraudulent activity, factoring in fraud networks, and AML rates.

- Resource Accessibility (20%) reflects access to digital services and financial power, using indicators like GDP per capita, internet speed, and purchasing power.

- Government Intervention (20%) evaluates regulatory anti-fraud commitment, infrastructure, and resilience through seven governance and policy metrics.

- Economic Health (10%) tracks factors in instability such as corruption, cost of living, unemployment, and economic decline, which may rationalize fraudulent behavior.

Each country receives a score to determine its place on the Global Index, allowing for a global resilience comparative framework. The average Global Index score is 2.79.

For example, across the four pillars, Singapore scored 1.78 in the Fraud Activity pillar, 0.33 in the Resource Accessibility pillar, 0.08 in the Government Intervention pillar, and 0.31 in the Economic Health pillar. Overall, Singapore's index score was 1.36.

In comparison, across the four pillars, Argentina scored 4.22 in the Fraud Activity pillar, 1.56 in the Resource Accessibility pillar, 0.72 in the Government Intervention pillar, and 0.51 in the Economic Health pillar. Overall, Argentina's index score was 4.05.

The methodology relies on huge volumes of data, including more than one million verification checks that Sumsub sees each day.

Suggested read: The Biggest Identity Theft Cases of the Past Decade

Sumsub’s Fraud Index 2025: Key insights

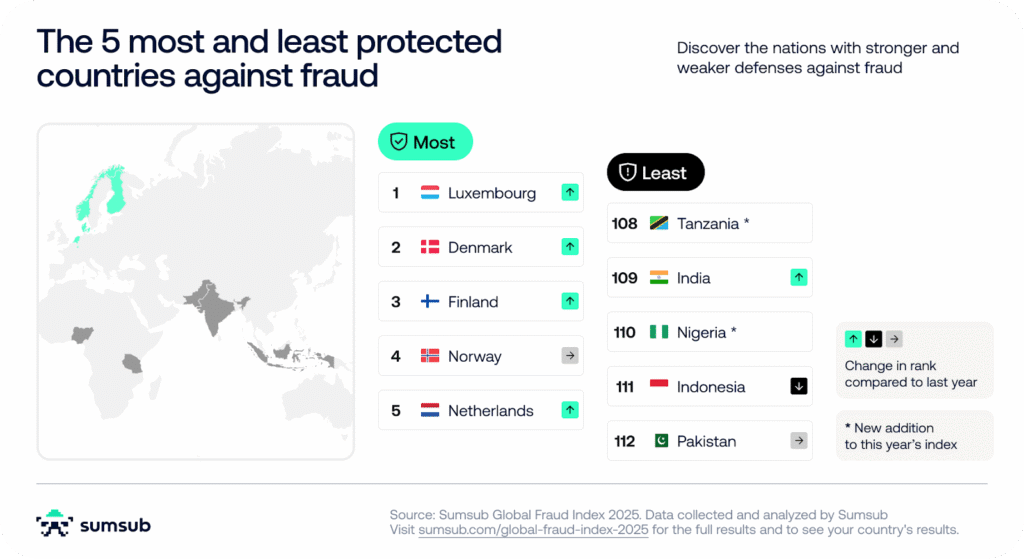

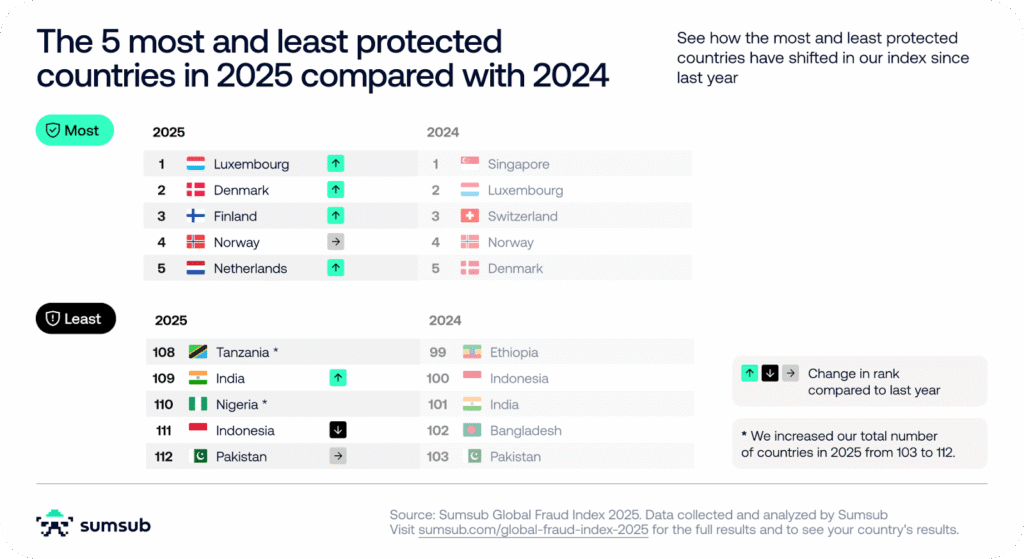

According to the 2025 Global Fraud Index, Luxembourg, Denmark, Finland, Norway, and the Netherlands are the nations most safeguarded against fraud.

Tanzania, India, Nigeria, Indonesia, and Pakistan, however, are the least safeguarded:

Pakistan has the highest fraud rate in the Index, showing that a lack of safeguards can align with high rates of fraud.

Other key insights include:

- Singapore dropped from first place for fraud resilience in 2024 to 10th in 2025

- The USA remains the global leader for AI readiness

- Greece climbed 17 places for fraud resilience, rising from 40th in 2024 to 23rd in 2025

- Europe has the largest concentration among the 15 most-protected countries

- Senegal ranks lowest for resource accessibility

- Singapore ranks the highest for government intervention.

The rankings help paint a picture of how countries are doing in terms of fraud resilience, as well as the systemic reasons for their relative successes or failures.

Why the Global Fraud Index matters for businesses and policymakers in 2025 and 2026

The Global Fraud Index does more than rank countries. It embeds structural indicators and allows for easy comparisons across countries of similar profiles and regions, providing insights that help reveal significant vulnerabilities. For example, a country might have moderate rates of fraud but very poor levels of government intervention, suggesting a higher risk of future fraud exposure if these underlying structural indicators remain weak or deteriorate further.

With AI fueling a fraud crisis, businesses and policymakers need to adapt, as bad actors can easily exploit complacency.

Fraud may be a universal problem, but understanding helps provide a global solution. The Sumsub Global Fraud Index makes it easier to understand how to improve resilience and provides the data needed to do so. You can also explore the 2024 Global Fraud Index for last year's results to see how fraud patterns are changing.

Explore the Global Fraud Index for key insights into regional fraud protection, resilience, policy strength, AI readiness, and other critical indicators that help businesses make informed decisions:

Download the Global Fraud Index 2025Relevant articles

- Article

- Yesterday

- 11 min read

Check out how AI deepfakes are evolving and discover proven strategies for detecting and preventing deepfake threats to protect your business.

- Article

- 2 weeks ago

- 9 min read

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.