- Nov 12, 2021

- 2 min read

AML Compliance Officer: the Role, Skills, and Responsibilities

The main obligation for an anti-money laundering compliance officer is to implement an AML program, so that the institution is compliant with certain financial regulations.

The position is crucial in any financial company since compliance officers are fully responsible for AML and personal data compliance of the company. That is why we decided to put this article together and explain what AML Compliance Officer actually does.

Main responsibilities

AML Compliance Officer is in charge of financial regulations and personal data compliance requirements, making sure the company’s AML policy corresponds to the international system. Other responsibilities include screening and monitoring, payment fraud prevention, transaction monitoring for fiat and cryptocurrency, specifically the following:

- Looking after records of high risk clients and report suspicious activities, if any;

- Assisting the implementation of an Anti-Money Laundering program of an organization;

- Arranging inspections from third-party organizations and eliminating mistakes in the program, if any.

The Position Profile

Since there’s no special major such as AML Compliance Officer, people with different types of background, from an IT project manager to a lawyer, can be hired to take the position. Senior Management should be aware of the candidate’s skills that are important for the role.

In general, AML Compliance Officer must be skilled in all types of financial policy and methodology of financial crime. It is essential to consider not only candidate’s skills and abilities but also the fact of how appropriate the candidate is for the unique policy of a company, such as:

- Usage of math skills including multiplying, dividing, and counting using fractions;

- The ability to read and interpret documents such as government regulations, internal controls, and instruction manuals;

- Maintenance of discretion in handling confidential information;

- Interaction with team members at all levels of the organization professionally, including the ability to speak in front of groups;

- The ability to work irregular hours and extended shifts, including late nights, early mornings, weekends, and holidays.

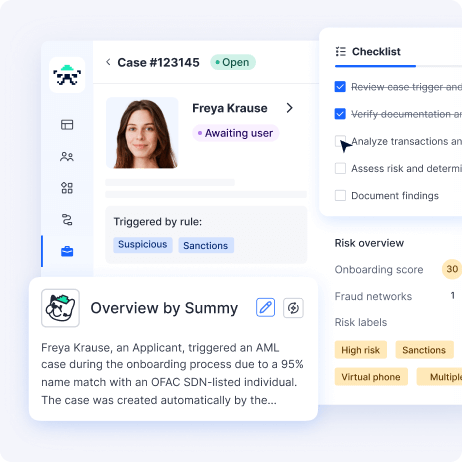

AML Compliance Officer is an indispensable employee as they are fully responsible for the company’s regulatory processes and reports. To simplify the work for a potential employee, companies can employ additional sources to automate AML screening and monitoring, report generation, case management and transactions monitoring.

Relevant articles

- Article

- 2 weeks ago

- 9 min read

- Article

- 2 weeks ago

- 13 min read

How to check if a company is legit: a step-by-step guide for businesses and consumers covering registrations, licenses, reviews, and scam warning sig…

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.