- Sep 10, 2025

- 9 min read

Is Crypto Gambling Legal? Global Regulations in 2025

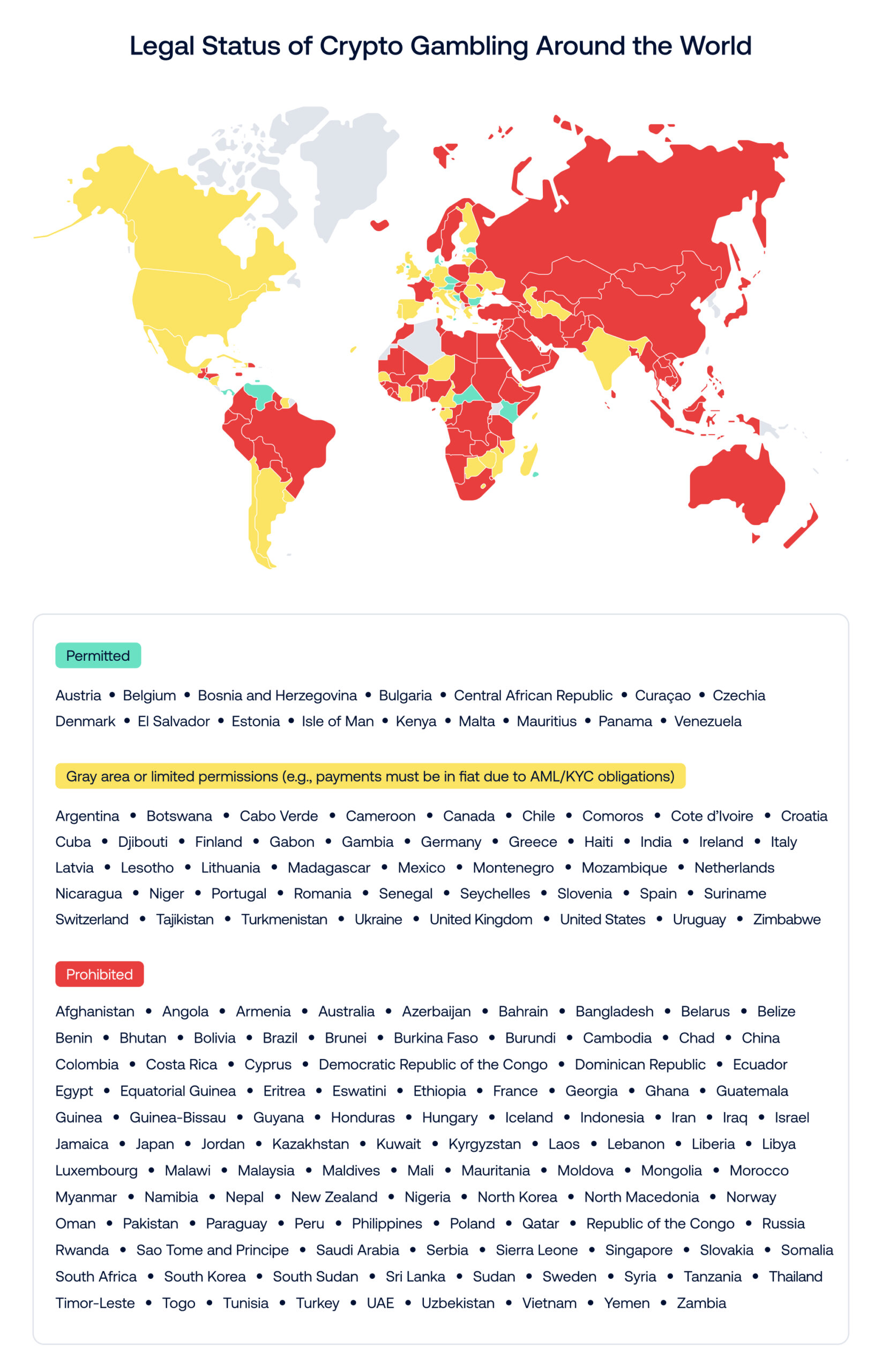

Virtual assets are changing the face of the online gambling industry. We break down the legal status of crypto casinos across major markets, helping your business navigate complex and changing regulations.

Crypto gambling has exploded into a global industry, with crypto casinos taking more than $81 billion in 2024—five times the volume seen just two years earlier. Meanwhile, the crypto betting platform Stake’s GGR of $4.7 billion (an increase of 80% from 2022) now rivals that of traditional betting companies like Entain ($5 billion), the owner of brands like Coral and Ladbrokes. This boom comes despite significant uncertainties and global restrictions facing the industry, with players using VPNs to bypass geographic blocks and access casinos located in permitted jurisdictions.

In most regulated markets, licensed gambling is fiat-first; accepting crypto directly is either not allowed or treated as high-risk and permitted only with robust controls. A smaller set of jurisdictions lets licensed operators accept virtual assets with explicit approval and strict AML/CTF requirements.

Let’s now dive into the peculiarities of crypto gambling: where it’s legal, how platforms can be licensed, and the challenges these platforms face in 2025.

What is crypto gambling?

Crypto gambling refers to gambling where customers fund or withdraw using virtual assets (VAs) such as Bitcoin, Ether, or stablecoins.

Its appeal is clear: fast cross-border settlement and fewer intermediaries. However, it introduces higher AML/CTF, sanctions, and consumer-protection risks.

Is crypto gambling legal?

It depends on three things:

- Is online gambling itself permitted in the market you’re targeting?

- Does the operator’s licence in that market allow accepting virtual assets (and on what conditions)?

- Do payments / AML rules and regulations allow your exact flow?

Always consider a risk-based approach. Many regulators do not ban crypto outright but classify VA-originated funds as high-risk, requiring Enhanced Due Diligence, sources of funds/sources of wealth checks, and on-chain monitoring. In practice, most licensees in mature markets take a fiat-only stance.

Be aware that player access does not mean operator legality. Offshore sites may be reachable via VPNs, but this does not make them lawful to operate or market into a regulated jurisdiction.

The use of virtual assets for payments in online gaming may be permitted under specific regulatory conditions of a particular jurisdiction. For instance, in Malta operators licensed by the Malta Gaming Authority (MGA) may accept virtual assets as a means of payment, but only after obtaining explicit approval from the MGA. While the MGA regulates the use of virtual assets within the gaming sector, any third-party service providers facilitating virtual asset transactions (such as crypto exchanges) must be authorized separately under applicable financial regulations, including those aligned with the EU’s Markets in Crypto-Assets Regulation (MiCA). The dual oversight ensures that both gambling and financial compliance standards are met when virtual assets are used in online gaming.

Types of crypto casinos

Crypto casinos generally fall into three categories:

1. Centralized off-chain casinos

A centralized (off-chain) casino is a regular licensed online casino that simply lets customers deposit or withdraw in crypto. The games run on the casino’s own servers, and the crypto is usually converted to fiat for play by a regulated payment partner. The casino typically doesn’t hold customers' keys. Full AML and KYC checks apply.

2. On-chain decentralized casinos

An on-chain (decentralized) casino runs games by smart contracts. Players connect a wallet and may not open a normal account. Because KYC, age checks, responsible gambling tools, and sanctions controls are hard to enforce, this model is rarely licensable in mature markets and is often blocked.

3. Hybrid online casinos

A hybrid model keeps the usual licensed controls (KYC, geoblocking, responsible gambling tools) and adds crypto in one of two ways:

- most common: use a regulated crypto partner for deposits/withdrawals while gameplay stays in fiat and the operator doesn’t hold keys

- less common: operator does hold keys or runs its own exchange.

The compliance outcome hinges on who holds crypto, who sends/receives it, and where conversion happens. If the operator holds keys, expect extra rules similar to a crypto provider; if a partner handles it, the operator still treats crypto funds as high-risk and keeps strong AML controls.

As regulations in the digital asset and gambling industries can change quickly, gambling companies should stay up to date with relevant laws and regulations to maintain full compliance.

The legality of crypto gambling is also more complicated than a simple “yes” or “no.” To better understand its legality worldwide, it’s important to carefully examine the legal status, licensing requirements, and AML/KYC obligations for crypto gambling in specific countries and regions worldwide.

Suggested read: The Top 10 Crypto-Friendly Countries (2025)

Crypto gambling in the US

| Legal status | Federal law does not explicitly ban crypto gambling, but the specific legal status of both gambling and virtual asset use varies by state. Crypto casinos typically operate offshore. |

| Regulatory body | Depends on the industry. |

| Licensing | Virtual asset use is not approved for gambling operators licensed in the United States. |

| AML/KYC rules | Operators need to follow state-specific and federal AML/KYC requirements for licensed gambling. Crypto deposits often require conversion to fiat. Review the AML/KYC requirements for gambling and crypto in your state. |

Suggested read: Crypto Regulations in the US—A Complete Guide (2025)

Crypto gambling in Canada

| Legal status | The legal status of crypto gambling is province-dependent. Direct virtual asset payment is generally not permitted. Crypto casinos also operate offshore. Use of crypto-assets by the province:Alberta: unregulatedBritish Columbia: unregulatedManitoba: unregulated, as of December 2024 Manitoba does not accept cryptocurrency as a form of payment for gambling transactions.Nova Scotia: unregulatedOntario: unregulated, however, iGaming Ontario doesn’t currently authorize operators to accept cryptocurrency deposits or payouts.Quebec: unregulatedKahnawake: unregulated |

| Regulatory body | Provincial gaming authorities (e.g., AGCO in Ontario, Kahnawà:ke Gaming Commission for KGC-licensed operators). |

| Licensing | Requirements vary depending on the province. Most licensed operators only accept fiat currencies. However, Kahnawà:ke licenses may allow crypto. |

| AML/KYC rules | Operators must comply with federal and provincial AML/KYC regulations. This means crypto deposits often require conversion to fiat for compliance. |

Crypto gambling in the UK

| Legal status | UKGC classifies crypto-originated funds as high risk and expects enhanced scrutiny. In practice, GB licensees rarely accept crypto, but it’s a risk/control question, not an outright prohibition. UKGC operators can accept crypto-originated funds where they can meet LCCP/AML/CFT controls. |

| Regulatory body | UK Gambling Commission (UKGC) |

| Licensing | A UKGC license is required for all gambling operators. |

| AML/KYC rules | Gambling funds must be deposited and withdrawn using fiat before being exchanged to or from virtual assets. Operators need to implement enhanced AML/KYC controls for high-risk payments. |

Suggested read: All You Need to Know About UK Crypto Regulations—2025 Guide

Crypto gambling in Australia

| Legal status | Online casinos are illegal. Crypto gambling is therefore prohibited. |

| Regulatory body | Australian Communications and Media Authority (ACMA) and state/territory gambling regulators. |

| Licensing | Operators can obtain licenses only for land-based casinos. |

| AML/KYC rules | AML /KYC rules exist and are mandatory. |

Crypto gambling in Brazil

| Legal status | Prohibited. Cryptocurrency is not accepted as a form of payment for gambling transactions. |

| Regulatory body | Ministry of Economy (Secretaria de Avaliação, Planejamento, Energia e Loteria – SECAP) oversees licensing and compliance. |

| Licensing | Gambling operators cannot acquire a license in Brazil. |

| AML/KYC rules | In Brazil, crypto and gambling are treated as separate industries, but both are subject to AML obligations under different regulatory frameworks. |

Crypto gambling in Argentina

| Legal status | Online gambling is legal under provincial licensing, but crypto gambling is generally not permitted for licensed operators. |

| Regulatory body | Provincial gaming authorities |

| Licensing | License required by province, with virtual assets typically prohibited as payment, not being legal tender. |

| AML/KYC rules | Operators must comply with federal and provincial AML/KYC regulations; crypto deposits are usually converted to fiat to remain compliant. |

Suggested read: Crypto Compliance in Argentina: What You Need to Know (2025)

Crypto gambling in India

| Legal status | All kinds of online money games and online money services are prohibited in India as of September 2025. |

| Regulatory body | State governments regulate gambling individually. |

| Licensing | Licenses are issued by states for approved forms of gambling |

| AML/KYC rules | Operators must comply with federal and state-specific AML/KYC requirements. Crypto deposits may be converted to fiat to remain compliant. |

Crypto gambling in Germany

| Legal status | Online gambling is legal under strict licensing |

| Regulatory body | Gemeinsame Glücksspielbehörde der Länder |

| Licensing | License required for all online gambling. |

| AML/KYC rules | Operators must implement AML/KYC procedures via approved PSPs. |

Crypto gambling in France

| Legal status | Online gambling is restricted; crypto gambling is not permitted. |

| Regulatory body | Autorité Nationale des Jeux |

| Licensing | — |

| AML/KYC rules | — |

Crypto gambling in Sweden

| Legal status | According to the Swedish Tax Agency, sale or exchange of or payment with a cryptocurrency (crypto-asset, virtual currency or digital currency) must be reported to the Tax Agency. As stated by the Tax Agency, players must declare their cryptocurrencies if they have used them for gambling. |

| Regulatory body | Spelinspektionen |

| Licensing | License required for all online gambling; only approved fiat payment methods are allowed. |

| AML/KYC rules | — |

Crypto gambling in the Netherlands

| Legal status | Licensed online gambling is legal, but it’s subject to strict regulation. According to Dutch law, licensed gambling operators are only allowed to use payment methods that can be clearly linked to the identity of the player. Since cryptocurrencies often lack this level of traceability, their use in gambling is seen as problematic. |

| Regulatory body | Kansspelautoriteit |

| Licensing | License required for all online gambling. |

| AML/KYC rules | Operators must comply with AML/KYC regulations; |

Crypto gambling in Curaçao

| Legal status | Crypto gambling is permitted under the LOK regime for licensed operators. |

| Regulatory body | Curaçao Gaming Authority |

| Licensing | License required for all operators; crypto use is allowed as long as compliance conditions are met. |

| AML/KYC rules | Operators must implement AML/KYC procedures; crypto deposits are closely monitored but accepted when compliant. |

Crypto gambling in Malta

| Legal status | Crypto in gambling is legal in Malta, but it’s regulated under specific laws. The use of cryptocurrencies, such as virtual financial assets and tokens, is allowed for betting, provided it complies with the rules established by Maltese authorities. These include the requirements outlined in the Virtual Financial Assets Act and the guidelines on Distributed Ledger Technology (DLT) issued by the Malta Gaming Authority (MGA). Operators must ensure that any crypto-related activities align with the established legal framework, including the use of blockchain-based systems, smart contracts, and other innovative technologies. Acceptance of crypto is permitted only if all regulatory standards are met, ensuring transparency and compliance. |

| Regulatory body | Malta Gaming Authority |

| Licensing | Operators licensed by the Malta Gaming Authority (MGA) may accept virtual assets as a means of payment, but only after obtaining explicit approval from the MGA. |

| AML/KYC rules | Operators must comply with AML/KYC requirements per MGA guidance; crypto deposits are closely monitored and must be compliant. |

Crypto gambling in Denmark

| Legal status | Only regulated currencies are covered under the Danish Payments Act. Any unregulated virtual currencies will not be accepted as a method of payment by gambling operators. |

| Regulatory body | Spillemyndigheden |

| Licensing | Only approved fiat payment methods are provided. |

| AML/KYC rules | Operators must comply with strict AML/KYC regulations. |

Crypto gambling in the Philippines

| Legal status | Offshore gambling is no longer permitted. Crypto use for gambling is unregulated and effectively prohibited, as it falls outside current financial and regulatory frameworks. Cryptocurrency cannot be used to fund gambling transactions. |

| Regulatory body | PAGCOR / Cagayan Economic Zone Authority (CEZA) |

| Licensing | PAGCOR has stopped issuing or renewing offshore licenses, ending operations for Philippine Offshore Gaming Operators (POGOs) and similar platforms. No license exists for crypto gambling. |

| AML/KYC rules | Any crypto gambling activity could breach BSP and AMLC regulations, including VASP rules. |

Crypto gambling in Spain

| Legal status | Licensed online gambling is legal, but Spain does not have specific laws requiring virtual currency providers to be licensed or registered with the central bank. This means crypto businesses, including those involved in gambling, have operated without formal regulatory oversight. |

| Regulatory body | Dirección General de Ordenación del Juego |

| Licensing | A license is required for all online gambling. No specific license exists yet for crypto service providers, including those in gambling, but proposed AML updates (Law 10/2010) may introduce registration/licensing requirements in the future. |

| AML/KYC rules | Operators must comply with AML/KYC regulations; crypto deposits and withdrawals need to be converted to fiat. |

Crypto gambling in the Isle of Man

| Legal status | Crypto gambling is legal and regulated under the Online Gambling Regulation Act (OGRA). Online Gambling (Amendment) Regulations 2016 allow gambling businesses to accept any form of value (including crypto) if it has global use or is recognized by an operator as a valid deposit method. |

| Regulatory body | The Isle of Man Gambling Supervision Commission permits the use of both fiat and digital assets, including crypto, as long as the same currency is used for both deposit and withdrawal. |

| Licensing | An OGRA license is required. No separate license is needed for gambling services involving crypto. Licensed operators may accept crypto for deposits, staking, and withdrawals. |

| AML/KYC rules | Operators must implement AML/KYC procedures as per licensing conditions; crypto transactions are monitored. |

Suggested read: EU Crypto Regulations 2025

Is the Travel Rule relevant for crypto gambling platforms?

Gambling platforms need to give careful consideration as to whether the Travel Rule applies, which requires Virtual Asset Service Providers (VASPs) to share identifying information about the originator and beneficiary of virtual asset transfers. FATF guidance notes that Designated Non-Financial Businesses and Professions (DNFBPs)—such as gaming sites—are required to comply with VASP obligations if they engage in virtual asset activities.

In practice, the applicability of the Travel Rule depends on two factors:

- the platform’s actual functions

- how assets are handled.

Some gambling platforms could technically qualify as VASPs if they custody, and/or transfer client’s virtual assets, then the Travel Rule compliance may be mandatory. However, most platforms rely on external VASPs for custody and transfers and do not directly hold or move client assets.

The determining factor for the Travel Rule to apply, then, is not how a gambling platform describes or calls itself, but whether it operates as a VASP (i.e., has custody of or transfers virtual assets).

Suggested read: Ask Sumsubers: Does the Travel Rule apply to decentralized platforms, gambling platforms, or on/off-ramp platforms?

Crypto gambling compliance checklist

- Check if crypto gambling is legal:

- Confirm it’s legal to operate a crypto casino in your desired jurisdiction.

- Confirm online gambling is permitted in any target markets.

- Confirm whether virtual asset payments are allowed in any target markets.

- Follow the regulatory guidance:

- Obtain approvals from regulators and the necessary licenses in each jurisdiction, if applicable.

- Ensure your license explicitly allows crypto payments.

- Maintain robust AML/KYC procedures:

- Implement robust customer due diligence and monitor activity to prevent fraud, money laundering and terrorist financing.

- Verify user identities with KYC checks, monitor transactions, and flag any suspicious activity to report to the relevant regulator.

- Keep records of deposits, withdrawals, and wallet addresses as required.

- Follow the Travel Rule:

- If the platform operates as a VASP, then the Travel Rule applies.

- Follow payment processing and virtual asset management requirements:

- Use regulated virtual asset gateways or custodial services.

- Where required by law, either convert crypto deposits into fiat currency before gambling activity, or restrict certain types of virtual asset transactions (for example, privacy coins or high-risk transfers) to meet AML and gambling regulations.

- Provide legally required responsible gambling tools and consumer protections:

- Provide tools for self-exclusion, deposit limits, and game limits, as is often required.

- Offer clear terms regarding withdrawals, wallet usage, and transaction times.

- Ensure user data is protected, and you follow cybersecurity best practices.

- Ensure geoblocks are activated for restricted markets.

- Comply with regulatory reporting and audits:

- Submit reports to regulators as required.

- Maintain records for audits and regulatory reviews.

How crypto gambling platforms can stay compliant: A global solution

The uncertainties of the legal status of crypto gambling around the world make navigating regulations complex and potentially risky. Operators need to keep abreast of changing laws on online gambling, as well as regulations on virtual asset use, licensing, and AML/KYC rules in every market they serve.

The risks of failing to comply can lead to penalties, including fines and revoked licenses, and reputational damage.

Sumsub can lessen risks, deter fraud, and make compliance as frictionless as possible with instant KYC, real-time crypto monitoring, AML screening, Travel Rule compliance, and timely jurisdiction-specific guidance.

FAQ

-

Do I need a license to operate a crypto casino?

Yes. If gambling is regulated in the jurisdiction you operate, then you will need a gambling license. In addition, operating a crypto casino may require compliance with crypto-specific financial regulations and potentially a separate license. Since there is no universal licensing model, the need for licenses depends on the specific legal framework of each jurisdiction, where both gambling and virtual currency rules must be taken into account.

-

How do regulators track crypto gambling?

Regulators can monitor crypto casino gambling through a combination of AML/KYC reporting, transaction monitoring, and blockchain analysis. Suspicious activity must be reported.

-

How do AML/CFT regulations apply to crypto-assets in gambling?

AML/CFT regulations apply to crypto-assets in gambling in the same way they apply to fiat gambling. Operators must perform customer due diligence, verify identities, and report suspicious transactions to prevent money laundering and other financial crimes, as well as anything else required for legal online gambling and virtual asset use in the jurisdiction.

Relevant articles

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.